🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 73

The Hierarchy of Pain

Markets, like any organism under stress, reveal their true nature when the pressure’s on. And what we’re seeing now is a complete inversion of the natural order: the kind of thing that should make you sit up and pay attention, even if you’re half-drunk and exhausted.

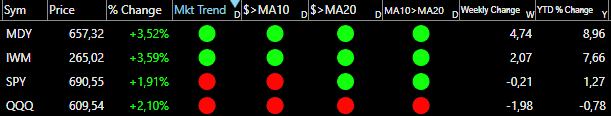

Small caps (those scrappy, unloved bastards that usually get slaughtered first when things go sideways) are holding the line. Mid-caps trail behind, bruised but standing. Then comes the S&P 500, limping along in the middle of the pack like a wounded animal trying to keep up with the herd.

And bringing up the rear, bleeding out in real time? The Nasdaq. Your beloved tech darlings. The stocks everyone spent the last three years telling you were “the future.” They’re getting destroyed.

This isn’t how bull markets work. This is rotation. This is capital fleeing to safety. This is the market telling you something, if you’re sober enough to listen.

Our indicators (the ones we built, the ones we trust because we put our own money behind them) are screaming red. Not yellow. Not orange. Red.

As in: stop, look both ways, and for the love of God, don’t assume that because you didn’t die yesterday, you’re immortal today.

Digital assets had the kind of week that makes you question your life choices. Bitcoin broke support. Altcoins evaporated. The order books looked like a ghost town at 3 A.M.: nobody home, nobody buying, just the sound of wind whistling through empty streets.

Three things converged to create this perfect storm of misery:

The Warsh Effect. Kevin Warsh gets nominated for Fed Chair, and suddenly the speculative froth that’s been holding up crypto like a bad scaffolding starts to wobble. The market smells hawkishness. It smells tightening. It smells the end of free money. And crypto, that beautiful, ridiculous casino built entirely on liquidity and vibes, doesn’t do well when the punch bowl gets yanked.

ETF Exhaustion. Remember when institutional money was supposed to save us all? When were the ETFs going to bring legitimacy and stability? Yeah, about that. The flows reversed. The smart money that piled in during the euphoria is now heading for the exits, and they’re not looking back.

Thin Order Books. This is the part that should terrify you. When the whales decided to sell, there was nobody—nobody—on the other side to catch the knife. The bids disappeared. The market gapped down like a trapdoor opening beneath your feet. This is what happens when liquidity is an illusion, when everyone’s long and nobody wants to be the bagholder.

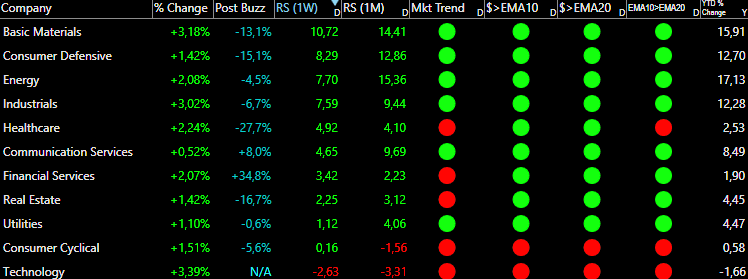

You want to know where the real players are positioning? Look at the sector leaderboard. It’s not sexy. It’s not going to get you invited to cocktail parties in the Hamptons. But it’s honest.

Basic Materials. Consumer Defensive. Energy.

These are the sectors you rotate into when you're scared. When you want tangible value. When you want something real that you can touch, something that won't evaporate if the narrative shifts.

When you want things that exist in the physical world and generate cash flow regardless of whether some venture capitalist thinks they're "disruptive."

There’s a Taoist principle that applies here: flow with the current, not against it. Fighting the tape is how you get your face ripped off. Ego is expensive. Stubbornness is a luxury we can’t afford.

Last week, we made moves. We exited high-beta, speculative positions that lost momentum. We don’t marry our trades. We don’t fall in love. When the chart breaks, we leave. No drama. No second-guessing. Just execution.

We entered two new positions in Oil & Gas and Consumer Cyclicals.

Not AI. Not data centers. Not the shiny objects everyone’s chasing. We’re following relative strength. We’re going where the money is actually flowing, not where we wish it was flowing.

Are these positions exciting? No. Will they make for good dinner conversation? Absolutely not.

Friday’s chaos (that violent, whipsaw action) destroyed a lot of clean setups. The risk/reward ratios are garbage now. Everything’s messy. The charts look like a crime scene.

We could throw out a laundry list of mediocre ideas, half-baked setups with dubious outcomes. We could fill the space.

We could give you something to do, just so you feel busy.

Sometimes the smartest thing you can do is sit on your hands, watch the tape, and wait for the market to give you something clean.

Latest articles:

Each stock carries a risk badge: ⚠️ High | 📊 Medium | 🛡️ Low.

Based on volatility, float, technicals, and fundamentals. Size your positions accordingly.

📈 Free Setup: Make It Count

ENPH: Enphase Energy 📊

What they do: A leading provider of microinverter-based solar energy systems

Why watch? Enphase recently reported fourth-quarter results that exceeded Wall Street expectations on both revenue and profitability, providing a welcome positive surprise in a sector that has faced significant headwinds over the past few years. While the company’s European business continues to struggle(sales declined to multi-year lows), the core U.S. market showed encouraging signs of stabilization and growth.

The domestic business experienced solid demand, with sell-through (actual end-customer purchases, not just shipments to distributors) increasing more than 20% sequentially to reach the highest level in over two years. This is a meaningful data point because it suggests genuine end-market demand rather than channel stuffing. Management attributed the strength to several factors: safe harbor shipments (customers accelerating purchases ahead of potential policy changes), innovative financing solutions that make solar more accessible to homeowners, new product introductions, rising electricity prices that improve the economics of solar adoption, and the anticipation of lower interest rates, which reduce the cost of financing solar installations.

Looking ahead, the broader energy landscape is evolving in ways that could benefit solar companies. The explosive growth of artificial intelligence is driving unprecedented demand for electricity to power data centers. This structural shift is creating urgency around expanding energy capacity, and solar is positioned as a key component of that expansion. If this thesis plays out, the entire solar sector could see sustained tailwinds throughout 2026 and beyond.

Adding to the bullish case, Enphase’s CEO made a notable insider purchase on February 5, 2026, acquiring approximately $250,000 worth of shares. While insider buying doesn’t guarantee future performance, it does signal management’s confidence in the company’s prospects: executives typically don’t deploy personal capital unless they believe the risk-reward is favorable.

Technical Outlook: The stock experienced its highest volume day on the earnings announcement (nearly five times the normal daily average, purple volume bar), indicating significant institutional interest. The gap-up from earnings has established $47.50 as a key support level, while $51.50 represents the immediate resistance to watch. Currently, the stock is somewhat extended from its moving averages, suggesting that a brief consolidation period would be healthy before the next leg higher. Ideally, we’d like to see a couple of additional days of sideways price action with declining volume; a 50% reduction in the average daily range would create a lower-risk entry point with tighter stop-loss parameters. Patience here could be rewarded with a more favorable setup.

Why We Don’t Wait for Sunday

Markets don’t move on your schedule. The best low-risk entries don’t announce themselves politely and wait for the weekend newsletter.

They show up when they show up. And if you’re not positioned, you miss them.

Paid members get real-time alerts: exact entries, stops, position sizing, and the thesis behind every trade. The same information we use to manage our own capital.

Free members get just one pick on Sunday.

Does that sound like an edge to you?

What’s Inside Premium

📊 Watchlist Elite (7-9 Stocks)

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment.

💼 Full Portfolio Transparency

Every position we hold. Entry price. Current P&L. Stop level. Real money, real risk.

⚡ Real-Time Trade Alerts (Chat Access)

This is where the edge lives. Exact entries, stops, and position sizing. Real-time. No lag

🎯 Quick Picks (5 Names)

Additional setups that just missed our main criteria but are worth watching.

💬 Chat Access

See our thought process in real time. Ask questions. Watch how we manage risk.

🛠️ The Tools We Actually Use

Member discounts on TC2000, Fiscal.ai, and other platforms. Same tools, better pricing.

What Paid Members Say:

We’re entrepreneurs first, traders second. We’ve sat in the CEO chair. We know what real execution looks like and how to spot it.

€39/month or 299€/year. Less than one losing trade. Cancel anytime.

Portfolio updates and new positions: