🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 38: 🪙 Bitcoin Booms, Gold Slips: Allocating Alternatives in Your Portfolio

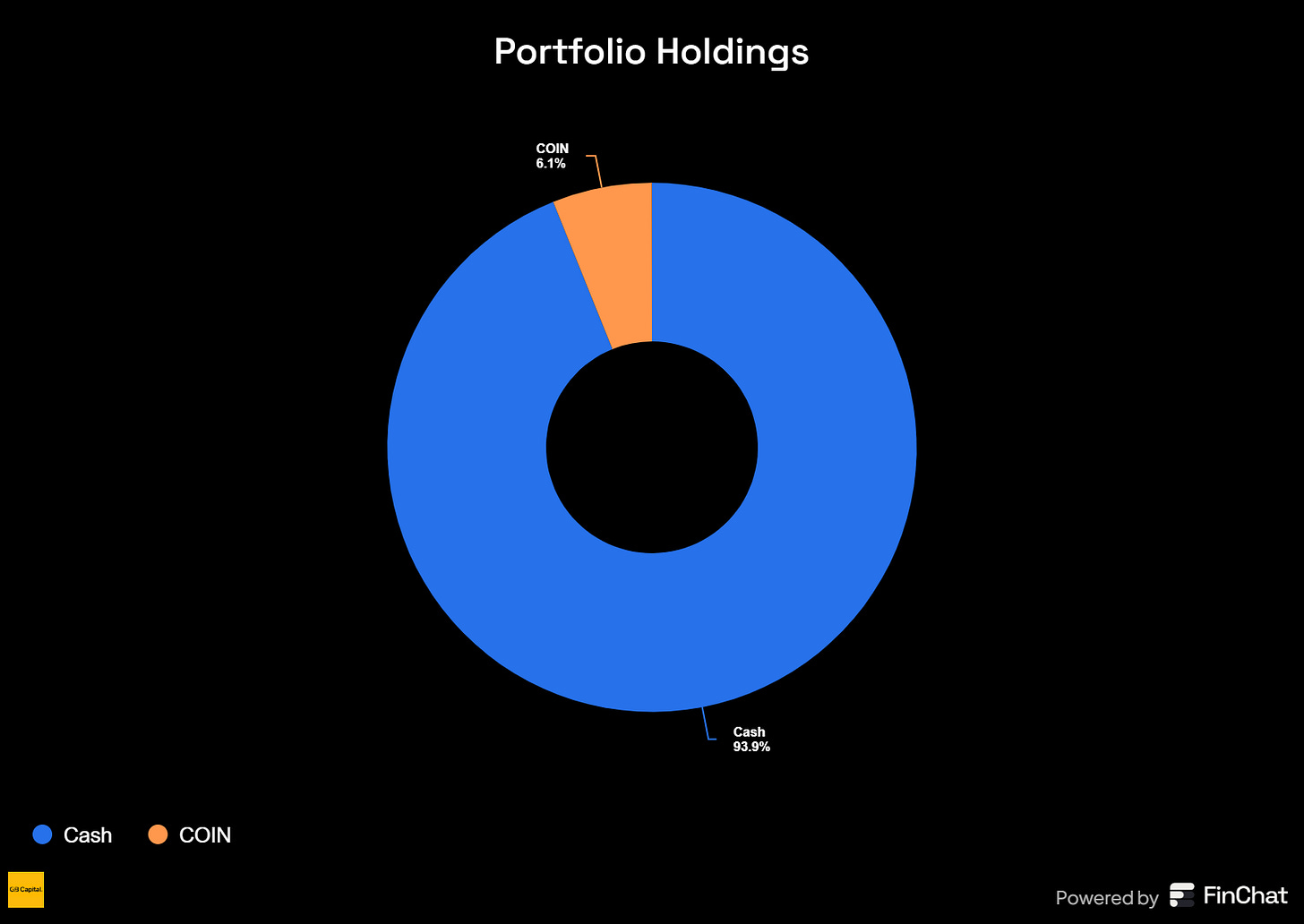

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Finchat's data. Explore now →

T2118

This week, the T2118 market breadth indicator closed at 57.06, a medium level that reflects a balanced market environment, not too high, not too low. Last week’s analysis proved to be spot on, as the market gained positive momentum, validating the power of these indicators in understanding market dynamics. The current level of T2118 suggests a healthy equilibrium, providing a constructive backdrop for the market.

Looking ahead to next week, a pullback on low volume would be an ideal scenario, as it could help create a low-risk environment for investors and set the stage for sustainable growth.

The VIX volatility index, meanwhile, closed at 24.84 this week. While still elevated, it is moving in the right direction. A further decline below the 20.00 level next week would be a significant step toward creating a more favorable environment for the stock market in general. Lower volatility would provide the stability needed for the market to build on its recent momentum.

T2108

This week, the T2108 market breadth indicator climbed to 31.20, crossing the critical 30.00 level and offering a more optimistic outlook for the market’s underlying dynamics. Historically, in a bull market, buying stocks when this indicator is near the 30.00 level has often been a good spot for a bounce. Now that we’ve crossed this threshold, it’s crucial to maintain this level in the coming weeks. While a retest of the 30.00 level is possible, holding above it will be key to sustaining the current momentum.

The 4% Bull-Bear Indicator delivered a clear and encouraging signal this week, with bulls firmly in control for almost the entire week. This marks the first time in months that we’ve seen such strong bullish power, a development that is certainly worth noting. It suggests that the market may be transitioning into a more favorable phase for buyers.

The 25% Bull-Bear Indicator continues to show that bears are losing steam week by week. While bears are still technically in the lead, the underlying dynamics suggest that their dominance is waning. Bulls are slowly but steadily taking control, and it seems increasingly likely that the bears’ leadership could come to an end soon.

Latest articles:

🌱 Support Our Work: Buy Us a Coffee or Shop Our Services! 🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

[☕ Buy Us a Coffee]

[🛒 Visit Our Shop]

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock's risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

EA: Electronic Arts Inc 📊

What they do: Video game development and publishing.

Why watch? 🎮 EA is coiling just below the critical $147 level, which stands out as a major resistance on both daily and weekly charts. The stock is currently supported by all major moving averages, but volume remains subdued—suggesting a breakout could be powerful if accompanied by a surge in trading activity. A decisive move above $147 could ignite a significant leg higher, making this a key level for momentum traders to monitor.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

VITL: Vital Farms Inc 📊

What they do: Ethical food company specializing in pasture-raised eggs and butter.

Why watch? 🥚 Buyers stepped in last week at the $29.00 support level, a key area on the weekly chart. The stock has formed a rounded bottom and is now showing a cup-and-handle pattern on the daily chart. A breakout above $34.00 could trigger a new uptrend.

SUPV: Grupo Supervielle SA 📊

What they do: Argentine financial services company.

Why watch? 💰 After losing half its value earlier this year, SUPV has found support at the $15.00 level and is consolidating. A few more days of consolidation could set the stage for a new leg higher.

PNBK: Patriot Bank NA ⚠️

What they do: Regional bank with a focus on community banking.

Why watch? 🏦 PNBK is consolidating just below the $4.00 key level, with volume steadily declining—a classic setup for a potential volatility expansion. The stock is showing relative strength versus the indexes, and a breakout above $3.80–$4.00 could spark a sharp move higher. This is a speculative play, best suited for nimble traders who can manage risk tightly.

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment, delivering institutional-grade research.

Every week, we showcase one complete premium analysis at no cost, letting you experience firsthand the depth and quality that sets Elite research apart.

PGNY: Progyny Inc 📊

What they do: Fertility benefits management.

Why watch? 🍼 Progyny addresses a critical gap in medical insurance by offering fertility benefits, including IVF, surrogacy, and adoption support. Despite a volatile 2024, the company boasts a pristine balance sheet with $230M in cash and no debt. Insiders are buying, and 25% of its market cap is in net cash. The stock is forming a VCP (volatility contraction pattern), and a breakout could occur after a few more low-volume days. Earnings are in two weeks, so plan accordingly.