Equity X-Ray: In-Depth Research #27

How Data Centers Hijacked the Grid and Where the Money Flows Next

Introduction

A set of large diesel generators hums to life somewhere behind a new hedge and security gate. Your bills go up. It may smell slightly burned as a “test” occurs. A whispered rumor at city hall regarding “large load additions,” special tariffs, and a rushed permit for a gas peaker suddenly has a price tag with your name on it.

That is the dirty truth that was left out of the AI keynote: “the green cloud” is gray at night. Hyperscale campuses are using power like a million homes at a single node; they are depending on natural gas and diesel to run their models during the day, while the rest of the population will have to deal with the pollution and higher rates. The ownership of hyperscale campuses is hidden by NDAs. Backup diesel generators that were “just in case” are running once a week. Utilities are racing to meet the needs of private, always-on computer services, even if it means your neighborhood receives brownouts and increased rates.

If this all sounds like an exaggeration, good. What happens now will determine who will pay for the AI explosion, who will breathe in the smoke from the explosion, and who will make the profits from the bottlenecks that exist.

The article below is the story behind the substation fence and the road map for investors to follow, hiding in plain sight:

Part I reveals the power math no one wants to own—and the water arithmetic communities can’t ignore: how hyperscale campuses and AI data centers pressured and distorted utility forecasts, how transformer shortages and interconnection queues are the real chokepoints, and what the “Dark Truth” looks like up close—diesel test days, PM2.5 spikes, and privately funded urgency with socially funded costs.

Part II explains why natural gas is the connection keeping AI operating in the recent future—fast, firm, and unglamorously—and the bill shows up at 2 a.m. in emissions and rates.

Part III identifies the direction of the money flow: two investable directions in the grid‑edge buildout and dispatchable power, including the company details, risk, and curiosities that differentiate a headline from a thesis.

If you want to see your power bill decrease, your air quality improve, or your investments grow, you cannot remain silent. The most valuable moat in AI is not model weight; it is the substation. And the competition to secure these is already occurring.

🌱 Support Our Work: Buy Us a Coffee🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

Part I — The Boom That Ate The Grid

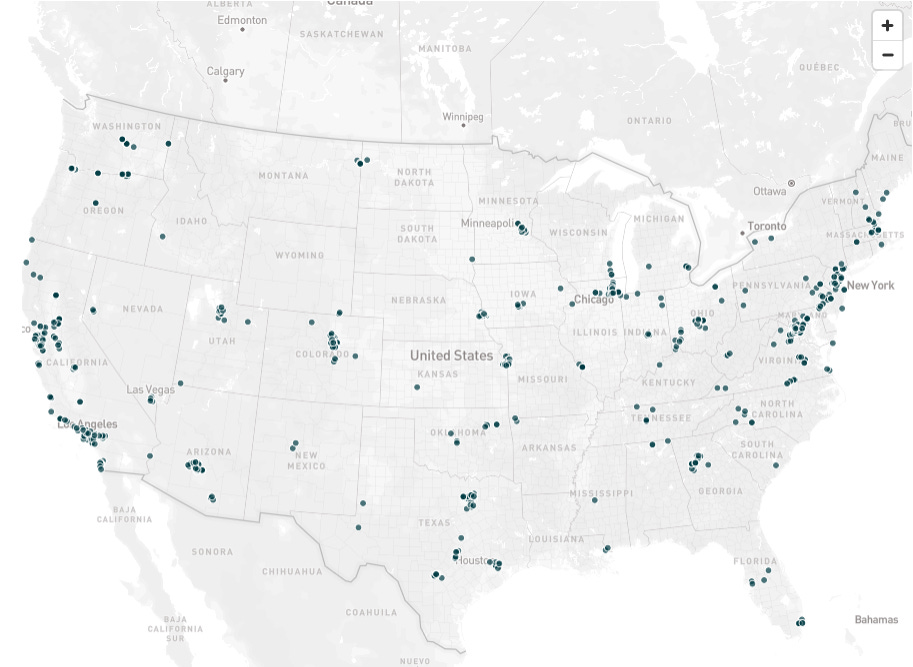

The first part of this article describes the electric grid’s vulnerability to the growing energy demands of data centers. These data centers are being built at an incredible rate. There are no national records for the number of data centers in the United States, and no single federal agency is responsible for tracking them. They operate under many different names, including shell LLCs (limited liability companies), and they negotiate non-disclosure agreements (NDAs) to protect their business interests from competitors. However, data center builders do obtain permits for emergency diesel backup generators and other components that use electricity, which can be used as indicators of where data centers are located.

When the locations of all the emergency backup generators are mapped and combined with information obtained from permit applications, a picture emerges. Data centers currently consume approximately 1,000+ megawatts of electricity—nearly four times the amount consumed in 2010. The largest providers include Amazon, Microsoft, Google, Meta, and QTS. Approximately 329 data centers operating in Northern Virginia alone, generating nearly one-quarter of the total electricity consumed in the state in 2024, supported nearly one-third of global Internet traffic through the region. Data centers continue to be developed throughout the United States in areas such as Santa Clara, California; Maricopa County, Arizona; and the suburbs surrounding Columbus, Ohio. These developments are fueled by inexpensive land and water resources, tax incentives, access to high‑speed fiber‑optic connections, and the availability of high‑voltage power lines.

From an aerial perspective, the facilities appear to be neat geometric structures composed of transformer yards, diesel backup generators, cooling systems, and rows of server cabinets. However, once removed from the structure, the true nature of the facility becomes apparent. The server cabinets continuously draw power to process data. The continuous consumption of power creates significant heat in the data centers. Cooling systems, designed to remove the excess heat, also continuously consume power. Industrial‑scale cooling systems, commonly referred to as chillers, use large amounts of power. Furthermore, these cooling systems are redundant to ensure continued operation during periods of failure. Some of the larger data center campuses are estimated to consume as much as 2 terawatt‑hours (TWh) of electricity annually. This represents enough electricity to support the annual needs of 200,000 homes. The next generation of data center developments will be comprised of high‑density artificial intelligence (AI) training clusters. The power consumption of these clusters will significantly exceed that of traditional data centers.

The communities near the data centers will bear the burden of the increased power consumption. Communities, however, experience the increased power consumption of data centers as daily living expenses and lifestyle changes rather than as abstract charts and statistics. For example, residents in Prince William County, Virginia, report experiencing the effects of the continuous operation of the data center cooling systems as “continuous industrial noise.” In some cases, residents install new windows, insulate their homes, purchase white‑noise machines, and/or move to basements to escape the constant hum of the data center cooling systems. Regulators argue that the data center operations comply with existing regulations. Residents disagree. Existing regulations were established before the development of a city’s worth of machine operations continuing to operate 24/7, 365 days per year.

In addition to the power consumption of data centers, the water usage associated with data center operations adds a secondary strain to the infrastructure. For example, in metropolitan Phoenix, where the drought situation has drastically altered available land uses, Microsoft applied for permits for nearly 280 backup generators to support its expanding data center campus. Additionally, Microsoft applied for approval to utilize up to 1 million gallons of water per day per building. Therefore, in aggregate, the water usage of Microsoft’s data center campus would represent the equivalent of a mid‑sized city’s water usage. Throughout the United States, similar trade‑offs occur between water conservation measures and increased electricity consumption. Closed‑loop or air‑based cooling methods can reduce water usage; however, they require increased electricity consumption to operate. The data show that large percentages of the largest data center operators’ facilities are constructed in regions with high levels of water stress. In Texas, for example, Google utilized approximately 160 million gallons of water in 2023 to cool its data center campus. Similarly, Kyndryl’s data center campus in Boulder, Colorado, utilized approximately 84.5 million gallons of water in 2023. Many of the largest data center operators have pledged to achieve “water positivity” status by 2030; however, many of these commitments rely upon credits and offsets to achieve the water‑positivity goal.

Credits and offsets enable companies to compensate others for conserving water, thereby offsetting their own water usage at the local tap.

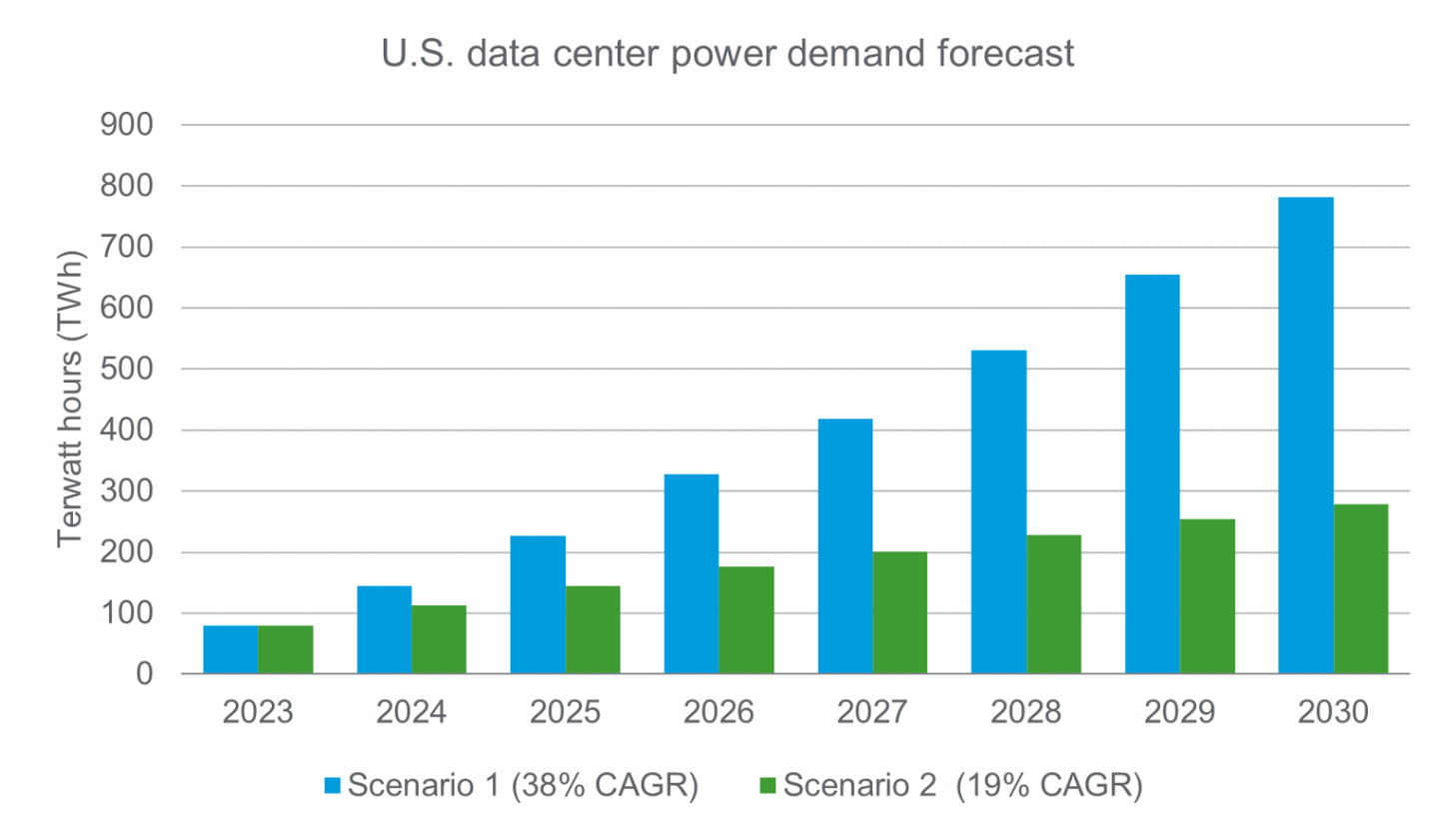

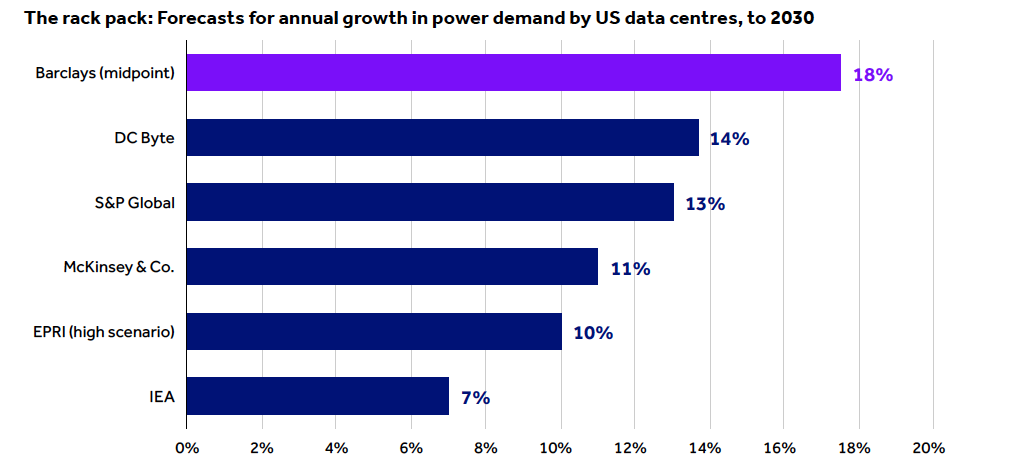

The local examples of water usage and power consumption of data center operations contribute to the larger mathematical models of the potential power consumption of future data center development. If all the power requirements of the data centers tracked so far are aggregated, the power consumption of the data center sector could potentially surpass the electricity consumption of an entire European country. Future data center power consumption could potentially reach mid-hundred-terawatt-hour levels in a short period, further reducing the margin of error of the electrical grid. Utilities are working to increase the amount of electricity generated to meet the increasing demands placed upon them by the data center sector.

For example, Dominion Energy estimates that it will need to double the amount of electricity it generates by 2039 and invest up to $103 billion in capital improvements to support the increased electricity demand. Dominion Energy believes that the cost of electricity to residential consumers could increase by as much as 50%. In the Midwest, planned coal‑fired plant retirements have slowed down; therefore, gas‑fired peaking plants are once again being considered as viable options. Interconnection queues are stretching into the distant horizon.

States continue to offer economic incentives to encourage the development of the data center sector. For example, states offer zero sales tax on equipment and materials, favorable tariff rates, and extended property‑tax abatement programs to attract data center development announcements. When the location of a proposed data center is announced, the owner of the data center is rarely identified publicly until after the data center is operational. An anonymous limited liability company applies for a 15‑year property‑tax abatement for 300 acres of land. Later, the owner of the LLC is revealed to be Meta or another major data center operator. The land is graded, the switchgear is purchased, and the substation is sited.

This represents the paradox of the data center build‑out. We are consuming staggering amounts of power and water to create software that promises to make everything else more efficient. While the promise of the software to optimize routes, smooth peaks, reduce waste, and possibly even optimize the data centers themselves may eventually be realized, the current physics of power and heat dictate the immediate realities of the data center build‑out. The electrical grid must supply the power required to support the data centers immediately, not in theory.

When you need to deliver gigawatts of power in a matter of months, while interconnection studies take years and multistate transmission lines remain tied up in courts, your choices become very limited very quickly. While solar and wind are increasingly viable options for providing baseload power to data centers (and several of the hyperscalers have signed numerous large power‑purchase agreements (PPAs) and are exploring the feasibility of developing nuclear power facilities) to provide the surge capacity, maintain grid stability, and support peak AI loads on a particular morning, utilities and developers are turning to the dispatchable fuel source that is abundant, financeable, and capable of rapid deployment: natural gas. Part Two examines how and why natural gas is becoming the default bridge between the current state of the electrical grid and the future AI‑driven electrical grid, and where alternative fuels may potentially replace natural gas as the primary fuel source supporting the data center build‑out.

Part II — Gasland, Explained: Why Natural Gas Is Powering AI Right Now