🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 61

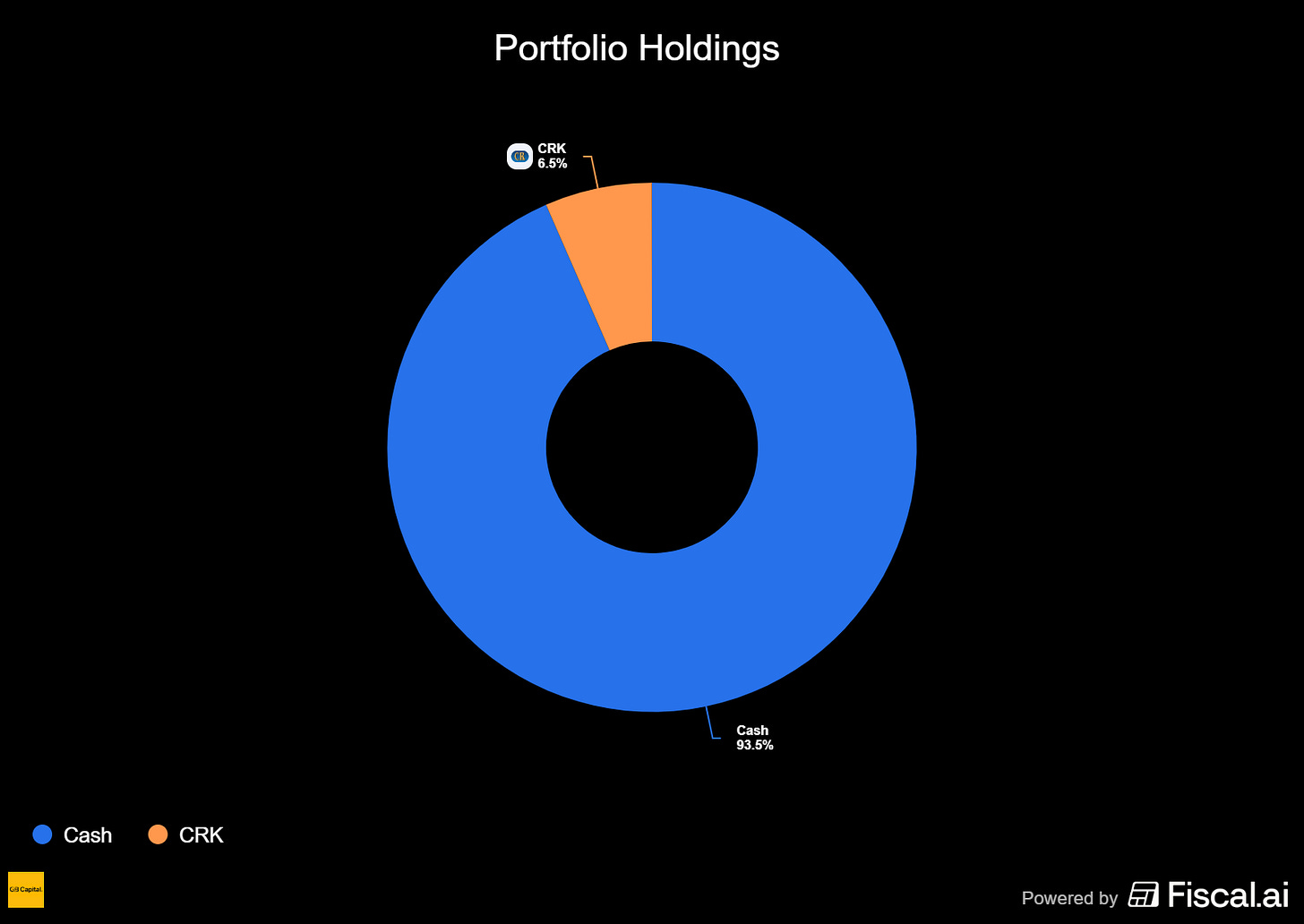

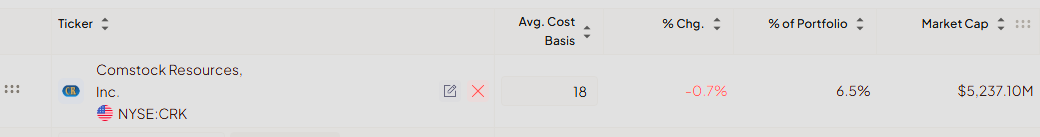

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Fiscal.ai data. Explore now →

Cash, Whiplash, and the Long Week Ahead

This week was pure, uncut frustration. Two weeks out from one of the nastiest bearish candles we’ve seen in a while, we did the sensible thing—protected the stack, went full cash, congratulated ourselves for slipping out at the right moment.

And the market, amused, reminded us to know our place. Back to highs. We’re flat. Village idiots with helmets on.

Add another bruise: low‑risk setups are scarce. Volatility’s been feral, too jumpy to let those neat little compression patterns form, the ones we need to take shots with a straight face. We scraped together a watchlist, sure, but most of what’s interesting is also too hot for our style. The tape is a good bar in a bad neighborhood.

Next week is loaded, the kind of calendar that stiffens the air:

US–China deal reaction (weekend chatter says “positive”)

FOMC rate decision

Mega‑tech earnings parade: META, MSFT, GOOGL, AMZN, AAPL

Any one of those can shove the market’s center of gravity. All of them together can rearrange furniture.

Our plan is gloriously boring: make background where we can; if the market wants to grind higher into year‑end, we’ll do nothing heroic: just follow the flow, whichever direction it actually runs. No prophecy, just posture.

Trades? Not many, and that’s the point.

The notable attempt was a long in Banco Macro S.A. (BMA). We took it; the breakout failed; we killed it the same day. Did it actually tag our pre‑set stop? Of course not. Where is it now? About 12% above our entry. Great idea, solid setup, ugly execution. Put it on the wall under Lessons I Apparently Need Twice.

The other trade—our lone hold, despite almost being tossed the day we opened it—is Comstock Resources (CRK). Oil and gas has been shouldering through; pull up BOIL or UNG and you’ll see the mood we were chasing. If you’ve got a take, drop it in the comments or chat. We can argue like adults.

This has probably been one of our hardest months. That’s not tragedy, it’s a page in the logbook. The road is long. The market isn’t paying our style right now.

It will again.

Patience isn’t romantic, but it compounds. Earnings season is hitting its stride; at least a couple of names will blindside Wall Street—in a good way. That’s where we’ll focus our attention and our bullets.

We’ll be in chat with live feedback for subscribers, as always. Until then: keep your capital clean, your calendar circled, and your ego on a leash.

The next week doesn’t care how frustrated we are. It cares whether we can wait.

🌱 Support Our Work: Buy Us a Coffee🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

Latest articles:

There are two questions every elite trader answers daily.

“Where is the money flowing?” and “How can I best capture it?”

To definitively answer the “Where,” gain an immediate edge with the unparalleled situational awareness of the TC2000 Market Monitor & Sector Table.

To master the “How,” empower your trading with the speed, organization, and precision of our TC2000 Custom Platform and Scans.

We use this system every single day, and it works.

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock’s risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

META: Meta Platforms Inc 🛡️

What they do: A global technology conglomerate operating social media, advertising, and artificial intelligence platforms.

Why watch? With earnings due next week, caution is warranted. However, the stock has successfully reclaimed its prior downtrend and is now trading above key moving averages. Ideally, a few more days of consolidation would build a stronger base for the next advance. The critical level to monitor is $740.00, as a decisive break could signal the start of a new uptrend.

AMAT: Applied Materials Inc 🛡️

What they do: A leading supplier of equipment, services, and software for the manufacture of semiconductor chips.

Why watch? The stock has exhibited significant volatility recently, making it a challenging trade despite its strength. As a key player in the semiconductor space—one of the market’s leading sectors—the bull trend appears poised to continue. The company’s significant China concentration presents a double-edged sword; it is a primary candidate to gain higher on any positive developments in U.S.-China relations. After a torrid 50%+ advance in just over a month, the stock is now consolidating as the 10- and 20-day EMAs catch up. Further consolidation would be constructive, with $230.00 being the key pivot level to watch.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment, delivering institutional-grade research.