🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 68

Time Is the Only Asset That Matters (The Rest Is Just Noise)

Let’s talk about what actually happened last week, because it was a mess until it wasn’t.

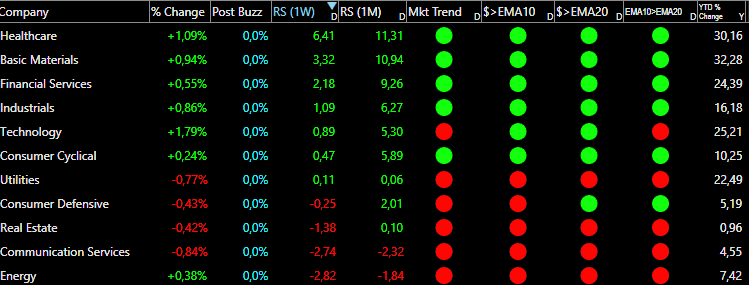

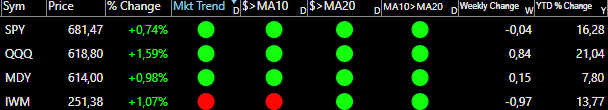

The S&P 500 spent most of the week bleeding red. Investors kept rotating out of AI stocks and piling into cyclical plays. It was a continuation of the theme that started the week before: AI is out, everything else is in.

Tuesday brought fresh jobs data. November nonfarm payrolls? Better than expected. October unemployment? Rising. The market shrugged. No immediate impact on rate-cut expectations, but the pressure kept building, especially in AI.

Then Thursday-Friday happened. The delayed November Consumer Price Index (CPI) report dropped, and it showed cooler-than-expected inflation. The market perked up. Treasury yields fell. Suddenly, the dream of more rate cuts in 2026 felt real again. Add in a strong earnings report from the tech sector, and stocks got a temporary boost.

The broader market recovered a chunk of its early-week losses. By the close, it felt like maybe—maybe—Santa was coming after all.

Next week is Christmas. Low volume. Thin trading. Everyone’s waiting for Santa to show up and deliver the big rally they’ve been promised.

Friday was a great start: the gift everyone wanted under the tree. But here’s the question: Is this the first leg to new highs, or just a counter-trend rally designed to suck everyone back in before the market ruins Christmas and the start of the new year?

We don’t know yet. And honestly? Neither does anyone else.

A Gift to Yourself: Upgrade Your Subscription

Look, we’re going to be blunt here. If you’re still on the free tier, now’s the time to upgrade to paid.

Why? Because we’re literally crushing it right now. We’ve positioned ourselves in the new themes the market is handing us on a silver platter: Robotics and Space.

Our two biggest winners at the moment?

Planet Labs (PL): Entered at $12.18. Now up 55%.

Kodiak Robotics (KDK): Entered at $5.78. Now up 75%.

Planet Labs is one of the biggest winners in the space theme, right alongside Rocket Lab. Kodiak Robotics is a recent IPO riding the autonomous driving and robotics wave.

And here’s the kicker: on December 3rd, we released an article breaking down the space theme and highlighting a great company to position yourself in. Guess what? If you followed that, you’re sitting on a 35% gain in three weeks.

We’re not here to pump out endless content just to keep you entertained. We’re not trying to be your daily dopamine hit. We’re here to provide high-value, low-frequency content that actually moves the needle.

Quality over quantity.

Signal over noise.

So if you’ve been on the fence about upgrading, this is your sign. Give yourself a Christmas gift that actually pays dividends.

The Only Thing That Actually Matters

We’re not going to hit you with the usual “be kind during Christmas” bullsh*t. You’ve heard it a thousand times. It’s tired. It’s cliché.

But we are going to say this:

Spend time with your family and loved ones. As much as you can.

Because here’s the truth: no one knows how much time we have in this world. Time is the most important asset we have. Not stocks. Not options. Not money. Not investing. That’s all noise.

Time is the only thing you can’t buy back.

So this Christmas, close the laptop. Put down the phone. Stop checking the market. Be present. Be there.

The market will still be here when you get back. Your family might not be.

Think about it.

We’re Taking a Break (Maybe)

From Christmas to the first week of January, we’re planning to take a break. We’re not sure yet if we’ll publish the newsletter on January 4th or skip it entirely and come back fresh on January 11th.

We’ll see. If we scan the market and there’s nothing really interesting (nothing that demands our attention), we’ll skip it. We’ll use that time to focus on family and to study ideas for 2026.

We’re also working on a full 2026 themes article that we’ll try to get out next week, or at least before the year ends. We’ll keep you posted.

Latest articles:

Each stock carries a risk badge: ⚠️ High | 📊 Medium | 🛡️ Low.

Based on volatility, float, technicals, and fundamentals. Size your positions accordingly.

📈 Free Setup: Make It Count

LMND: Lemonade Inc. ⚠️

What they do: Operate a digital insurance platform powered by artificial intelligence and behavioral economics

Why watch? Lemonade remains one of the most controversial names in insurance: a high-growth, unprofitable company operating in an industry typically dominated by slower-growth, conservative value stocks. The insurance sector has historically resisted change, and traditional investors have been skeptical of Lemonade’s “move fast and break things” tech mentality. However, the company is beginning to turn heads: it recorded its eighth consecutive quarter of accelerating revenue growth in the third quarter, a streak almost certain to attract momentum investors. Third-quarter revenue reached $194.5 million, up 42.4% year-over-year and beating analyst estimates by 4.8%. Adjusted EPS of -$0.55 beat expectations by 22.5%, and adjusted EBITDA came in at -$25.6 million, a 27.2% beat. Critically, Lemonade generated $5 million in operating cash flow and $15+ million in adjusted free cash flow during the quarter. CFO noted that with over $1 billion in cash and investments, efficient capital management, and positive adjusted free cash flow, the company is “well positioned to fund our growth strategy without need for additional capital.” Management also highlighted that while claims volume has more than doubled (due to customer growth, not higher losses), the company has shrunk its claims processing department by leveraging AI to speed up processing and reduce overhead. Additionally, growth in non-home categories (particularly pet and car insurance) is helping Lemonade cross-sell into a larger revenue base and diversify its risk profile. In short, Lemonade offers a unique way to gain exposure to AI-driven disruption in a traditional industry.

Technical Outlook: Lemonade is struggling to break above the $83.50 level, a key resistance on the weekly chart that has attracted significant attention from traders and investors. The stock has attempted to clear this level multiple times without success, creating frustration for both short-term traders and long-term holders. However, the stock remains supported by the 10-EMA and 20-EMA, indicating the underlying trend is still intact. The repeated tests of $83.50 suggest that once this level finally gives way, it could trigger a sharp move higher as pent-up buying pressure is released. For now, patience is required, but the technical setup remains constructive as long as the moving averages hold.

Why We Don’t Wait for Sunday

Markets don’t move on your schedule. The best low-risk entries don’t announce themselves politely and wait for the weekend newsletter.

They show up when they show up. And if you’re not positioned, you miss them.

Paid members get real-time alerts: exact entries, stops, position sizing, and the thesis behind every trade. The same information we use to manage our own capital.

Free members get just one pick on Sunday.

Does that sound like an edge to you?

What’s Inside Premium

📊 Watchlist Elite (7-9 Stocks)

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment.

💼 Full Portfolio Transparency

Every position we hold. Entry price. Current P&L. Stop level. Real money, real risk.

⚡ Real-Time Trade Alerts (Chat Access)

This is where the edge lives. Exact entries, stops, and position sizing. Real-time. No lag

🎯 Quick Picks (5 Names)

Additional setups that just missed our main criteria but are worth watching.

💬 Chat Access

See our thought process in real time. Ask questions. Watch how we manage risk.

🛠️ The Tools We Actually Use

Member discounts on TC2000, Fiscal.ai, and other platforms. Same tools, better pricing.

What Paid Members Say:

We’re entrepreneurs first, traders second. We’ve sat in the CEO chair. We know what real execution looks like and how to spot it.

€39/month or 299€/year. Less than one losing trade. Cancel anytime.

Portfolio updates and new positions: