💼 Inside the Portfolio: Updates from our Swing Trading Desk

18 Dec 2024 - Insights, adjustments, and forecasts about our latest swing trades 💹

Position Updates:

The market is currently experiencing significant deterioration in the indices, making it increasingly challenging to identify new opportunities that are not overextended or overly risky. Recent attempts have struggled to gain traction, prompting us to take profits more quickly than usual.

Eli Lilly and Co. (LLY): We successfully closed the last batch of stock for a profit. Unfortunately, our stop-profit order was triggered this morning, and, as is often the case, the stock resumed its upward movement shortly after.

Celsius Holdings, Inc. (CELH): This position was closed at break-even. In this case, the stock continued to decline, so we are comfortable with the decision. However, we believe CELH is undervalued below $30.00 and may revisit this opportunity in the future.

uniQure N.V (QURE): also in this case B/E trade.

New Positions and Subscriber Insights:

Today, we initiated a new position with a very small size and a tight stop-loss. This cautious approach reflects the current market conditions and our commitment to managing risk effectively.

As always, entry points and specific details for this new position were communicated in real time to our paid subscribers through our premium alert system via chat, ensuring they had the opportunity to execute trades promptly.

1. KULR Technology Group Inc. (KULR)

KULR Technology Group, Inc. engages in developing, manufacturing, and licensing next-generation carbon fiber thermal management technologies for batteries and electronic systems. Its products include cell check, safe case, thermal capacitor, fiber thermal interface, thermal runaway shield, internal short circuit, and cathode. The company was founded by Michael Mo and Timothy R. Knowles in December 2015 and is headquartered in San Diego, CA.

Fundamental Analysis

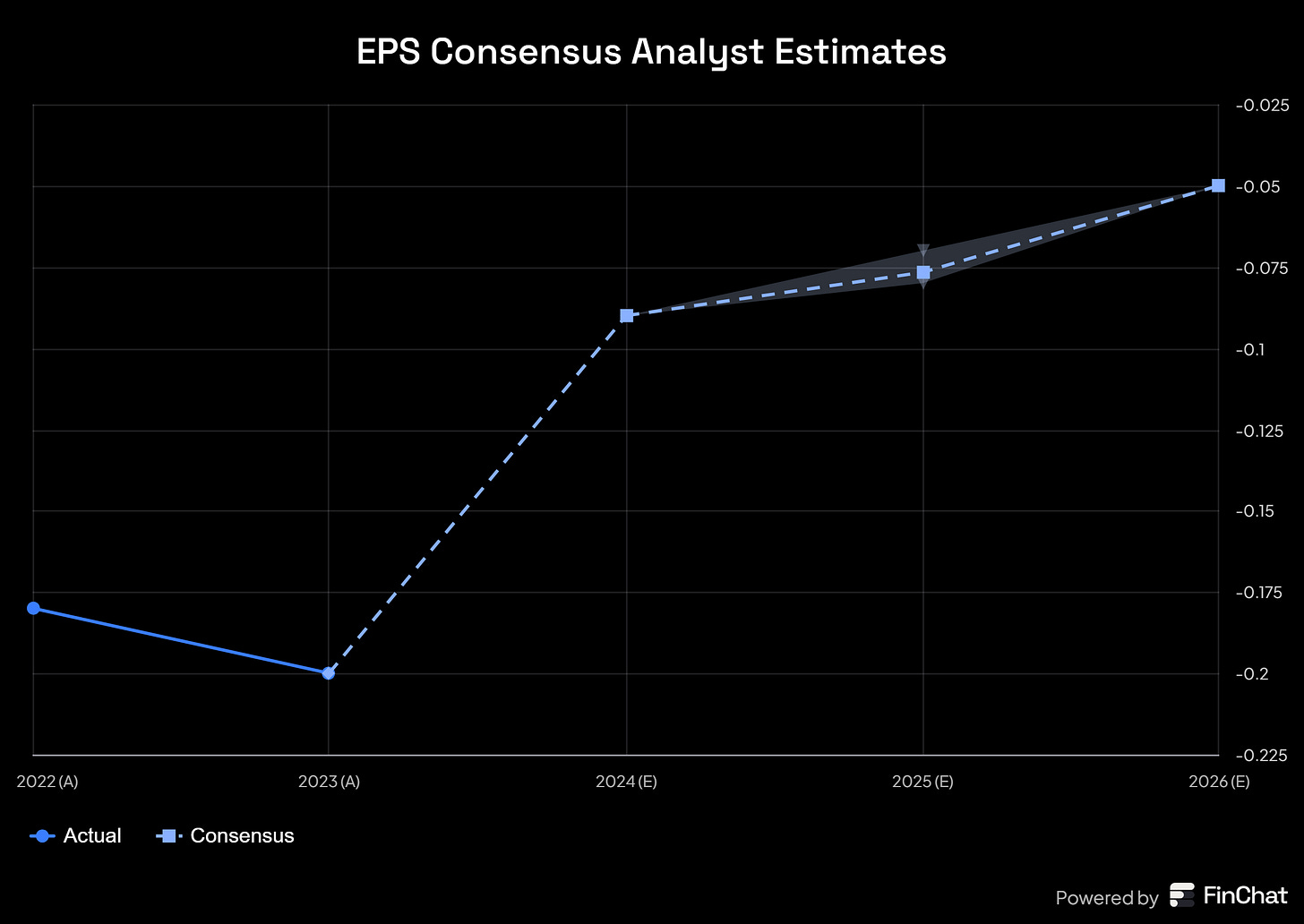

KULR Technology Group (KULR) demonstrates significant potential through its strategic positioning in multiple high-growth sectors, including eVTOL, data centers, small modular reactors (SMRs), and space battery technologies. While currently unprofitable, the company shows promising revenue growth trajectories coupled with decreasing operational expenses, indicating improving operational efficiency.

Key Catalysts:

Strategic partnerships with industry leaders (Amprius, H55, Molicel)

Recent U.S. Navy contract award for battery safety development

Exposure to multiple high-growth industrial sectors

Operational cost optimization initiatives

Growing market recognition reflected in recent price action

Market Dynamics: The company's diversified exposure across emerging technology sectors provides multiple growth vectors. The recent 400% share price appreciation indicates growing market interest, primarily from retail investors, suggesting potential for further institutional adoption. KULR's positioning in critical technology segments, particularly in battery safety and thermal management, aligns with major industry trends.

Challenges:

Limited cash reserves impacting operational flexibility

Potential near-term dilution risk from equity financing needs

Current unprofitability status

Heavy reliance on successful execution across multiple sectors

Need for continued partnership development to maintain momentum

The risk/reward profile presents an asymmetric opportunity, warranting a strategic position with planned accumulation during market pullbacks. The company's technological differentiation and multi-sector exposure provide potential upside catalysts, while careful position sizing addresses the inherent risks of early-stage technology investments.

Technical Analysis

Entry Point: We initiated our position when the stock broke above the down trendline of the channel on the daily chart. Volume decreasing last week was another clue for a potential breakout. Stop already B/E.

Support and Resistance Levels: Support is currently established at $1.10 on the daily chart. The first resistance level is at 1.55 on the daily, then 1.75 (recent highs)

Additional Notes: While the company's fundamentals and market position are intriguing, we view this primarily as a swing trading opportunity rather than a long-term investment.

Entry Day: 16 December

Price: $1.24

2. uniQure N.V (QURE)

uniQure N.V., a gene therapy company, engages in the development of treatments for patients suffering from genetic and other devastating diseases. Its lead program is Etranacogene dezaparvovec (AMT-061), which is in Phase III HOPE-B pivotal trial for the treatment of hemophilia B. The company also engages in developing AMT-130, a gene therapy that is in Phase I/II clinical study for the treatment of Huntington's disease; AMT-060, which is in Phase I/II clinical trial for the treatment of hemophilia B; AMT-210, a product candidate for the treatment of Parkinson's disease; AMT-260 for temporal lobe epilepsy; AMT-240, a preclinical product candidate for the treatment of autosomal dominant Alzheimer's disease; and AMT-161 for the treatment of amyotrophic lateral sclerosis. uniQure N.V. was founded in 1998 and is headquartered in Amsterdam, the Netherlands.

Fundamental Analysis

uniQure N.V. (QURE) shows promise through its breakthrough treatment AMT-130 for Huntington's disease, a devastating genetic condition. Think of this disease as a computer with a corrupted file that keeps making copies of itself, gradually causing the system to malfunction. AMT-130 acts like an advanced antivirus program, targeting and reducing this corrupted code.

Key Catalysts:

Impressive 80% slowdown in disease progression for high-dose patients

FDA showing positive signals for faster approval pathway

Strong financial backing from previous successful treatment (Hemgenix)

Multiple treatments in development for other genetic diseases

Recent 100%+ stock price jump showing market confidence

Market Dynamics:

The company targets a $3 billion market opportunity by 2032 for Huntington's disease alone. With 41,000 affected people in the U.S., there's a clear need for effective treatments. Think of uniQure as having a first-mover advantage in a race where few competitors have reached this far.

Challenges:

Treatment requires brain surgery - like requiring a specialized mechanic for a unique car

High treatment costs (potentially millions per patient)

Limited treatment centers with the necessary expertise

Slow adoption rate typical for new gene therapies

Competition from simpler treatment options (like pills)

Risk/Reward Profile:

The investment opportunity resembles backing a pioneering technology company - high potential rewards but significant risks. The company's strong cash position from Hemgenix sales provides a safety net while they develop their pipeline, similar to having a steady income stream while working on breakthrough projects.

Simplified Medical Context:

AMT-130 works like a highly specialized "delete button" for the problematic gene causing Huntington's disease. While the treatment shows great promise, its delivery method (brain surgery) is like needing to open up the computer to fix the software - more complicated than simply downloading an update. This complexity, combined with the high cost, means that despite its effectiveness, adoption might be gradual rather than explosive.

The company's diverse pipeline of other treatments provides multiple opportunities for success, making it less dependent on any single product's performance.

Technical Analysis

Entry Point: We initiated our position when the stock broke the little flag on the daily chart. Volume decreasing last week was another clue for a potential breakout. Stop already B/E.

Support and Resistance Levels: Support is currently established at $14.35 on the daily chart. The first resistance level is at 17.50 on the daily, then 22.00

Additional Notes: While the company's fundamentals and market position are intriguing, we view this primarily as a swing trading opportunity rather than a long-term investment.

Entry Day: 16 December

Price: $15.98