🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 53

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Fiscal.ai data. Explore now →

T2118

This week, the market has left investors in a state of limbo. The data are not providing a clear direction, and it seems we may need at least 1-2 more weeks to gain better clarity on where things are headed. In times like these, maintaining discipline and sticking to a well-defined strategy is more important than ever.

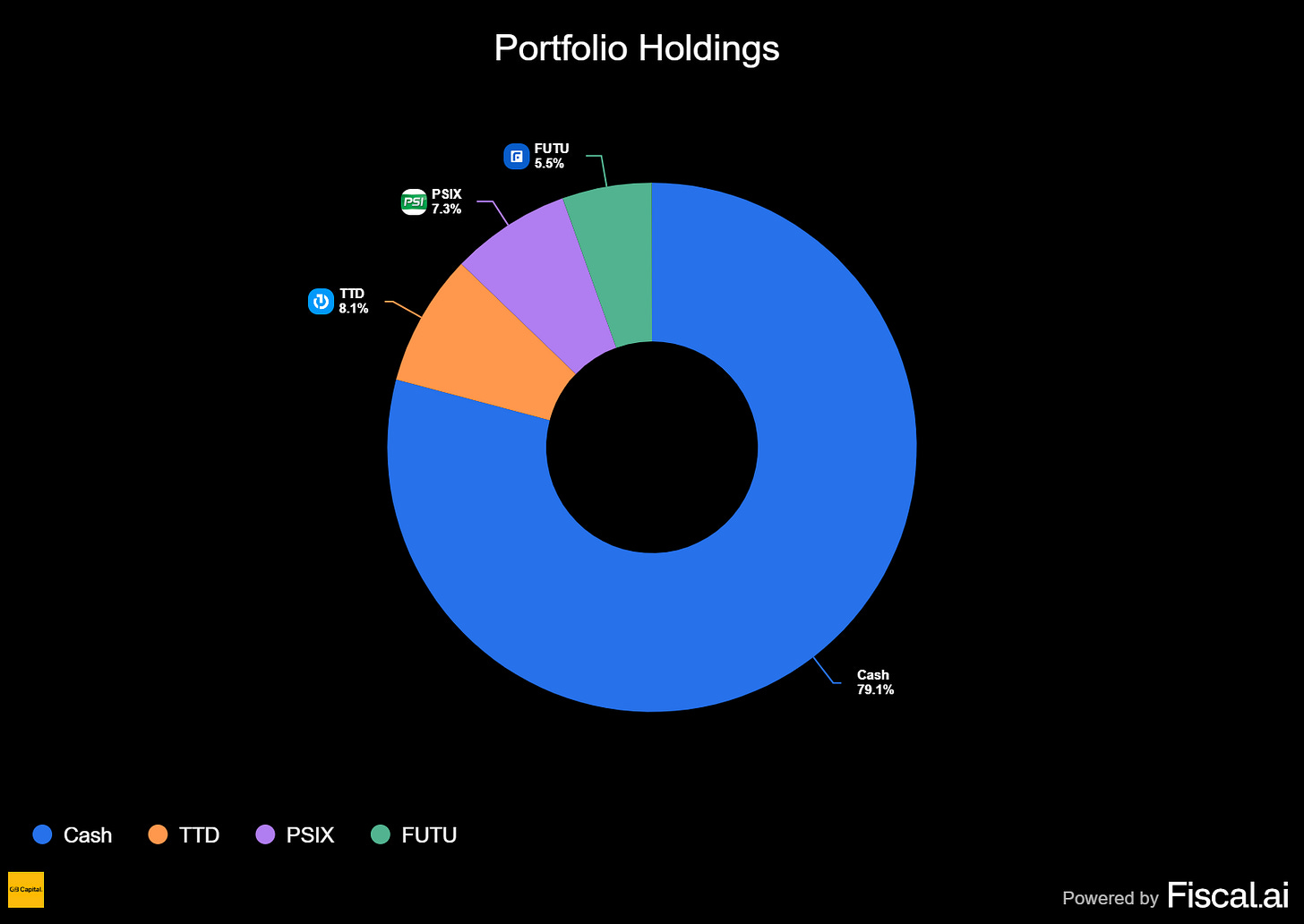

Our portfolio has seen significant depletion recently, with only FUTU standing out as a big winner. However, we’ve taken steps to rebuild by adding TTD and PSIX as new positions. These companies have experienced pullbacks but maintain strong overall quality, aligning with our criteria for low-risk setups. Given the 5-month rally in the indexes and the historically bearish seasonality of September and October, we remain cautious, perhaps even more so than usual.

The T2118 has shown improvement this week, rising from 33.42 to 44.88. While this increase suggests some broadening market participation, it is not yet a definitive signal. Similarly, the Volatility Index (VIX) has ticked up slightly, moving from 14.22 to 15.36. This modest rise in volatility doesn’t provide much clarity either, leaving us in a wait-and-see mode.

For real-time updates on our positioning, trade ideas, and market commentary as conditions evolve, our chat remains the best resource for staying connected with our analysis and decision-making process.

T2108

The T2108 indicator has shown little movement this week, slipping slightly from 62.81 to 61.39. This near-flat performance highlights the ongoing choppy action in the market, with no significant change or added clarity. The lack of momentum suggests that the market remains indecisive, leaving investors waiting for a more definitive signal.

The 4% Bull-Bear Indicator reflects the same sentiment. This past week was marked by continued choppiness, with only a slight edge for the bulls. However, the movement was not substantial enough to indicate a clear shift in control or direction.

The 25% Bull-Bear Indicator remains flat as well, showing no meaningful change. This lack of movement reinforces the current state of equilibrium in the market, with neither bulls nor bears gaining a decisive advantage.

Latest articles:

🌱 Support Our Work: Buy Us a Coffee or Shop Our Services! 🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

[☕ Buy Us a Coffee]

[🛒 Visit Our Shop]

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock's risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

NIO: NIO Inc. 📊

What they do: A leading Chinese electric vehicle manufacturer.

Why watch? NIO is set to report earnings on September 2nd, and the stock has formed its first flag pattern after decisively breaking out of the $5.30–$5.50 range. This marks the end of a prolonged 1.5-year basing period within a $2.00 range. The technical setup suggests a strong potential for a post-earnings move, making this an attractive entry point for traders looking to capitalize on renewed momentum.

HNGE: Hinge Health Inc. ⚠️

What they do: A digital musculoskeletal care company.

Why watch? Hinge Health delivered a strong first public earnings report, with revenue surging 55% year-over-year to $139.1 million. While the company reported a significant operational loss of $580.7 million, this was largely due to IPO-related stock-based compensation. The stock is consolidating near $58.00, and a breakout above this level with volume could attract more attention to this high-growth digital health name, offering explosive upside potential.

DASH: DoorDash Inc 🛡️

What they do: A leading food delivery platform.

Why watch? DoorDash recently dipped below its 50-day EMA but quickly recovered as buyers stepped in, pushing the stock back above the level—a strong show of support. The stock is now consolidating between $242.00 and $249.00, with the 50-day EMA acting as a solid base. A breakout above $249.00 could turn this consolidation into a new uptrend, offering a favorable risk/reward setup for traders.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment, delivering institutional-grade research.