🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 67

Santa Rally? We’re Following the Money Instead

Here’s what you need to know: the rich world’s rate-cut momentum is fading fast. A year that started with the promise of successive cuts across advanced economies is ending with central banks hitting the brakes. They’re stepping back, reassessing, watching how their moves so far are impacting growth and inflation. The easing cycle? It’s either losing steam or effectively over.

And in the U.S.? Powell’s walking a tightrope. The Fed’s divided, inflation’s sticky, and the market’s hanging on every word. It’s a wait-and-see game now, and nobody likes waiting.

Globally, it’s the same story: caution, hesitation, and a whole lot of “let’s see what happens next.” Not exactly the dovish dream everyone was hoping for.

This week? Classic market mind games.

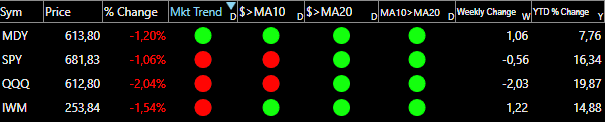

Look at the signals we’re getting, they’re all over the place. The VIX is sitting pretty at 15.74, calm as a Sunday morning. But the indexes? They closed near the lows. And the VIX itself? Closed in the bottom half of its daily candle. Mixed signals. Confusing signals. The kind of signals that make you want to throw your hands up and walk away.

Breadth indicators aren’t helping either. T2118 is at 75.79, not overheated yet (we’d need to see 90.00 for that), but definitely above the caution line of 70.00. We’re in that uncomfortable middle zone where anything can happen.

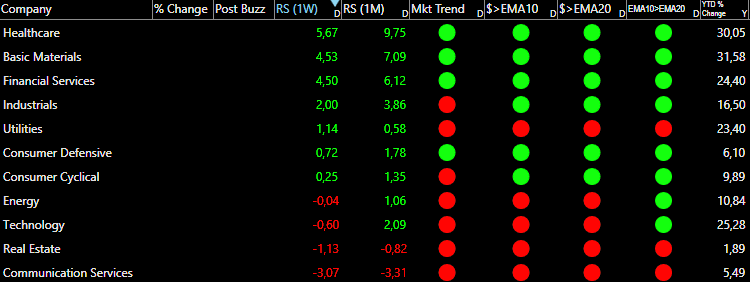

And the sectors? Oh, the sectors are telling a story. The healthiest ones right now? Healthcare. Basic materials. Consumer defensive.

For the first time this year, consumer defensive is lighting up green across our dashboard.

That’s not a good sign. That’s a defensive sign. That’s the market saying, “Maybe I should hide under the bed for a while.”

Everyone and their grandmother is talking about the Santa rally. “It’s coming!” “It always happens!” “Buy now before it’s too late!”

Yeah, well, we don’t see it yet. And honestly? We don’t care.

We’re not here to predict what happens next. We’re not here to bet on seasonal patterns or holiday magic. We’re here to follow the money.

And right now, the money is crystal clear: it’s flowing out of tech and AI plays and into small caps.

Our portfolio knows this intimately. We don’t have any exposure to the AI hype machine right now. Why? Are we geniuses? Hell no. It’s simpler than that: the setups we religiously follow (the low-risk, high-probability entries we hunt for) aren’t coming out of that sector. That’s it. That’s the whole story.

If AI and tech rebound and start setting up properly, we’ll find them in our scanners in the coming weeks or months. Until then? We’re not forcing it.

Let’s talk about what we’re most proud of this period: Space.

We saw the space theme setting up early. We got into Planet Labs (PL) at $12.18. We took profits along the way. We let 25% of the position ride into earnings. And now? We’re sitting on almost 50% profit.

That’s the kind of trade that makes this whole game worth it. The kind that validates the process, the patience, the discipline. It feels good.

But let’s not pretend we’re perfect. Because we’re not.

The Worst Thing About This Week? Hesitation

Friday. Canopy Growth (CGC). Near $1.40. We had the setup. We had the entry. We were right there.

And then we hesitated.

The cannabis rescheduling news was clearly bullish. But we’ve seen this movie before: weed stocks skyrocket on news, then crater a couple of days later. So we thought about it. We analyzed. We second-guessed.

And guess what? We missed a 30% move in a single day.

Here’s the brutal truth: sometimes in trading, you just need to execute without thinking too much. Overthinking kills opportunities. Hesitation is one of the costliest mistakes you can make.

We know this. We’ve learned this lesson before. And yet, here we are, learning it again.

But that’s the beauty of trading and investing, isn’t it?

You’re always learning.

Always refining.

Always getting humbled by the market when you think you’ve got it figured out.

Latest articles:

Each stock carries a risk badge: ⚠️ High | 📊 Medium | 🛡️ Low.

Based on volatility, float, technicals, and fundamentals. Size your positions accordingly.

📈 Free Setup: Make It Count

ULTA: Ulta Beauty Inc. 🛡️

What they do: Operate specialty beauty retail stores offering cosmetics, fragrance, skincare, haircare products, and salon services.

Why watch? Ulta Beauty delivered a blowout quarter that exceeded expectations across all key metrics, triggering a strong market reaction. Revenue came in at $2.86 billion, up 12.9% year-over-year, while earnings per share of $5.14 beat analyst estimates by $0.56. The company is also aggressively returning capital to shareholders during the quarter. Ulta repurchased 400,000+ shares, bringing the nine-month total to 1.5+ million shares retired. Following the strong Q3 beat, management raised guidance for the next quarter. More importantly for long-term investors, the CEO provided unusually clear guidance on the 2026 outlook, stating that next year will not be another heavy investment cycle and that margins should remain at least at 2025 levels. This signals a shift toward margin expansion and improved profitability after a period of growth investments, making the earnings trajectory more predictable and attractive.

Technical Outlook: The stock demonstrated relative strength on Friday, consolidating within the gap-up day's range on declining volume, a healthy sign of accumulation. The 10-EMA is now close to price, setting up for a potential breakout. A decisive move above the $603.00–$605.00 level would trigger the next leg higher with no overhead resistance, as the stock would be making new all-time highs. The consolidation pattern is constructive and suggests the stock is coiling for continuation of the uptrend.

Why We Don’t Wait for Sunday

Markets don’t move on your schedule. The best low-risk entries don’t announce themselves politely and wait for the weekend newsletter.

They show up when they show up. And if you’re not positioned, you miss them.

Paid members get real-time alerts: exact entries, stops, position sizing, and the thesis behind every trade. The same information we use to manage our own capital.

Free members get just one pick on Sunday.

Does that sound like an edge to you?

What’s Inside Premium

📊 Watchlist Elite (7-9 Stocks)

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment.

💼 Full Portfolio Transparency

Every position we hold. Entry price. Current P&L. Stop level. Real money, real risk.

⚡ Real-Time Trade Alerts (Chat Access)

This is where the edge lives. Exact entries, stops, and position sizing. Real-time. No lag

🎯 Quick Picks (5 Names)

Additional setups that just missed our main criteria but are worth watching.

💬 Chat Access

See our thought process in real time. Ask questions. Watch how we manage risk.

🛠️ The Tools We Actually Use

Member discounts on TC2000, Fiscal.ai, and other platforms. Same tools, better pricing.

What Paid Members Say:

We’re entrepreneurs first, traders second. We’ve sat in the CEO chair. We know what real execution looks like and how to spot it.

€39/month or 299€/year. Less than one losing trade. Cancel anytime.

Portfolio updates and new positions: