🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 51

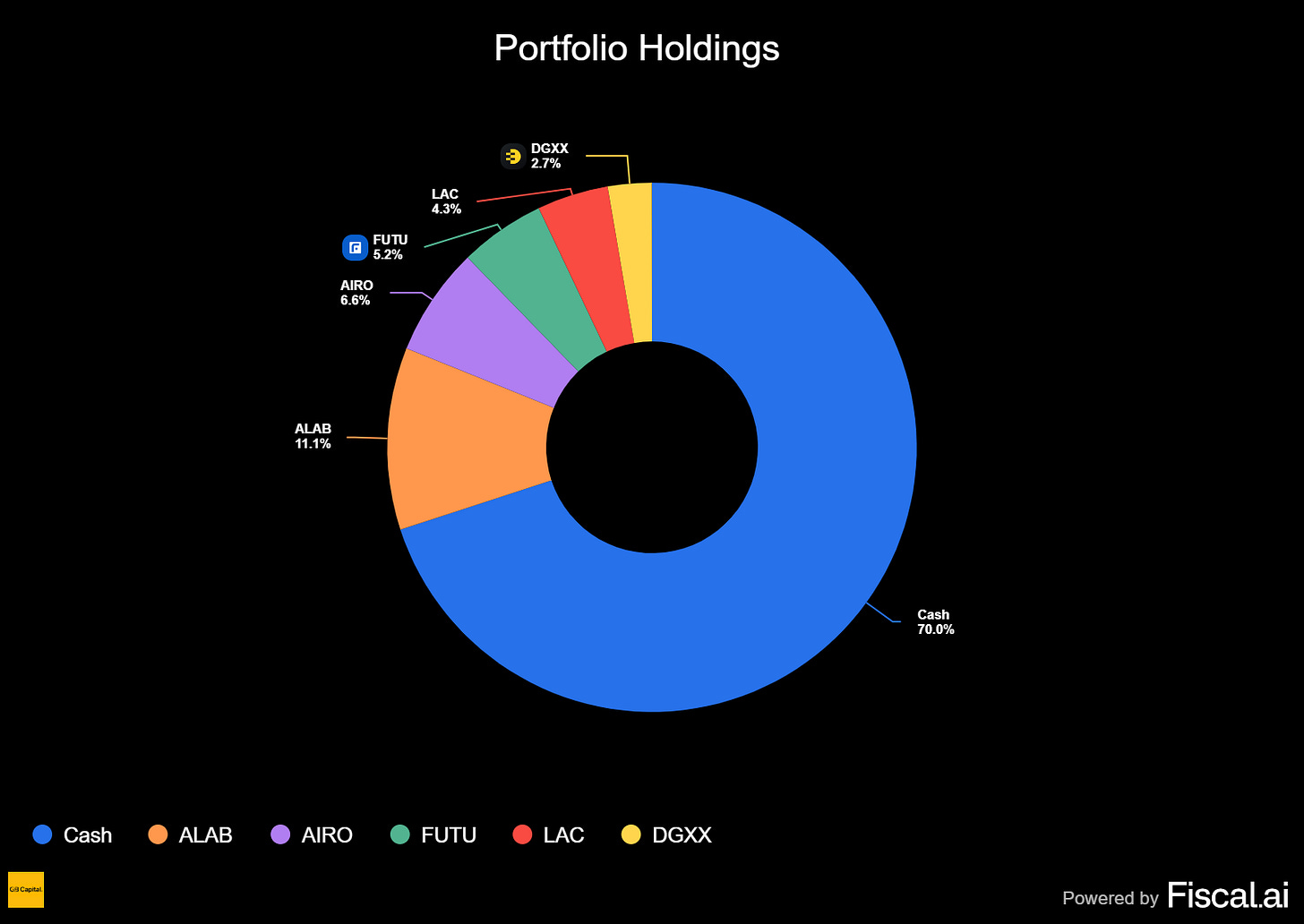

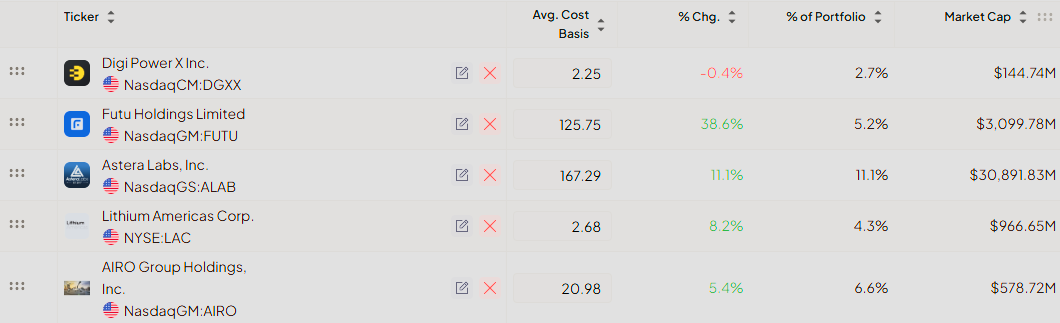

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Fiscal.ai data. Explore now →

T2118

The market remains selective and choppy, with indexes pulling back slightly, demanding a continued disciplined and highly selective approach. While the environment is challenging, we are observing some underlying shifts that could present new opportunities.

A key internal indicator, the T2118, has shown a modest improvement, rising to 28.05 from last week's 22.05. While this is a step in the right direction, the value still suggests that broad market participation remains limited. This reinforces the need for caution, as a small number of stocks continue to have an outsized influence on the major indexes. On a positive note, the Volatility Index (VIX) remains a source of stability, holding steady near the 15.00 level, largely unchanged from last week. This suggests a lack of widespread panic, providing a stable base for our stock-picking approach.

Given this backdrop, we are seeing a rotation into beaten-down sectors like healthcare and homebuilders, which we view as a healthy sign for a potential continued uptrend. While we must remain prepared for a deeper pullback, for now, our strategy is to stay extremely selective.

The market's choppiness has impacted some of our recent positions. Unfortunately, we were stopped out of our position in SHOP on Friday. Furthermore, our position in DGXX is trading near our break-even stop, and we anticipate it may be stopped out on Monday.

For real-time updates on our positioning, trade ideas, and market commentary as conditions evolve, our chat remains the best resource for staying connected with our analysis and decision-making process.

T2108

The T2108 indicator is giving us a reading of 50.05, a marginal change from last week's 44.76. A positive development is that the indicator has climbed back over its 10-day moving average, moving into what can be considered a neutral zone. While this is an improvement, it doesn't yet signal a strong return of bullish conviction, confirming that the market's footing remains tentative.

The 4% Bull-Bear Indicator tells the story of a divided week. The bulls were in control during the first part of the week, but the second half was characterized by choppy action with a slight advantage for the bears. Ultimately, the week ended without a clear winner, highlighting a lack of a defined short-term trend and reinforcing the market's current indecisiveness.

The 25% Bull-Bear Indicator is holding almost flat, with no significant changes from the previous week. This lack of movement suggests the market is in a state of equilibrium, a standoff between bullish and bearish forces. While there's no sign of deterioration, the absence of upward momentum indicates that the bulls are struggling to press their advantage, keeping the market coiled for its next significant move.

Latest articles:

🌱 Support Our Work: Buy Us a Coffee or Shop Our Services! 🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

[☕ Buy Us a Coffee]

[🛒 Visit Our Shop]

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock's risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

MP: MP Materials Corp. ⚠️

What they do: A leading U.S.-based producer of rare-earth materials critical for the manufacturing of high-strength magnets used in electric vehicles, defense systems, and clean energy technologies.

Why watch? Following a significant rally of over 90% in the preceding month, the stock is undergoing a period of consolidation near the pivotal $77.00 level. This price point now acts as a critical line of resistance; a decisive breakout above it could initiate the next leg of its uptrend, with an initial price target of $100.00. From a technical standpoint, an additional week of consolidation below this resistance would allow for moving averages to catch up, potentially creating a more optimal, lower-risk entry point.

GLW: Corning Inc. 🛡️

What they do: A multinational technology company specializing in advanced glass, ceramics, and related materials for industrial and scientific applications, including consumer electronics and fiber optics.

Why watch? The stock's constructive price action is underpinned by a strong second-quarter earnings performance and an optimistic business outlook for the remainder of the year. Management highlighted continued momentum from its Springboard platform and strong customer adoption of new Gen AI and U.S.-made solar products. Technically, the stock has spent the last two weeks consolidating in a tight $1.00 range above its 10-day EMA, accompanied by a notable decrease in trading volume. A volume-supported move above $66.00 would confirm a range expansion and signal a potential continuation of the uptrend.

BULL: Webull Corporation⚠️

What they do: A global financial services company providing a popular commission-free trading platform for stocks, options, and cryptocurrencies aimed at retail investors.

Why watch? The stock is currently forming a large "saucer with handle" base, a bullish continuation pattern that is well-defined on both the daily and weekly charts. The key pivot level to monitor is the $16.00 resistance. With all key moving averages now trending upwards and providing a floor of support above the $15.00 level, the current structure presents a favorable risk/reward scenario for a potential breakout.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment, delivering institutional-grade research.