🚀 Wall Street Radar: Stocks to Watch Next Week

💼 Volume 30: 🔥 Hot Sectors Cool Down: Temporary Timeout or Turning Point? ⏱️

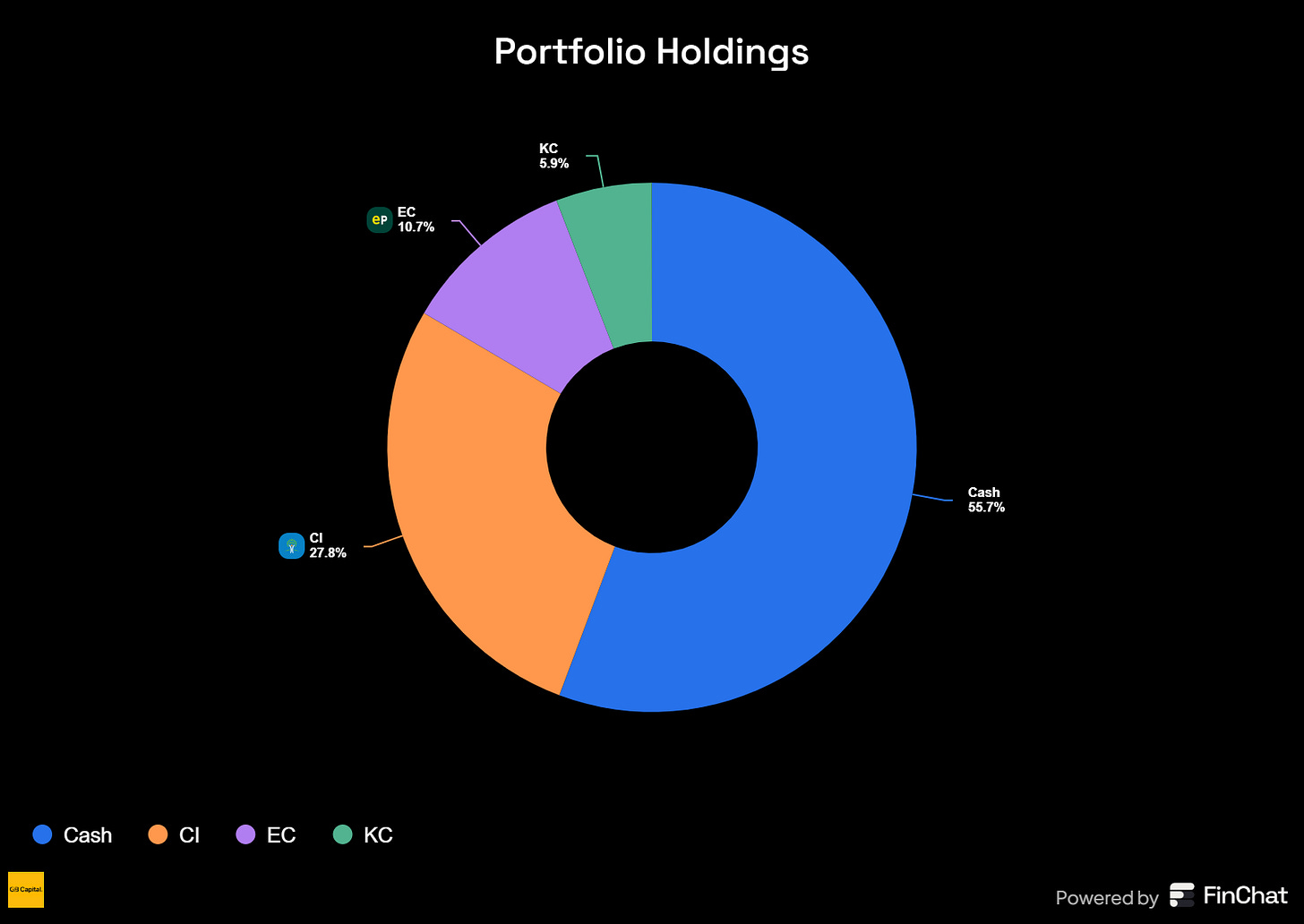

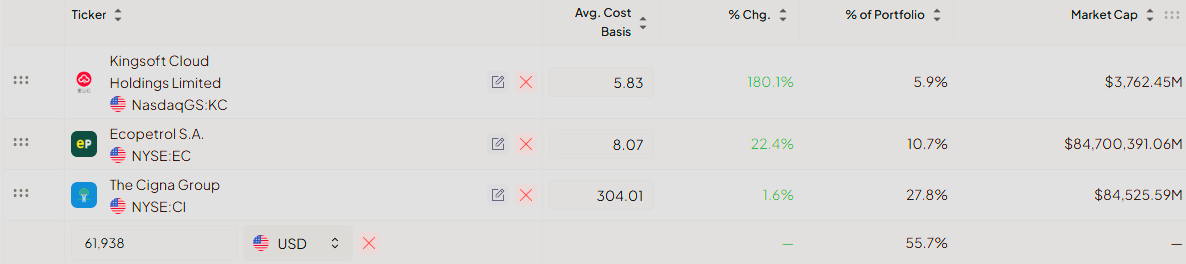

Portfolio updates and new positions:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Finchat's data. Explore now →

T2118

The T2118 market breadth indicator has experienced a significant decline, dropping to 35.51 from over 70.00 in recent weeks. This substantial pullback validates the cautious positioning many strategic investors have maintained during the market's extended bullish run.

With T2118 now at 35.51, we're approaching but not yet reaching oversold territory. Historically, the most reliable and sustainable market bounces occur when this indicator falls below 30, ideally reaching the 15.00-30.00 range. This suggests that while we may see a technical bounce next week, investors should remain vigilant. The. The current pullback may have more to run before establishing a solid foundation for the next meaningful advance.

The VIX volatility index hovering near the psychologically important 20.00 threshold further reinforces the need for continued caution. This elevation in the market's "fear gauge" typically signals increasing uncertainty among market participants and often precedes periods of heightened volatility.

T2108

The T2108 market breadth indicator is currently in a neutral zone, trading below its 10-day exponential moving average but not reaching extremes in either direction. This placement in the "middle of nowhere"—neither oversold nor overbought—provides limited additional directional guidance in the current market context.

The 4% Bull-Bear Indicator has established a decidedly negative bias throughout the past week, consistently registering bearish readings. However, Friday's session concluded with a notable surge in buying activity. This late-session strength introduces an element of uncertainty that requires careful monitoring. The opening sessions of the coming week will be crucial in determining whether Friday's buying represents a meaningful shift in sentiment or merely a temporary relief rally that fails to gain traction.

The 25% Bull-Bear Indicator signals that bears have seized control of market direction. This longer-term indicator's bearish transition signals a potentially important shift in market dynamics, suggesting that downside pressure may persist beyond short-term fluctuations. When a trend indicator of this significance turns negative, it often precedes extended periods of challenging market conditions.

🌱 Help us help you: Coffee or Shop finds fund our progress and your gains! 🌱

Each stock on the watchlist will now have a risk grade badge next to its name, reflecting our assessment based on factors such as volatility, share float, technicals, fundamentals, ADR, and more. This badge is designed to help readers gauge the stock's risk profile, providing valuable context for making informed decisions about approaching it.

High risk: ⚠️

Medium Risk: 📊

Low Risk: 🛡️

🆓✨ Watchlist Essentials: Top Free Picks

AGRO: Adecoagro S.A. 🛡️

What they do: Leading sustainable agricultural production company in South America

Why watch? 🌱 The stock is beautifully consolidating on low volume above the 10-EMA, demonstrating remarkable technical strength. A major catalyst has emerged with Tether Investments S.A. proposing to acquire outstanding Common Shares at $12.41 per share through a tender offer that would result in Tether holding 51% of the company. This significant development, combined with positive sector trends, suggests a new leg up could materialize very soon. The acquisition news represents a substantial premium to recent trading levels and indicates strong institutional interest in the company's long-term value proposition.

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

TMDX: TransMedics Group Inc 📊

What they do: Medical technology company focused on organ transplant solutions

Why watch? 🫀 Despite broader market weakness, the stock has demonstrated exceptional resilience following strong Q4 2024 results with total revenue of $121.6 million, representing approximately 50% growth year over year. US revenue grew 11% sequentially to $117 million, showcasing robust domestic performance. The technical setup appears remarkably similar to Cigna Group (CI), which we highlighted last week. Current price action suggests accumulation patterns with $80.00 identified as the next key resistance level. The combination of strong fundamentals and technical resilience positions TMDX for potential outperformance.

HLF: Herbalife Ltd 📊

What they do: Global nutrition and direct selling company

Why watch? 🥤 Wall Street responded positively to recent earnings despite declining sales, focusing instead on the company's robust transformative digital strategy to enhance distributor engagement and business operations. The successful repayment of $250 million in debt further strengthens the financial position. Technically, the stock is now consolidating above the 200-EMA, suggesting building momentum. Analysis indicates the stock likely needs a few additional days in sideways consolidation to establish a solid base before initiating a new upward leg. Current price action shows decreasing volume during consolidation, typically a precursor to directional movement.

DOCS: Doximity Inc 📊

What they do: Digital platform for medical professionals

Why watch? 👨⚕️ Following an impressive earnings report in early February, the stock experienced a controlled pullback and is now finding support at a critical technical level - the low of the gap-up earnings day. The formation of a hammer candlestick pattern with higher than average volume suggests strong buying interest at current levels. Technical analysis indicates bulls are actively defending this crucial support zone, with price action suggesting the stock appears primed for an upward bounce. The combination of strong fundamentals and favorable technical patterns provides a compelling watchlist opportunity.

AMTM: Amentum Holdings Inc 📊

What they do: Defense and engineering services provider

Why watch? 🛡️ For watchlist followers check last two weeks analysis, AMTM approaches its fourth test of critical $19.50 support. Technical analysis suggests strong accumulation patterns, with $21.00 representing the key breakout threshold required for potential acceleration. Current price action indicates institutional interest building at these levels.

DOMH: Dominari Holdings Inc ⚠️

What they do: Investment company with holdings in private technology companies

Why watch? 💼 The stock recently made an extraordinary move as investors recognized the company's valuable stakes in non-publicly traded companies including Anduril, Databricks, and SpaceX. Additional momentum came from investments by Trump's sons, creating supplementary market interest. The stock is consolidating between the 10 and 20 EMAs on decreasing volume, forming a bullish wedge pattern. Technical analysis suggests the stock is approaching a potential breakout point, with current price action indicating accumulation before the next potential upward movement. The unique exposure to high-growth private companies provides a differentiated investment thesis.

💎📈 Watchlist Elite: Premium Market Movers

Each selection undergoes rigorous financial analysis, technical evaluation, and strategic assessment - delivering institutional-grade research.

Every week, we showcase one complete premium analysis at no cost - letting you experience firsthand the depth and quality that sets Elite research apart.

SSSS: Suro Capital Corporation ⚠️

What they do: Publicly traded venture capital firm investing in late-stage private companies

Why watch? 🚀 Similar to DOMH, Suro Capital provides investors access to companies not available in public markets. A significant catalyst emerged with portfolio company Coreweave announcing plans to go public in 2025. Suro Capital's early investment in Coreweave at presumably favorable valuations positions them for substantial profit upon the IPO. This presents a unique opportunity for investors to gain pre-IPO exposure to Coreweave through SSSS shares, potentially benefiting from appreciation between now and the IPO launch. The company's portfolio approach provides diversification across multiple high-growth private companies, reducing single-company risk while maintaining upside potential.