🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 56

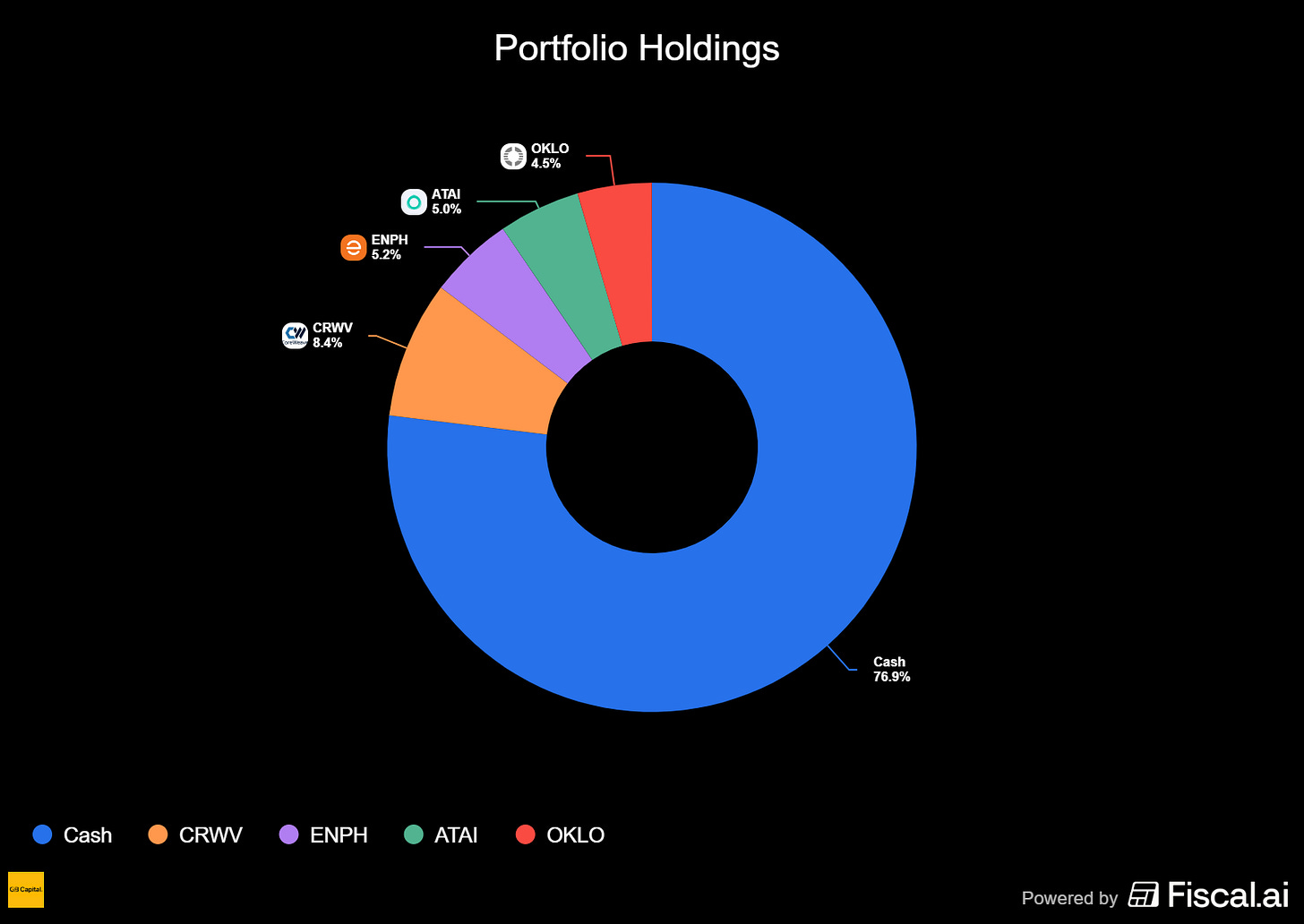

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Fiscal.ai data. Explore now →

Tape Hums, Knuckles White

Monday opens like a guitar amp warming up—low hiss, a promise, that little threat of feedback if you lean in too far. Screens are green again, another week of all‑time highs, the indexes flexing in the mirror. You could fall in love with yourself out here if you’re not careful. The trick is to keep your hands out of your pockets and your exits closed.

There’s a split in the room you can feel in your teeth, the headline tape struts; the undercarriage coughs. Breadth rolls over. Secondary tells go from purr to throat‑clear. Divergence isn’t a headline: it’s a posture.

The market’s smiling while it reaches for your wallet. I’ve learned to watch the smile.

We went shopping anyway. Not for the heroes already crowdsurfing, those names are sticky with other people’s fingerprints, but for instruments with sweat still on them and frets left to wear down.

Quality or nothing.

This week, mostly nothing. The watchlist looked like a stage after last call: a couple of bent stands, one good cable, stale beer on the floor. You can play a show with that, but you’re going to work.

OKLO paid like a loud encore. Half off at 5R—by the book, by the oath—then the rest sprinted into the kind of multiple that turns even disciplined people into historians of what‑ifs. Do I wish we’d ridden the whole thing? Sure. Do I wish I were six inches taller and less interested in stupid risks? Same category. We take the money, we keep the plan. The plan is what keeps you from becoming a story told in the past tense.

ATAI tried to mug us on day one. Ugly close. You could smell the panic breath. The twitch is to slide the stop, negotiate with your future self. We didn’t. We let the trade earn its keep or die clean. It bled, it healed, it’s green. Not triumph, proof of life. The difference matters.

ENPH did the coins‑on‑the‑rail trick, twenty cents from popping the carriage off. Twice. We stood there, hands off the throttle, listening to the metal sing. Forty looks like plywood that’s already scored. Maybe it breaks. Maybe we’re the ones who break. You live with maybes in this racket, you just don’t marry them!

CRWV, we’re treating like a wild dog you’d prefer to keep: set boundaries, offer food, don’t flinch. Stop in. Monday gets the first word.

Zoom out and you can hear the venue shift. T2118 down at 29.25 while the majors pose for their glossy magazine cover. Participation is a handful of session players carrying the band while the rest mime along. It works until it doesn’t.

Rallies die like relationships: slowly, then suddenly, with the two of you still smiling for other people’s cameras.

VIX at 15‑ish keeps the bouncer by the door polite. Under twenty is bull‑market weather: leather jacket optional, shades indoors encouraged. That’s fine. Complacency isn’t evil; it’s a climate. You just don’t forget where the fire exits are.

Here’s the part most newsletters skip: this job is personal. It rubs your nose in who you are. On my worst days, I’m a tourist with a platinum card and a theory, talking myself into “one more” because the last one felt good.

On my better days, I’m a line cook of capital: prep done, station clean, tickets called, ego checked, knife sharp.

The market rewards the second guy. The first one spends his nights crafting alibis.

Latest articles:

🌱 Support Our Work: Buy Us a Coffee or Shop Our Services! 🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

[☕ Buy Us a Coffee]

[🛒 Visit Our Shop]

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock's risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

RIGL: Rigel Pharmaceuticals Inc 📊

What they do: A Biotechnology company focused on small-molecule therapies for immune and hematologic disorders.

Why watch? Shares doubled on earnings before fading and slipping below the 10- and 20-day EMAs. Historically, the first tests of the 50-day EMA tend to attract buyers. The stock now sits in a falling wedge: a last shakeout at the 50-day or an upside break from the wedge would set the next move. Either way, this remains on watch for next week as price converges and momentum compresses.

OPEN: Opendoor Technologies Inc ⚠️

What they do: A leading iBuyer platform for residential real estate.

Why watch? The first falling-wedge setup emerged in late July. We passed due to the name’s speculative profile, wrong call. Now, consensus seems eager to short, but price is quietly consolidating above the 10-day EMA on lighter volume. The line of least resistance is $10.50. A decisive break above that level could ignite a parabolic extension.

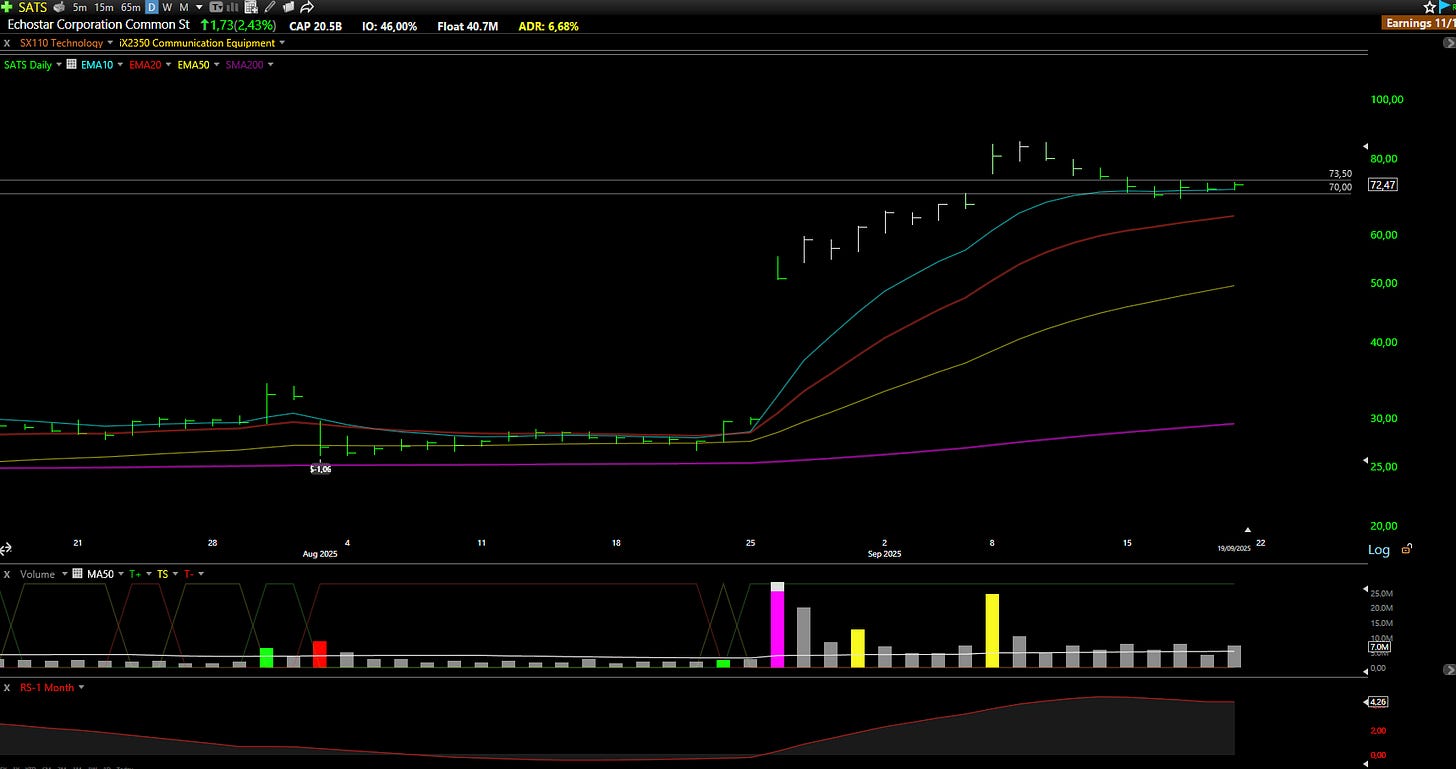

SATS: EchoStar Corporation ⚠️

What they do: Satellite communications and connectivity

Why watch? Following the deal headlines with AT&T and SpaceX, shares rallied roughly 200%. This is the first meaningful low-volume consolidation since the surge. Price is riding the 10-day EMA and coiling within a tight $3.50 Darvas Box. Risk/reward screens are attractive for position initiations with defined risk, while the 10-day continues to provide support.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment, delivering institutional-grade research.