48. Weekly Market Recap: Key Movements & Insights

Stocks Rebound as NASDAQ Hits New High Amid Tariff Uncertainty

Wall Street ended the week on a positive note, with the S&P 500 recovering much of its prior losses and the NASDAQ reaching a new all-time high. Investors navigated a volatile week marked by tariff announcements, weak economic data, and mixed sector performances. The week ahead promises further market-moving events, with a key Consumer Price Index (CPI) update on the horizon.

The trading week was a rollercoaster, with stocks swinging between gains and losses as geopolitical and economic uncertainties loomed large. The S&P 500 began the week strong, snapping a four-day losing streak, but faltered on Tuesday following weak economic data and fresh tariff concerns. A mid-week rally on Wednesday, despite President Trump’s announcement of a 100% tariff on imported semiconductor chips, showcased the market's resilience. However, Thursday’s gains were short-lived as tariff fears resurfaced, only for Friday’s strong earnings reports to lift sentiment and close the week on a high note.

Tech and Consumer Durables Lead the Charge

The NASDAQ’s record-breaking performance was fueled by strength in the technology sector, with electronic technology, non-energy minerals, and consumer durables emerging as the week’s top-performing sectors. On the flip side, consumer services, energy minerals, and industrial services lagged, reflecting a divergence in market sentiment.

President Trump’s announcement of a 100% tariff on semiconductor imports, with exemptions for U.S.-based manufacturing, added to the week’s volatility. The move, part of a broader push to onshore high-tech manufacturing, drew mixed reactions from investors. While companies like Nvidia (NVDA) and Taiwan Semiconductor (TSM) saw gains, the broader market remained cautious.

A Spotlight on Other Assets

Bonds:

The U.S. Treasury market saw modest yield increases amidst the week’s uncertainties. A $42 billion securities auction by the Treasury Department added to the pressure, while weak economic data and tariff concerns kept investors on edge.

Oil:

Oil prices fell 5.3% for the week, reversing the prior week’s attempted rally. Geopolitical uncertainty and concerns over the economic impact of tariffs weighed heavily on sentiment, with weak economic data further dampening the outlook.

Gold:

Gold emerged as a winner, gaining 1.2% for the week. The precious metal benefited from heightened economic uncertainty and weaker-than-expected jobs data, which fueled hopes for a potential interest rate cut later in the year.

Crypto:

The cryptocurrency market remained relatively quiet for most of the week, with Bitcoin trading within its prior range. However, a late-week rally in altcoins on Thursday and Friday brought renewed optimism. Ethereum broke the $4,000 mark, signaling a potential shift in sentiment. Bitcoin ended the week up 1.9%, continuing its strong year-to-date performance of 23.3%.

Economic Data Highlights

Consumer Credit:

U.S. consumer credit rose by $7.37 billion in June, slightly below the $7.40 billion consensus. Revolving credit, including credit card debt, slipped to $1.297 trillion, while nonrevolving credit, such as auto and student loans, increased to $3.758 trillion. The data reflects a 2.3% annualized growth rate, signaling cautious consumer spending amidst economic uncertainty.

Jobless Claims:

Initial jobless claims for the week ended August 2 rose by 7,000 to 226,000, exceeding the 221,000 consensus. Continuing claims climbed to 1.974 million, the highest level since November 2021. The data underscores a slowdown in hiring across industries, with federal layoffs and newly discharged veterans’ unemployment claims contributing to the rise.

Upcoming Key Events:

Monday, August 11:

Earnings: Saudi Arabian Mining Company (1211), KE Holdings Inc. (BEKE)

Economic Data: None

Tuesday, August 12:

Earnings: Tencent Holdings Limited (700), Sea Limited (SE), CoreWeave, Inc. (CRWV), Circle Internet Group, Inc. (CRCL)

Economic Data: Core Inflation Rate MoM, Core Inflation Rate YoY

Wednesday, August 13:

Earnings: Cisco Systems, Inc. (CSCO), Venture Global, Inc. (VG)

Economic Data: None

Thursday, August 14:

Earnings: Applied Materials, Inc. (AMAT), Foxconn Industrial Internet Co., Ltd. (601138), Nu Holdings Ltd. (NU), Adyen N.V. (ADYEN), JD.com, Inc. (JD)

Economic Data: PPI MoM

Friday, August 15:

Earnings: None

Economic Data: Retail Sales MoM, Michigan Consumer Sentiment Prel

Here are the most pertinent earnings details.

Due to the volume of reports during the earnings season, it is not feasible to include every single one in our calendar.

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Fiscal.ai data. Explore now →

Index Insights: How Major Benchmarks Performed Last Week

Price>MA10: 🟢

Price>MA20: 🟢

MA10>MA20: 🟢

Market Trend*:🟢

Trend Signal: 🟢

*When Price and Moving Averages are all green, the Market Trend will also be green

Price>MA10: 🟢

Price>MA20: 🟢

MA10>MA20: 🟢

Market Trend: 🟢

Trend Signal: 🟢

Price>MA10: 🟢

Price>MA20: 🟢

MA10>MA20: 🟢

Market Trend: 🟢

Trend Signal: 🟢

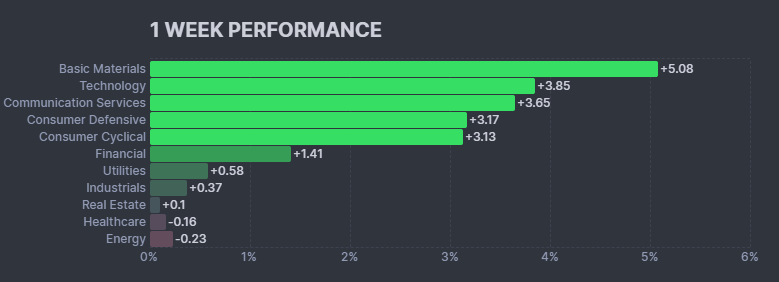

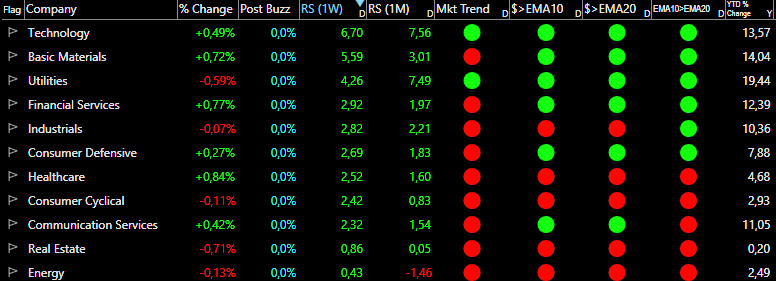

Sector Performance: Winners and Losers from Last Week

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

Winners

🧱 Basic Materials (+5.08%)

Basic Materials led the market this week with an impressive 5.08% gain, driven by strong demand for commodities and industrial inputs.

💻 Technology (+3.85%)

Technology posted a robust 3.85% increase, fueled by optimism in the semiconductor and software industries despite ongoing tariff concerns.

📱 Communication Services (+3.65%)

Communication Services gained 3.65%, reflecting renewed interest in digital and connectivity services.

🛡️ Consumer Defensive (+3.17%)

Consumer Defensive stocks rose 3.17%, signaling strong demand for essential goods and services.

🛍️ Consumer Cyclical (+3.13%)

Consumer Cyclical stocks climbed 3.13%, benefiting from improved consumer sentiment and spending.

🏦 Financial (+1.41%)

Financials gained 1.41%, supported by resilience in banking and investment services despite broader economic uncertainties.

⚡ Utilities (+0.58%)

Utilities posted a modest 0.58% increase, maintaining their reputation as a stable, dividend-focused sector.

🏭 Industrials (+0.37%)

Industrials edged up by 0.37%, reflecting steady performance in manufacturing and infrastructure-related activities.

🏢 Real Estate (+0.01%)

Real Estate was flat this week, with a marginal 0.01% gain, indicating a pause in property market momentum.

Losers

🏥 Healthcare (-0.16%)

Healthcare declined by 0.16%, showing a slight pullback despite its usual defensive appeal.

🛢️ Energy (-0.23%)

Energy was the weakest performer this week, falling 0.23%, as geopolitical uncertainties and weak economic data weighed on the sector.

🌟 Weekly Industry Leaders 🌟

🔥 Coking Coal (+20.08%)

Coking Coal led the market this week with a staggering 20.08% gain, driven by strong demand from steel production and favorable commodity market dynamics.

💎 Other Precious Metals & Mining (+13.4%)

The mining sector posted robust gains of 13.4%, reflecting ongoing demand for precious metals and industrial minerals.

📱 Consumer Electronics (+13.23%)

Consumer Electronics surged 13.23%, fueled by strong consumer demand and innovation in the tech space.

🥇 Gold (+11.12%)

Gold climbed 11.12%, benefiting from its safe-haven appeal amidst economic uncertainties.

🍷 Beverages - Wineries & Distilleries (+11.05%)

The beverages sector gained 11.05%, supported by strong consumer spending on premium alcoholic products.

🥈 Silver (+10.12%)

Silver advanced 10.12%, reflecting heightened investor interest in precious metals as a hedge against inflation and economic volatility.

🧵 Textile Manufacturing (+8.42%)

Textile Manufacturing rose 8.42%, signaling strong demand for apparel and industrial fabrics.

💻 Computer Hardware (+7.72%)

Computer Hardware gained 7.72%, driven by increased demand for devices and components.

🔩 Copper (+7.04%)

Copper prices climbed 7.04%, supported by robust industrial activity and infrastructure investments.

🚗 Auto Manufacturers (+6.94%)

Auto Manufacturers advanced 6.94%, benefiting from strong consumer demand and innovation in electric vehicles.

🚀 Top Market Gainers: Clinical Trials, AI Partnerships, and Strategic Sales

BTAI BioXcel Therapeutics (+206.59%)

💎 BioXcel Therapeutics shares surged after the company announced the completion of its SERENITY At-Home Pivotal Phase 3 safety trial. The final patient has concluded their last visit for the trial, which evaluates a treatment for acute agitation associated with bipolar disorders or schizophrenia. This key milestone has generated significant optimism among investors about the therapy's potential.

MENS Jyong Biotech Ltd (+136.82%)

❓ Jyong Biotech Ltd saw its stock price climb dramatically by over 136% without any official news or filings from the company. The sudden and unexplained spike has led to market speculation that it may be another instance of a pump-and-dump scheme, often seen with recent Chinese IPOs.

MRM Medirom Healthcare Technologies Inc (+113.71%)

📈 Medirom Healthcare Technologies announced a significant collaboration with Hakuhodo Inc. to participate in "World," a "proof of human" protocol co-founded by OpenAI's Sam Altman. The partnership aims to accelerate the adoption of "World ID," a system for verifying human identity in the age of AI, driving strong investor interest in MEDIROM's forward-looking strategy.

COMM CommScope Holding Company Inc (+102.31%)

💰 CommScope's stock nearly doubled, hitting a new all-time high after the company announced it would sell its connectivity and cable solutions (CCS) business for a massive $10.5 billion. Investors reacted with overwhelming enthusiasm, aggressively buying up shares following the transformative deal.

ZEPP Zepp Health Corporation (+89.62%)

📈 Zepp Health Corporation reported impressive second-quarter 2025 financial results, with revenues of $59.4 million, a 46.2% year-over-year increase that beat guidance. The company also narrowed its net loss and projected strong third-quarter growth of 70% to 79%. The positive earnings, coupled with new product launches and high-profile athlete endorsements, fueled the stock's rally.

🔻 Biggest Decliners: Dilution, Poor Earnings, and Suspected Scams

BINI Bollinger Innovations (-80.63%)

📉 Bollinger Innovations, formerly known as Mullen Automotive, continued its long-term collapse, with shares plummeting over 80%. The company has become notorious among investors as a "dilution machine," consistently issuing new shares and destroying shareholder value since its IPO, leading many to label it a total scam.

BIVI BioVie Inc (-73.47%)

💸 BioVie Inc. shares took a nosedive after the company announced the pricing of a $12 million public offering. The move, which will dilute the value for existing shareholders, was met with a swift and severe sell-off in the market.

LGVN Longeveron Inc (-58.72%)

💸 In a similar story of dilution, Longeveron's stock fell sharply after the company announced a public offering of up to $17.5 million. The prospect of an increased number of shares on the market triggered a significant drop in the stock's price as investors reacted to the news.

SDM Smart Digital Group Limited (-51.84%)

📉 Smart Digital Group Limited shares were cut in half, reinforcing investor skepticism about certain Chinese IPOs. The stock's rapid decline is being widely viewed as another pump-and-dump scheme, serving as a warning for those investing in these highly speculative names.

AGL Agilon Health Inc (-49.88%)

⚠️ Agilon Health shares crashed after a disastrous second-quarter report that missed revenue estimates and showed a net loss more than double what analysts expected. The poor results were compounded by the abrupt departure of CEO Steven Sell and the company's withdrawal of its 2025 financial guidance, shattering investor confidence.

🌱 Support Our Work: Buy Us a Coffee or Shop Our Services! 🌱

Your small gesture fuels our big dreams. Click below to make a difference today.