🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 63

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Fiscal.ai data. Explore now →

This Wasn’t a Week to Be a Hero

What a week. Not a week to trade. A week to step back, keep your powder dry, and study the tape like it owes you answers.

Volatility took the wheel, and the bad days barked louder than the good ones. We stayed in cash and took the heat for it: DMs lecturing us about the year‑end melt‑up, the “inevitable” rally, the usual sermons. Then the indexes dropped around 5%. Friday’s late save pinned the price right at the 50-day mark on the daily—same trick we saw in July and again in September. Is this the third rescue or the setup for something different? We don’t pretend to know. What matters is that you carry the question into every decision you make next week.

We get the celebration, one good hammer day is a nice way to close a bruiser of a week. But one hammer doesn’t build a house. We’re not bullish. We’re not bearish. We’re neutral and patient, ready to press if the tape earns it, but not chasing shadows. If we increase exposure, it’ll be into the lowest‑risk structures we can find, not because we’re bored or because someone on X decided it’s “go time.”

One thing you watch like a tripwire: VIX. Over 20 and rising is not bullish. We’re sitting around 19.00—close enough to respect, far enough to keep your hands steady. If it spikes and keeps climbing, you don’t argue; you scale your ambition down and live to fight the next round.

Now the part most people don’t want to hear: after a week like this, genuinely low‑risk entries are rare. Plenty of reversals, sure. Plenty of candles that look brave on a screenshot. But a true low‑risk setup—the kind that lets you define risk tight and let the market do the work—those were scarce. The watchlist is there, like always, but a lot of structures are wider than we’d prefer. Adjust your position sizes. Respect your stops. Survival first.

We did add one fresh name from this earnings season—thinner liquidity, but real relative strength versus the tape and a clean daily structure that should also be buyable next week. Paid subs already got the full briefing, the mechanics, the “why.” That’s the work. Not just tickers, but reasons.

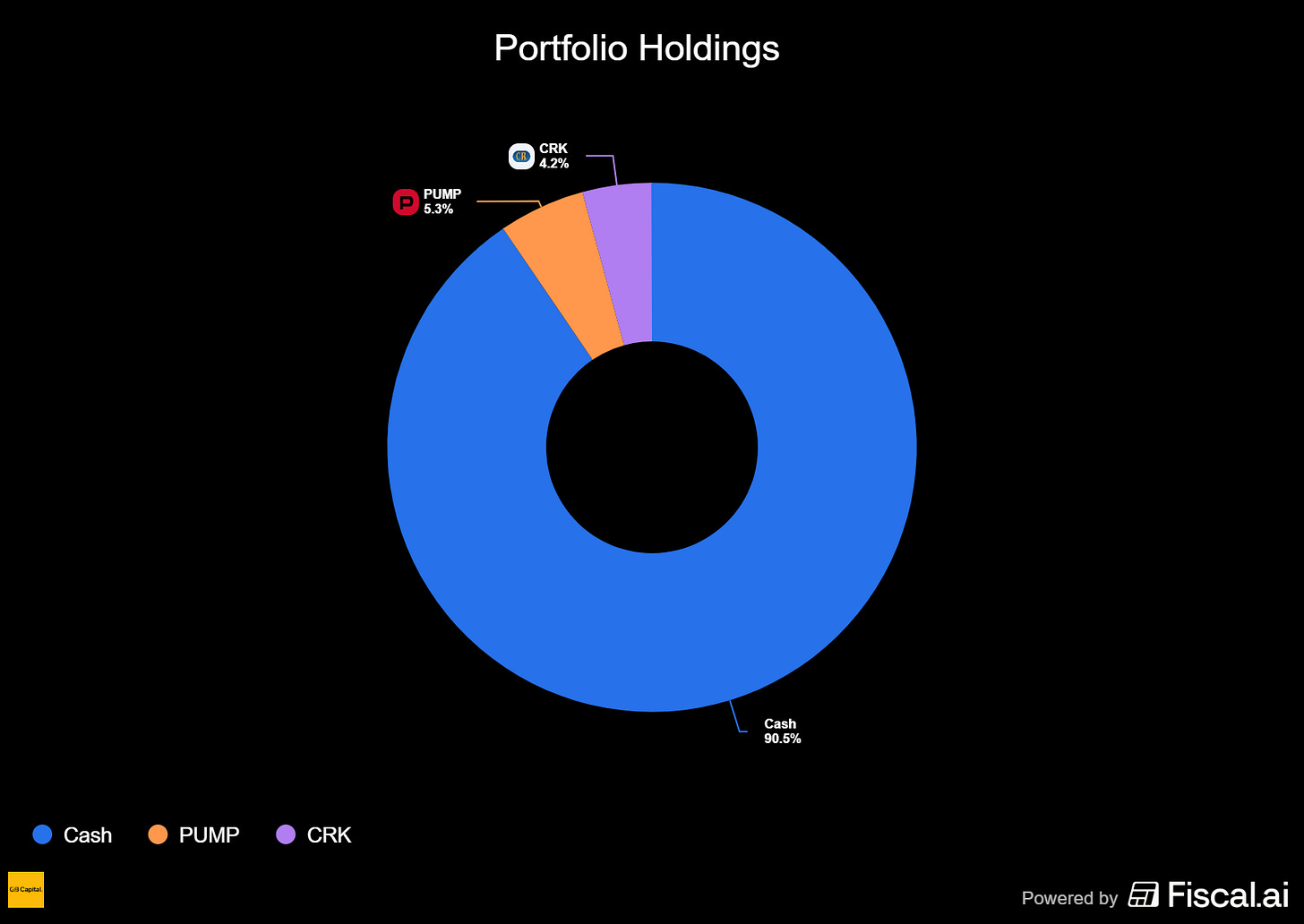

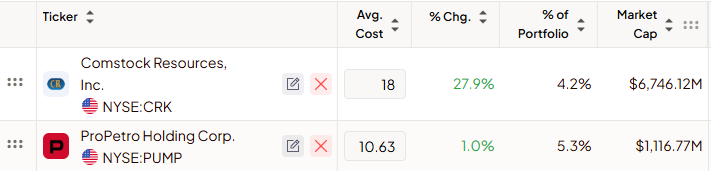

Beneath the noise, the job doesn’t change: read between the lines. There is always a theme, a sector, a single name dragging the market forward by the collar, even when the tape is crooked. Two weeks ago, it was natural gas for us; Comstock Resources (CRK) was the vehicle. Nearly 30% up, half off the table, and for a stretch, it was the only line item in the book. Singular conviction beats scattered hope.

After a big run, people need to catch their breath. Protect what they made over the last six months. If the market wants to sprint into year‑end, fine. But don’t bring April’s expectations to November’s terrain. The context changed. The tape is louder, messier, meaner. You adjust, or it adjusts you.

So here’s the posture:

Neutral until proven otherwise.

Respect the 50‑day: acknowledge the save, don’t crown it a regime change.

Treat VIX like a live wire.

Hunt for setups where risk is knowable and small. Size down when it isn’t.

Keep a short leash on anything speculative. Cut losers without ceremony.

Patience isn’t passive. It’s prep. Keep the book clean, keep your head clear, and let the market show its hand. When it finally does, you won’t need to force a thing. You’ll already know what to do.

Context matters.

🌱 Support Our Work: Buy Us a Coffee🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

Latest articles:

There are two questions every elite trader answers daily.

“Where is the money flowing?” and “How can I best capture it?”

To definitively answer the “Where,” gain an immediate edge with the unparalleled situational awareness of the TC2000 Market Monitor & Sector Table.

To master the “How,” empower your trading with the speed, organization, and precision of our TC2000 Custom Platform and Scans.

We use this system every single day, and it works.

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock’s risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

AMZN: Amazon.com Inc 🛡️

What they do: Runs the world’s largest online store and a leading cloud platform (AWS), with growing ads, logistics, and devices businesses.

Why watch? Amazon’s Q3 2025 underscored a reacceleration story in both cloud and core operations. AWS growth reaccelerated to 20% YoY, underpinned by rapid advances in AI that should compound over time. Operational efficiency continues to improve (cash from operations rose 78% YoY), while ongoing investments in robotics and fulfillment position margins to expand. Looking out, if Amazon reaches 15+% operating margins in the next years, operating income could approach $150+ billion, implying a potential market value over $5 trillion. Among the “Magnificent Seven,” AMZN screens as one of the larger upside opportunities on attractive forward multiples and leadership in the next tech cycle.

Technically, shares bounced hard Friday for three reasons: a broad index rebound, a decisive hold at a well-watched $242.50 level (visible on weekly and monthly charts since February), and support from the rising 10-day EMA. You’re effectively buying an acceleration in fundamentals at February prices. The setup also offers appealing risk/reward: risking roughly $2–$3 off the recent support to target $10–$15 higher leaves a favorable profile for swing traders.

BROS: Dutch Bros Inc 📊

What they do: A fast-growing drive‑thru coffee chain known for specialty beverages.

Why watch? Dutch Bros delivered another robust quarter that combined rapid unit expansion with improving operating leverage, evidence that the model scales. In Q3 FY2025, revenue rose 25% to $424M (from $338M), operating income increased 28% to $41.5M (from $32.5M), net income climbed 26% to $27.3M (from $21.7M), and EPS advanced 27% to $0.14 (from $0.11). Both revenue and profits reached record highs, reflecting healthy unit economics and cost discipline as the brand expands.

Recently, BROS has been very volatile with large candles in both directions. Ideally, we’d wait for a tighter range, but there’s no guarantee we’ll get one, so position sizing and stop discipline matter. The stock bounced off the $47.00 support—the same level that held in April—then pushed to the $60.00 area before pulling back, shaping a cup with a low and a somewhat loose handle. It’s not a textbook pattern, but it offers a workable setup: if the stock starts ramping next week, using Friday’s lows as a stop can create a defined-risk entry.

PL: Planet Labs PBC ⚠️

What they do: Operates a large constellation of Earth-imaging satellites delivering geospatial data

Why watch? Rising geopolitical risk and AI analytics are boosting demand for high-cadence, high-resolution imagery. Planet’s recurring model, expanding customer base, and tailored constellations support durable growth and efficiency. After strong September earnings, the stock more than doubled and has been consolidating above $12.50 with support from the 10- and 20-day EMAs. A bit tighter digestion after the recent quick shakeout would be constructive before a push higher, but the stock seems quite ready.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment, delivering institutional-grade research.