💼 Inside the Portfolio: Updates from our Swing Trading Desk

24 Dec 2024 - Insights, adjustments, and forecasts about our latest swing trades 💹

Position Updates:

KinderCare Learning Companies Inc (KLC): We closed this position for a small loss. The stock broke out yesterday, but we exited early to protect our account. While we may have been slightly premature, our priority remains risk management in this volatile market.

KULR Technology Group, Inc. (KULR): This trade was a standout success, delivering a gain of over 130% in just one week. While we may have closed the position too early, we are very pleased with the outcome. In hindsight, there may have been additional upside, but locking in such a significant profit was the prudent choice.

New Positions and Subscriber Insights:

Yesterday, we initiated a pilot position and a tight stop-loss. We are pretty happy that the position is already in profit.

As always, entry points and specific details for this new position were communicated in real time to our paid subscribers through our premium alert system via chat, ensuring they had the opportunity to execute trades promptly.

1. KULR Technology Group Inc. (KULR)

KULR Technology Group, Inc. engages in developing, manufacturing, and licensing next-generation carbon fiber thermal management technologies for batteries and electronic systems. Its products include cell check, safe case, thermal capacitor, fiber thermal interface, thermal runaway shield, internal short circuit, and cathode. The company was founded by Michael Mo and Timothy R. Knowles in December 2015 and is headquartered in San Diego, CA.

Fundamental Analysis

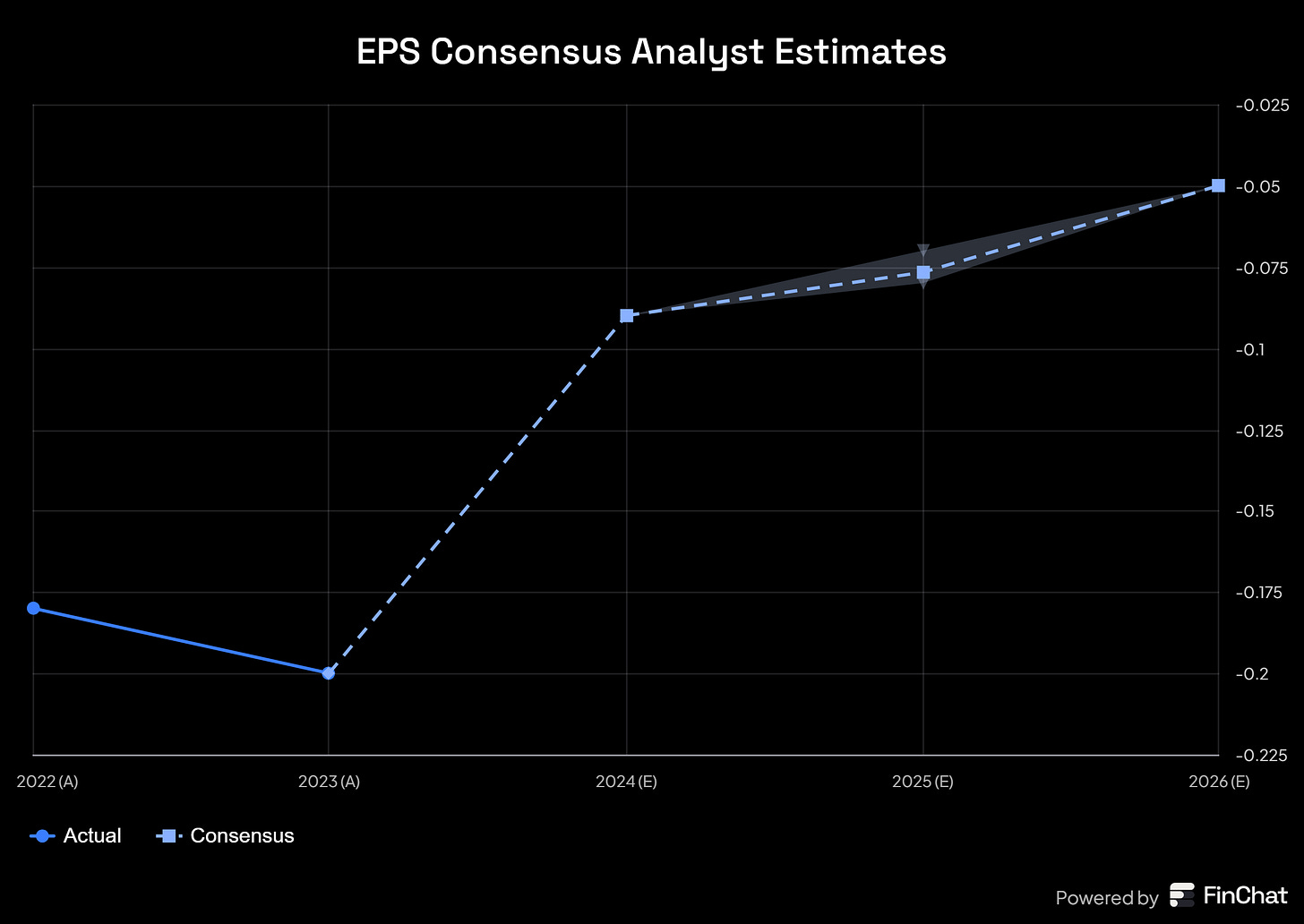

KULR Technology Group (KULR) demonstrates significant potential through its strategic positioning in multiple high-growth sectors, including eVTOL, data centers, small modular reactors (SMRs), and space battery technologies. While currently unprofitable, the company shows promising revenue growth trajectories coupled with decreasing operational expenses, indicating improving operational efficiency.

Key Catalysts:

Strategic partnerships with industry leaders (Amprius, H55, Molicel)

Recent U.S. Navy contract award for battery safety development

Exposure to multiple high-growth industrial sectors

Operational cost optimization initiatives

Growing market recognition reflected in recent price action

Market Dynamics: The company's diversified exposure across emerging technology sectors provides multiple growth vectors. The recent 400% share price appreciation indicates growing market interest, primarily from retail investors, suggesting potential for further institutional adoption. KULR's positioning in critical technology segments, particularly in battery safety and thermal management, aligns with major industry trends.

Challenges:

Limited cash reserves impacting operational flexibility

Potential near-term dilution risk from equity financing needs

Current unprofitability status

Heavy reliance on successful execution across multiple sectors

Need for continued partnership development to maintain momentum

The risk/reward profile presents an asymmetric opportunity, warranting a strategic position with planned accumulation during market pullbacks. The company's technological differentiation and multi-sector exposure provide potential upside catalysts, while careful position sizing addresses the inherent risks of early-stage technology investments.

Technical Analysis

Entry Point: We initiated our position when the stock broke above the down trendline of the channel on the daily chart. Volume decreasing last week was another clue for a potential breakout. Stop already B/E.

Support and Resistance Levels: Support is currently established at $1.10 on the daily chart. The first resistance level is at 1.55 on the daily, then 1.75 (recent highs)

Additional Notes: While the company's fundamentals and market position are intriguing, we view this primarily as a swing trading opportunity rather than a long-term investment.

Entry Day: 16 December

Price: $1.24