🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 28: 📰 Tariff Delay Hopes Fuel Market Optimism 🔥

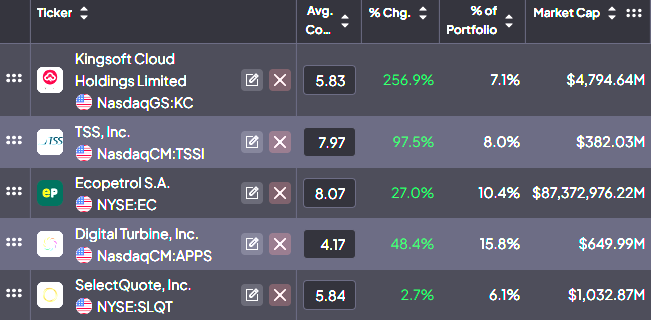

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Finchat's data. Explore now →

T2118

The T2118 market breadth indicator is showing signs of cooling off after a volatile week, but its value remains elevated, making it challenging to add additional risk to portfolios confidently. This persistent strength reflects the market's remarkable resilience, even in the face of less-than-stellar CPI and PPI data. Despite these headwinds, the market has chosen to move upward rather than decline, defying expectations. The coming week will be crucial in determining whether this upward momentum can be sustained or if a period of consolidation is on the horizon.

Meanwhile, the CBOE Volatility Index (VIX) is also retreating, a potentially positive signal for market stability. After a period of heightened volatility, the cooling VIX suggests the possibility of a consolidation phase, which could provide a much-needed breather for equity markets.

T2108

The T2108 market breadth indicator continues to navigate a consolidation phase, with price action compressing along the 10-day exponential moving average. Currently sitting at 48.88, the indicator maintains a moderate reading that suggests stable market breadth conditions without raising immediate concerns. This consolidation pattern, rather than showing signs of deterioration, appears to be building potential energy for a possible upward resolution alongside the major indexes.

Market internals reveal a split personality:

The 4% Bull-Bear Indicator remains caught in choppy trading conditions, offering little directional guidance as it oscillates without clear conviction

The 25% Bull-Bear Indicator is showing early signs of a bullish crossover, providing technical evidence that could support an upward resolution of the current consolidation pattern.

🌱 Help us help you: Coffee or Shop finds fund our progress and your gains! 🌱

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock's risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

LEU: Centrus Energy Corp ⚠️

What they do: Nuclear fuel and services provider

Why watch? ⚛️ The company has demonstrated exceptional growth, with a 40% year-over-year revenue surge, reaching $442 million in 2024. Three major Department of Energy (DOE) contract awards focused on advancing American production of LEU and HALEU further strengthened its strategic positioning. Technically, the stock shows promising consolidation below the critical $118.00 resistance level on decreasing volume, suggesting potential for a significant breakout move.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

AXSM: Axsome Therapeutics 📊

What they do: CNS-focused biopharmaceutical company

Why watch? 🧬 Recent FDA approval coupled with favorable patent litigation resolution has catalyzed substantial upward momentum. Current technical analysis reveals healthy low-volume consolidation, with the 10-day EMA approaching as potential support. Additional consolidation may provide optimal entry conditions as moving averages align for potential continuation.

AVGO: Broadcom Inc 📊

What they do: Semiconductor and infrastructure software solutions

Why watch? 💻 Following stellar December earnings, the stock has demonstrated remarkable stability within a $30 range. Technical analysis reveals an emerging bullish pattern with higher lows approaching the crucial $240.00 resistance level. The developing triangle formation presents an attractive early entry opportunity slightly below the breakout level.

KLC: KinderCare Learning Companies Inc 📊

What they do: Early childhood education services

Why watch? 📚 This recent IPO demonstrates compelling technical formation with a classic cup-and-handle pattern on the daily timeframe. Fundamental support comes from robust secular demand in the early childhood education sector, where KLC maintains market leadership. The $21.00 level represents the key breakout threshold for potential upside momentum.

RKLB: Rocket Lab USA Inc ⚠️

What they do: Space systems and launch services

Why watch? 🚀 Currently trading within a defined downward channel since late January, the stock shows consolidation patterns suggesting potential reversal. The critical $30.00 level represents both psychological and technical resistance, with breakthrough potential for significant upward movement.

PINS: Pinterest Inc 🛡️

What they do: Visual discovery platform

Why watch? 📱 Following an impressive 20% post-earnings surge, the stock demonstrates healthy consolidation near the earnings gap support level. Technical analysis suggests maintaining current support with $40.00 serving as the crucial breakout level for establishing a new uptrend phase.

SIG: Signet Jewelers Limited 📊

What they do: Specialty retail jeweler

Why watch? 💎 Despite a severe 25% decline following disappointing earnings, the stock shows resilience above the critical $51.00 monthly support level. Technical analysis reveals a developing falling wedge pattern, typically a bullish reversal formation, suggesting potential recovery as negative catalysts appear fully priced in.

💎📈 Watchlist Elite: Premium Market Movers