🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 33: 🛑 Pause Button: Markets Take a Breather as Headlines Quiet Down

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Finchat's data. Explore now →

T2118

The T2118 market breadth indicator has risen to 30.11, continuing its climb from the 15.00 level as anticipated. This upward movement is mirroring January's pattern when readings below 15.00 quickly reversed and surged above 70.00 in less than two trading weeks.

Adding to the positive outlook, the VIX volatility index has dropped below the key 20.00 level, reaching 19.28 for the first time in almost a month. This "fear gauge" decline suggests diminishing market anxiety and uncertainty.

The combination of rising T2118 and falling VIX provides encouraging evidence that the market bounce many investors have anticipated may finally materialize. However, for this recovery to gain momentum, the indexes must hold above last Friday's lows. Failure to maintain these support levels could transform the current pattern into a bear flag, potentially triggering another downward leg in the market.

T2108

The T2108 breadth metric currently stands at 24.06. Since midweek, a concerning trend has developed: as major indexes push upward, T2108 has paradoxically declined, establishing a divergence that questions the durability of the current upswing.

The Nasdaq-tracking QQQ has emerged as the clear frontrunner, while S&P 500 and Russell components struggle to keep pace. This imbalanced advancement raises questions about whether the current recovery has sufficient breadth across industries and equities, or if it's merely concentrated in select technology heavyweights.

The 4% Bull-Bear Indicator has displayed modest positive shifts since Wednesday, yet buyers haven't secured a definitive advantage in near-term trading patterns.

The 25% Bull-Bear Indicator continues indicating seller dominance in the extended outlook, confirming the primary signals highlighted in yesterday's comprehensive market assessment.

🌱 Support Our Work: Buy Us a Coffee or Shop Our Services! 🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

[☕ Buy Us a Coffee]

[🛒 Visit Our Shop]

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock's risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

OKTA: Okta Inc 📊

What they do: Identity and access management platform

Why watch? 🔐 The $115 level represents the final major resistance from 2024, with the potential for significant price advancement beyond this threshold. OKTA's Q4FY25 earnings exceeded expectations with 13% YoY sales growth, triggering a 20% stock price surge. Currently consolidating under the critical $115 level while forming higher lows along the 10EMA, the stock demonstrates exceptional relative strength compared to broader market indices.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

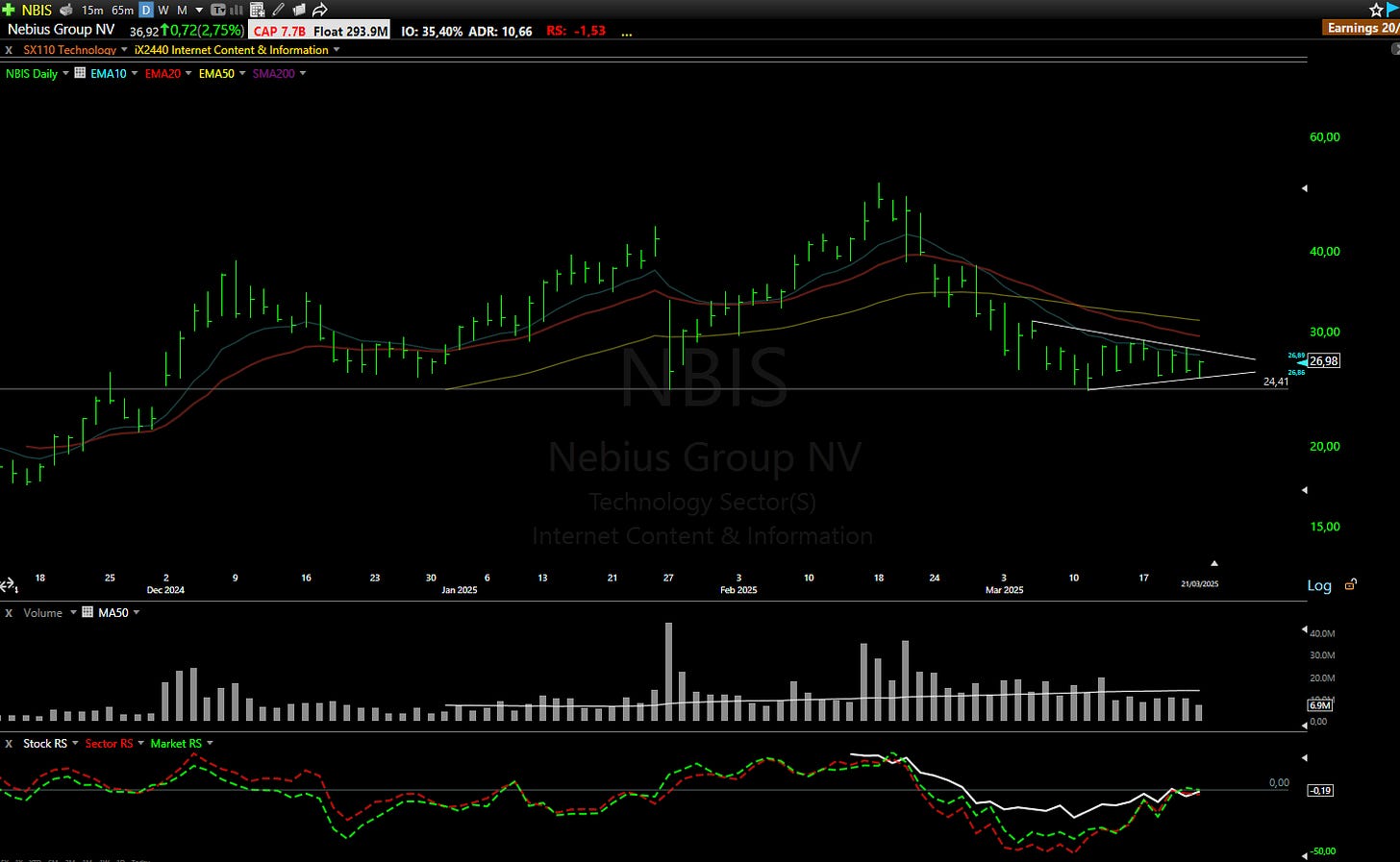

NBIS: Nebius Group NV ⚠️

What they do: Cloud computing and AI infrastructure provider

Why watch? ☁️ NBIS has established strong support at the key $24 weekly level for the third time, now consolidating below all major moving averages. A market bounce could catalyze a bullish flag breakout. The upcoming CoreWeave IPO later this month should provide additional momentum for NBIS given their shared sector focus and similar business models.

BZAI: Blaize Holdings Inc ⚠️

What they do: AI hardware and software solutions

Why watch? 🧠 This speculative recent IPO specializes in edge AI chips for industrial applications where traditional CPUs/GPUs are impractical due to cost, power consumption, or space constraints. The $3.00 level appears to be established as key support, offering an attractive risk-reward profile with a potential downside limited to $0.50 while targeting a $1.50-$2.00 upside. Could benefit from sector momentum following NBIS and the CoreWeave IPO.

ORGO: Organogenesis Holdings Inc ⚠️

What they do: Advanced wound care and surgical solutions

Why watch? 📈 Following a 100%+ surge after recent earnings, ORGO is now consolidating near the 10 and 20 EMAs while forming a bullish falling wedge pattern. A decisive break above $5.00 with increased volume could trigger a fresh upward leg in this momentum story.

WEN: The Wendy's Company 🛡️

What they do: Fast-food restaurant chain

Why watch? 🍔 Wendy's has strategically pivoted toward international expansion, targeting growth from 1,100 to 2,000 locations outside the US by 2028. The stock is trading at 2023 levels while consolidating near converging 10, 20, and 50 EMAs. A break above $15.50 would signal renewed upside momentum in this transformation story.

PTGX: Protagonist Therapeutics Inc ⚠️

What they do: Biopharmaceutical company developing peptide-based therapeutics

Why watch? 💊 PTGX surged over 45% after announcing successful Phase 2b ANTHEM-UC study results for icotrokinra, a first-in-class targeted oral peptide developed jointly with Johnson & Johnson. This breakthrough treatment for plaque psoriasis and ulcerative colitis represents a significant catalyst for long-term growth. Currently forming a falling wedge pattern with support from the rising 10 EMA, a break above $54.00 could fuel the next significant advance.

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment - delivering institutional-grade research.

Every week, we showcase one complete premium analysis at no cost - letting you experience firsthand the depth and quality that sets Elite research apart.

NAGE: Nagen Pharmaceuticals Inc ⚠️

What they do: Nutraceutical and pharmaceutical products focused on NAD+ precursors

Why watch? 🧪 Formerly known as Chromadex, NAGE has demonstrated impressive revenue growth and profitability driven by its NAD+ precursors and flagship product Niagen. Record-breaking financial performance includes a 35%+ revenue increase, $7+ million net income, and expanded gross margins, fueled by significant e-commerce momentum. This fundamental strength recently propelled the stock 60% higher. Currently consolidating in a tight Darvas box between $7.50 support and $8.00 resistance, a breakout could catalyze a retest of recent highs above $9.00.