🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 65

The Dip That Keeps on Dipping (Or: How I Learned to Stop Worrying and Love Cash)

There’s a sickness in this business. A compulsion. An itch that won’t quit.

It’s the same impulse that makes a drunk reach for one more drink at 3 A.M., knowing damn well he’s going to wake up with his face in the toilet. It’s the gambler doubling down on a busted hand because “the odds have to turn eventually.” It’s the guy at the bar who keeps texting his ex, convinced this time she’ll respond.

It’s buying the dip.

Every. Single. Time.

People love it. They crave it. The price drops, and suddenly everyone’s a value investor. “Too good to pass up,” they say, fingers hovering over the buy button like it’s a slot machine that’s definitely about to pay out. And hey, if it drops more? No problem. They’ll just buy more. Average down. Dollar-cost average their way into oblivion.

I must have something broken in my brain (some circuit that didn’t get soldered right at the factory) because watching this makes me feel like I’m watching someone stick their hand in a hot stove. Over. And over. And over.

How do you buy without context? Without knowing what the hell the market’s actually doing? Without a setup that doesn’t require you to pray to whatever god you think is listening?

It’s not investing. It’s masochism with a brokerage account.

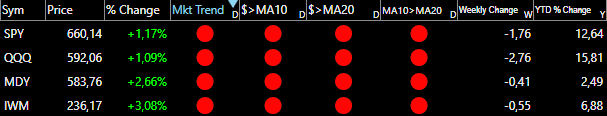

Here’s the thing: the dip has been dipping for a month now. A little more each day. Maybe we get a bounce next week. Maybe. The line in the sand is 597.00 on the QQQs. It needs to break to the upside and hold. Defended like it’s the Alamo and we’re down to our last bullets.

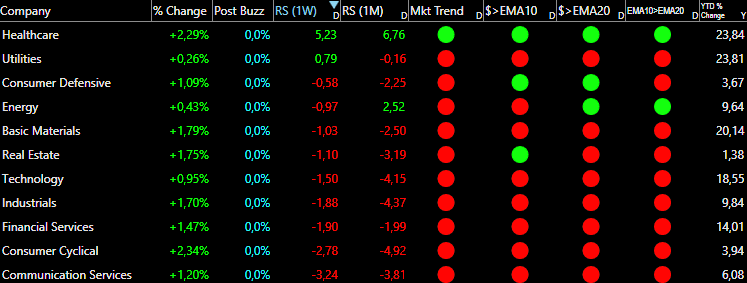

Until then? Our indicators are screaming red. All of them. So we sit. Hands off. Cash-heavy. Watching.

The market doesn’t owe us action. It doesn’t care that we’re bored, that we’re itching to do something. The market will take our money whether we’re patient or not, but it’s a hell of a lot more generous when we wait for the right moment.

If there’s one industry that’s been beaten like a rented mule, it’s restaurants. These stocks have lost 40-50% in the last few months. They’ve been filleted, deboned, and left to rot in the walk-in. If you’re looking for a bottom, this might be it. Or maybe it’s just another false floor in a collapsing building. Hard to say. But at least the restaurant stocks are interesting, which is more than I can say for most of this market (we’re closely monitoring one in particular).

This week, like last week, we did almost nothing. We had three positions. Now we have two. And a lot of cash.

We found a couple of setups that looked promising—good bones, decent risk/reward—but the volatility is so violent, so erratic, that nothing’s setting up cleanly. Stocks can’t consolidate. They can’t build a base. They’re getting whipsawed like a fish on a line, and we’re not interested in getting hooked alongside them.

You have to get creative in a market like this. You have to find different ways in: side doors, back alleys, the kind of entries that don’t scream

“I’M HERE, TAKE MY MONEY.”

We’re adapting. Trying new things. But we’re not forcing it.

Because forcing it is how you get your face ripped off.

Another window will open. It always does. And when it does, we’ll be ready to increase our risk appetite, add positions, and get back in the game.

Latest articles:

Each stock carries a risk badge: ⚠️ High | 📊 Medium | 🛡️ Low.

Based on volatility, float, technicals, and fundamentals. Size your positions accordingly.

📈 Free Setup: Make It Count

INBX: Inhibrx Biosciences Inc ⚠️

What they do: Develop novel biologic therapies targeting rare cancers and hard-to-treat solid tumors.

Why watch? Inhibrx Biosciences represents a compelling risk-reward proposition in the oncology space, anchored by ozekibart (INBRX-109), a differentiated therapeutic candidate addressing chondrosarcoma, a rare bone malignancy with no approved targeted therapies and limited chemotherapy efficacy. Recent Phase 2/3 data demonstrated a doubling of progression-free survival versus placebo, a clinically meaningful outcome in a disease characterized by poor prognosis and high unmet need. Beyond chondrosarcoma, ozekibart is exhibiting encouraging early-stage activity in colorectal cancer and Ewing sarcoma, suggesting potential label expansion and broader commercial applicability across multiple tumor types. The company’s pipeline is further bolstered by INBRX-106, an immunotherapy asset in development for refractory head and neck cancer and non-small cell lung cancer, with pivotal data readouts anticipated by year-end 2025, a near-term catalyst that could materially re-rate the equity. Financially, INBX maintains adequate liquidity to fund operations through at least the next twelve months, though additional capital raises are likely as the pipeline advances toward commercialization. The planned mid-2026 U.S. regulatory filing for ozekibart represents a critical inflection point; successful approval would transition Inhibrx from a clinical-stage entity to a commercial-stage biopharmaceutical company, unlocking significant value given the scarcity of effective treatments in its target indications.

Technical Outlook: The stock is navigating the 10-EMA with precision, demonstrating notable resilience amid broader market volatility and index weakness. A constructive consolidation pattern is forming on below-average volume, suggesting accumulation rather than distribution. The $85.00 level has emerged as a clear line in the sand for bulls. The initial breakout (marked by elevated volume) left the stock overextended; the current digestion phase is healthy, allowing the stock to consolidate recent gains and establish a more sustainable base. This technical reset improves the risk-reward profile for continuation higher.

Why We Don’t Wait for Sunday

Markets don’t move on your schedule. The best low-risk entries don’t announce themselves politely and wait for the weekend newsletter.

They show up when they show up. And if you’re not positioned, you miss them.

Paid members get real-time alerts: exact entries, stops, position sizing, and the thesis behind every trade. The same information we use to manage our own capital.

Free members get just one pick on Sunday.

Does that sound like an edge to you?

What’s Inside Premium

📊 Watchlist Elite (7-9 Stocks)

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment.

💼 Full Portfolio Transparency

Every position we hold. Entry price. Current P&L. Stop level. Real money, real risk.

⚡ Real-Time Trade Alerts (Chat Access)

This is where the edge lives. Exact entries, stops, and position sizing. Real-time. No lag

🎯 Quick Picks (5 Names)

Additional setups that just missed our main criteria but are worth watching.

💬 Chat Access

See our thought process in real time. Ask questions. Watch how we manage risk.

🛠️ The Tools We Actually Use

Member discounts on TC2000, Fiscal.ai, and other platforms. Same tools, better pricing.

What Paid Members Say:

We’re entrepreneurs first, traders second. We’ve sat in the CEO chair. We know what real execution looks like and how to spot it.

€39/month or 299€/year. Less than one losing trade. Cancel anytime.

Portfolio updates and new positions: