🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 70

Greenland, Tariffs, and Three Straight Stop-Outs in 48 Hours

Is the Trade War Back? (Spoiler: Yes)

President Trump announced new tariffs on the EU and confirmed his top strategic priority: acquiring Greenland. Yes, you read that right. Greenland.

Here’s the breakdown: a 10% tariff on Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland, starting February 1st. And these tariffs will increase to 25% on June 1st and will NOT be lifted until a deal is reached on Greenland.

Not just any deal: a “complete and total purchase of Greenland,” according to Trump.

If this sounds insane, that’s because it is. But it’s also classic Trump. And if you’ve been paying attention for the last 12 months, you know exactly how this playbook works.

Trump’s Tariff Playbook: Timing, Pressure, and Theater

The trade war has become an episodic headwind. Tariffs resurface when markets least expect them, create chaos, and then slowly fade away.

This isn’t random. This is by design.

Trump’s entire negotiation strategy is centered around timing and pressure. He gives 2-3 weeks of lead time before tariffs go into effect, creating a window for a deal to be reached. His goal? For these tariffs to never actually go live. He wants a deal. He wants leverage. He wants the threat to do the work.

That’s why these announcements increasingly come on weekends, when markets are closed. It’s strategic. It’s calculated. It’s a theater.

And he pushes the threats to the edge. That’s why they work. Because they’re market-moving and world-changing, if they were to ever truly go into effect and stick.

But here’s the thing: they rarely do. The threat is the weapon.

The deal is the goal.

Senate Democrats Are Already Pushing Back

The latest news? Senate Democrats are planning to introduce legislation to block Trump’s newly announced 10% tariffs on the 8 European countries that oppose the US acquiring Greenland.

Will it pass? Who knows. But the buzz is building. And if this drama continues, you'd better have a good list of rare earth stocks in your watchlist.

Because next week? Those stocks are going to be the best way to profit from this madness. Probably alongside an emotional gap down on Tuesday when the market digests the news.

We have at least 1-2 names in our watchlist linked to this theme. But here’s the smarter play: adjacent stocks.

Sometimes, if you play stocks in adjacent sectors connected to basic materials and, in particular, rare earth, you’ll find names that aren’t already widely covered by investors. And that’s where you find the highest movers.

Everyone’s going to pile into the obvious plays.

But the real money? It’s in the names that fly under the radar.

Last Week We Said Opportunities Were Shrinking. This Week Confirmed It.

Last week, we told you the watchlist wasn’t great. Opportunities were shrinking. Not much was setting up.

This week? We got confirmation. The hard way.

Three stocks bought. Three times stopped out. In less than 48 hours.

Are we suddenly terrible investors? Or is the market trying to tell us something?

We’re betting on the latter.

We started this week unloading our winning positions. Why? Because a pullback is likely. Especially with this Trump tariff drama back on the table.

And honestly? A pullback would be healthy. The market’s been running hot. Too hot.

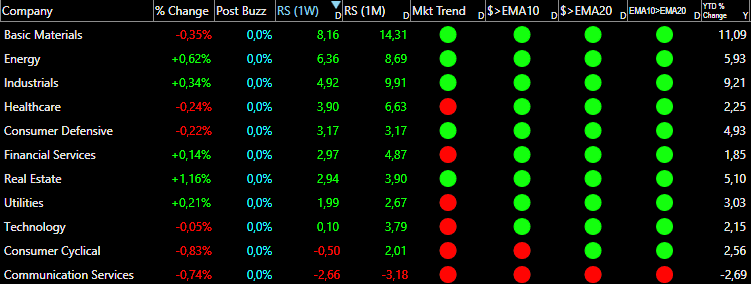

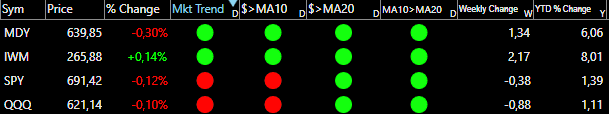

Look at the data: T2118 closed this week at 83.08. The overheat level? 90.00. We’re not there yet, but we’re close. Close enough to start thinking about it.

And if you check the consumer defensive sector, you’ll see six straight days of gains. Six. That’s not normal. That’s a warning sign.

That’s the market saying, “Maybe I should take a breather.”

Can this rally continue without at least a pullback? Maybe. But we’re not betting on it.

Not Satisfied With Our Trading Week

Let’s be honest: we’re not satisfied with this week. Three stop-outs in 48 hours? That’s not the standard we hold ourselves to.

So we’re using the holiday in the market to analyze our work. To figure out what went wrong. To be more cautious next week.

We want to stay on top of our game. Every week. Every month. Every year. That’s the goal. That’s the standard.

And when we fall short, we don’t make excuses. We adjust.

Latest articles:

Each stock carries a risk badge: ⚠️ High | 📊 Medium | 🛡️ Low.

Based on volatility, float, technicals, and fundamentals. Size your positions accordingly.

📈 Free Setup: Make It Count

BIDU: Baidu incorporated 🛡️

What they do: A leading Chinese technology company operating the country's dominant search engine

Why watch? Baidu just announced plans to spin off Kunlunxin, its semiconductor chip unit, and has officially filed an IPO application with the Hong Kong Stock Exchange. Kunlunxin produces AI-optimized semiconductors designed specifically for enterprise customers to run large language models and other AI workloads, positioning it as China’s answer to NVIDIA in the domestic AI infrastructure buildout. The IPO is likely to see strong demand from investors, given the market’s demonstrated appetite for AI-related offerings in China and the strategic importance of semiconductor self-sufficiency in the region. Like other large-scale cloud platforms such as Alibaba, Baidu has developed its own in-house AI chips and computing platforms that enterprise customers use to build, train, and deploy their own models. This vertical integration gives Baidu control over its AI stack and reduces dependence on foreign chip suppliers, a critical advantage as China pursues its strategic goal of making its domestic semiconductor industry more independent from Western vendors. The Kunlunxin spinoff could unlock significant value by allowing the market to separately value Baidu’s AI chip business, which has been embedded within the broader corporate structure. It also provides Kunlunxin with dedicated capital and management focus to scale production and compete more aggressively in China’s rapidly growing AI chip market. Beyond the spinoff, Baidu remains a core beneficiary of China’s AI infrastructure buildout, with its Ernie large language model gaining traction among enterprise customers and its Apollo autonomous driving platform continuing to expand commercially. If China emerges as a major investment theme in 2026 (driven by stimulus measures, AI adoption, or geopolitical repositioning), Baidu is positioned to be one of the primary beneficiaries and potential market leaders, arguably offering better risk-reward than Alibaba at current valuations.

Technical Outlook: The stock approached the $150.00 level in October and was sharply rejected. In January, the stock has already made two attempts to push above this resistance without success, but notably, the 10-day exponential moving average has provided support on both pullbacks, a sign of underlying demand. The stock is now setting up for a third attempt at breaking $150.00. If this attempt succeeds on strong volume, it could mark the beginning of a new long-term uptrend. The key question is whether the third time will be the charm. If you believe China can be one of the dominant themes of 2026, Baidu is likely to be among the leaders, if not the leader, in the technology sector.

Why We Don’t Wait for Sunday

Markets don’t move on your schedule. The best low-risk entries don’t announce themselves politely and wait for the weekend newsletter.

They show up when they show up. And if you’re not positioned, you miss them.

Paid members get real-time alerts: exact entries, stops, position sizing, and the thesis behind every trade. The same information we use to manage our own capital.

Free members get just one pick on Sunday.

Does that sound like an edge to you?

What’s Inside Premium

📊 Watchlist Elite (7-9 Stocks)

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment.

💼 Full Portfolio Transparency

Every position we hold. Entry price. Current P&L. Stop level. Real money, real risk.

⚡ Real-Time Trade Alerts (Chat Access)

This is where the edge lives. Exact entries, stops, and position sizing. Real-time. No lag

🎯 Quick Picks (5 Names)

Additional setups that just missed our main criteria but are worth watching.

💬 Chat Access

See our thought process in real time. Ask questions. Watch how we manage risk.

🛠️ The Tools We Actually Use

Member discounts on TC2000, Fiscal.ai, and other platforms. Same tools, better pricing.

What Paid Members Say:

We’re entrepreneurs first, traders second. We’ve sat in the CEO chair. We know what real execution looks like and how to spot it.

€39/month or 299€/year. Less than one losing trade. Cancel anytime.

Portfolio updates and new positions: