Equity X-Ray: In-Depth Research #24

Palantir: A Great Company At A Price Divorced From Reality

Introduction

I have been analyzing technology stocks for 10 years, and I can honestly say that I've never seen a valuation that is as far removed from reality as Palantir's (NYSE: PLTR) is right now at over 180$ a share. The stock price has been greatly impacted by theemarket's enthusiasm regarding the AI opportunity, and the company recently moved into the realm of speculation in a way that no financial model, even one that is the most bullish of blue skies, can perhaps ever deliver to investors.

I recognize Palantir has top-tier technology and is cash-flow generative.

However, even a top-tier technology platform and an ability to generate cash are insignificant compared to a market capitalization that has front-run ten consecutive years of perfect execution. I tried to find the bull case and very carefully built a number of assumptions into a model that was the most generous I could reasonably defend.

My price target was well above where a bear case would leave you!

I am starting coverage with a Sell and a price target of $85 a share.

Company Background

The easiest way to think about Palantir is to think about it like they are building a central nervous system for an organization.

Consider a big government agency or a multinational corporation. The agency's or corporation's information is everywhere: distributed in an unlimited number of spreadsheets, legacy databases, reports from field agents, sensor logs from factory equipment, and customer feedback forms. It is like having a brain, a heart, and lungs that each function independently. Making intelligent, fast-paced decisions is virtually impossible because nobody can see the situation in total. Palantir builds the software that fills the gaps between siloed data and connects all of that mess into one single operational reality. This reality allows a human user, whether analyst, executive, or general, to ask incredibly difficult questions and get answers that would otherwise be buried.

To put Palantir in perspective, you need to understand its background in the early 2000s. Palantir was founded by a group including Peter Thiel, one of the co-founders of PayPal. Thiel and his innovative peers had gained immense experience in fighting complex international financial fraud while working at PayPal. They designed systems that could ingest enormous streams of transaction data, filtering real-time data "as it happened" to find the more subtle crime signaling patterns buried in the data.

After the September 11th attacks, it was apparent that the exact technological approaches to the fight against financial crime could be applied to fight terrorism. The well-known 9/11 Commission Report showed that several U.S. intelligence agencies had the pieces but could not connect the dots. Palantir was created to solve the problem of connecting the dots with the goal of constructing software and integrating data from dozens of incompatible sources and formats.

From those roots, the Palantir business has grown to now feature two primary software platforms.

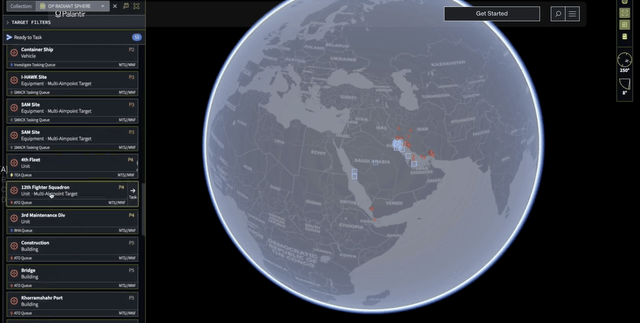

The first is Gotham, Palantir's original operating system for the defense and intelligence communities. Gotham takes large unstructured datasets from a variety of sources (signal intelligence, informant reports, financial records, and satellite imagery) and organizes this information as a single map or graph so that an analyst can visually explore relationships among people, places, events and objects. Think of it as a digital detective corkboard, with billions of data points and the ability to search and analyze it in seconds. Its use extends well beyond counter-terrorism to military logistics, disaster response management, and complicated investigations into various law enforcement situations.