🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 37: ⚡️ Market Resilience: Why Investors Aren’t Panicking (Yet)

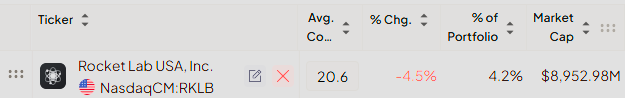

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Finchat's data. Explore now →

T2118

This week, the T2118 market breadth indicator closed at 26.00, offering a fascinating glimpse into the market's underlying dynamics. Unlike the previous week’s lackluster performance, ongoing tariff tensions with China and a 34% likelihood of no US-China trade deal being reached before June (Polymarket), this week’s data reveals a more encouraging picture, with the T2118 showing signs of resilience even as major market indexes pulled back.

What makes this week particularly noteworthy is the crossover of the T2118 indicator with its 10-day exponential moving average (10 EMA), coupled with a rising value. This technical development is a strong signal that something constructive may be brewing beneath the surface. While the broader indexes have struggled to maintain momentum, the T2118’s upward movement suggests that certain segments of the market, most notably small-cap companies, are quietly showing strength.

Adding to the cautiously optimistic tone is the movement in the VIX volatility index, which has finally dipped below 30.00. While still elevated, this decline in volatility is a welcome development for investors. A further drop in the VIX next week could provide the stability needed for the market to regain its footing.

T2108

This week, the T2108 market breadth indicator climbed to 18.41, offering a clearer picture of the market’s underlying dynamics. Much like the T2118, the T2108 is signaling resilience, providing additional confirmation of the thesis that the market may be setting up for a potential leg up. Despite last week’s slightly bearish tone and ongoing choppiness, the rising T2108 suggests that the market is stabilizing and could be preparing for a more constructive phase.

The 4% Bull-Bear Indicator delivered mixed signals this week, perfectly encapsulating the choppiness observed in the broader market. This lack of a clear directional bias underscores the importance of remaining cautious and flexible in the current environment.

The 25% Bull-Bear Indicator continues to show that bears remain in control, as has been the case for several weeks. However, there are signs that their momentum is waning, with a slight decrease in value this week.

Seize the Easter Opportunity before it's too late!

With only a handful of seats left from our original 20 for the annual plan, this is your chance to secure a spot, The price will not change F-O-R-E-V-E-R

Latest articles:

🌱 Support Our Work: Buy Us a Coffee or Shop Our Services! 🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

[☕ Buy Us a Coffee]

[🛒 Visit Our Shop]

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock's risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

SPOT: Spotify Technology 📊

What they do: Streaming audio platform

Why watch? 🎵 The stock is near the $579 key level, a resistance that has held since the end of March. SPOT must clear that level with volume before approaching the first target at $620.00. All moving averages (10, 20, and 50 EMA) are stacked, supporting the stock, but volume has been low. Watch for a breakout with strong volume for confirmation.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

CELH: Celsius Holdings Inc 📊

What they do: Functional energy drinks and beverages

Why watch? 🥤 CELH is currently between $36 and $38, supported by the 10 EMA. The stock shows good relative strength versus sector peers and the index, but volume is lower than normal. A move over $38.00 could trigger a new leg up.

PLTR: Palantir Technologies Inc. ⚠️

What they do: Data analytics and AI solutions.

Why watch? 🤖 One of the market's strongest performers, PLTR remains largely unaffected by tariff concerns. The stock is currently resting on stacked support from the 10, 20, and 50 EMAs. While additional consolidation would be ideal, this is a name you'll want to catch before it makes its next move.

MSTR: MicroStrategy Inc ⚠️

What they do: Business intelligence and Bitcoin holdings

Why watch? ₿ MSTR has a similar setup to SPOT but with more relative strength. The $320 level is a key resistance that must be broken with volume to start a new move higher. Always check Bitcoin for additional conviction on an entry.

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment, delivering institutional-grade research.

Every week, we showcase one complete premium analysis at no cost, letting you experience firsthand the depth and quality that sets Elite research apart.

PAGS: Pagseguro Digital Ltd 📊

What they do: Brazilian fintech offering comprehensive banking services

Why watch? 🏦 PAGS has evolved from a payment processor into a full-service digital bank offering current accounts, CDs, lending products, and card services for both B2B and B2C customers. Backed by Brazil's leading media conglomerate, Grupo UOL/Folha, the company benefits from strong institutional support and market recognition.

The investment thesis centers on geographic diversification away from US markets, with Brazil potentially benefiting from changing global trade dynamics. Despite proposed US tariffs, economists suggest Brazil's economy may prove relatively advantageous in this environment, with markets reacting positively to these developments.

Technically, the stock has been under heavy accumulation since early 2025, with $8.50 representing a crucial technical level on both daily and weekly charts.