Equity X-Ray: In-Depth Research #29

2026 Investment Frontiers: The Themes That Will Shape the Future

“The future is already here. It’s just not evenly distributed.”

William Gibson

We do not attempt to predict the future. Markets have a long history of humbling anyone who claims to see too far ahead. What we do aim to do is identify signals, tensions and structural shifts that are beginning to emerge, often quietly, at the edges of consensus.

The investment themes presented here are not forecasts for 2026, nor are they timelines. Some of these trends may take longer to fully materialize. Others may evolve in ways that differ from today’s expectations. What they share is relevance, each represents a set of forces that we believe will matter increasingly over the coming years.

These themes are intended as lenses through which to observe markets differently. They are tools for reflection and deeper analysis, designed to challenge conventional framing and highlight areas where long-term change may be underestimated or misunderstood.

Some of these themes are already moving toward the mainstream.

Others focus on dynamics that, in our view, have not yet received sufficient attention from investors. Together, they offer a structured way to think beyond short-term narratives and consider where durable opportunities may gradually take shape.

The following six themes reflect our current thinking on where it may be worth paying attention, not only in 2026, but well beyond.

THEME 1: THE SPACE ECONOMY & ORBITAL INFRASTRUCTURE REVOLUTION

The next leg of the space economy won’t be defined by satellites alone. It will be defined by infrastructure in orbit (computing, energy, defense, and logistics) and the economics are moving faster than most investors realize.

The most underappreciated opportunity is orbital data centers and space-based computing. AI workloads are on track to consume roughly 8% of U.S. electricity by 2030, pushing terrestrial power grids and cooling systems toward their limits. Space solves both problems at once. In orbit, solar power is continuous and cooling is effectively free. No land costs. No massive HVAC systems. No local energy bottlenecks.

This isn’t theoretical at all. Starlink’s latest V3 satellites already operate with terabit-class onboard data processing, functioning as distributed computing nodes in space. Nvidia-backed Starcloud and Alphabet’s Project Suncatcher are pushing in the same direction. Once computation moves closer to where data is generated, orbital infrastructure stops being a science project and starts looking like a cost advantage.

Want the full picture on the space economy and its biggest opportunities? Check out our detailed deep dive here.

The SpaceX IPO is the inevitable catalyst that forces the market to take all of this seriously. A public listing around 2026 at a valuation rumored near $1.5 trillion would do more than unlock liquidity, it would validate the entire sector. Starlink alone generates roughly $6.6 billion in annual revenue from over six million subscribers, and that figure doesn’t include any future orbital computing revenue. Once SpaceX trades publicly, institutional investors will be forced to build space exposure. Capital won’t stop at one ticker. It will flow downstream into suppliers, infrastructure providers, and adjacent platforms.

At the same time, space is becoming militarized, and defense spending is accelerating accordingly. The U.S. Space Force budget is growing at roughly 15% per year, focused on satellite defense, space domain awareness, and counter-space capabilities. The companies best positioned here are those with dual-use technologies, commercial platforms that also serve national security needs. Historically, that overlap is where the fastest and most durable growth occurs.

All of this is happening against the backdrop of collapsing launch costs. The economics have shifted dramatically. Launch costs have fallen from roughly $65,000 per kilogram during the Space Shuttle era, to about $1,500 per kilogram with Falcon 9, and potentially to $100 per kilogram with Starship. That’s a 650-fold reduction. It’s the space equivalent of the bandwidth explosion in the 1990s, and it enables entirely new business models: orbital manufacturing, space tourism, asteroid mining, and even point-to-point Earth transport via suborbital flights.

Finally, there’s the satellite constellation arms race. Amazon’s Project Kuiper, China’s Guowang, and OneWeb’s continued expansion are turning satellite internet into a multi-trillion-dollar market. But the real opportunity isn’t necessarily in owning the constellations themselves. It’s in the picks and shovels: ground station equipment, satellite components, launch services, and orbital servicing. The satellite industry today looks a lot like semiconductors in the mid-1990s: early, fragmented, and on the verge of exponential scale.

MACRO TAILWINDS

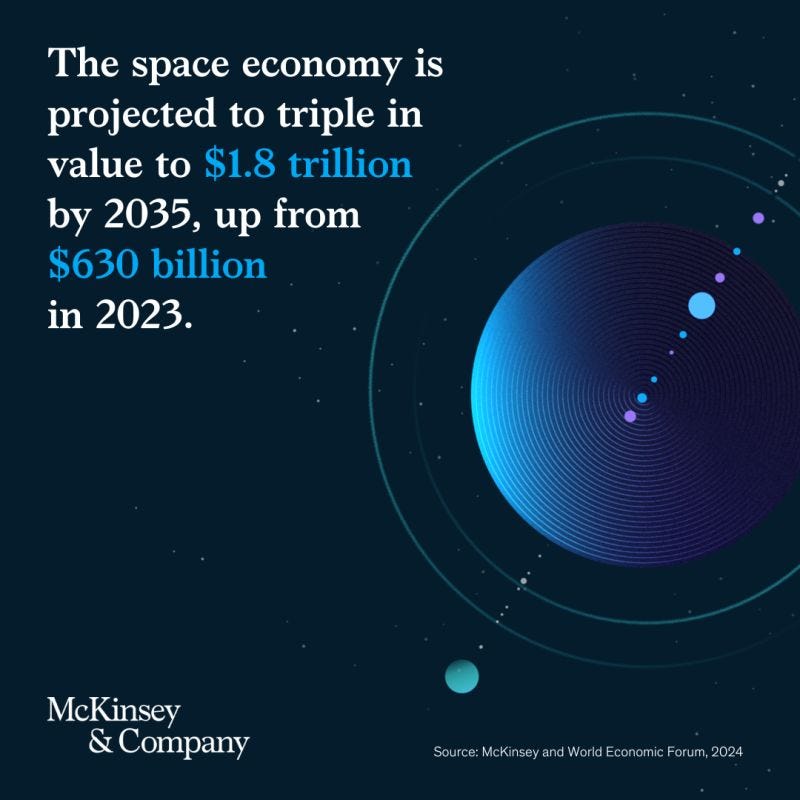

The macro picture is unambiguous. The global space economy is expected to grow from roughly $630 billion in 2023 to $1.8 trillion by 2035. Commercial activity now accounts for nearly 80% of all space activity, upending decades of government dominance. More than 60 countries have active space programs, compared to just 10 at the turn of the century. Since 2013, private investors have deployed over $270 billion into space-related ventures. This is no longer a niche. It’s an industrial transition.

RISKS

None of this is risk-free. Regulatory uncertainty remains a real overhang, particularly around spectrum allocation, orbital debris, and space traffic management. Technical execution risk is non-trivial: Starship delays, satellite failures, and scaling challenges can derail timelines. Geopolitical tensions introduce another layer of complexity as space becomes a contested domain. And valuation risk is real: if the SpaceX IPO underwhelms, sentiment across the sector could compress quickly.

Still, when costs collapse, infrastructure scales, and capital is forced in by benchmark pressure, entire industries get repriced. Space is entering that phase now.

STOCK PICKS:

1. Rocket Lab USA (RKLB)

Only pure-play public launch company

Electron rocket: 50+ successful launches

Neutron rocket (2026 debut): Falcon 9 competitor

Space systems division: satellites, components, reaction wheels

Valuation: $8B (vs SpaceX $180B) = massive upside if execution continues

2. Lockheed Martin (LMT)

Largest space revenue of any public company ($12B annually)

Builds GPS satellites, missile defense systems, Orion spacecraft

60-year track record of government contracts

Space segment growing 8% annually with 95%+ margins

Dividend aristocrat with 3% yield

3. Intuitive Machines (LUNR)

First private company to land on the Moon (Feb 2024)

$4.8B contract backlog (NASA, DoD, commercial)

Pivoting to lunar infrastructure: communications, navigation, data relay

Trading at $1.5B market cap vs $4.8B backlog

Binary outcome: either 10x or bankruptcy

4. Iridium Communications (IRDM)

66-satellite constellation providing global voice/data

Government contracts (DoD, intelligence agencies): 30% of revenue

IoT growth: tracking ships, planes, trucks, containers globally

FCF yield: 12% with minimal capex (constellation fully deployed)

Recession-resistant: government + mission-critical commercial

5. Redwire Corporation (RDW)

Only public pure-play space infrastructure company (solar arrays, components, in-space manufacturing)

Roll-Out Solar Arrays (ROSA) on ISS + commercial satellites

In-space manufacturing on ISS: producing fiber optics, pharmaceuticals, and semiconductors in microgravity

Strong Backlog despite share decline and underwhelming recent earnings

Stalker and Penguin UAS platform is giving them an additional drone-focused theme