🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 75

The Waiting Room

The terminal blinks. Same numbers, different day. You refresh. Nothing. You refresh again. Still nothing.

This is what they don’t prepare you for in business school: the slow torture of a market that refuses to move. Since November, we’ve been locked in a cage match where nobody throws a punch. Bulls stare at bears. Bears stare at bulls. Everyone’s waiting for someone else to flinch first.

I’ve been doing this long enough to know that boredom in markets is like silence in a bad neighborhood. It doesn’t mean nothing’s happening. It means you can’t see what’s happening yet.

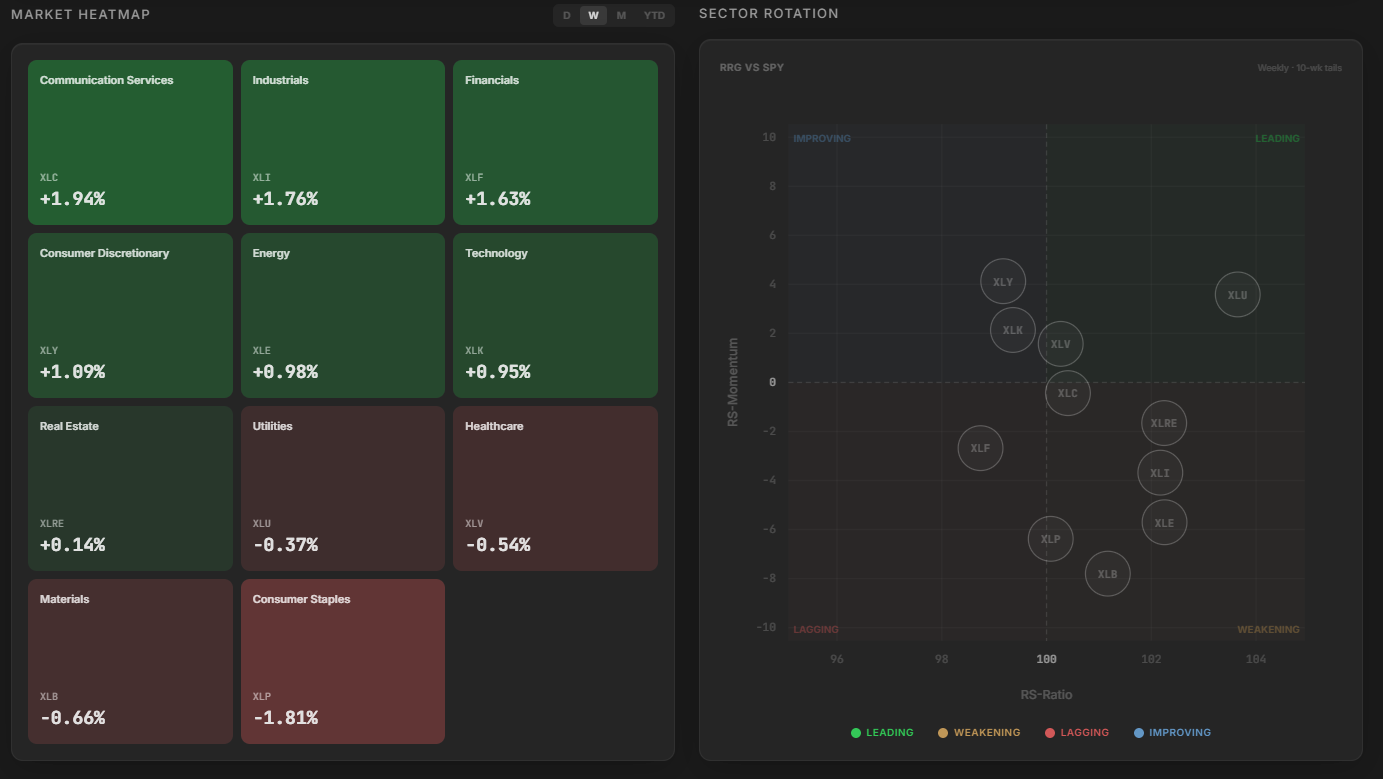

The Rotation

Close your eyes, and you’d think the market’s asleep. Open the hood, and you’ll see capital moving like a card sharp’s hands: fast, deliberate, invisible to anyone not paying attention.

Everyone’s screaming about AI. Bubble or backbone? The lazy comparison is to 2000, when every kid with a Geocities page got venture funding and companies with no revenue traded at fifty times nothing. But here’s what’s different: the hyperscalers aren’t burning through daddy’s money. They’re printing cash! tens of billions in operating flow, the kind of numbers that make your eyes water when you actually look at the statements.

Is there excess? Absolutely. There’s always excess when humans smell the future. But excess doesn’t mean fraud. It means overshoot.

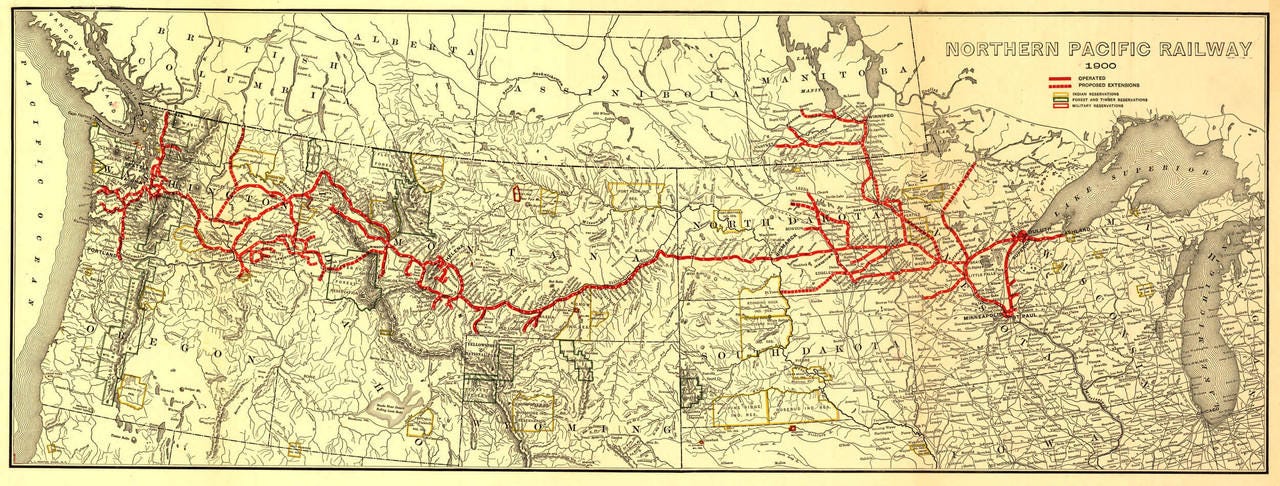

My great-grandfather worked for the railroad. By 1901, over half the railroad stocks in America were bankrupt. Dead money. Shareholders got obliterated. But you know what didn’t go bankrupt? The actual rails. The steel stayed in the ground. The infrastructure became the circulatory system of the entire industrial age. The investors who funded it got slaughtered, but the country got rich.

That's the thing about revolutions: they're terrible investments until they're not. And even when they are, the people who build them rarely get to keep the spoils.

If AI becomes infrastructure—and it will—then we need to talk about what happens to pricing power. When electricity was new, the companies that built the grid made fortunes. Then it became a utility. Returns flattened. Margins compressed. Everyone still needed it, but nobody got rich owning it anymore.

That’s the risk here. Not a crash. A slow fade into respectability. You fund the revolution, you earn utility returns. It’s not sexy. It’s not a Ponzi scheme. It’s just the patient, grinding reality that capital hates to admit: sometimes you pay for the future, and someone else collects.

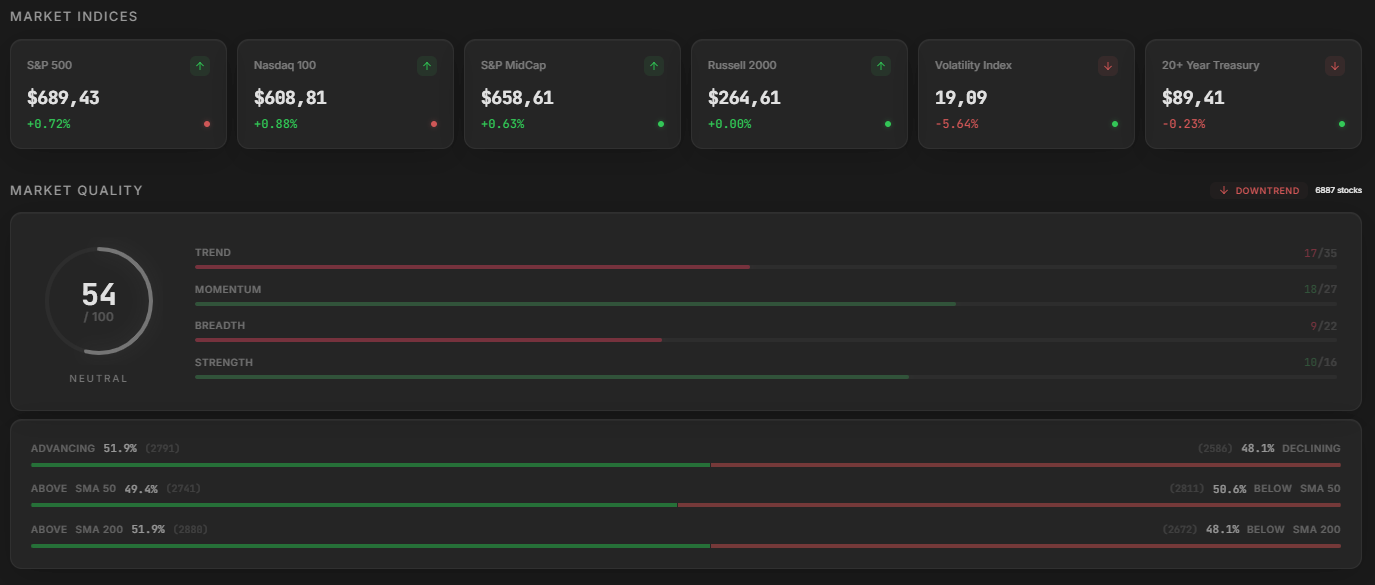

What's Actually Moving

Equities won’t break. That’s the headline. But underneath, there’s a tell: the S&P MidCap 400 is leading. Not the Magnificent Seven. Not the meme stocks. The middle boring, cash-generating, operational businesses that don’t get profiled in Wired.

The Russell 2000 just turned green in our models. Small caps. The stuff that moves when people think the economy might actually hold together.

We added positions this week. Solar. Big tech. Software. Not the fashionable names. The ones that generate cash and don’t need a story to justify the valuation.

No stops triggered! In a market this choppy, that’s a miracle.

Survival as Strategy

There’s a scene in every war movie where the veteran tells the rookie that the goal isn’t to be a hero. The goal is to make it home.

Markets are the same.

In dull regimes, the winners aren’t the ones swinging for the fences. They’re the ones who don’t get knocked out.

Resilience compounds. Slowly. Quietly. Long before the excitement comes back and everyone pretends they knew it all along.

The machine wasn’t built to reward patience. It was built to extract fees from impatience. But if you can sit in the waiting room without losing your mind, you’ll still be here when the doors finally open.

And they always open.

Eventually.

We are currently developing an application.

It is not a generic solution for every market participant, but a platform built specifically for swing trading, momentum strategies, and short to medium-term investing.

If we see meaningful interest, we will open a limited number of testing spots and allow selected users to access the platform early.

As previously stated, all paid subscribers will receive full access to the platform at no additional cost.

Latest articles:

Each stock carries a risk badge: ⚠️ High | 📊 Medium | 🛡️ Low.

Based on volatility, float, technicals, and fundamentals. Size your positions accordingly.

📈 Free Setup: Make It Count

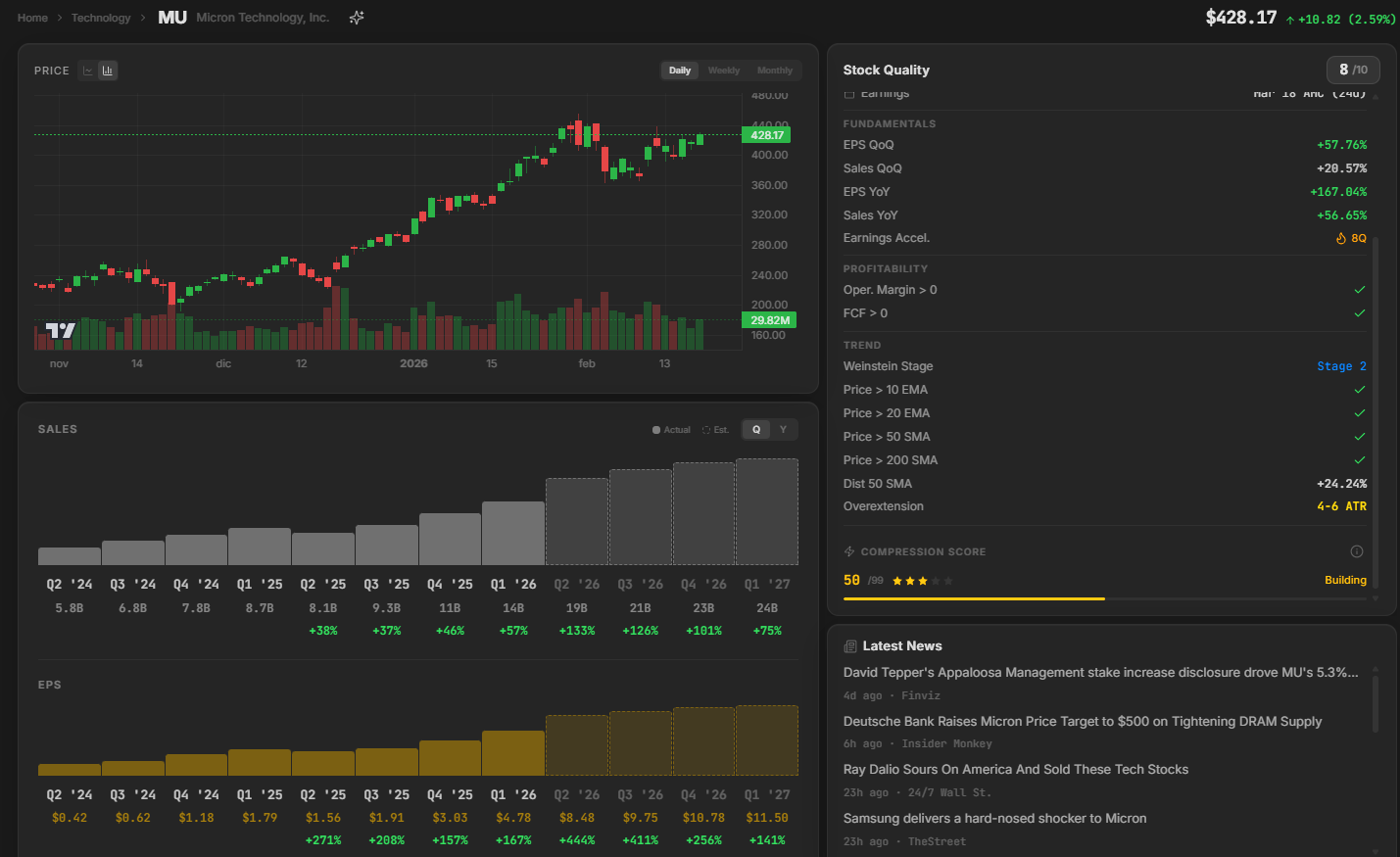

MU: Micron Technology Inc 📊

What they do: A leading global manufacturer of memory and storage solutions

Why watch? Most narratives surrounding Micron focus on artificial intelligence driving unprecedented memory demand, HBM being sold out through 2026, and the stock trading at a discount relative to the broader semiconductor sector. While these points are valid, the market may be underweighting a more nuanced and potentially more important story: how Micron is allocating its constrained supply and converting that strategic positioning into superior margins and cash flow.

In a supply-constrained environment (which is where Micron finds itself today), the most critical strategic decision isn’t how much to produce, but rather where to send what you produce. Rather than distributing output evenly across all markets, Micron is deliberately rotating its production capacity toward the highest-margin, highest-return-on-investment applications. This is a subtle but powerful shift that can dramatically impact profitability even if total unit volumes remain relatively flat.

As AI workloads scale exponentially, the storage infrastructure must evolve to move data faster and store it more densely to support the massive datasets that need to sit close to compute resources. Micron’s data center NAND revenue exceeded $1 billion in the first quarter of fiscal 2026, with the company successfully qualifying 122-terabyte and 245-terabyte QLC (quad-level cell) solid-state drives at multiple hyperscale customers. These aren’t simply larger versions of existing drives; they represent an entirely new product class purpose-built for AI-scale workloads. Micron is already qualifying PCIe Gen6 interfaces for the next technology cycle, positioning itself at the leading edge of storage performance.

For context, the shift from general-purpose memory to AI-optimized memory products can carry significantly higher margins, sometimes 2-3x higher, because these products are mission-critical, highly differentiated, and face less price competition. If Micron can continue executing this product mix shift while maintaining supply discipline, the earnings leverage could be substantial.

Technical Outlook: Micron is one of the strongest-performing stocks in the market within one of the most important investment themes of recent months: memory and storage. The stock is currently approaching a significant downtrend line that began at the end of January and appears ready to break through. After a brief pullback at the beginning of the month, the stock has recovered. It is now trading above the 10-day and 20-day exponential moving averages, a sign of strong underlying demand and buyer support. This resilience in a choppy market environment is particularly impressive and suggests institutional accumulation. A clean break above the downtrend line with volume could trigger the next leg higher, potentially attracting momentum buyers.

Why We Don’t Wait for Sunday

Markets don’t move on your schedule. The best low-risk entries don’t announce themselves politely and wait for the weekend newsletter.

They show up when they show up. And if you’re not positioned, you miss them.

Paid members get real-time alerts: exact entries, stops, position sizing, and the thesis behind every trade. The same information we use to manage our own capital.

Free members get just one pick on Sunday.

Does that sound like an edge to you?

What’s Inside Premium

📊 Watchlist Elite (7-9 Stocks)

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment.

💼 Full Portfolio Transparency

Every position we hold. Entry price. Current P&L. Stop level. Real money, real risk.

⚡ Real-Time Trade Alerts (Chat Access)

This is where the edge lives. Exact entries, stops, and position sizing. Real-time. No lag

🎯 Quick Picks (5 Names)

Additional setups that just missed our main criteria but are worth watching.

💬 Chat Access

See our thought process in real time. Ask questions. Watch how we manage risk.

🛠️ The Tools We Actually Use

Member discounts on TC2000, Fiscal.ai, and other platforms. Same tools, better pricing.

What Paid Members Say:

We’re entrepreneurs first, traders second. We’ve sat in the CEO chair. We know what real execution looks like and how to spot it.

€39/month or 299€/year. Less than one losing trade. Cancel anytime.

Portfolio updates and new positions: