💼 Inside the Portfolio: Updates from our Swing Trading Desk

20 Nov 2024 - Insights, adjustments, and forecasts about our latest swing trades 💹

Position Updates:

CXW: Despite yesterday's robust price action with strong closing momentum, the position was terminated at our predetermined stop-loss level (break-even).

DIS: The equity is currently testing our initial entry level, presenting a critical decision point for position management. Today's session will be instrumental in determining whether to execute a defensive exit or maintain exposure on potential price recovery that could reestablish our desired safety margin.

LMND: Following an exceptional two-day surge exceeding 30%, we've executed a strategic partial exit, harvesting 25% of the position at substantial profit levels (44.00). The remaining position will be maintained with trailing stops to capture potential continued momentum, aligning with our risk management protocol while maintaining exposure to further upside.

New Positions and Subscriber Insights:

Amid renewed market weakness, we've implemented a defensive tactical approach, initiating two new positions with minimal size allocations to maintain strategic flexibility. These starter positions reflect our cautious stance while preserving optionality in the current corrective phase.

1. Lemonade Inc (LMND)

Lemonade, Inc. provides various insurance products in the United States and Europe. Its insurance products include stolen or damaged property, and personal liability that protects its customers if they are responsible for an accident or damage to another person or their property. The company also offers renters, homeowners, pet, car, and life insurance products, as well as landlord insurance policies. In addition, it operates as an agent for other insurance companies. The company was formerly known as Lemonade Group, Inc. and changed its name to Lemonade, Inc. Lemonade, Inc. was incorporated in 2015 and is headquartered in New York, New York.

Fundamental Analysis

Financial Health: Lemonade Inc.'s Q3 2024 earnings report demonstrated strong performance with a 24% increase in In Force Premium and improved loss ratios. The company achieved a 71% increase in gross profit to $38 million, with gross profit margin reaching 27%. While reporting an adjusted EBITDA loss of $49 million, the company maintained a positive net cash flow of $48 million and stable operating expenses. Management remains optimistic, projecting continued positive cash flow through year-end and targeting adjusted EBITDA profitability by 2026, supported by their strategic focus on profitable growth and technological innovation.

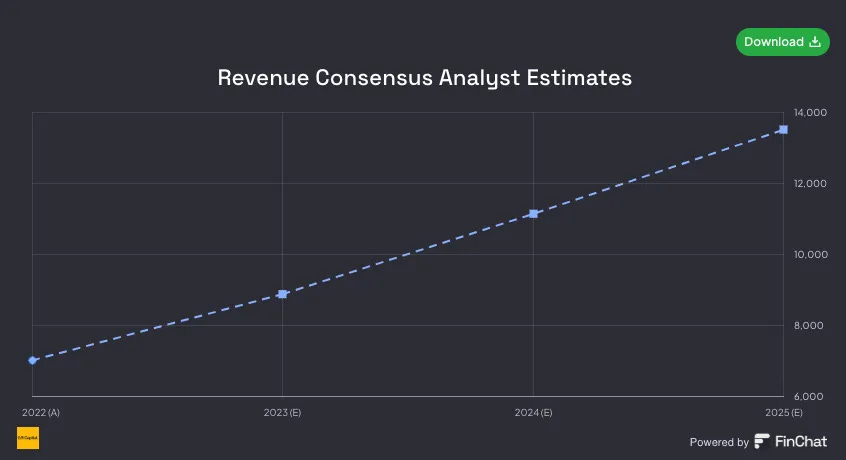

Growth Prospects:

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Finchat's data. Explore now →

Technical Analysis

Entry Point: We entered when the stock broke to the upside 35 level with volume and a very high RS relative to the Market.

Support and Resistance Levels: Support is now 35, and the first resistance is 45.00 and 50.

Additional Notes: Lemonade (NYSE: LMND) shares surged following today's Investor Day presentation, as the digital insurance company unveiled its strategic roadmap and financial projections. The market responded enthusiastically to management's vision, driving significant stock price appreciation.

Entry Day: 19 November

Price: $35.45