💼 Inside the Portfolio: Updates from our Swing Trading Desk

24 Oct2024 - Insights, adjustments, and forecasts about our latest swing trades 💹

In the wake of impressive earnings from TSLA (Tesla Inc), the stock market experienced a significant upward gap, a stark contrast to the previous day's downturn. This kind of market volatility and uncertainty presents a challenging environment for traders. As financial analysts, we prioritize stability and strategic decision-making, which is why we opted to close most of our positions to safeguard profits and reassess market direction.

Position Updates:

ASTS (AST SpaceMobile Inc): We decided to close our position entirely today. A substantial seller near the $28 level indicates resistance, and today's false breakout reinforces our decision to exit.

SYM (Symbotic Inc): Our position was stopped out in profit yesterday. This strategic exit allowed us to secure gains amidst market fluctuations.

WULF (TeraWulf Inc): We closed out our entire position today. The recent offering is a concerning signal, prompting us to lock in a 25% gain over a few days—a substantial return in a volatile market.

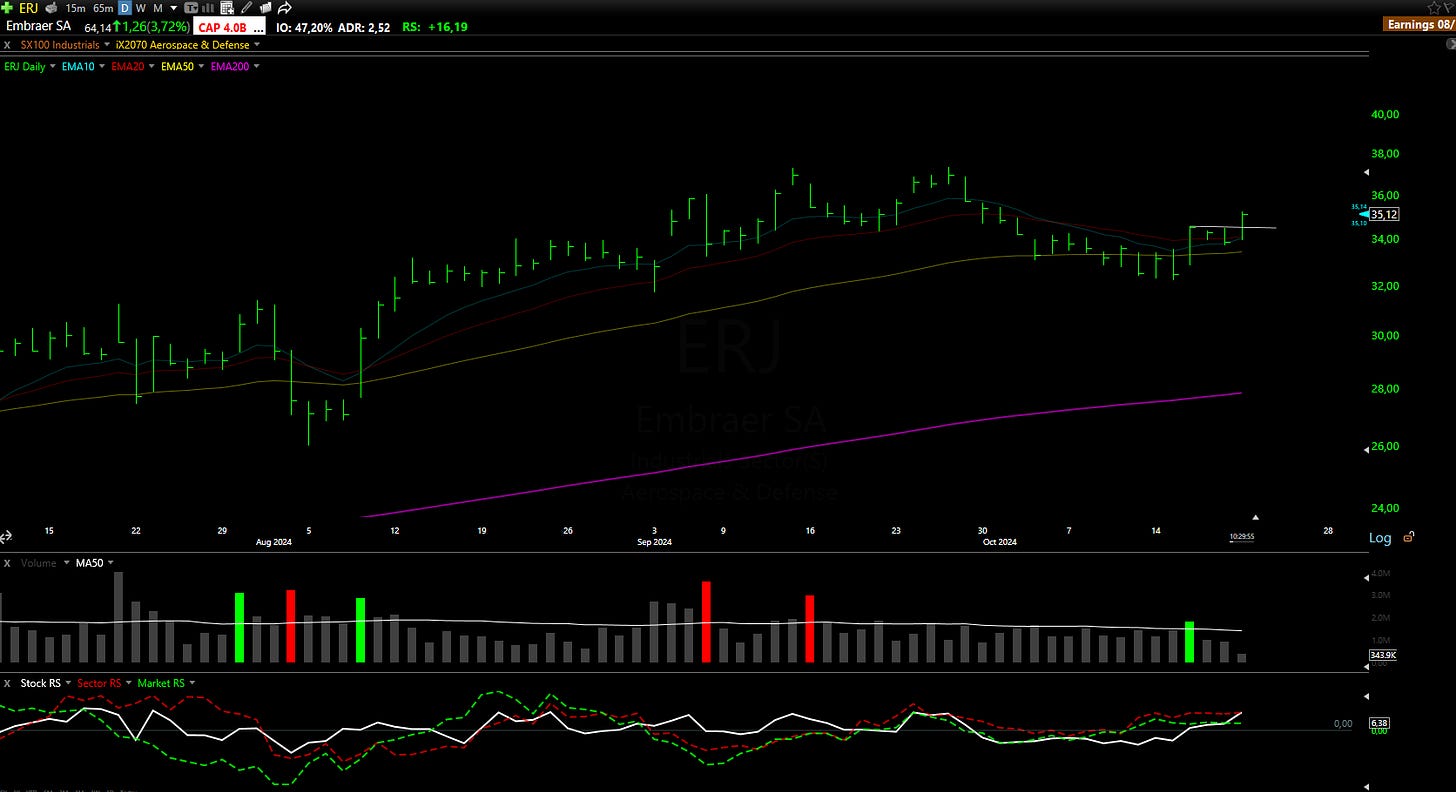

ERJ (Embraer S.A.): This stock is finally gaining traction after hovering near our stop for three days. We are closely monitoring its progress as it shows potential for upward movement.

New Positions and Subscriber Insights:

Today, we initiated one new position, more a medium/long term hold. Our paid subscribers received detailed information on this through our new chat service on the Substack platform. This exclusive insight is part of our commitment to providing timely and actionable information to our valued subscribers.

1. Embraer S.A. ADR (ERJ)

Embraer S.A. (Ticker: ERJ) is a leading aerospace and defense company based in São Paulo, Brazil. Founded in 1969, Embraer designs develops, manufactures, and sells aircraft and systems globally. The company operates through several segments: Commercial Aviation, Defense and Security, Executive Jets, Service & Support, and Other segments. Embraer is known for its innovative aircraft solutions and has a strong presence in both commercial and defense aviation markets.

Technical Analysis and Investment Rationale

Financial Performance:

Embraer has shown significant growth and resilience in recent quarters. Key highlights from the latest earnings call include:

Revenue Growth: Revenues in Q2 2024 increased by over 15% year-over-year, driven by strong performance in Defense & Security, Commercial Aviation, and Services & Support.

Operating Margin Improvement: The operating margin improved by 1.6% to 9.3% in Q2 2024.

Backlog: The company's backlog reached a 7-year high of $21.1 billion, supported by a strong book-to-bill ratio of over 2.2

New Orders: New orders from Mexicana de Aviación for E2 jets and contracts for C-390 and Super Tucano aircraft.

Analyst Estimates

Revenue Estimates:

2024: R$35.55B

2025: R$41.26B

2026: R$45.1B

EPS Estimates:

2024: R$2.95

2025: R$2.82

2026: R$3.41

The last news was excellent, Embraer recorded a 33% year-on-year increase in deliveries and reached a new US$ 22.7 billion backlog record, here are additional details.

Technical Analysis:

After a brief two-day pullback on low volume, ERJ has resumed its upward trajectory, supported by key technical indicators. The stock's price action is finding strong support at both the 10-day and 20-day exponential moving averages (EMAs), a bullish signal that often precedes continued upward movement.

Entry Day: 21 October

Price: $34.62