🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 54

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Fiscal.ai data. Explore now →

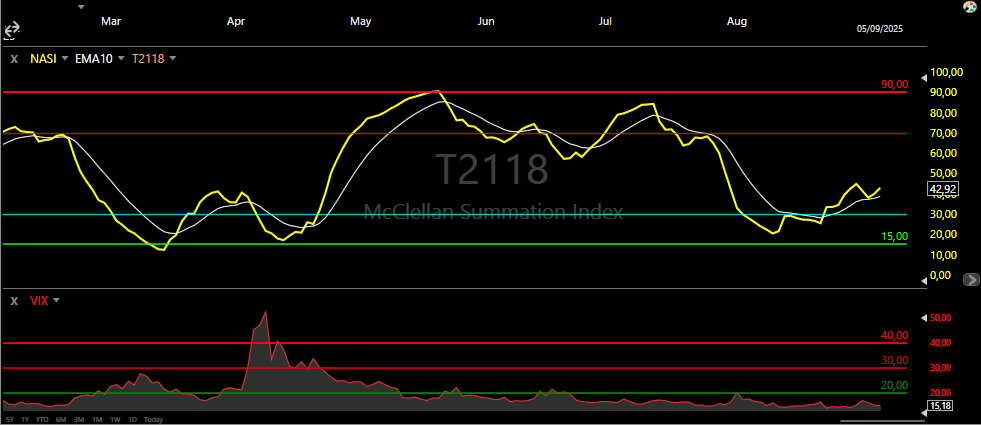

T2118

Last week proved to be another choppy period, offering no real traction for our trading style, just as we anticipated. The broader market is not behaving well, and our recent performance reflects this challenging environment. We attempted a couple of starter positions in PSIX and TTD without much success, resulting in one loss and one break-even trade.

Given our dissatisfaction with the current market conditions, we have decided to move to a full cash position. This decision was solidified by selling the last batch of our FUTU holdings, locking in a 50% gain on the position. For now, our focus shifts to studying and analyzing the market landscape to identify new, high-quality opportunities as they emerge.

Scanning the market for potential watchlist candidates this week has yielded slim pickings. In terms of sector-specific strength, we are only seeing some nuclear-related names and a significant number of pharma/biotech stocks beginning to set up. A couple of names on the battery theme, also. Beyond these areas, there is little that catches our eye.

The T2118 is nearly flat, moving from 44.8 last week to 42.92, indicating no significant change in market breadth. Similarly, the Volatility Index (VIX) has remained stable, shifting from 15.36 to 15.18. These indicators confirm the lack of clear direction, reinforcing our decision to remain on the sidelines.

Hopefully, the coming week will bring more clarity and better opportunities.

For real-time updates on our positioning, trade ideas, and market commentary as conditions evolve, our chat remains the best resource for staying connected with our analysis and decision-making process.

T2108

The T2108 indicator has shown little movement this week, slipping slightly from 61.39 to 59.67. This near-flat performance highlights the ongoing choppy action in the market, with no significant change or added clarity. The lack of momentum suggests that the market remains indecisive, leaving investors waiting for a more definitive signal.

The 4% Bull-Bear Indicator reflects the same sentiment. This past week was marked by continued choppiness, with only a slight edge for the bulls. However, the movement was not substantial enough to indicate a clear shift in control or direction.

The 25% Bull-Bear Indicator remains flat as well, showing no meaningful change. This lack of movement reinforces the current state of equilibrium in the market, with neither bulls nor bears gaining a decisive advantage.

Latest articles:

🌱 Support Our Work: Buy Us a Coffee or Shop Our Services! 🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

[☕ Buy Us a Coffee]

[🛒 Visit Our Shop]

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock's risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

DUOL: Duolingo Inc. 📊

What they do: A leading global language-learning platform.

Why watch? Duolingo has experienced a severe 44% downturn over the last 20 trading sessions, a remarkably sharp correction following what was a stellar earnings report. This price action has brought the stock down to a critical support level around $270.00, a zone that has been successfully defended on three separate occasions since late 2024. For a fundamentally sound company with a strong track record, this technical confluence presents a compelling risk/reward scenario, making it an attractive candidate for at least a technical bounce play.

HNGE: Hinge Health Inc. ⚠️

What they do: A digital musculoskeletal care company.

Why watch? Hinge Health delivered a strong first public earnings report, with revenue surging 55% year-over-year to $139.1 million. While the company reported a significant operational loss of $580.7 million, this was largely due to IPO-related stock-based compensation. The stock is consolidating near $57.00, and a breakout above this level with volume could attract more attention to this high-growth digital health name, offering explosive upside potential.

TSLA: Tesla Inc. 🛡️

What they do: A vertically integrated sustainable energy company, best known for its electric vehicles.

Why watch? From a technical perspective, Tesla's chart is currently one of the most constructive setups in the market. An analysis of the daily, weekly, and monthly timeframes reveals a powerfully bullish posture. Should broader market sentiment remain cooperative, a decisive breakout above the $355.00 resistance level, particularly on significant volume, could act as a major catalyst. Such a move would likely fuel a substantial advance, with an initial price objective near the psychological $400.00 mark.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment, delivering institutional-grade research.