🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 59

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Fiscal.ai data. Explore now →

After the Screenshot Parade

Friday felt like a dare answered. All week (and also the one before), the timeline was a confetti cannon: record P&Ls, victory screenshots, everyone suddenly fluent in genius. Then the market did the rude thing it always keeps in its pocket.

One giant red candle, stocks and indexes, and crypto the same shade, billions erased in the time it takes to finish your coffee. Stairs up, elevator down. No apology, no lesson plan, just the drop.

If you need a scale: twenty days of up carved out by a single bar. Twenty. If that doesn’t reset your posture, you’re not trading, you’re gambling with borrowed luck.

Do yourself a favor this week: leave the storylines to the people who need them. Trump, China, Rare Earth, Aliens, whatever the media pins to the board to explain why you feel sick, they’re props. Price is the plot. Follow it. Then wait. And wait. And wait some more. The urge to mash buttons is how red candles turn into red weeks. Use your head.

Anyone can push: professionals pause.

We’re early for shorts and late for hero longs. That’s the honest map. Utilities are the only sector with a clean halo: respectable, defensive, not exactly the soundtrack to a bull’s greatest hits album. We scan thousands of tickers a week; patterns usually hum before they sing. Right now, the hum is faint. A few biotechs show relative strength, enough to circle but not enough to bet the house.

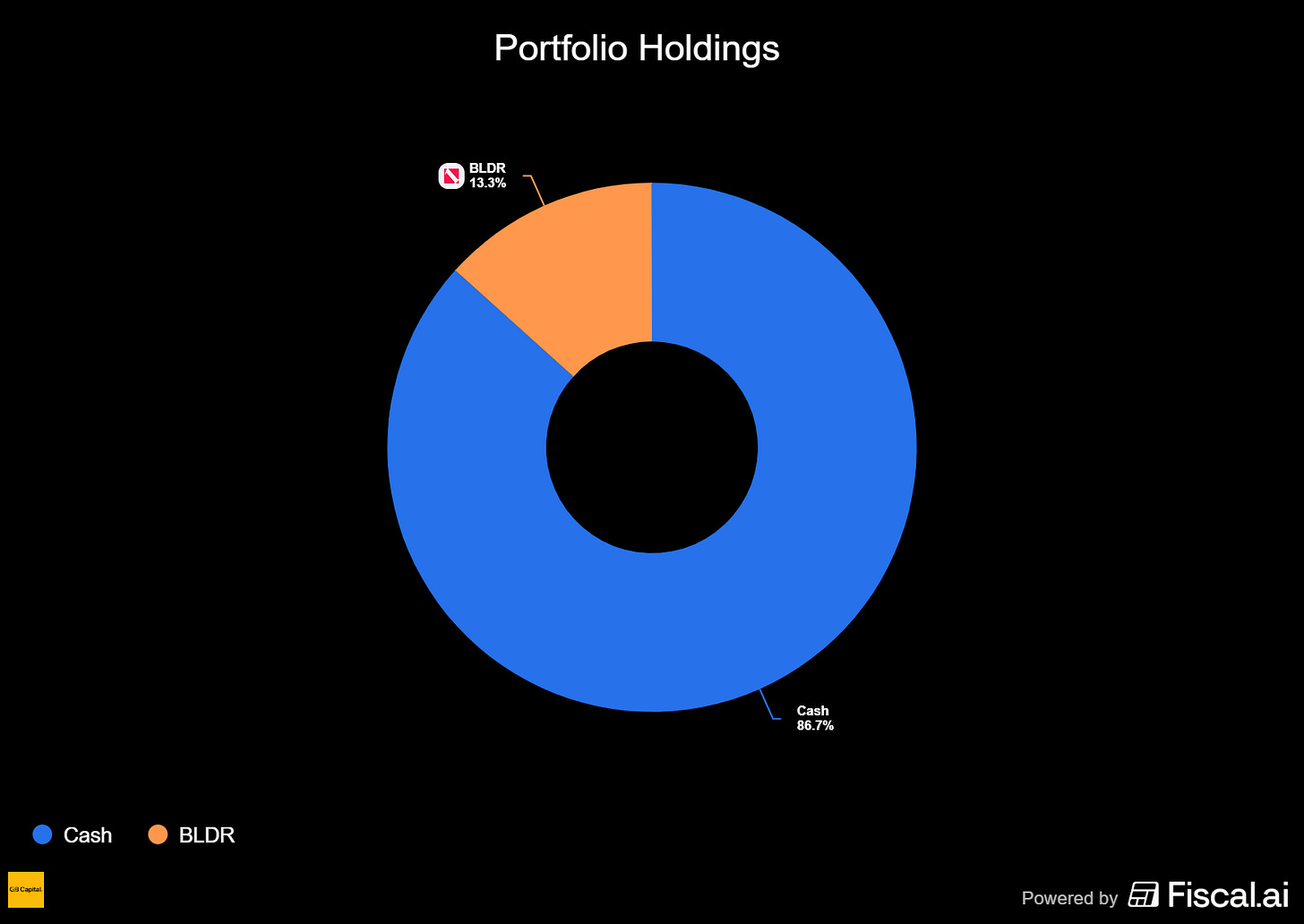

We ended the week mostly in cash. BLDR is the last holdout, and even that might meet the exit door on Monday if it forgets why we’re in it. This isn’t cowardice. It’s a craft.

What mattered most was the boring thing: we managed risk like it pays our rent—because it does. We closed everything with profit, gave back only the imaginary kind they print on your screen to make you reckless. Maybe we underperformed the mania the last couple weeks. Fine. We’re still sitting at or near performance highs without donating sanity back to the house. Mental capital is a position. Guard it.

The gauges are not serenading us. T2118 sits at 8.72; if it dips under 5 this week, expect at least a dead‑cat bounce, maybe better. It’s been sliding for thirty days straight. T2108 at 25.53 says there’s room to rot further. Mixed signals. Mixed signals breed bad decisions if you force answers out of them.

So here’s the gospel for the moment: brake lights on. Give it a week. Let the chart add color, let the tape show its next trick. Volatility is on the schedule; you don’t need a press release to know that.

There will be days that look like salvation and nights that taste like copper.

Stand down from the need to be first. Be right enough, late enough, with capital intact.

🌱 Support Our Work: Buy Us a Coffee🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

Latest articles:

There are two questions every elite trader answers daily.

“Where is the money flowing?” and “How can I best capture it?”

To definitively answer the “Where,” gain an immediate edge with the unparalleled situational awareness of the TC2000 Market Monitor & Sector Table.

To master the “How,” empower your trading with the speed, organization, and precision of our TC2000 Custom Platform and Scans.

We use this system every single day, and it works.

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock’s risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

PPSI: Pioneer Power Solutions Inc 📊

What they do: A pure-play provider of mobile, off-grid power supplies and EV charging infrastructure.

Why watch? After a volatile post-earnings period in August, the stock has settled into a low-volume consolidation, finding support at the 10-day and 20-day EMAs in the $4.20-$4.30 zone. Fundamentally, a consistently growing backlog is being driven by new contract wins across diverse sectors like emergency services, aerospace, and clean energy. These agreements underscore widespread demand for its mobile charging solutions, positioning Pioneer as an inexpensive way to gain exposure to the anticipated growth in EV infrastructure.

PEPG: PepGen Inc ⚠️

What they do: Develops peptide delivery therapeutics

Why watch? At the end of September, PepGen released clinical data from the 15 mg/kg cohort of its ongoing FREEDOM-DM1 Phase 1 single-ascending-dose study in DM1 patients. DM1 is a rare, inherited disorder marked by progressive muscle weakness and myotonia (delayed muscle relaxation after contraction). Shortly after the data release, the company announced a $100 million public offering. Following a broad market selloff on Friday, the stock recaptured part of the decline and reclaimed the technically important $5.40 level. If shares can hold above $4.50 and consolidate, the setup favors a fresh leg higher. Notably, biotech showed relative strength into and through Friday’s weakness, lending support to the bull case.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment, delivering institutional-grade research.