🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 74

When the Kitchen Gets Too Hot, You Build Your Own

This week, the market did what it does best: it made liars out of everyone.

January started with Wall Street leaning so far forward they were practically kissing the pavement. Record low cash. Hedges? What hedges? AI was the lock, the sure thing, the trade you’d mortgage your mother’s house for.

Then, in the span of a few weeks, the script flipped.

Not because AI stopped working (it’s working just fine, thanks) but because someone finally asked the question nobody wanted to hear: who’s getting cooked by this thing?

Turns out, it’s not the robots that are the problem. It’s the humans who thought they were irreplaceable.

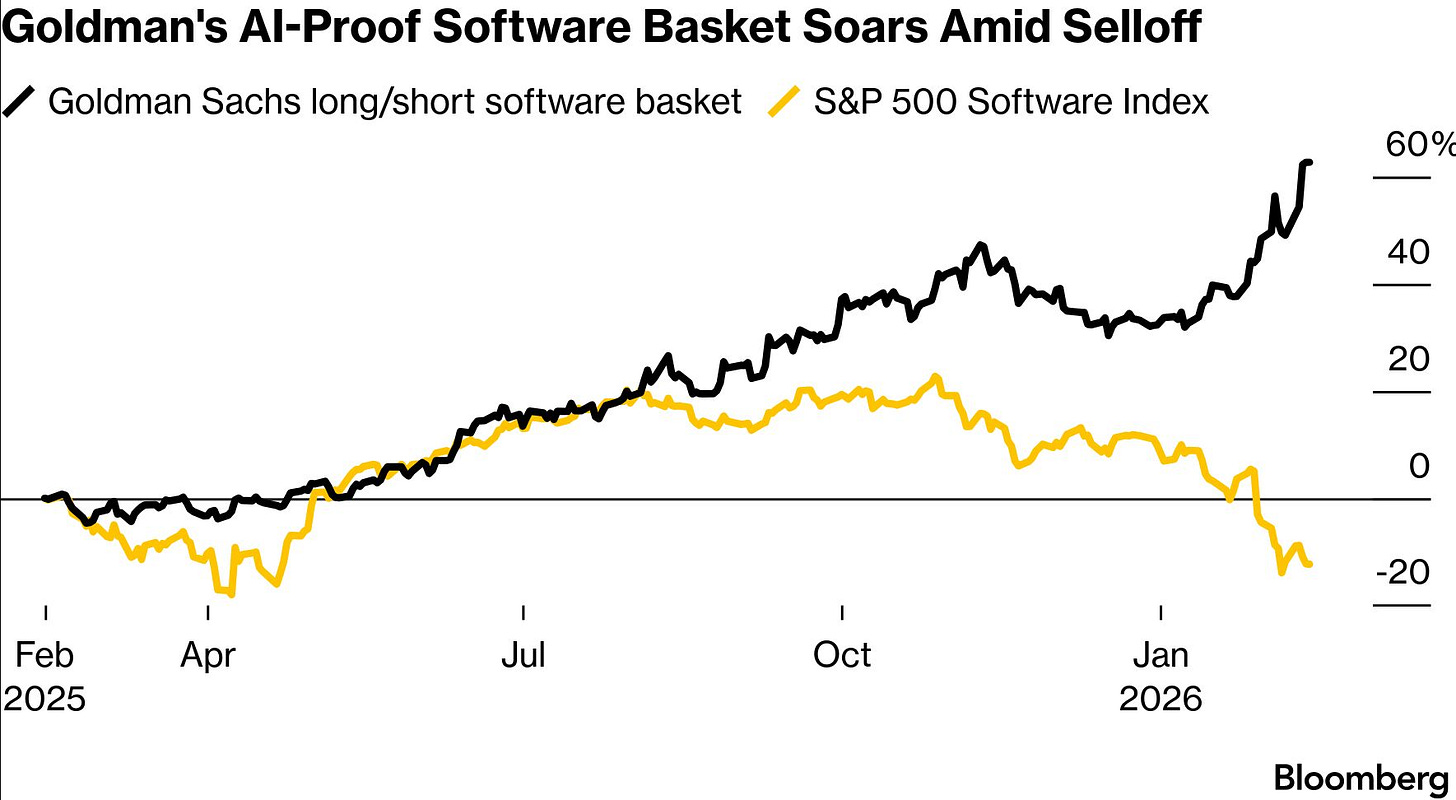

The Software Purge

The S&P 500 Software Index didn’t just stumble; it got dragged into the alley and worked over. Meanwhile, Goldman’s “AI resilient” basket? Outperforming as if it had insider information. The market’s telling you something, and it’s not subtle: software isn’t dead, but the gravy train has left the station.

If your product is a glorified wrapper around a database, a feature some kid with a laptop can replicate in a weekend using Claude or ChatGPT, you’re in trouble.

The companies that survive this aren’t the ones with the slickest UI or the best Series B pitch deck. They’re the ones managing the messy, high-stakes stuff: systems of record, critical data infrastructure, workflows where a screw-up means lawsuits, not just a bad Yelp review.

Complexity is the new moat. Liability is the new defensibility. Everything else is just noise waiting to get compressed into an API call.

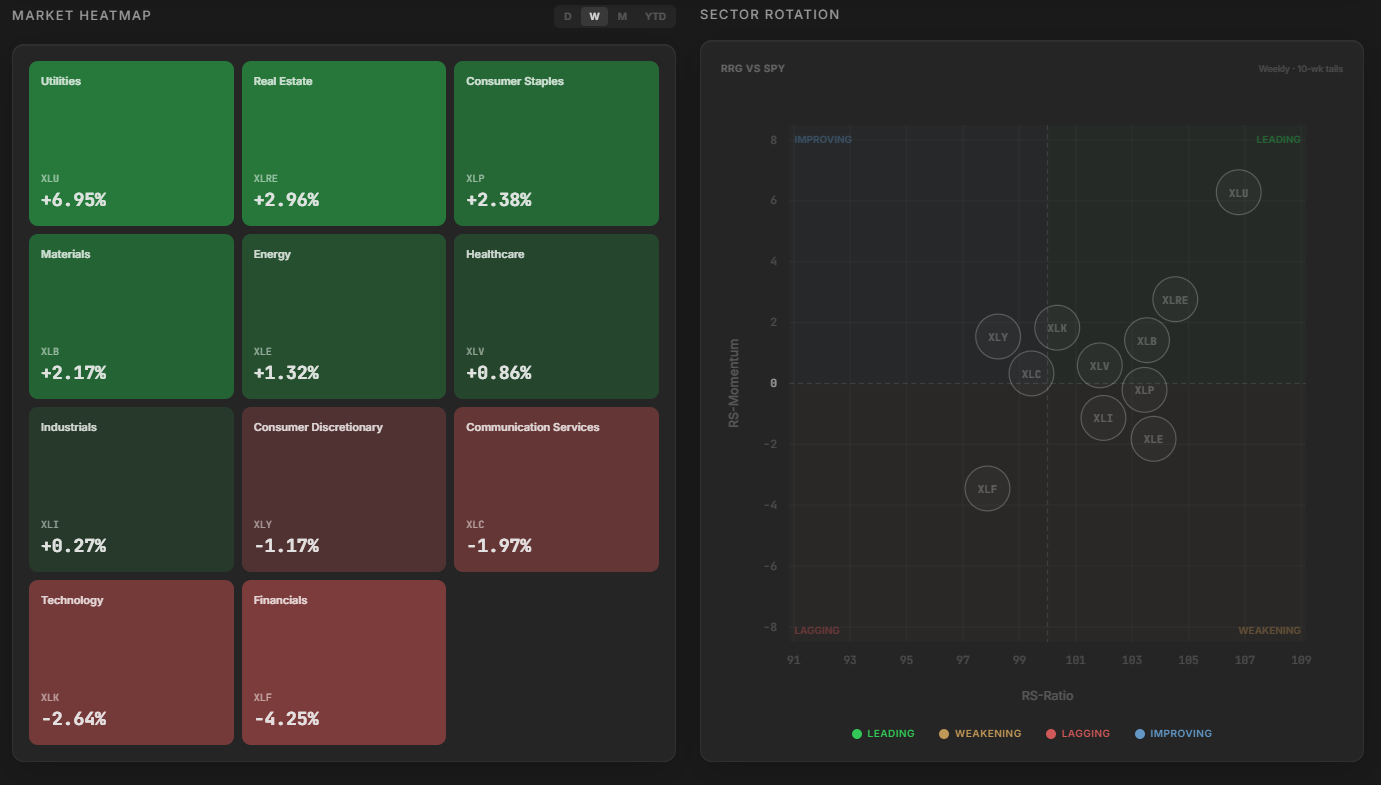

The Contagion Spreads

But it didn’t stop at software. The fear metastasized. Wealth managers, brokers, and tax advisers (the entire white-collar apparatus that spent a decade getting fat on margin expansion) suddenly looked vulnerable.

A decade of optimism got repriced in weeks.

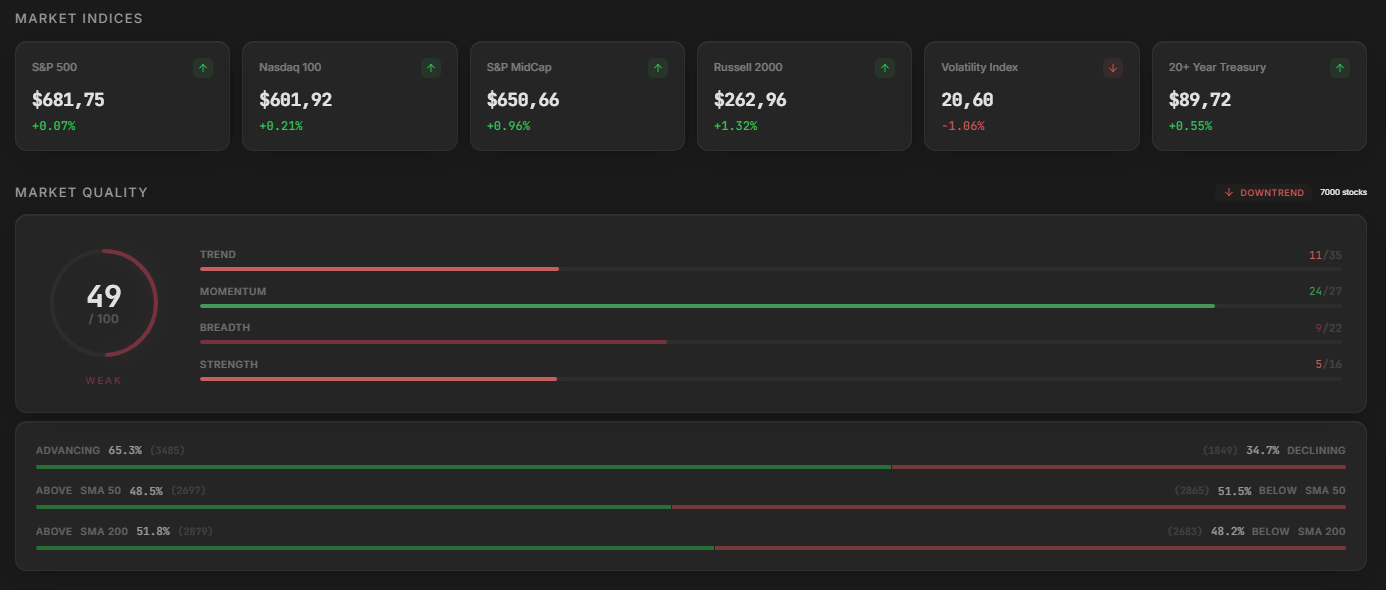

Private debt markets, loaded up on exposure to these businesses, started sweating. The S&P 500 had one of its ugliest stretches in months before a softer inflation print gave it permission to stop bleeding.

We’re range-bound now. Choppy. Difficult. The kind of market where forcing a trade is how you get your face ripped off.

Cash Is a Position (Again)

So we did what any sane operator does when the kitchen’s on fire: we stepped back. Closed another position. Raised more cash.

When setups aren’t following through, when the edge isn’t there, you don’t trade for the sake of trading. You wait. You watch. You preserve capital.

Aggression has its place. This isn’t it.

Building in the Wreckage

But here’s where it gets interesting.

While the market was busy eating itself, we decided to test the AI disruption thesis firsthand.

We’ve been building our own app: rewriting and integrating the proprietary algorithms and indicators we originally developed on TC2000, but in a new environment built specifically for how we trade.

(Shhh… keep it between us — it’ll be free for our Substack paid subscribers! 😉)

Swing setups. Momentum plays. Real-time signals. No bloat.

And you know what? It’s shockingly easy now!

Not frictionless: there are still technical landmines, moments where you’re staring at the screen wondering what the hell just broke, but the leverage AI tools provide is undeniable. A small team with strong ideas and some curiosity can build things that would’ve required a full engineering department three years ago.

It feels like building a video game, except this one actually makes us better at our job. And yeah, some companies are absolutely going to get disrupted.

We’re watching it happen in real time, because we’re doing the disrupting.

Irreplaceability at All Costs

So here’s where we are. The market’s shifted from “growth at all costs” to “irreplaceability at all costs.” The companies that win from here aren’t the ones with the best story; they’re the ones that are too embedded, too complex, too critical to replace.

We’re staying cautious. Higher cash. Selective exposure. And while everyone else is panicking about AI, we’re building tools that give us an edge in whatever comes next.

Because in the end, the best way to survive disruption isn’t to bet on who wins.

It’s to make sure you’re not the one getting replaced.

Join the free TradeDeck waitlist now to show your interest!

If demand is strong, we’ll fast-track the public beta and open limited early access to the software we’re currently testing in-house.

Latest articles:

Each stock carries a risk badge: ⚠️ High | 📊 Medium | 🛡️ Low.

Based on volatility, float, technicals, and fundamentals. Size your positions accordingly.

📈 Free Setup: Make It Count

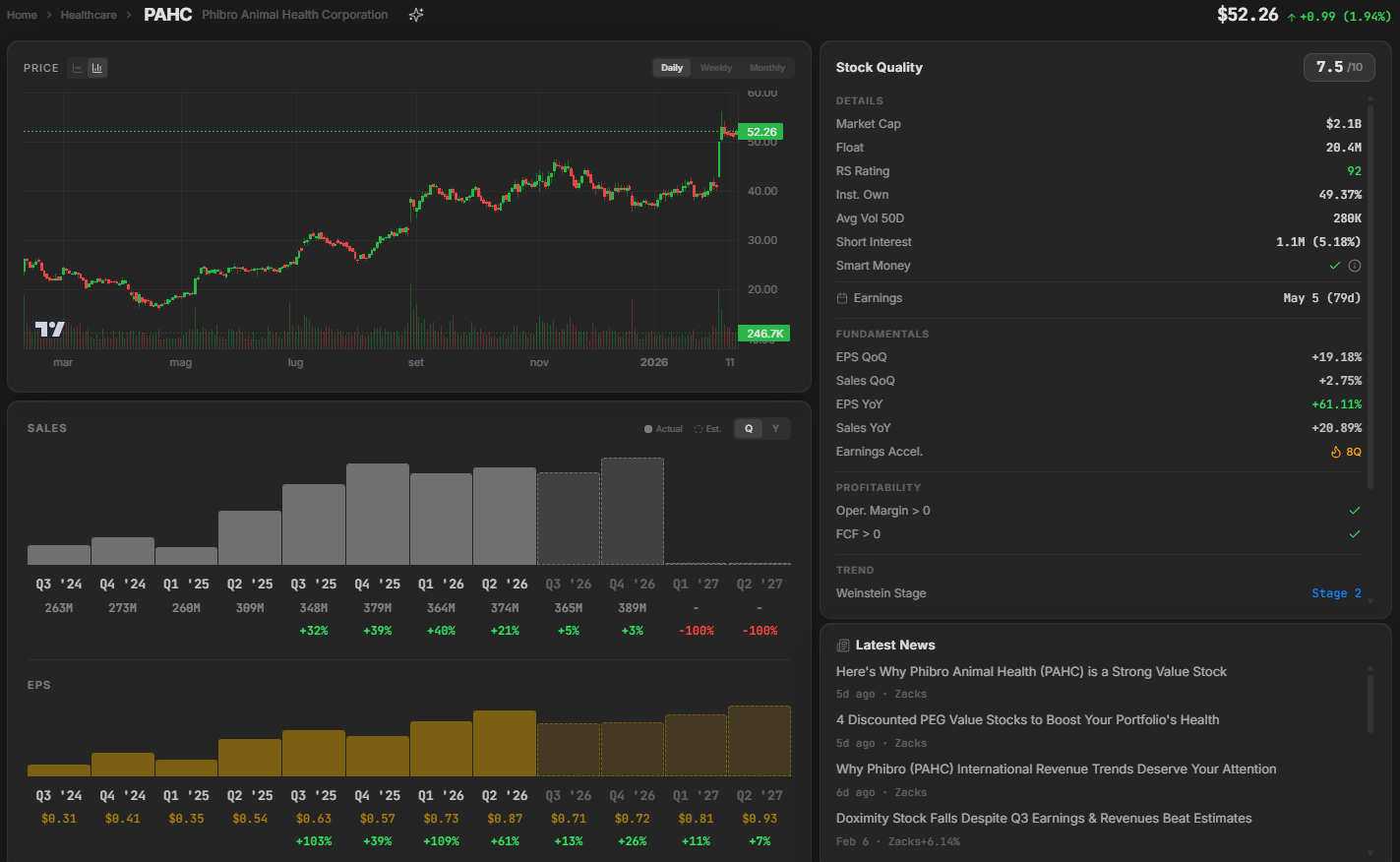

PAHC: Phibro Animal Health Corp 📊

What they do: A global developer and manufacturer of animal health products and mineral nutrition solutions

Why watch? Phibro Animal Health has undergone a significant transformation following its acquisition of Zoetis’ medicated feed additive (MFA) business, which has reshaped the company’s Animal Health division and provided a meaningful growth catalyst. For those unfamiliar with medicated feed additives, these are products mixed into animal feed to prevent disease, promote growth, and improve feed efficiency in livestock: a critical component of modern animal agriculture.

The company is executing on its “Phibro Forward Initiative,” a multi-year program designed to drive operational efficiency through structural changes. The initiative includes three key pillars: First, establishing a global procurement organization to leverage scale for better pricing and cost reduction. Second, strengthening Salesforce effectiveness and reducing employee turnover through CRM tools and enhanced customer focus, and third, expanding the product portfolio with new offerings for both livestock and companion animals, which should drive revenue diversification and growth.

The recent financial results demonstrate that this strategy is working. Phibro reported a strong second-quarter performance with net sales of $373.9 million, up 21% year-over-year, and a 41% increase in adjusted EBITDA. Management raised fiscal 2026 guidance to $1.45–$1.5 billion in sales, $245–$255 million in adjusted EBITDA, and $120–$127 million in adjusted net income, significant upward revisions that reflect confidence in the business trajectory.

The Animal Health segment led the growth, with sales rising 26% to $290 million, driven primarily by the acquired MFA business. The new MFA operations contributed $94.1 million in the quarter, with total MFA growth of 34%. Legacy MFA sales dipped approximately 5%, largely due to a roughly $10 million inventory-timing impact that management expects to reverse in the coming quarter.

From a balance sheet perspective, the company generated $47 million in trailing twelve-month free cash flow and ended the quarter with $74.5 million in cash and short-term investments. Gross leverage stands at 3.1x and net leverage at 2.8x; manageable levels given the growth profile and cash generation. Management also announced a planned CEO transition in July, with Jack Bendheim moving to executive chairman and Donnie Bendheim assuming the CEO role.

Technical Outlook: The stock was recently rejected at all-time highs of $54.62 and has since formed a very narrow Darvas box, a consolidation range of just $2.00 from low to high. This tight range indicates indecision but also compression, which often precedes a significant move. However, we generally prefer to see more than just a couple of days of consolidation before entering, as very short consolidations are more prone to failure. A few additional days of sideways action would increase the odds of a successful breakout. Once the stock clears the all-time high resistance at $54.62, there’s blue sky ahead with no overhead supply, a setup that can lead to explosive moves as there are no prior resistance levels to contend with.

Why We Don’t Wait for Sunday

Markets don’t move on your schedule. The best low-risk entries don’t announce themselves politely and wait for the weekend newsletter.

They show up when they show up. And if you’re not positioned, you miss them.

Paid members get real-time alerts: exact entries, stops, position sizing, and the thesis behind every trade. The same information we use to manage our own capital.

Free members get just one pick on Sunday.

Does that sound like an edge to you?

What’s Inside Premium

📊 Watchlist Elite (7-9 Stocks)

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment.

💼 Full Portfolio Transparency

Every position we hold. Entry price. Current P&L. Stop level. Real money, real risk.

⚡ Real-Time Trade Alerts (Chat Access)

This is where the edge lives. Exact entries, stops, and position sizing. Real-time. No lag

🎯 Quick Picks (5 Names)

Additional setups that just missed our main criteria but are worth watching.

💬 Chat Access

See our thought process in real time. Ask questions. Watch how we manage risk.

🛠️ The Tools We Actually Use

Member discounts on TC2000, Fiscal.ai, and other platforms. Same tools, better pricing.

What Paid Members Say:

We’re entrepreneurs first, traders second. We’ve sat in the CEO chair. We know what real execution looks like and how to spot it.

€39/month or 299€/year. Less than one losing trade. Cancel anytime.

Portfolio updates and new positions: