🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 72

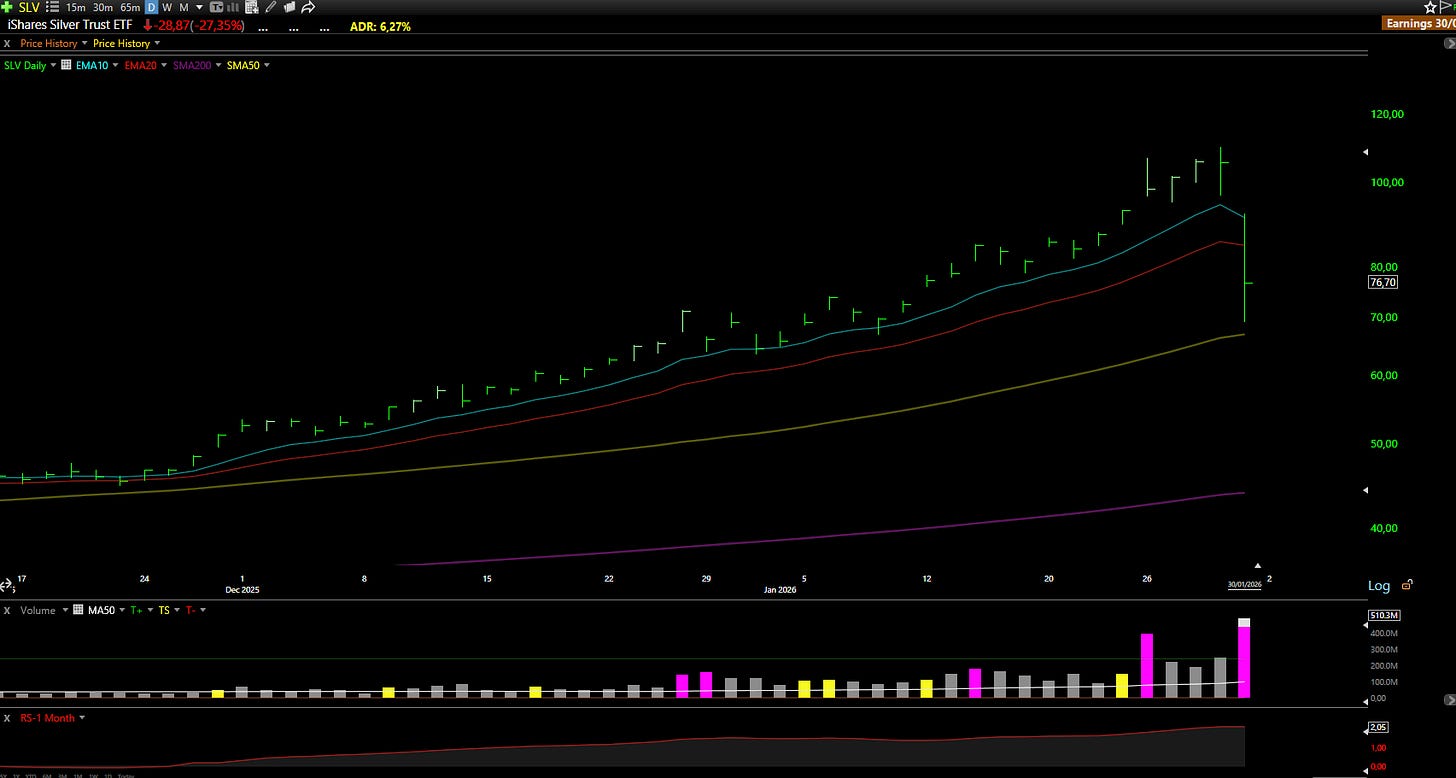

When Gods Bleed: The Silver Massacre and What It Means When You Think "This Time Is Different"

Friday hit like a freight train with no brakes.

Gold and silver—those ancient stores of value, those supposed hedges against the madness, those metals that every doomsday prepper and macro tourist had been piling into like it was the last lifeboat off the Titanic—got absolutely slaughtered. We’re talking one of the sharpest single-day declines in decades. The kind of move that makes grown men check their accounts twice because surely, surely the screen is lying.

Just twenty-four hours earlier, both metals had kissed record highs. Everyone was a genius. The trade was “obvious.” Inflation hedge, they said. Monetary debasement, they said. Trump’s Fed pick means easy money forever, they said.

Then Kevin Warsh got the nod for Fed Chair, and the narrative flipped faster than a line cook flipping omelettes on a Sunday brunch rush.

Policy expectations shifted.

Sentiment turned.

And the crowd that had been screaming “to the moon” suddenly found itself holding bags of burning metal, watching their accounts bleed out in real time.

The Mechanics of a Massacre

Let me walk you through what actually happened, because the mechanics matter. This wasn’t some orderly retreat, some gentlemanly repositioning of capital.

This was a stampede.

A full-blown, trampling-over-your-grandmother-to-get-to-the-exit panic.

Silver (beautiful, volatile, treacherous silver) is a leveraged beast. The futures market is thin, the liquidity shallow compared to its golden cousin. When prices started breaking through key technical levels, the algorithms woke up. Stop-losses triggered. Margin calls came screaming through like artillery fire. Traders who’d been riding high on 10x, 20x leverage suddenly found themselves liquidating positions they didn’t want to liquidate, at prices that made them physically ill.

The momentum systems (those soulless, emotionless trading bots) smelled blood and piled on. What started as profit-taking turned into a cascade, a waterfall, a goddamn avalanche of selling that rolled across every exchange from New York to Shanghai.

Silver dropped almost 30% in a single day. Let that sink in. If you were long and leveraged, you didn’t just lose money.

You got erased.

There’s a quote that explains everything better than I ever could:

“The investor who says, ‘This time is different,’ when in fact it’s virtually a repeat of an earlier situation, has uttered among the four most costly words in the annals of investing.”

People piled into metals, thinking they’d found the golden escalator to the moon. They ignored every warning sign, every historical precedent, every flashing red light that screamed “PARABOLIC MOVE AHEAD: DANGER.”

Because this time, they told themselves, it really was different.

It never is.

Human behavior doesn’t change. Greed looks the same in 1929 as it does in 2026. Fear smells the same whether you’re wearing a top hat or a hoodie. The chart goes vertical, everyone convinces themselves they’re geniuses, and then gravity remembers how to work.

Every. Single. Time.

Timing Is Everything (And Nearly Impossible)

Here’s the part where I tell you the truth, the uncomfortable, ego-bruising truth that most people in this business won’t admit: timing this trade was almost impossible.

We tried. Our trading desk had been watching silver like a hawk watches a field mouse. We saw it climb higher than anyone thought possible. We saw the fake exhaustion candle on January 26th (the kind of move that usually signals the top) and then watched in disbelief as it pushed even higher before finally collapsing when the market was closed.

How do you trade that? How do you position for a move that defies logic, fakes you out, and then implodes during off-hours?

On our swing portfolio, we tried to start a position in ZSL (a leveraged inverse silver ETF) at the beginning of the week. Our stop was at $1.50. The low hit $1.44. We got stopped out and watched from the sidelines as it ripped 65% in one day.

That’s the game. Even professionals who do this for a living, who’ve seen every trick and trap the market can throw, get humbled.

We study these moves not because we nailed them, but because we need to understand them for next time.

You need to have a big, expansive, almost delusional imagination about what’s possible. Because the magnitude of moves we’re seeing now (the sheer violence and velocity) is increasing. The liquidity is deeper, the leverage is higher, the algorithms are faster. What used to take weeks now happens in hours.

If you can’t imagine silver dropping 30% in a day, you won’t be prepared when it does. If you can’t imagine a “safe haven” turning into a killing field, you’ll be the one getting carried out on a stretcher.

What This Means for You

You just need to understand the game.

You need to know that when everyone’s piling into something because “it can only go up,” that’s exactly when you should be looking for the exits. You need to respect leverage like you’d respect a loaded gun.

You need to define your risk before you enter the trade, not after.

And most importantly, you need to remember that the market doesn’t care about your feelings, your mortgage, or your retirement plan.

It will take everything you have and then send you a bill for the privilege.

But if you approach it with humility, with discipline, with the understanding that you’re going to be wrong sometimes (maybe even most of the time), you can survive. And if you survive long enough, you might even thrive.

The silver massacre was a lesson. The question is: are you paying attention?

Latest articles:

Each stock carries a risk badge: ⚠️ High | 📊 Medium | 🛡️ Low.

Based on volatility, float, technicals, and fundamentals. Size your positions accordingly.

📈 Free Setup: Make It Count

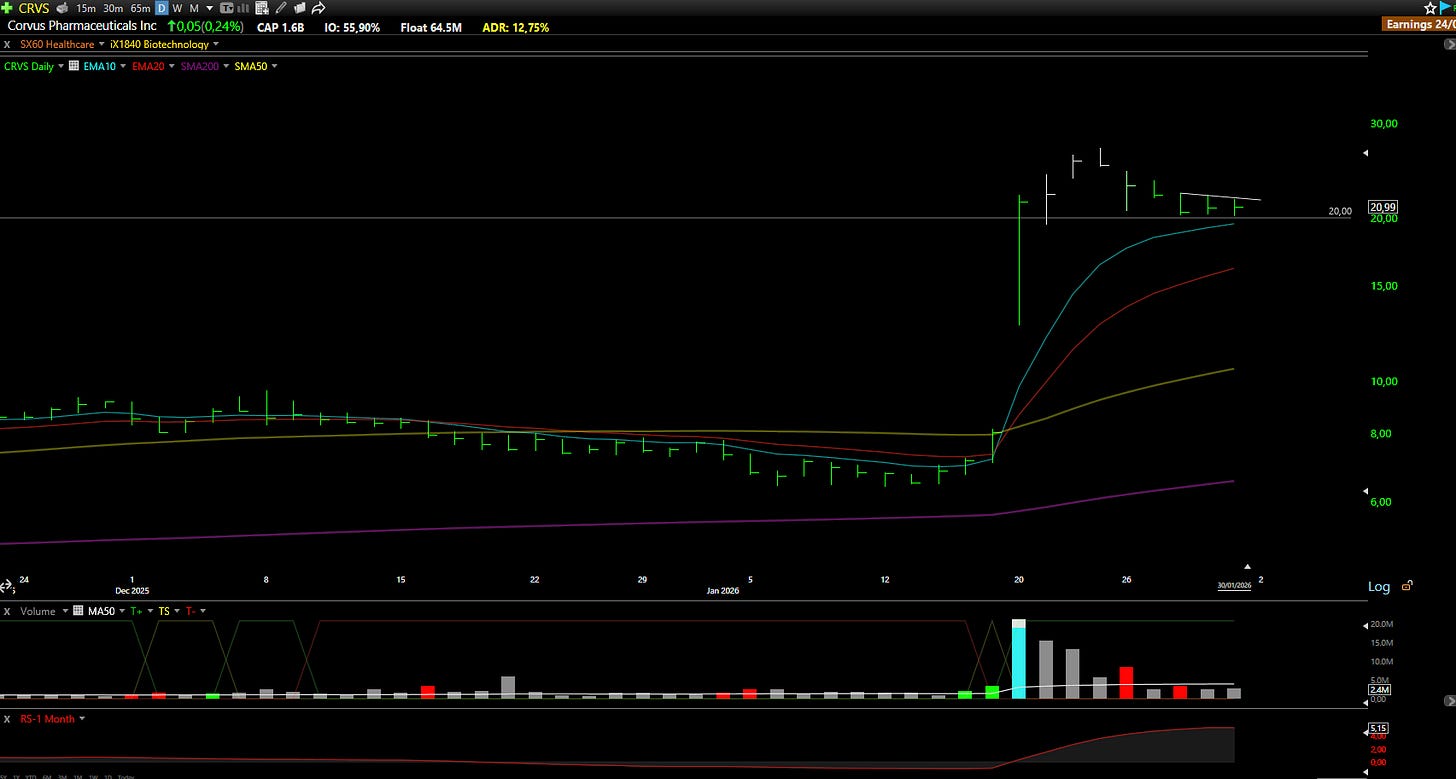

CRVS: Corvus Pharmaceuticals Inc⚠️

What they do: A clinical-stage biopharmaceutical company

Why watch? Corvus has emerged as a compelling story in the biotech space following breakthrough Phase 1 data for its lead asset, soquelitinib, an oral ITK inhibitor being developed for moderate-to-severe atopic dermatitis (AD). The company recently reported highly positive results from cohort 4 of its early-stage study, demonstrating the drug’s potential to become a leading oral treatment option for AD patients. For context, atopic dermatitis is a chronic inflammatory skin condition affecting millions, and the current treatment landscape remains fragmented with significant unmet needs, particularly for oral therapies that can offer convenient, effective alternatives to injectable biologics.

What makes this particularly interesting is the dual-purpose nature of ITK inhibition: the same mechanism can target both immune-mediated disorders and certain cancers. This gives Corvus an expansive runway to pursue multiple indications with soquelitinib, potentially unlocking significant value across therapeutic areas. The market clearly recognized this potential: following the positive data announcement, the company successfully closed an upsized public offering at $22.15 per share, raising approximately $201 million in gross proceeds. This capital infusion provides a substantial runway to advance clinical programs and positions the company well for the next stages of development.

The biotech sector has been volatile, but Corvus is demonstrating exceptional relative strength even as broader markets have experienced selling pressure and choppiness. The company’s ability to raise capital at a premium and maintain investor confidence speaks to the quality of its clinical data and the commercial opportunity ahead.

Technical Outlook: The chart structure here is encouraging. Following the offering, shares have pulled back on notably low volume, a healthy sign that suggests profit-taking rather than fundamental concerns. The stock is now approaching its rising 10-day exponential moving average, which has historically provided support during this uptrend. The key level to monitor is $20.00, which has acted as a floor on the daily chart and represents a clear line in the sand for risk management. Above that, $22.00 marks the breakout level that could trigger the next leg higher. Ideally, we’d like to see another day or two of consolidation, or even a brief shakeout below $20.00 to flush out weak hands, before the stock resumes its upward trajectory. The risk-reward setup appears favorable for patient investors willing to wait for the right entry.

Why We Don’t Wait for Sunday

Markets don’t move on your schedule. The best low-risk entries don’t announce themselves politely and wait for the weekend newsletter.

They show up when they show up. And if you’re not positioned, you miss them.

Paid members get real-time alerts: exact entries, stops, position sizing, and the thesis behind every trade. The same information we use to manage our own capital.

Free members get just one pick on Sunday.

Does that sound like an edge to you?

What’s Inside Premium

📊 Watchlist Elite (7-9 Stocks)

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment.

💼 Full Portfolio Transparency

Every position we hold. Entry price. Current P&L. Stop level. Real money, real risk.

⚡ Real-Time Trade Alerts (Chat Access)

This is where the edge lives. Exact entries, stops, and position sizing. Real-time. No lag

🎯 Quick Picks (5 Names)

Additional setups that just missed our main criteria but are worth watching.

💬 Chat Access

See our thought process in real time. Ask questions. Watch how we manage risk.

🛠️ The Tools We Actually Use

Member discounts on TC2000, Fiscal.ai, and other platforms. Same tools, better pricing.

What Paid Members Say:

We’re entrepreneurs first, traders second. We’ve sat in the CEO chair. We know what real execution looks like and how to spot it.

€39/month or 299€/year. Less than one losing trade. Cancel anytime.

Portfolio updates and new positions: