🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 52

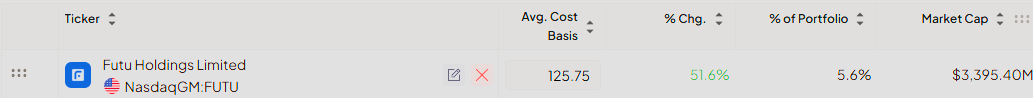

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Fiscal.ai data. Explore now →

T2118

Days like Friday can test the conviction of any investor. After a choppy and mostly negative week, a disciplined approach suggested taking protective measures and closing positions, especially with comments from Fed Chairman Powell on the horizon. However, the market then shot up with incredible force, leaving cautious investors largely in cash.

This is a classic market scenario designed to stir emotions and FOMO, tempting investors to abandon their plans. We resisted this temptation. Our specialty is low-risk setups, and we must stick to the strategy we know best. The market will always find a way to test your discipline.

A key internal indicator, the T2118, has finally shown significant improvement. It is starting to curl upwards and has broken above its 10-day exponential moving average, with a current value of 33.42. This suggests broadening market participation and is a healthy sign for a potential uptrend.

At the same time, the Volatility Index (VIX) has tanked, falling from a weekly high of 17.00 down to 14.22. This sharp drop in volatility indicates that fear is subsiding, providing a more stable foundation for the market to build upon.

With the market now seemingly headed for all-time highs, our strategy will shift. We will now look to identify new low-risk entry points to carefully rebuild our portfolio in the coming weeks, should the market remain positive.

For real-time updates on our positioning, trade ideas, and market commentary as conditions evolve, our chat remains the best resource for staying connected with our analysis and decision-making process.

T2108

The T2108 indicator has increased in value to 62.81, a significant jump from last week's 50.05. It's important to note that most of this change occurred on Friday following comments from Chairman Powell. Before that, the indicator was tracking for a third consecutive week in the neutral zone, reflecting the market's indecisiveness. The strong finish suggests a shift in sentiment, but we will need to see if the market provides a follow-through next week to confirm this momentum. Worth noting, the T2108 and T2118 indicators are now moving in tandem, adding more conviction to the overall bullish signal.

The 4% Bull-Bear Indicator painted a picture of a choppy and uncertain week right up until the end. However, a massive 1.3k green bar on Friday changed the entire landscape. This represents an important and powerful shift in value. Historically, such a strong, decisive move often leads to a follow-through in the subsequent trading days, suggesting the bulls have seized control.

The 25% Bull-Bear Indicator is confirming this shift, as it has started drifting to the upside again. This movement gives a clear signal that the bulls have regained control and are now operating in full force, breaking the previous state of equilibrium and suggesting a potential new leg up for the market.

Latest articles:

🌱 Support Our Work: Buy Us a Coffee or Shop Our Services! 🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

[☕ Buy Us a Coffee]

[🛒 Visit Our Shop]

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock's risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

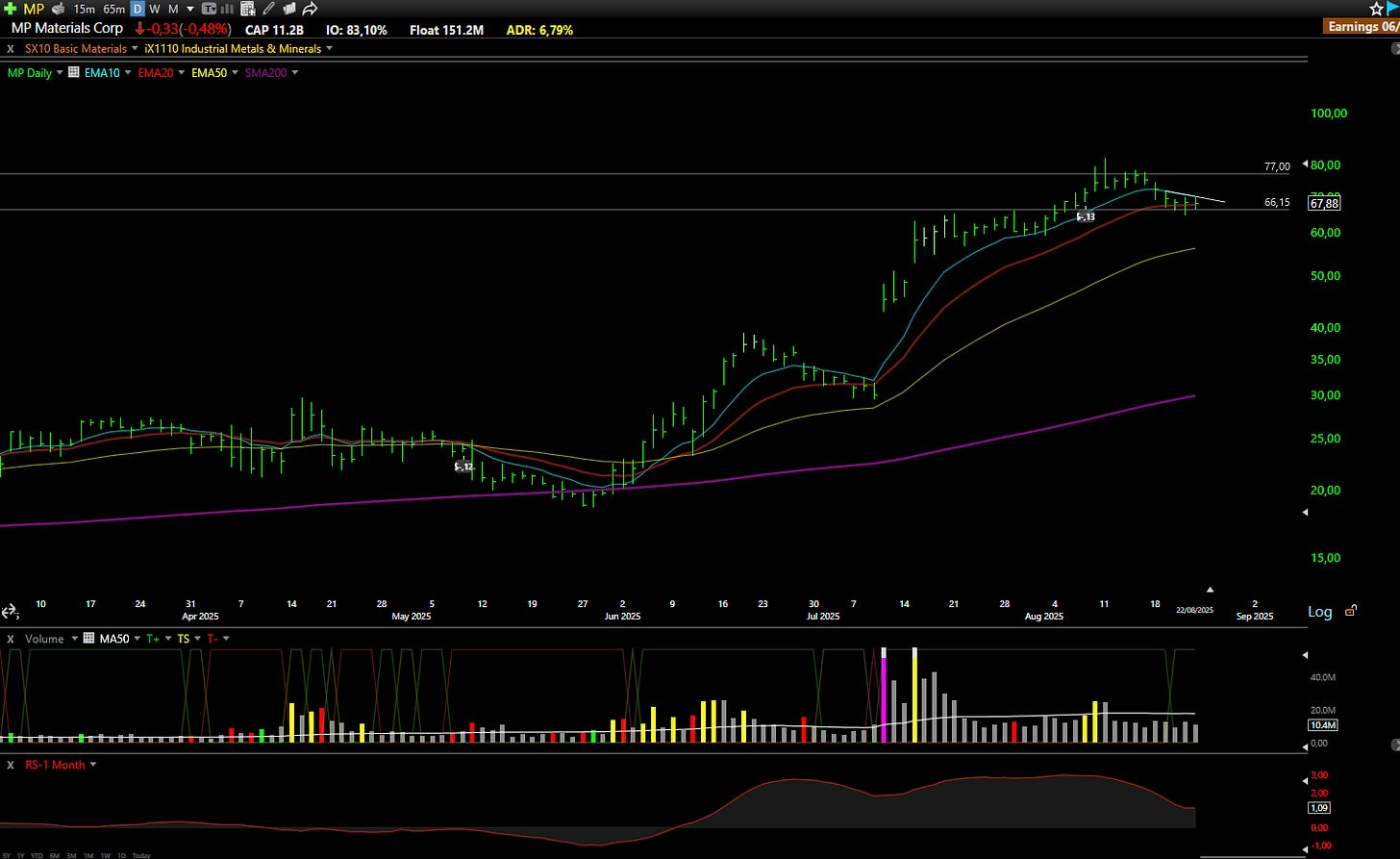

MP: MP Materials Corp. ⚠️

What they do: A leading U.S.-based producer of rare-earth materials critical for the manufacturing of high-strength magnets used in electric vehicles, defense systems, and clean energy technologies.

Why watch? Following a significant rally of over 90% in the preceding month, the stock is undergoing a period of consolidation near the $66.00 level. A decisive breakout over 70.00 could initiate the next leg of its uptrend, with an initial price target of $100.00. From a technical standpoint, the stock seems ready to break out.

COMM: CommScope Holding Company Inc 📊

What they do: A global provider of network infrastructure solutions, including hardware and software for wireless and wireline networks.

Why watch? The company's fundamentals are showing impressive strength. It reported a substantial 32% year-over-year increase in net sales to $1.388 billion and a remarkable 79% surge in adjusted EBITDA to $338 million. The ANS and RUCKUS segments were standout performers, with revenues climbing 58% year-over-year, contributing $127 million in adjusted EBITDA, a 326% increase from the prior year. In light of this performance and the pending CCS transaction, management has raised its full-year adjusted EBITDA guidance to a range of $1.15 billion to $1.2 billion. Furthermore, the company anticipates distributing significant excess cash to shareholders as a dividend within 60 to 90 days post-closing. Technically, the stock has been consolidating since the earnings announcement, allowing the 10-day EMA to catch up to the price. The $16.00 level appears to be the critical line in the sand; a breakout with convincing volume over that level could ignite the next leg higher.

WOLF: Wolfspeed Inc. ⚠️

What they do: A U.S.-based manufacturer of silicon carbide and GaN (Gallium Nitride) semiconductors used in electric vehicles, renewable energy, and communications infrastructure.

Why watch? This is a high-risk, speculative play for traders comfortable with volatility. The stock is forming a descending triangle pattern, with clear price support established at the $1.27 level. Following a massive rally at the beginning of July, trading volume has dried up significantly, indicating a period of consolidation. The 10 and 20-day EMAs are currently acting as resistance. A decisive break above the $1.45 mark could signal that the stock is ready to make its next move higher. Given its Chapter 11 status, this trade must be approached with appropriate risk management.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment, delivering institutional-grade research.