🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 58

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Fiscal.ai data. Explore now →

Loud Days, Quiet Warnings

Some weeks pay you in clean numbers and dirty truths. We had both. The day‑trading desk hit record sessions: fast hands, tidy exits, that rare flow when the tape moves like it’s taking your cues. On the swing side, we slipped two new names into the book, and they behaved. That’s the dream: short hits, long patience, nothing on fire. You don’t get many of those. Enjoy it. Don’t believe it.

Because out on the socials, everyone’s a prodigy again, PnL screenshots with the saturation dialed up, “record day” captions piling like empty bottles. I’ve seen that movie. The montage comes right before the third act wall. Our instruments don’t sing along with the chorus. Indexes keep climbing, sure, pressing cheeks against all‑time highs, but breadth is a whisper. T2118 thin. T2108 shows too many names living below the 10‑day. The band is loud. The crowd is smaller than it looks.

What’s the truth? When does the correction show its teeth? We don’t know.

Nobody knows. The only honest answer is we’re preparing like it’s already on the calendar and trading like it isn’t. Meanwhile, VIX rose all week, and gold set fresh highs, risk and fear walking arm in arm. It doesn’t make sense if you’re after a tidy narrative. Markets aren’t tidy; they’re honest in a way that feels like disrespect. Our opinion is just that, air. The positions are the only sentence that matters.

So we push until it’s over. We push with a helmet on.

The watchlist tells its own story: fewer names setting up, more stalling at the altar. When the menu shrinks, you pay attention to the kitchen, not the maître d’.

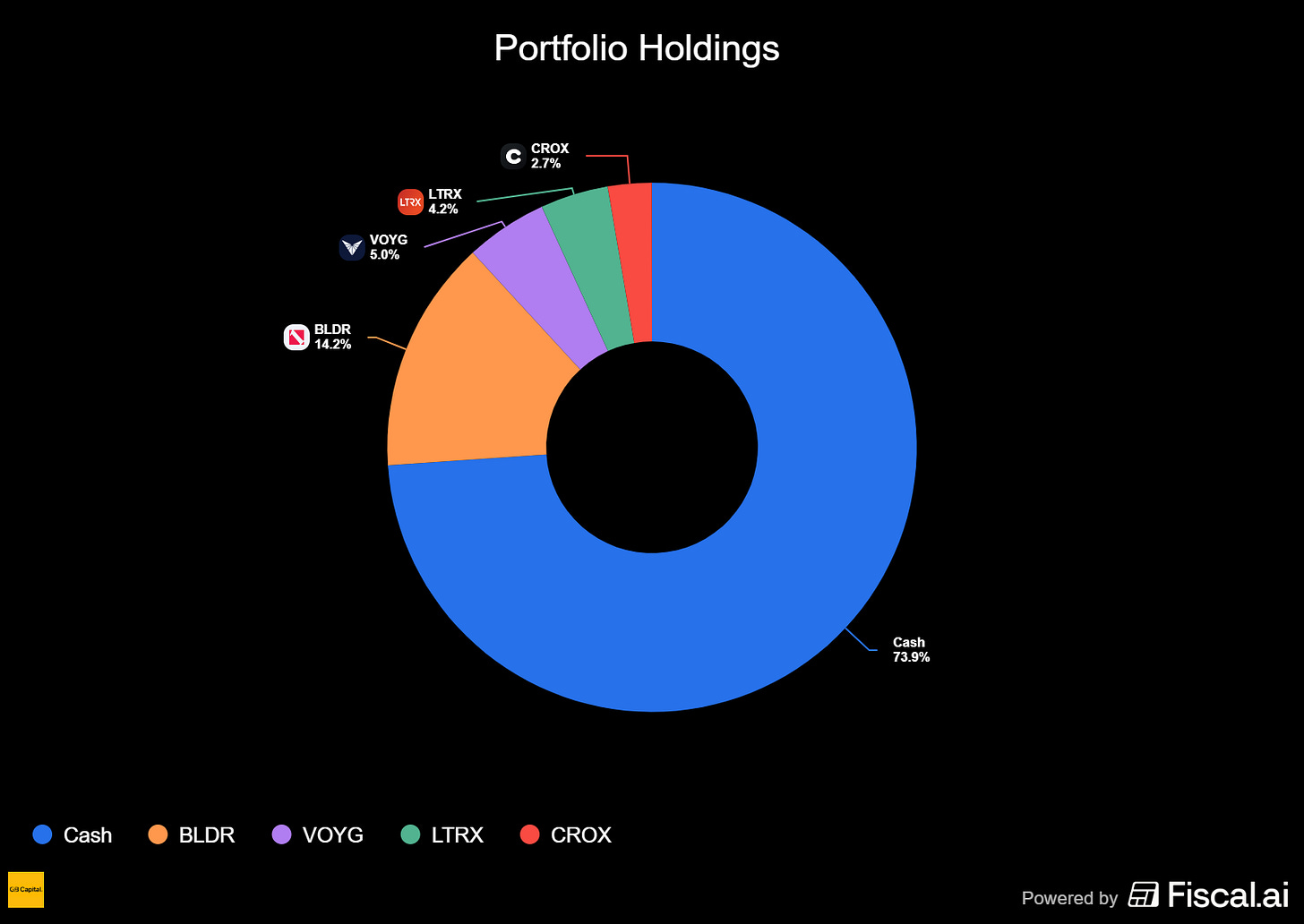

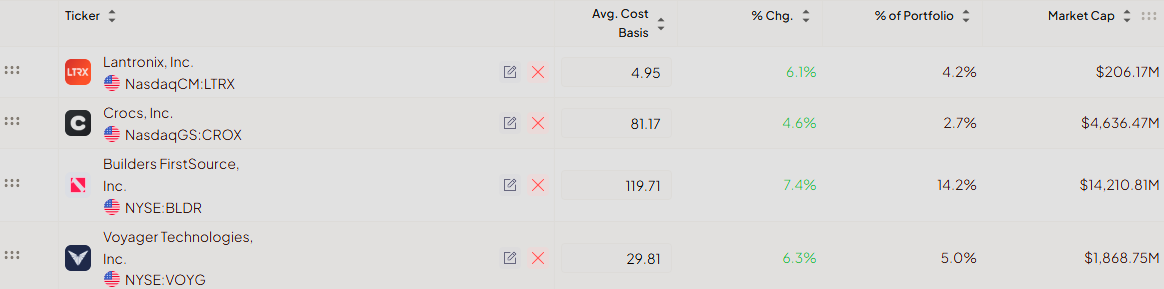

We opened BLDR and VOYG and took the adult skim, 30% off, into early strength. It’s not romance; it’s cash flow. CROX got the same treatment after five straight up days into the 50‑day. If we’re lucky, we get a pullback on light volume and a cleaner march higher. If we’re not, we already paid ourselves for showing up.

LTRX is the lesson we almost didn’t learn. We kept the stop under support, watched it tag the bottom of the channel like it owed rent, then rip higher exactly the way textbooks promise and real life refuses. The conviction felt good for about five minutes, then turned into annoyance that we hadn’t added. That’s trading’s humor: it scolds you for being weak and arrogant in the same breath.

A note for anyone caught up in uptrends: making money when everything rises is the cover charge. Keeping it when gravity returns is the career. The fall will come (maybe next week, maybe next year), but it comes. Until then, squeeze the rally without marrying it. Trim into strength. Keep your stops where the thesis dies, not where your comfort begins. Bank wins like you might need them later, because you will.

Enjoy the green. Respect the yellow lights. And if you must post a screenshot, post the one where you sold early and felt like a fool. That’s the one that keeps you in business long enough to see the next Sunday.

🌱 Support Our Work: Buy Us a Coffee🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

Latest articles:

There are two questions every elite trader answers daily.

“Where is the money flowing?” and “How can I best capture it?”

To definitively answer the “Where,” gain an immediate edge with the unparalleled situational awareness of the TC2000 Market Monitor & Sector Table.

To master the “How,” empower your trading with the speed, organization, and precision of our TC2000 Custom Platform and Scans.

We use this system every single day, and it works.

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock’s risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

TLRY: Tilray Brands Inc ⚠️

What they do: A leading global cannabis-lifestyle and consumer packaged goods company

Why watch? Optimism surrounding the potential U.S. rescheduling of cannabis to Schedule III has fueled a recent rally. The stock saw its highest single-day volume of the year last Monday and is now executing a constructive pullback on light volume. With an earnings report scheduled for October 9th, this setup presents a catalyst-driven trade. The $1.55 level serves as the critical support that bulls must defend to maintain the upward trajectory.

ANET: Arista Networks Inc 🛡️

What they do: A leader in data-driven, client-to-cloud networking for large data center, campus, and routing environments.

Why watch? Following a significant earnings gap-up in August, the stock has entered a quiet consolidation phase, trading tightly near its 10-day and 20-day EMAs. While the stock has made little net progress since the report, this period of low volatility could be the precursor to its next major move. Should the broader market continue its ascent, Arista appears poised to catch up. A high-volume breakout above the $150.00 line of least resistance would signal a resumption of the uptrend.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment, delivering institutional-grade research.