🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 71

The Art of the Wait (And Why You’re Going to Die Anyway)

Let’s be honest about what happened this week. The noise (whatever the hell the headlines were screaming about) faded into the background. The panic sellers wiped the vomit off their chins, looked at the screens, and decided maybe the world wasn’t ending after all.

Stocks clawed back, recouping the losses, and everyone patted themselves on the back.

But don’t get comfortable.

Here’s the thing they won’t tell you on CNBC while they’re flashing green arrows and smiling like sharks: The machine wasn’t built for you. It was built to grind you down, to extract your capital and your sanity in equal measure. We are in a volatility grinder now. The easy money? That’s gone. Now we’re in the trenches, and the only thing that matters is survival.

You see it all the time. Good operators are getting chewed up not by the market, but by their own wiring. Fear when the floor drops out. Euphoria when the line goes up. Anxiety when the P&L flatlines. It’s an emotional whirlpool, and if you let it, it will pull you under.

We have to look back to the old guard. I’m not talking about Buffett or Soros. I’m talking about Marcus Aurelius. The Stoics. These guys understood that the world is chaotic.

“You have power over your mind, not outside events. Realize this, and you will find strength.”

That’s the trade. Right there. You can’t control the Fed. You can’t control the algo-sweeps. You can’t control whether the market decides to rip your face off at the open. The only thing you control is your process. The only thing you control is how you take the punch.

But let’s go deeper.

Memento Mori.

Remember that you will die.

I want you to really sit with that. It sounds morbid, I know. But in this game, it is the ultimate liberation. When the screen is bleeding red, when your thesis is crumbling, when you feel like absolute sh*t because you missed the move or took the loss, remember that you are dust.

We have one life. Just one. And it is terrifyingly short. Do you really want to spend your limited time on this spinning rock, letting a fluctuating number on a glowing screen dictate your self-worth?

Trading is what we do. It is the craft. We love the action, the puzzle, the fight.

But it is not who we are.

If you let the outcome of a trade bleed into your dinner with your family, or ruin the taste of a good bottle of wine, the market has already beaten you.

Put it in perspective. You are going to die. The market will be here long after you’re gone, blinking and flashing for the next generation of suckers.

So relax. Take a breath. Detach.

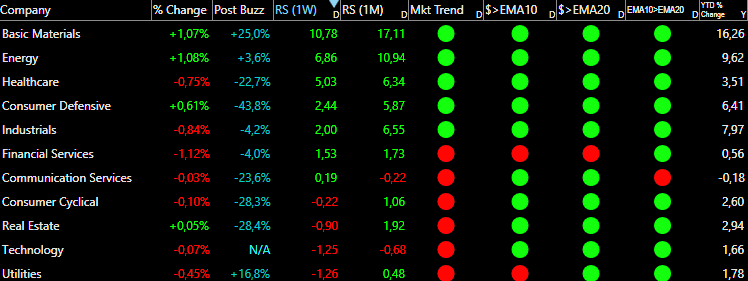

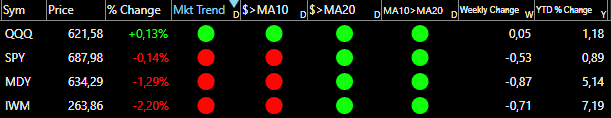

Now, let’s look at the board.

We started this intro with philosophy because, frankly, the tape this week was a mess.

We opened a position, but for the most part? We stayed flat. We sat on our hands.

Friday was a masterclass in illusion. You saw the heavy lifting.

The “Big Boys” (Netflix, Microsoft, the generals of this army) held the line. They dragged the indices higher. That’s important. It keeps the dream alive for next week. But look under the hood.

Our watchlist is thin. We are scanning thousands of charts, looking for that perfect setup, that moment where the probability tilts in our favor, and we’re coming up empty. It’s harder and harder to find good names.

So, what do we do? We wait.

Earnings season is coming down the pipe like a freight train, and that’s going to be the next key pivot.

Until then, pour a drink. Hug your kids. Remember Memento Mori. And be ready to react when the bell rings.

Latest articles:

Each stock carries a risk badge: ⚠️ High | 📊 Medium | 🛡️ Low.

Based on volatility, float, technicals, and fundamentals. Size your positions accordingly.

📈 Free Setup: Make It Count

EAT: Brinker International Inc🛡️

What they do: A restaurant operator managing casual dining brands

Why watch? Brinker has executed an exceptional turnaround of its Chili’s brand, making it one of the top-performing restaurant concepts in the industry over the past two years. However, concerns about the sustainability of restaurant spending and margin pressure due to ongoing consumer affordability challenges have weighed on the sector and EAT shares. The challenge is clear: consumers are pulling back and becoming more selective with discretionary spending. Restaurants have partially offset declining traffic by raising prices, but this strategy has limits. One positive development is that restaurant input costs appear to be easing. Higher beef prices have been a particular source of margin pressure, but we believe the worst is behind us. The Administration’s elimination of tariffs on Brazilian beef and increased imports from Argentina should expand supply and alleviate pricing pressure. While Chili’s is performing exceptionally well, the Maggiano’s brand is in the early stages of its own turnaround, implementing a playbook similar to what succeeded at Chili’s, including a revamped menu refocused on classic dishes, investments in improved service, and restaurant refurbishments. Brinker generated $72 million of free cash flow, even with $47 million in seasonal working capital headwinds. Importantly, the company maintains a strong balance sheet with just $526 million in long-term debt and finance leases, translating to less than 1x debt-to-EBITDA leverage.

Technical Outlook: The stock has already delivered an impressive 60% gain from its recent bottom. After breaking above the $155.00 level (a move we unfortunately missed), the stock tested this same level last week and found support at the 10-day exponential moving average, now forming a tight flag pattern. With a stop-loss positioned below the 20-day exponential moving average, the stock offers an attractive risk-reward setup in a beaten-down sector, and EAT appears to be the clear leader. If the consolidation resolves to the upside, the next leg higher could be significant.

Why We Don’t Wait for Sunday

Markets don’t move on your schedule. The best low-risk entries don’t announce themselves politely and wait for the weekend newsletter.

They show up when they show up. And if you’re not positioned, you miss them.

Paid members get real-time alerts: exact entries, stops, position sizing, and the thesis behind every trade. The same information we use to manage our own capital.

Free members get just one pick on Sunday.

Does that sound like an edge to you?

What’s Inside Premium

📊 Watchlist Elite (7-9 Stocks)

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment.

💼 Full Portfolio Transparency

Every position we hold. Entry price. Current P&L. Stop level. Real money, real risk.

⚡ Real-Time Trade Alerts (Chat Access)

This is where the edge lives. Exact entries, stops, and position sizing. Real-time. No lag

🎯 Quick Picks (5 Names)

Additional setups that just missed our main criteria but are worth watching.

💬 Chat Access

See our thought process in real time. Ask questions. Watch how we manage risk.

🛠️ The Tools We Actually Use

Member discounts on TC2000, Fiscal.ai, and other platforms. Same tools, better pricing.

What Paid Members Say:

We’re entrepreneurs first, traders second. We’ve sat in the CEO chair. We know what real execution looks like and how to spot it.

€39/month or 299€/year. Less than one losing trade. Cancel anytime.

Portfolio updates and new positions: