🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 64

When the Gods Bleed: A Love Letter to Market Pain

Early November hit like a bad oyster.

The Nasdaq—that glittering monument to American technological hubris—posted its steepest weekly drop since April. The biggest names in tech, those untouchable titans we’d been genuflecting before all year, suddenly looked mortal. Vulnerable. The headlines screamed. The talking heads wrung their hands. And then, like a drunk’s promise to quit, it was over. The following week, everyone moved on. The correction was “short-lived,” they said. Nothing to see here, folks.

But here’s the thing: you should not move on.

There’s a lesson in that volatility—a real, visceral, grab-you-by-the-throat lesson—and if you ignore it, you’re going to get your ass handed to you in the months ahead. I’ve seen this movie before. I know how it ends.

When one sector dominates returns for as long and as powerfully as technology has—when the AI trade becomes the only trade—you should expect turbulence. Even when the earnings look good. Even when the free cash flow is positive. Especially then.

Let me be clear: AI is transformative. The technology itself is real, powerful, and world-changing. I’m not some Luddite screaming about the robots taking our jobs. But the financial structures supporting this boom? They’re getting creative. And in my experience, when Wall Street gets “creative,” someone’s about to get fu**ed.

Building out data centers, chips, infrastructure—the whole AI backbone—requires extraordinary amounts of capital. And Wall Street, never one to miss a party, has responded with equally extraordinary financing. The kind of financing that looks brilliant in a bull market and catastrophic when the music stops.

Parts of this boom carry a whiff of excess. You can smell it if you know what to look for. It’s the same smell that preceded every other bubble I’ve lived through: the intoxicating perfume of easy money and collective delusion.

Every weekend, we scan thousands of stocks. It’s tedious, mind-numbing work: the kind of thing that makes your eyes bleed after hour three. But you develop a feeling for it. You start to see patterns. You notice when multiple stocks in the same group are setting up, flagging nicely, whispering that something’s about to happen.

This week, the group that caught my eye was Shipping & Ports. Four, maybe five names, all setting up beautifully. One of them will be in the watchlist. You’ll see.

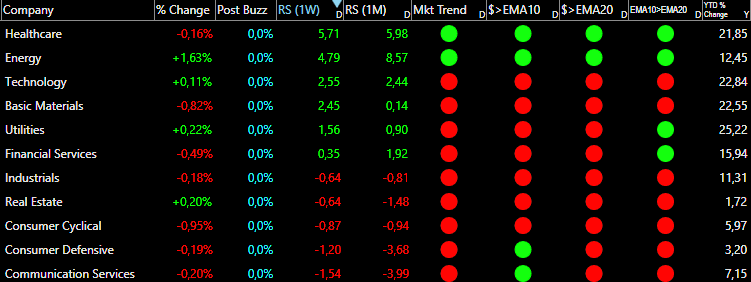

This is why we spent most of the week in cash. We added just one position on Friday. And yes, before you ask, it’s in one of the two strongest sectors out there. I’ll let you guess which one.

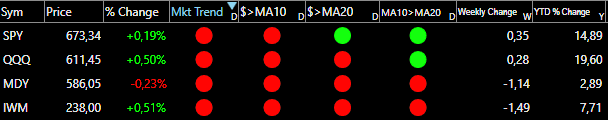

Our trend indicator is flashing red across all the major indexes: SPY, QQQ, and IWM. The VIX is flirting with 20.00 and climbing. Despite the bounce, the signals are clear.

Now, let’s not panic. The price is still above the 50-day exponential moving average, which means the long-term bull trend is intact. A correction is healthy. There’s nothing wrong with it. But for low-risk entries—the kind that let you sleep at night—we need more digestion. Less volatility. More clarity.

Right now, we’re neutral. We’re waiting. We’re watching.

Latest articles:

Each stock carries a risk badge: ⚠️ High | 📊 Medium | 🛡️ Low.

Based on volatility, float, technicals, and fundamentals. Size your positions accordingly.

📈 Free Setup: Make It Count

GTX: Garrett Motion Inc 📊

What they do: Supplies turbochargers and related technologies for automotive and industrial applications.

Why watch? Slower BEV adoption and resilient ICE/hybrid demand favor Garrett, which is also expanding into data-center generator sets. Management guided to “over $100M” of 2025 stationary-power sales and booked $40M+ of new genset awards in Q3. Q3 2025 net sales were $902M (+6% cc), adjusted EBITDA $133M (14.7% margin), and adjusted FCF $107M; outlook midpoint for 2025 was raised. Shares near ATHs inside a Darvas box with minimal overhead supply left; a low-volume consolidation is in progress. Prefer a couple more days of tight consolidation (20ema catching up), but 16.70 remains a key level buyers must defend.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

Why We Don’t Wait for Sunday

Markets don’t move on your schedule. The best low-risk entries don’t announce themselves politely and wait for the weekend newsletter.

They show up when they show up. And if you’re not positioned, you miss them.

Paid members get real-time alerts: exact entries, stops, position sizing, and the thesis behind every trade. The same information we use to manage our own capital.

Free members get just one pick on Sunday.

Does that sound like an edge to you?

What’s Inside Premium

📊 Watchlist Elite (7-9 Stocks)

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment.

💼 Full Portfolio Transparency

Every position we hold. Entry price. Current P&L. Stop level. Real money, real risk.

⚡ Real-Time Trade Alerts (Chat Access)

This is where the edge lives. Exact entries, stops, and position sizing. Real-time. No lag

🎯 Quick Picks (5 Names)

Additional setups that just missed our main criteria but are worth watching.

💬 Chat Access

See our thought process in real time. Ask questions. Watch how we manage risk.

🛠️ The Tools We Actually Use

Member discounts on TC2000, Fiscal.ai, and other platforms. Same tools, better pricing.

What Paid Members Say:

We’re entrepreneurs first, traders second. We’ve sat in the CEO chair. We know what real execution looks like and how to spot it.

€39/month or 299€/year. Less than one losing trade. Cancel anytime.