🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 57

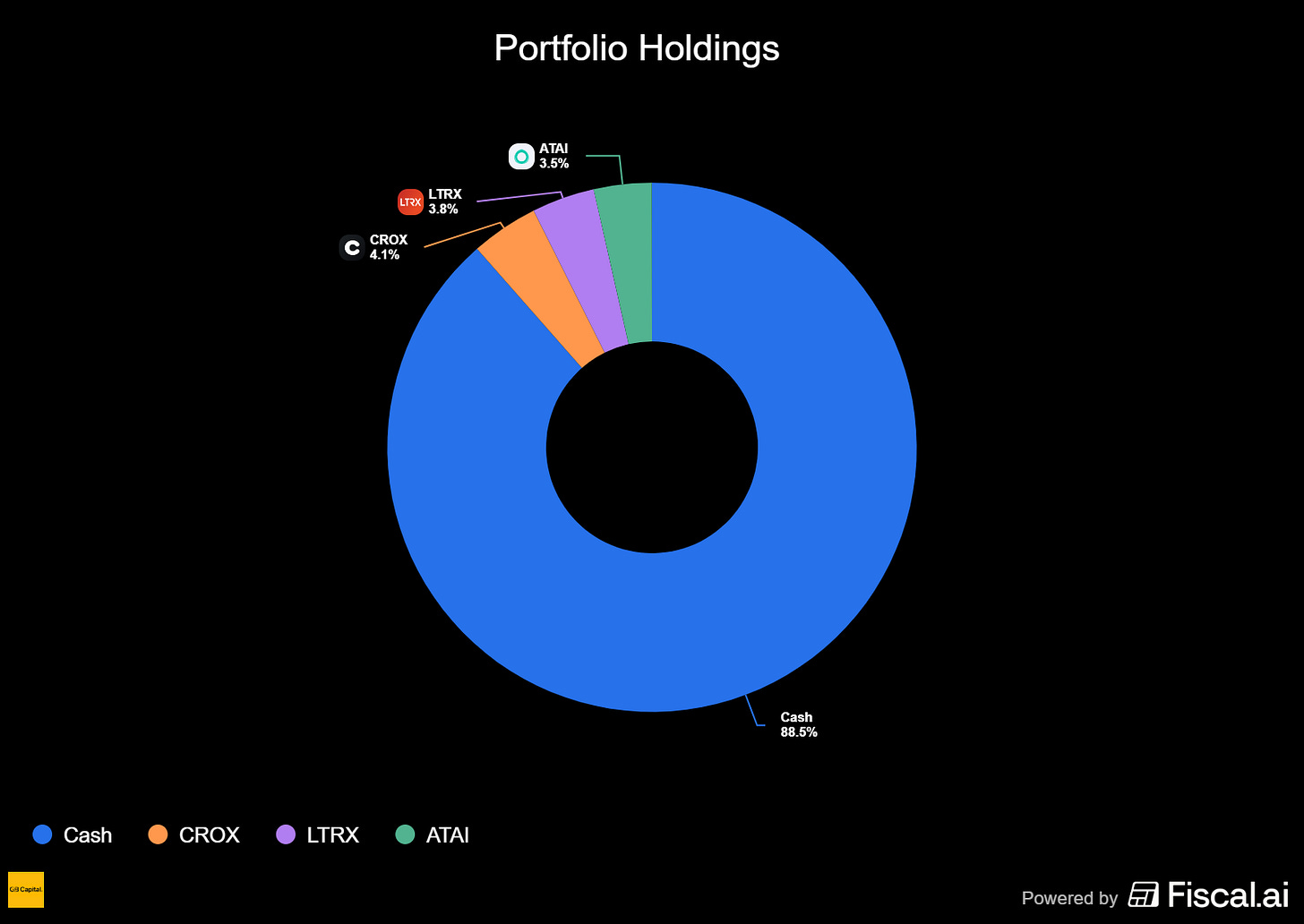

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Fiscal.ai data. Explore now →

Weeks That Take Skin

It was the kind of week that makes you talk to screens. Not prayers, bargains.

We spent most of it hunched over prices like mechanics over a stubborn engine, day‑trading a couple of names just to drag Friday into the green by its collar. Nothing humiliates quite like survival mode. You’re not building, you’re just bailing.

Trust? Thin. We don’t trust this market, and the market knows it.

We’re moving super cautiously, the way you walk across black ice pretending you’re not. Our job is simple and ugly: participate until the gauges light up red, and then breathe, regroup, sharpen. Not before. Not after. When Energy and Utilities are wearing the relative‑strength crown, you don’t whine that the party feels off; you pat your pockets, keep your shoes on, and stay near the door.

The portfolio shifted hard. We raised both CRWV and ENPH to break‑even stops and got tossed. Right call. They’d been loitering, doing nothing but charging rent on our attention. No harm, no shame. The best trades make you feel clever; the right trades often make you feel nothing.

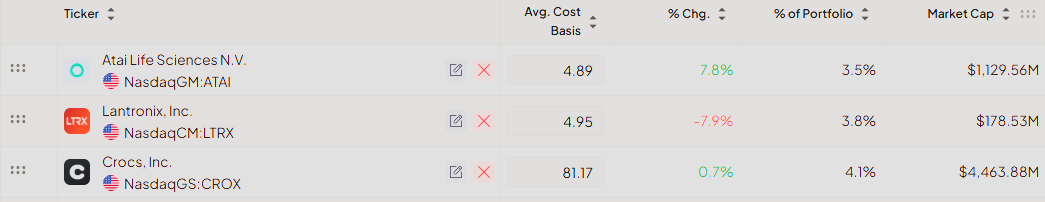

ATAI gave us a head rush: up more than 35% in a blink. We sold 30% into strength like adults and welded the stop to break even. Maybe it holds, maybe it doesn’t. The company’s interesting, the tape says biotech’s one of the few industries not lying to itself. Hope is not a thesis. A stop is.

OKLO: We sang our last note on Friday. Seventy‑five percent in short order. You don’t complain about a win like that. You log it, nod once, and refuse the victory lap. Recent best, yes. Proof of immortality, no.

Then there’s CROX. Friday’s HeyDude x Sydney Sweeney splash hit, and we slid in, not because celebrity endorsements save souls, but because the risk/reward answered without stuttering. Solid company, heavy shelf of support at 74–75, a clean break of the recent daily downtrend, and volume almost doubled. We took it with a wide stop and a smaller size; this isn’t a two‑day fling if it’s going to matter.

LTRX is the bruise you keep pressing. We bought the breakout that never arrived. The stock’s pacing a channel like a caged cat; our thesis dies if it slips the lower rail, and we’re already hearing the lock rattle. We gave it room on purpose, not out of mercy. The room is expensive. So is denial.

Macro mood music: VIX down, T2118 down, T2108 ticking up. The market’s bouncing. In two weeks, we’ll learn if this is a dead‑cat hop into a lower high or the coiling that slings us to fresh records.

Feels fifty‑fifty: an honest coin flip, the most dangerous odds in trading because they whisper that you’re supposed to guess. We won’t. We’ll react.

That’s the whole blueprint, unromantic and true:

Respect the drift even when it insults you.

Sell into strength because gravity is patient.

Put the stop where your thesis ends, not where your feelings begin.

Trade what’s in front of you, not the story you wanted.

We’ll show up again on Monday with knuckles uncurled and rules intact. If the bounce grows teeth, we’ll feed it. If it rolls under and shows belly, we’ll cut the risk and let it play dead without us.

Either way, no speeches, no hero shots. Just the work, done tight, while the market decides whether this was the week it took skin or the week it taught us how to keep it.

🌱 Support Our Work: Buy Us a Coffee🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

Latest articles:

There are two questions every elite trader answers daily.

“Where is the money flowing?” and “How can I best capture it?”

To definitively answer the “Where,” gain an immediate edge with the unparalleled situational awareness of the TC2000 Market Monitor & Sector Table.

To master the “How,” empower your trading with the speed, organization, and precision of our TC2000 Custom Platform and Scans.

We use this system every single day, and it works.

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock’s risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

VOYG: Voyager Technologies Inc ⚠️

What they do: A space technology company dedicated to building a vertically integrated, publicly traded enterprise focused on the commercialization of space.

Why watch? 🛰️ As a recent IPO in the hot aerospace sector, VOYG is positioned to capitalize on tailwinds from national security spending and the commercialization of low Earth orbit. Its majority stake in the Starlab joint venture, backed by a $217.5 million NASA grant, de-risks the story and positions VOYG as a future “landlord” in space. After forming a triple bottom at the $28.00 level, the stock offers a compelling low-risk entry for a potential bounce toward the $45.00-$50.00 zone.

MDB: MongoDB Inc 🛡️

What they do: A leading modern, general-purpose database platform.

Why watch? Following a strong earnings report in early September, the stock has spent the last two weeks in a consolidation phase, finding consistent support at the rising 20-day EMA. Volume has contracted significantly, trading well below its 40-day average, indicating a clear volatility compression on the daily chart. This tightening pattern suggests an imminent move, with the technical posture favoring a resolution to the upside.

AVGO: Broadcom Inc 🛡️

What they do: A global technology leader that designs, develops, and supplies a broad range of semiconductor and infrastructure software solutions.

Why watch? In contrast to some peers, Broadcom has shown relative weakness post-earnings, with the stock losing momentum and pulling back toward the low of its initial gap-up day. The price is now testing a key confluence of support near the 20-day EMA. If buyers defend this level, it could present a compelling low-risk entry with an attractive risk/reward profile. The $331.50 mark serves as a critical line in the sand for the current uptrend.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment, delivering institutional-grade research.