🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 69

The Tariff Drama, Earnings Season, and Why We're Fishing in Semis

We’re back. And honestly? We needed the break.

Last year was brutal. Mentally exhausting. The kind of year that grinds you down, day after day, until you’re running on fumes and spite. So we stopped. We recharged. We reset.

And now we’re here, staring at a market that didn’t wait for us. Because of course it didn’t.

The Watchlist This Week? Not Great

Unfortunately, this week’s watchlist isn’t our best work. Why? Because the market started pushing hard from the very first day of the new year. No consolidation. No pullback. No time to set up. Just a straight rip higher.

When the market moves like this, your job isn’t to chase. Your job is to be already positioned and enjoy the ride. If you’re not in, you’re watching from the sidelines, scanning thousands of stocks and finding nothing.

Which is exactly what we did this week. We scanned over 3,000 stocks. And we didn’t find much. Because that’s what happens when the market gaps up and runs without looking back.

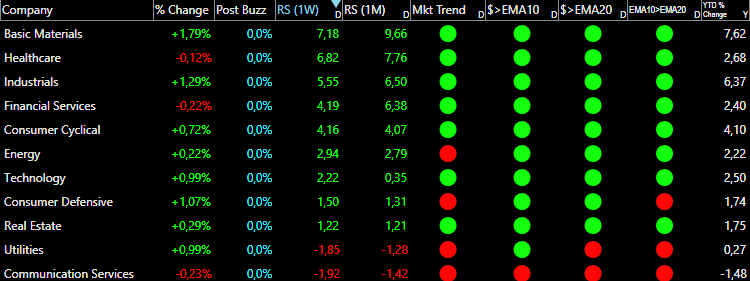

The Sectors Are Getting Slimmer (And That’s a Problem)

Here’s what we’re seeing very clearly: the sectors where money is rotating are getting slimmer and slimmer.

Last year, you had options. AI. Tech. Growth. Momentum. There were places to hide, places to play, and places to make money.

This year? We’re pretty sure it’s going to be harder. More selective. More brutal.

We might need to invest capital in sectors that aren’t sexy. Sectors that don’t get hyped on FinTwit. Sectors that don’t have flashy narratives or viral momentum.

And our new positions this week? They reflect exactly that.

Financials. Chemicals.

Not exactly the next big thing, right? Not the kind of trades that make you feel like a genius at a cocktail party. But that’s the point.

The market’s telling us where the money is going, and we’re listening, even if it’s not exciting.

Next Week: The Tariff Drama

Next week is going to be important. Why? Because the tariff drama is coming to a head.

The US Supreme Court is set to issue its next round of rulings on January 14, and one of the most closely watched cases is a legal challenge to President Trump’s sweeping global tariffs.

Here’s the setup: Trump imposed these tariffs by declaring a national emergency over persistent trade deficits, invoking the International Emergency Economic Powers Act (IEEPA), a 1977 law meant for actual national emergencies. The tariffs cover imports from nearly every US trading partner. He also used the same law to slap duties on China, Canada, and Mexico, citing fentanyl trafficking and illegal drug flows.

The case is testing the limits of presidential authority.

Can a president declare a national emergency over trade deficits and use it to impose tariffs on the entire world? The Supreme Court is about to weigh in.

And the market? The market’s going to react. Hard.

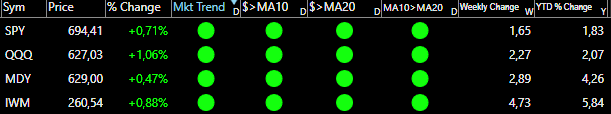

Right now, breadth indicators aren’t flashing red. We’re not overheated yet.

A pullback wouldn’t surprise us. At the very least, some consolidation. The market’s been running hard, and it needs to breathe.

But here’s the complication: we’re also approaching earnings season.

So our job now is to stay laser-focused. We’re scanning every company, looking for the ones that will catch the market off guard. The ones that will beat expectations and emerge as the new leaders. The ones that will set up properly and give us the low-risk entries we live for.

Where We’re Fishing: Semis, Crypto, and Blockchain

We scanned over 3,000 stocks this week. And while the pickings were slim, we did find a couple of interesting names.

Here’s where we think the action is:

Tech, specifically semiconductors. Semis are the pond where we think you need to fish right now. We found a couple of stocks from that sector in our watchlist.

Crypto-related plays. Everything tied to blockchain and stablecoins has room to run if the market decides to stay on fire. The narrative is there. The momentum is there. The setups? We’re watching.

But again, this is a market where you need to already be positioned. If you’re late, you’re chasing. And chasing is how you lose money.

Latest articles:

Each stock carries a risk badge: ⚠️ High | 📊 Medium | 🛡️ Low.

Based on volatility, float, technicals, and fundamentals. Size your positions accordingly.

📈 Free Setup: Make It Count

ALAB: Astera Labs Inc. ⚠️

What they do: A global semiconductor company that engages in the provision of hardware and software solutions for AI and cloud infrastructure

Why watch? Astera Labs sits at a rare intersection: it’s a pure-play beneficiary of the AI infrastructure buildout, yet it operates in a less crowded niche than GPU makers. While companies like NVIDIA grab headlines for AI chips, Astera quietly solves an equally critical problem: moving massive amounts of data between those chips without creating performance bottlenecks. Think of it as building the highways that connect AI supercomputers, rather than the cars themselves. The company maintains deep partnerships with major cloud providers (often called “hyperscaler” companies like Amazon, Microsoft, and Google that operate massive data centers) and chip manufacturers, giving it early visibility into next-generation designs and locking in multi-year revenue streams before competitors even know what’s coming. All four of its product families are either ramping production now or preparing to launch, creating multiple simultaneous growth engines. With cloud giants expected to invest tens of billions to upgrade AI infrastructure and eliminate data transfer constraints, Astera is uniquely positioned to capture an outsized share. The company’s Scorpio X Series, a family of advanced networking switches that connect hundreds of AI processors, is scheduled to ramp throughout 2026 and represents its largest revenue opportunity to date, with design wins already secured across at least ten major AI platform providers. Meanwhile, its Aries 6 PCIe retimers (chips that clean up and strengthen data signals traveling at extremely high speeds) are already shipping in volume, enabling the industry’s first PCIe 6.0 servers. These next-generation chips command roughly 20% higher prices than the previous generation, providing built-in revenue growth as customers upgrade. Importantly, Astera is deeply involved in developing UAL (Ultra Accelerator Link), an emerging industry standard for ultra-fast GPU-to-GPU communication: positioning it at the center of tomorrow’s AI architecture. Looking further ahead, the company recently acquired Xscape Photonics, a startup specializing in silicon photonics technology that uses light instead of electricity to transmit data between chips. While this technology may seem distant, it represents a strategic bet on the eventual industry-wide transition from copper to optical interconnects in data centers, a shift that could redefine connectivity economics. In short, Astera offers exposure to AI infrastructure growth through a differentiated lens: not the processors themselves, but the essential plumbing that makes them work.

Technical Outlook: The stock is forming a compelling volatility contraction pattern (VCP) on the daily chart, a technical setup favored by momentum traders that often precedes sharp moves higher. The pattern has completed its third contraction phase with only an 8% pullback, suggesting strong underlying demand. All major moving averages now sit directly beneath the current price, providing layered support. The key resistance level to watch is approximately $167.00; a decisive break above this level with strong volume could trigger the next leg higher. However, it’s important to note that Astera is not a forgiving trading vehicle: the stock experiences violent intraday swings that can quickly stop out traders using tight risk parameters. If you’re considering a position, allow extra room for volatility and avoid overleveraging.

Why We Don’t Wait for Sunday

Markets don’t move on your schedule. The best low-risk entries don’t announce themselves politely and wait for the weekend newsletter.

They show up when they show up. And if you’re not positioned, you miss them.

Paid members get real-time alerts: exact entries, stops, position sizing, and the thesis behind every trade. The same information we use to manage our own capital.

Free members get just one pick on Sunday.

Does that sound like an edge to you?

What’s Inside Premium

📊 Watchlist Elite (7-9 Stocks)

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment.

💼 Full Portfolio Transparency

Every position we hold. Entry price. Current P&L. Stop level. Real money, real risk.

⚡ Real-Time Trade Alerts (Chat Access)

This is where the edge lives. Exact entries, stops, and position sizing. Real-time. No lag

🎯 Quick Picks (5 Names)

Additional setups that just missed our main criteria but are worth watching.

💬 Chat Access

See our thought process in real time. Ask questions. Watch how we manage risk.

🛠️ The Tools We Actually Use

Member discounts on TC2000, Fiscal.ai, and other platforms. Same tools, better pricing.

What Paid Members Say:

We’re entrepreneurs first, traders second. We’ve sat in the CEO chair. We know what real execution looks like and how to spot it.

€39/month or 299€/year. Less than one losing trade. Cancel anytime.

Portfolio updates and new positions: