🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 55

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Fiscal.ai data. Explore now →

T2118

Well, it's time for some honest reflection. Our decision to move entirely to cash last week? Hindsight is 20/20, and it’s looking like that was the wrong call. If we have one flaw as investors, it’s that we can sometimes let caution get the better of us, and this was a classic example.

The market right now is a fascinating puzzle. By many metrics, it looks stretched, and the rally isn't being driven by a huge number of stocks. And yet, it keeps climbing. There's a famous saying to "trade what you see, not what you think," and that's our mantra for the moment. We have to respect the trend.

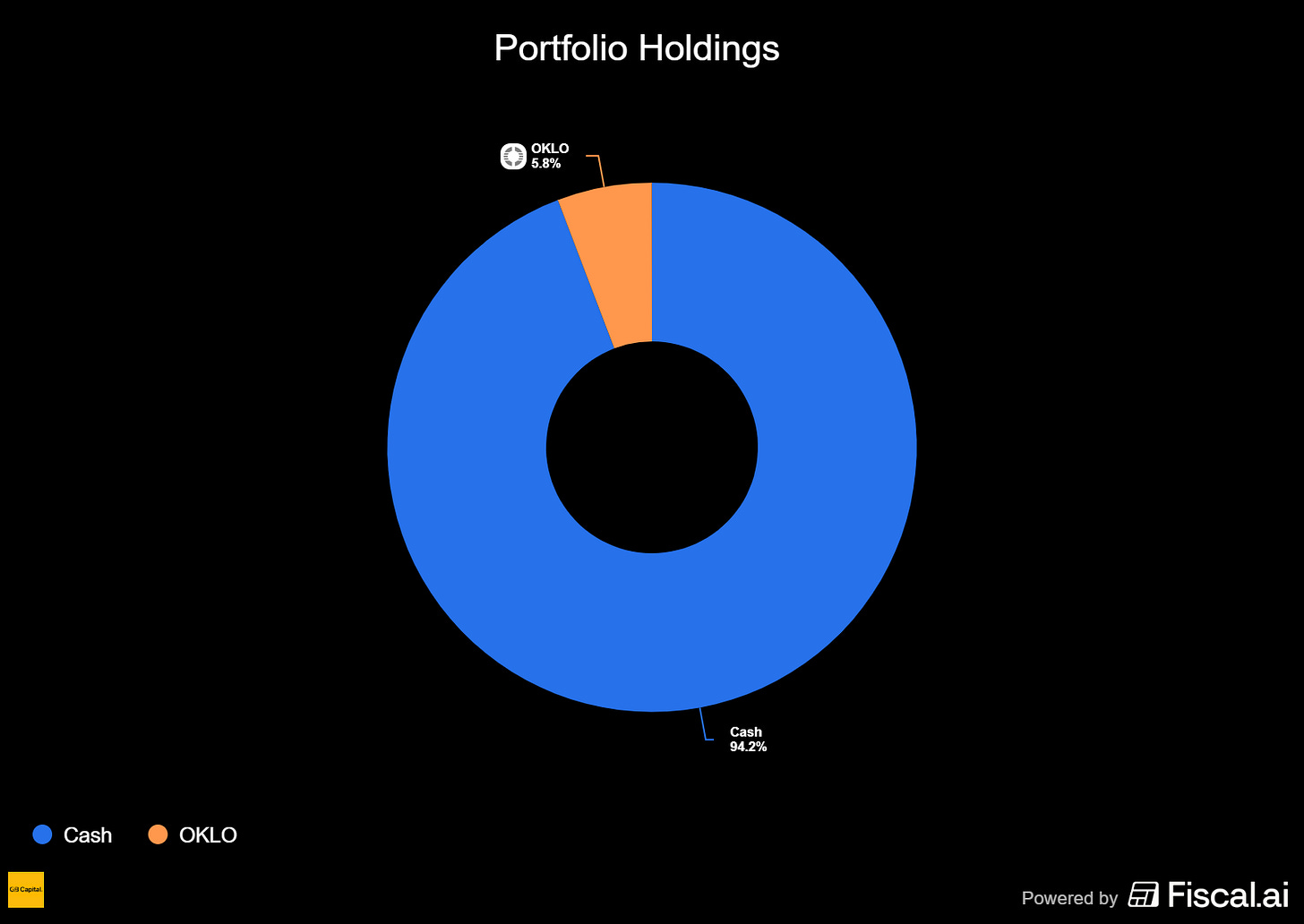

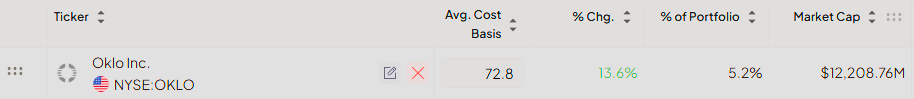

So, this week we decided to dip our toes back in the water. We opened a position in COMM, which we ended up closing for a small loss, and another in OKLO, which is now the only holding in our portfolio.

It’s a small start, but it’s a start. We also had Tesla on our watchlist, and it made exactly the move we were hoping for. Unfortunately, a meeting pulled me away from the screens at the crucial moment: a frustrating, but very real, part of trading.

Looking ahead, we want to slowly increase our exposure, but we’re finding that truly compelling setups for our swing-trading style are few and far between. We are, however, noticing a couple of interesting new themes bubbling to the surface, and we’ve shared a few specific ideas around those with our paid members.

On the technical front, the T2118 indicator (which measures market breadth) is still hovering around the 40 mark, stuck in a channel. We’re watching closely to see if it breaks higher or lower. Meanwhile, the VIX (the market's "fear gauge") is sitting comfortably at 14.76. A low VIX like this generally signals confidence and supports a continued uptrend, which is certainly a positive sign.

For real-time updates on our positioning, trade ideas, and market commentary as conditions evolve, our chat remains the best resource for staying connected with our analysis and decision-making process.

T2108

The T2108 indicator has shown little movement this week, slipping slightly from 59.67 to 58.19. This near-flat performance highlights the ongoing choppy action in the market, with no significant change or added clarity. The lack of momentum suggests that the market remains indecisive, leaving investors waiting for a more definitive signal.

The 4% Bull-Bear Indicator reflects the same sentiment. This past week was marked by continued choppiness, with only a slight edge for the bulls. However, the movement was not substantial enough to indicate a clear shift in control or direction.

The 25% Bull-Bear Indicator remains flat as well, showing no meaningful change. This lack of movement reinforces the current state of equilibrium in the market, with neither bulls nor bears gaining a decisive advantage.

Latest articles:

🌱 Support Our Work: Buy Us a Coffee or Shop Our Services! 🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

[☕ Buy Us a Coffee]

[🛒 Visit Our Shop]

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock's risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

NBIS: Nebius Group NV 📊

What they do: A technology company that provides a high-performance, scalable cloud and AI infrastructure platform.

Why watch? The company made a game-changing announcement this week, revealing a multi-billion-dollar AI infrastructure deal with Microsoft. Following this news, the stock experienced a significant gap-up and is now undergoing a healthy consolidation phase. This period of price digestion is occurring on progressively lower volume, a constructive technical sign suggesting that selling pressure is waning. The ideal scenario would involve a few more days of tight consolidation on low volume before the next potential move higher. This is undoubtedly a stock to keep on your radar for the coming days and weeks.

HLIO: Helios Technologies Inc 🛡️

What they do: A global industrial technology leader that develops and manufactures solutions for the hydraulics and electronics markets.

Why watch? At the beginning of August, Helios reported strong second-quarter 2025 financial results, signaling that the company is well-positioned to deliver profitable sales growth as demand trends improve. The report sparked a sharp rally, with the stock surging nearly 55% in just one month. Currently, the stock is consolidating its gains, constructively moving along its 10-day exponential moving average (EMA) on declining volume while maintaining a bullish uptrend. While a couple of additional tight trading days would be ideal, a decisive break above the $56.00 level could fuel the next leg higher. The $54.00-$56.00 zone represents a significant historical resistance area on the weekly chart dating back to 2024, suggesting the stock may need a bit more time to absorb this overhead supply.

GWRE: Guidewire Software Inc 🛡️

What they do: A cloud-based software platform for Property and Casualty (P&C) insurance carriers for core operations, data and analytics, and digital engagement.

Why watch? Guidewire delivered a stellar fourth-quarter report, with both earnings and revenues surpassing analyst estimates, causing the stock to surge 25% in a single session. The company posted non-GAAP earnings of 84 cents per share (up 35.5% year-over-year) on revenues of $356.6 million (up 22% year-over-year). Since the earnings-driven gap, the stock has been pulling back on remarkably low volume (nearly 70% below the earnings day volume), a bullish indication that the pullback is not driven by heavy selling pressure. We have identified $256.00 as the key pivot level to watch. A breakout from its current mini falling wedge pattern, combined with a move to reclaim the $256.00 level, could signal a resumption of its bullish momentum.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment, delivering institutional-grade research.