🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 49: Fed Holds Firm, Five-Week Stock Rally Hits a Wall 🧱📉

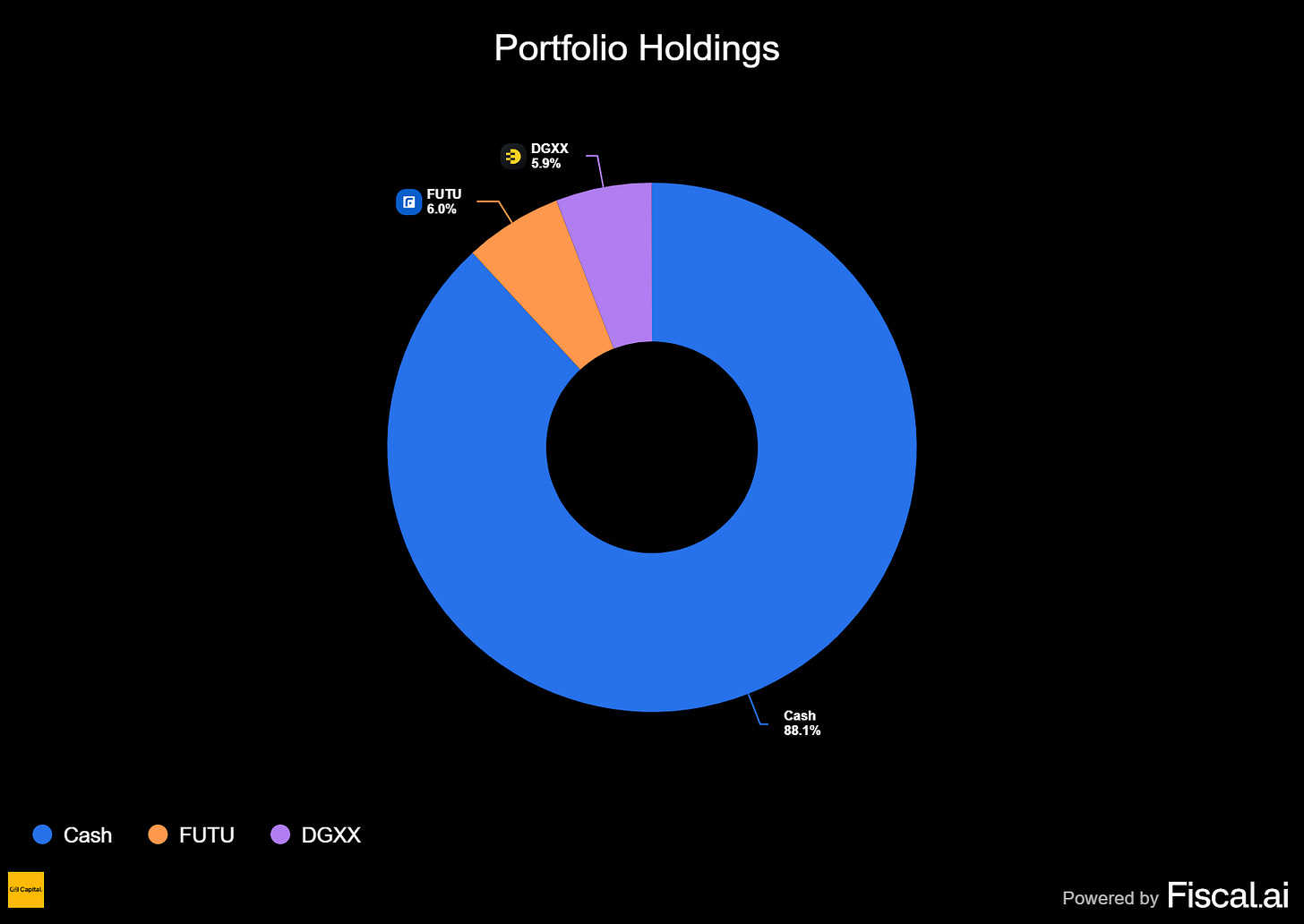

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Fiscal.ai data. Explore now →

T2118

After a refreshing two-week break, we have returned to a market that has undergone the significant reset we anticipated. The overextended conditions we noted previously have given way to a pullback, shifting the landscape and reinforcing the need for a disciplined and cautious strategy moving forward.

The change is most evident in our key indicators. The T2118, which measures the percentage of stocks above their 40-day moving average, has fallen sharply from 84.14 to 32.96. This substantial drop confirms the market is cooling off and undergoing an important reset. In tandem, the Volatility Index (VIX) has moved back over the 20.00 level, signaling that market anxiety has increased. Further confirming this cautious outlook, our proprietary trend indicator is now flashing red for the IWM and yellow for both the SPY and QQQ. Until the market tells us otherwise, caution is the name of the game.

Our defensive posture heading into the holiday period has played out as designed. Most of our portfolio positions were closed out by the stop-losses we had in place, protecting our capital from the recent downturn. Two positions, DGXX and FUTU, remain active. We will be monitoring them closely to see if they will be stopped out in the coming week or if they can withstand the current market pressure.

Our focus for the week ahead will be to thoroughly analyze the new market conditions. We will take the time to get back in sync with current trends and rhythms, providing the best possible guidance and identifying new opportunities as they arise.

For real-time updates on our positioning, trade ideas, and market commentary as conditions evolve, our chat remains the best resource for staying connected with our analysis and decision-making process.

T2108

This week, the market internals deteriorated significantly, confirming that the recent pullback is both real and powerful. The sharp decline in key breadth indicators, moving in tandem, paints a clear picture of weakening market health and underscores the need for a defensive posture. The price action itself was telling, with the last two days of the week wiping out nearly two weeks of gains in the major indexes, a stark reminder of the current fragility.

The T2108 indicator was almost cut in half from its value two weeks ago. This dramatic drop provides strong confirmation of the ongoing pullback. Adding to this evidence, we saw junk stocks flying all over the place just before the decline, a classic sign that a market top, or at least a severe pullback like the one we are experiencing, is near.

The 4% Bull-Bear Indicator gave a clear and decisive signal this past week: the bears were in absolutely total control. There was not a single day when the bulls were able to mount any meaningful offense, illustrating the intense, short-term selling pressure that has gripped the market.

The 25% Bull-Bear Indicator still shows that bulls remain in overall control, but their lead is shrinking as the bears are rising. The critical question now is whether the bulls can hold their ground in the coming weeks, or if the bears will finally take the baton and assume broader control of the trend.

Latest articles:

🌱 Support Our Work: Buy Us a Coffee or Shop Our Services! 🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

[☕ Buy Us a Coffee]

[🛒 Visit Our Shop]

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock's risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

JOBY: Joby Aviation, Inc. ⚠️

What they do: A vertically integrated air taxi company

Why watch? ✈️ After a 100% run-up, JOBY is building its first major base and consolidating the move near its 10-day EMA. The stock showed significant Relative Strength against the broader market on Friday and is trading near all-time highs. A decisive push over the $18.00 level could signal the start of the next major leg higher.

MP: MP Materials Corp. ⚠️

What they do: The largest producer of rare earth materials in the Western Hemisphere

Why watch? 💎 Following game-changing news in early July, the stock is consolidating a 100% advance, demonstrating excellent Relative Strength in a critical sector. It is currently trading tightly within a Darvas box, with clear support at $59.00 and resistance at $65.00. A breakout above $65.00 could unleash a powerful new uptrend with an initial target of $100.00.

CELC: Celcuity Inc. ⚠️

What they do: A clinical-stage biotechnology company

Why watch? 🔬 The stock surged over 150% overnight after the company announced positive topline results for its Phase 3 study of gedatolisib in breast cancer patients. The drug combination demonstrated a 76% reduction in the risk of progression or death. While the stock is currently extended, it is consolidating on lower volume and showing strong Relative Strength. A break above $42.00 on increased volume could trigger another sharp advance, even if further consolidation near the rising 10-day EMA would be ideal.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment, delivering institutional-grade research.