GBC Playbook: Volume V

Your Trading Tech Stack: Professional Tools vs. Budget Alternatives

Everything you need for charting, scanning, fundamental research, and market intelligence

“The secret to being successful from a trading perspective is to have an indefatigable and an undying and unquenchable thirst for information and knowledge.”

Paul Tudor Jones

Previous Chapters:

If you have been looking for a “perfect” trading platform, you are likely aware of the unfortunate reality: it does not exist.

The current landscape of trading technologies is littered with numerous platforms that excel in one area but fail miserably in everything else. Many charting platforms provide outstanding technical indicators, but they lack adequate news feeds. Some scanners can instantly identify momentum trades, but they lack all the fundamental information regarding the companies involved.

Many data terminals contain all the financial metrics you could want; however, the user interface resembles something from the 90’s.

This fragmentation is the natural result of developing very focused, specialized software. Developing the best possible specialized tools requires a great deal of concentration on that particular area of the market; that focus typically comes at the cost of a broader focus. As a result, most serious traders develop a customized technology stack by combining various tools that each address a different area of weakness.

Although this process is not particularly elegant, it is effective.

When you start off with a limited amount of capital, the decision to invest in advanced tools prior to validating your strategy becomes a real problem.

Do you spend money on high-end tools until you are confident in your method?

Or do you utilize free tools and risk losing access to important information?

This is a legitimate question, and unfortunately, there is no single correct answer.

However, the current trading landscape has undergone a significant shift over the last several years, specifically about Artificial Intelligence (AI). Trading AI tools have evolved significantly and now can analyze large volumes of information, combine multiple pieces of complex information, and present insightful conclusions that may require hours to manually discover. Whether you are reviewing earnings transcripts, researching news sentiment, or attempting to determine a company’s competitive position, AI can condense what previously took a full day to complete into minutes.

The key is using AI tools strategically and learning to effectively utilize them to reduce the mental burden of processing large volumes of information.

AI will not be making your trading decisions for you — and should not — however, it can greatly reduce the mental effort required to process and evaluate large volumes of data. AI can assist you in understanding the narrative surrounding a company, identifying potential catalysts that you may have overlooked, and rapidly evaluating whether a company’s story is based on substance or merely clever marketing. In today’s fast-paced trading environment, where information is disseminated at the speed of social media and trading reactions occur in seconds, utilizing AI as your research assistant is not merely beneficial; it is becoming necessary.

As mentioned earlier, we have been working on something new.

For years, the idea of consolidating most of the essential tools a trader relies on into a single environment felt unrealistic. Charting lived in one place. News in another. Scanners somewhere else. Fundamental data on a different terminal. AI analysis layered awkwardly on top of all of it.

It worked, but it was fragmented.

We are currently developing an application that attempts to solve that fragmentation.

It is not a generic solution for every market participant, but a platform built specifically for swing trading, momentum strategies, and short- to medium-term investing.

If we see meaningful interest, we will open a limited number of testing spots and allow selected users to access the platform early.

As previously stated, all paid subscribers will receive full access to the platform at no additional cost.

Our Trading Style: Why Our Tools Match Our Method

As we review some of the most popular tools used to support our swing-trading approach, we would first like to discuss the reason behind selecting those tools.

We are fundamental conscious swing traders, which means that while we rely heavily on the technical aspects of our trades (charts, price action, volume patterns, momentum indicators), we refuse to trade blind.

We need to know what we’re buying.

It is not about creating discounted cash-flow models or calculating the intrinsic value of an equity. Nor is it about projecting earnings over the next 5 years. However, we do need to have an understanding of the business model, the growth potential, the competitive landscape, and whether the company is building something tangible or simply selling a narrative to investors.

Here’s why this matters: risk management and position sizing.

There’s a massive difference between taking a swing trade on Amazon (a proven, cash-generating behemoth with multiple revenue streams and a track record of execution) and taking a swing trade on a speculative biotech company that’s burning $50 million per quarter on a single drug candidate that may or may not survive FDA trials.

Both might show the same bullish technical setup. Both might be breaking out of consolidation with strong volume. But the risk profiles are completely different. With Amazon, you’re betting on a temporary technical dislocation in a fundamentally sound business. With the biotech, you’re betting on a binary outcome where the entire investment thesis could evaporate overnight with a single press release.

Understanding this distinction allows us to calibrate our position sizes appropriately.

It helps us decide whether to use tight stops or give a position more room to breathe. It informs our decisions about whether to hold through earnings or take profits before the event.

It shapes how we think about portfolio construction and correlation risk.

We’ve seen too many technically-focused traders get blindsided by fundamental realities they didn’t bother to understand. A beautiful chart pattern means nothing if the company just announced they’re under SEC investigation, or their largest customer just canceled a major contract, or their cash runway is about to hit zero.

On the flip side, we’ve also seen fundamental investors who understand businesses deeply but have no sense of timing, buying “cheap” stocks that get cheaper for years, or holding through obvious technical breakdowns because “the fundamentals haven’t changed.”

Our approach tries to capture the best of both worlds: technical analysis for timing and momentum, fundamental awareness for context and risk management. This hybrid approach is why we need a diverse toolkit: we’re not just looking at charts, and we’re not just reading financial statements.

We’re synthesizing multiple streams of information to make more informed decisions.

The Reality: Why We Use Multiple Platforms

Let’s be honest from the start: we use a lot of different tools. Not because we enjoy complexity or like paying multiple subscriptions, but because we’ve yet to find a single platform that does everything exceptionally well.

The perfect all-in-one trading platform remains elusive. Some excel at technical analysis but have mediocre fundamental data. Others offer comprehensive financial information but clunky charting. Some have lightning-fast scanners but limited customization. The list goes on.

So we’ve built a modular system, where each tool serves a specific purpose and excels at its designated role. It’s not the most streamlined approach, but it’s the most effective one we’ve found.

Think of it like a professional kitchen: a chef doesn’t use one knife for everything. They have specialized tools for specialized tasks, and they know exactly when to reach for each one.

What follows is our complete toolkit, broken down by function, with honest assessments of what each platform does well, what it doesn’t, and whether there are viable free or low-cost alternatives. We’ll give you both the “pro” setup we actually use and the “scrappy” alternatives that can get you 80% of the way there if you’re on a budget.

Our Professional Setup

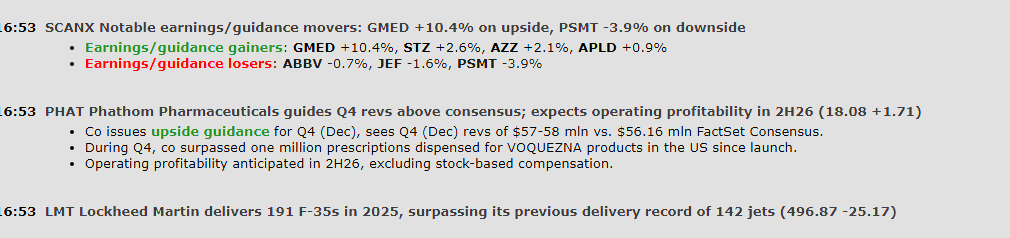

Briefing.com — Pre-Market Intelligence

What it does: Real-time news aggregation and market-moving headlines

When we use it: 1-2 hours before market open, every trading day

Cost: Free

This is our morning ritual. Before the opening bell, we’re on Briefing.com getting a comprehensive view of what’s moving the market. The platform aggregates news across all major stocks, sectors, and indices, giving us a quick but thorough snapshot of the overnight action.

What makes Briefing valuable isn’t just the news itself (you can get that anywhere) but the curation and presentation. Everything is organized and color-coded. You can quickly check what’s affecting the broad market, then drill down into specific details.

For swing traders, this pre-market intelligence is crucial. It helps us anticipate which of our positions might gap up or down, identify new opportunities emerging from overnight news and earnings reports, and understand the general market sentiment before we start making decisions.

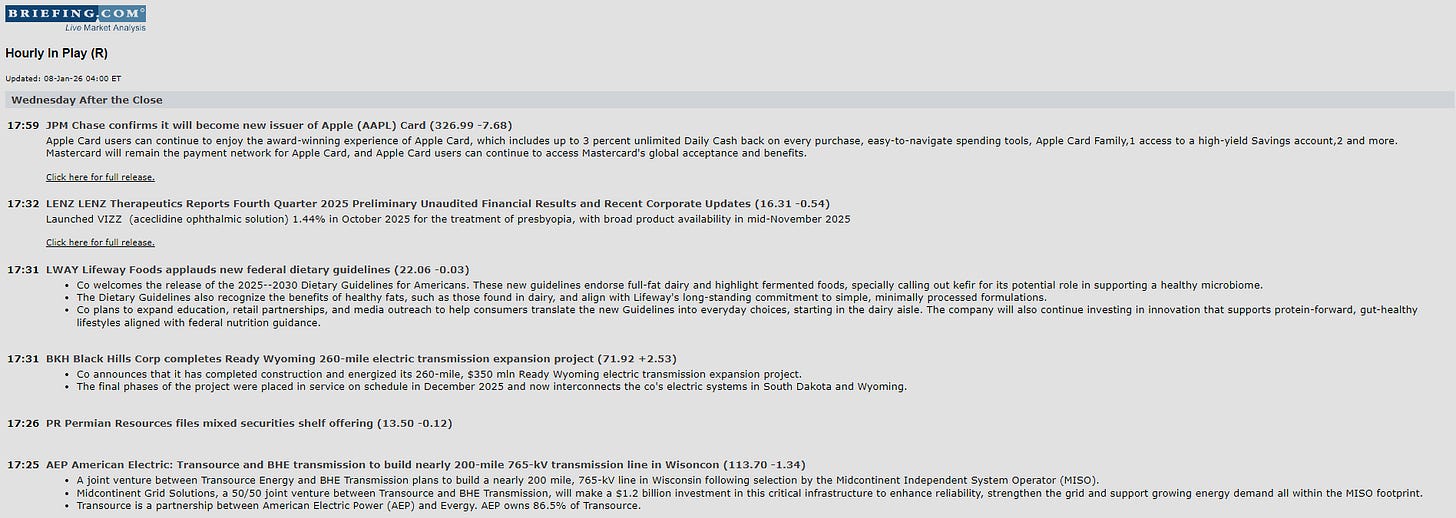

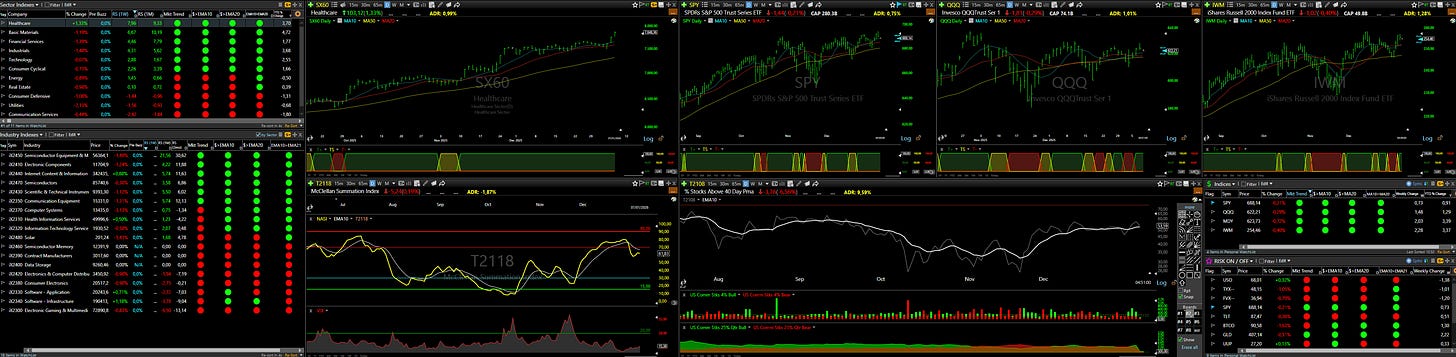

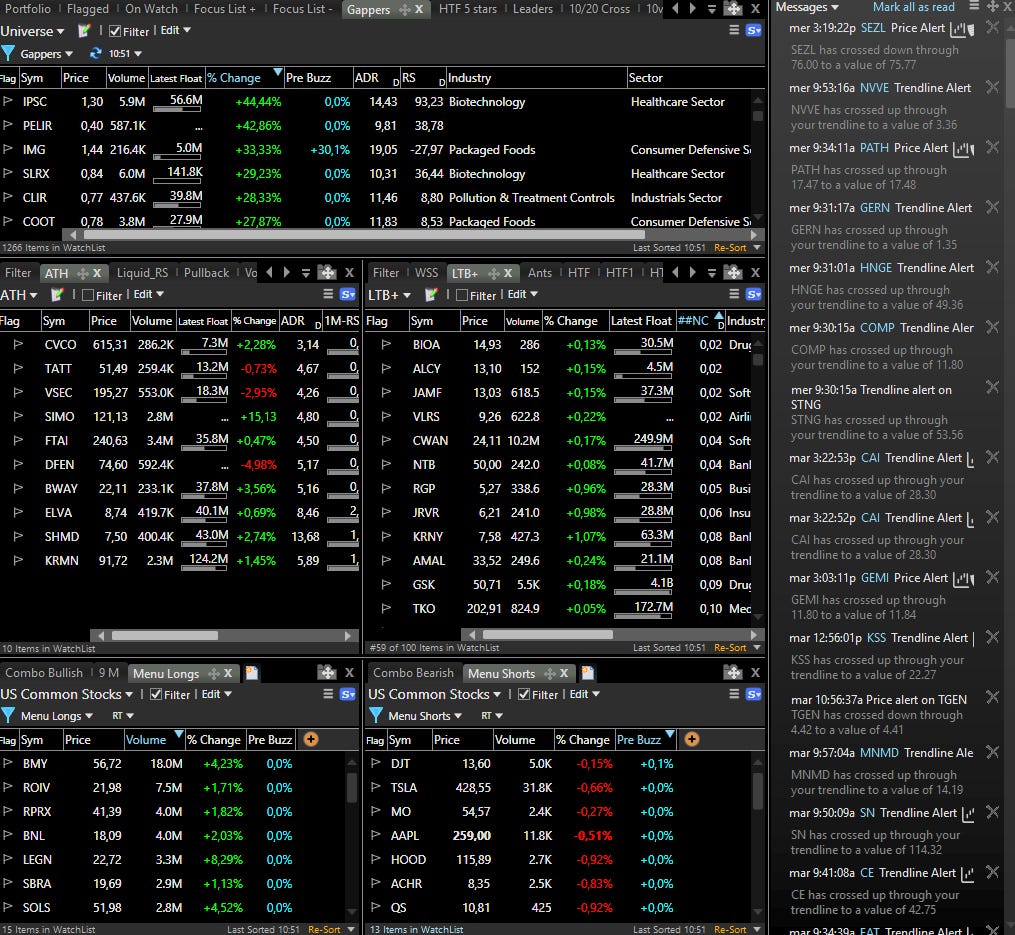

TC2000 — Our Trading Command Center

What it does: Advanced charting, custom scanning, market breadth analysis

When we use it: All day, every day. This is our primary platform.

Cost: Paid subscription

If we could only keep one platform and had to abandon everything else, it would be TC2000. This is where we’ve invested the most time, energy, and customization work. It’s our trading cockpit.

Here’s what we’ve built inside TC2000:

Market Breadth Dashboard: We have a custom layout that shows us real-time health metrics for major indices, sectors, and industries. This isn’t just about whether the S&P 500 is up or down; it’s about understanding the internal dynamics of the market. Are we seeing broad participation or narrow leadership? Are defensive sectors outperforming or risk-on assets? This breadth analysis informs every trading decision we make.

Custom Scanners: Over the years, we’ve developed a suite of proprietary scanners that run daily and weekly to identify swing trading candidates. They’re highly specific scanners based on our exact criteria for momentum, volume, technical setups, and relative strength. This is where we find most of our trade ideas.

Intraday Monitoring Tools: During market hours, we have custom indicators that highlight the best-performing stocks in real-time, track sector rotation throughout the day, and measure overall market breadth as it evolves. This helps us stay nimble and adjust our approach based on what’s actually working in the current environment.

The scanning engine in TC2000 is, in our opinion, the best available in the retail trading space.

It’s fast, flexible, and allows for complex multi-condition scans that would be impossible or painfully slow on other platforms. The charting is clean and highly customizable. The platform is stable and reliable, critical when you’re making time sensitive decisions.

Is there a learning curve? Absolutely. TC2000 rewards the time you invest in learning its capabilities. But once you’ve built your custom workspace, it becomes an extension of your trading process. And yes, AI is your friend.

Budget Alternative: TradingView (free tier with limitations, or affordable paid plans) is the closest alternative. It has excellent charting, a growing community of shared indicators and strategies, and decent scanning capabilities. You won’t get the same depth of customization or scanning power, but for many traders, especially those starting, TradingView offers tremendous value. The free version has ads and limited features, but the paid tiers are reasonably priced and unlock most of what you need.

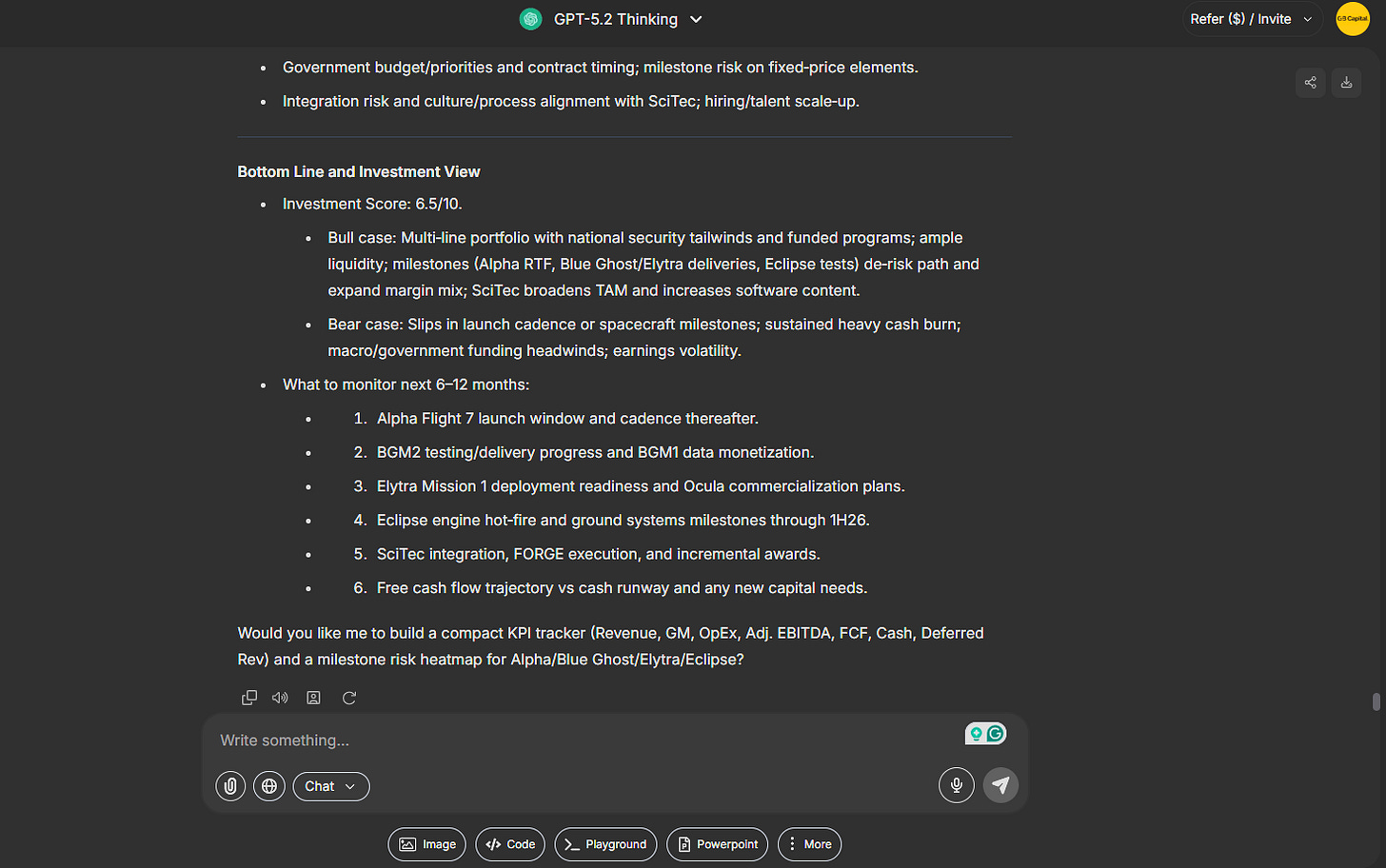

Abacus AI — Your AI Research Assistant

What it does: Unified access to multiple AI models (ChatGPT, Claude, Gemini, Grok, and more)

When we use it: Throughout the day for research, analysis, and information synthesis

Cost: Paid subscription

This is where the AI revolution meets practical trading. Instead of juggling multiple AI subscriptions or settling for limited free tiers, Abacus AI gives you access to all the major AI models in one place. You choose which AI to use based on the specific task at hand.

Here’s how we use different models:

Claude: Our go-to for generating investment ideas, analyzing complex scenarios, and getting nuanced perspectives on market dynamics. Claude tends to provide more thoughtful, balanced analysis.

ChatGPT: Excellent for quick information retrieval, summarizing articles, and general research tasks.

Gemini: Strong at analyzing documents and extracting key information from dense reports.

Image Generation (Midjourney, NanoBanana): When we need visual content for presentations or reports.

The real power is in the flexibility. Different AIs have different strengths, and having them all accessible in one interface means you can use the right tool for each job without the friction of switching between platforms.

We’ve tested both free and paid AI tiers extensively, and our strong recommendation is to pay for quality AI access. The free tiers are severely limited: slower responses, restricted usage, access to older models, and often unavailable during peak times. When you’re using AI as a research tool to inform real money decisions, those limitations become genuinely problematic.

Think of AI as your tireless research analyst.

It can read through earnings transcripts and pull out the key points.

It can scan news articles and identify potential catalysts.

It can help you understand complex business models or industry dynamics outside your expertise.

It can even help you spot patterns or connections you might have missed.

The key is learning to prompt effectively and always verify critical information. AI is a tool for augmenting your research, not replacing your judgment.

Budget Alternative: The free tier of ChatGPT or Claude can handle basic tasks, though you’ll face usage limits and slower performance. Google’s Gemini also offers a free tier. For most beginners, starting with free AI tools makes sense. Just be aware of their limitations and consider upgrading once you’re using them regularly and finding value.

X (formerly Twitter) — Curated Market Intelligence

What it does: Real-time market commentary, idea generation, breaking news

When we use it: Throughout the day for monitoring and research

Cost: Free

X is a double-edged sword. It can be the most valuable source of real-time market intelligence, or it can be a toxic wasteland of noise, hype, and misinformation.

The difference is entirely in how you use it.

The Right Way to Use X:

Curate ruthlessly: Follow people who add genuine value: experienced chartists sharing their technical analysis, macro analysts with deep expertise, traders whose process you respect. Unfollow anyone who’s primarily selling something or posting for engagement rather than insight.

Use it for idea generation only: X is excellent for discovering stocks you might not have found in your own scans, seeing different perspectives on setups you’re watching, and staying aware of emerging themes. But never—and we mean never—blindly follow someone else’s trade. Every idea you find on X should go through your own analysis process.

Leverage the search function: This is underutilized but incredibly powerful. When you see unusual price action in a stock, add “$” then the ticker symbol (example: $BABA), and you’ll instantly see what people are saying, whether there’s breaking news, and what might be driving the move. It’s often faster than traditional free news sources.

Build your network strategically: Think about the gaps in your knowledge and find experts who fill those gaps. If you’re weak on macro, follow the best macro analysts. If you want to improve your chart reading, follow skilled technical analysts. If you trade a specific sector, find people who specialize in that area.

The Wrong Way to Use X:

Following “gurus” who post their P&L screenshots and promise easy money

Getting caught up in hype cycles and FOMO

Letting the noise and negativity affect your emotional state

Treating it as entertainment rather than a professional tool

We maintain a carefully curated feed of high-quality accounts. You’re welcome to browse who we follow as a starting point; most are serious market participants with valuable perspectives. But ultimately, you need to build a feed that serves your specific needs and trading style.

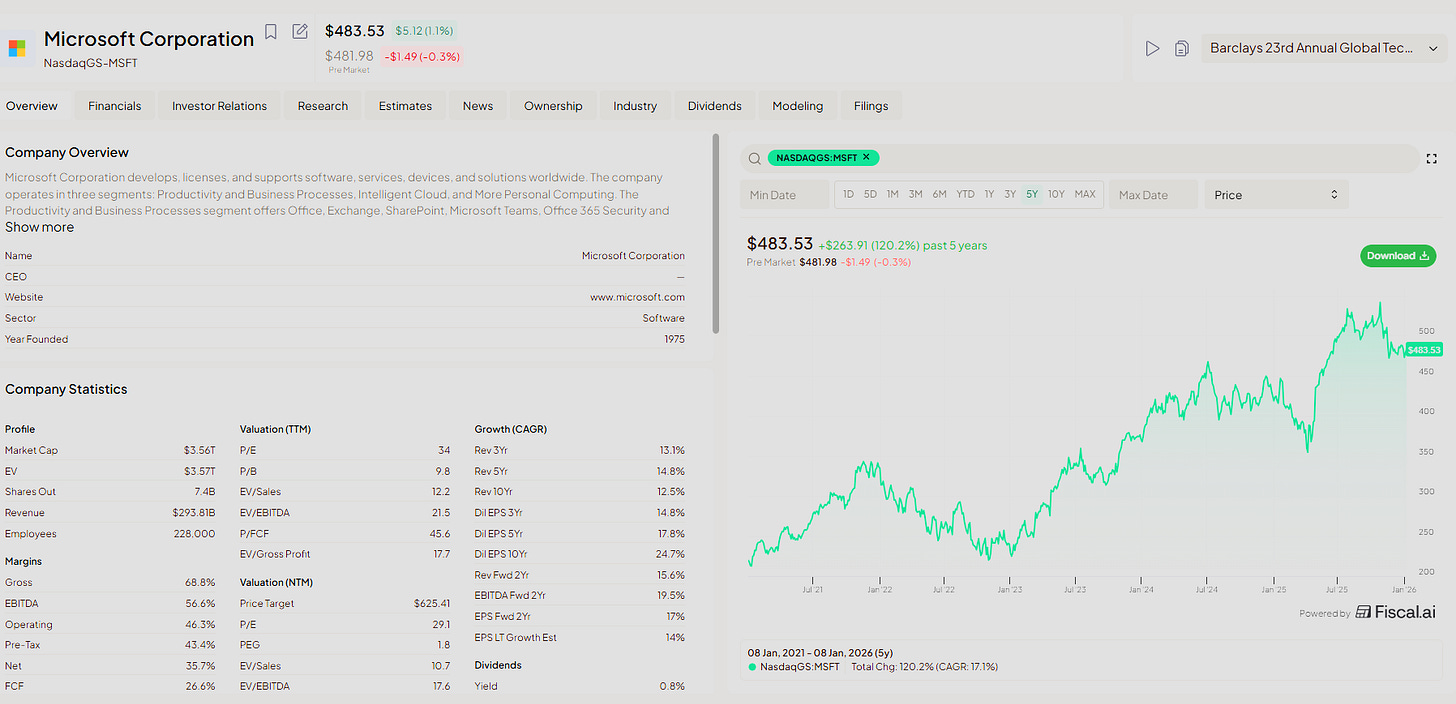

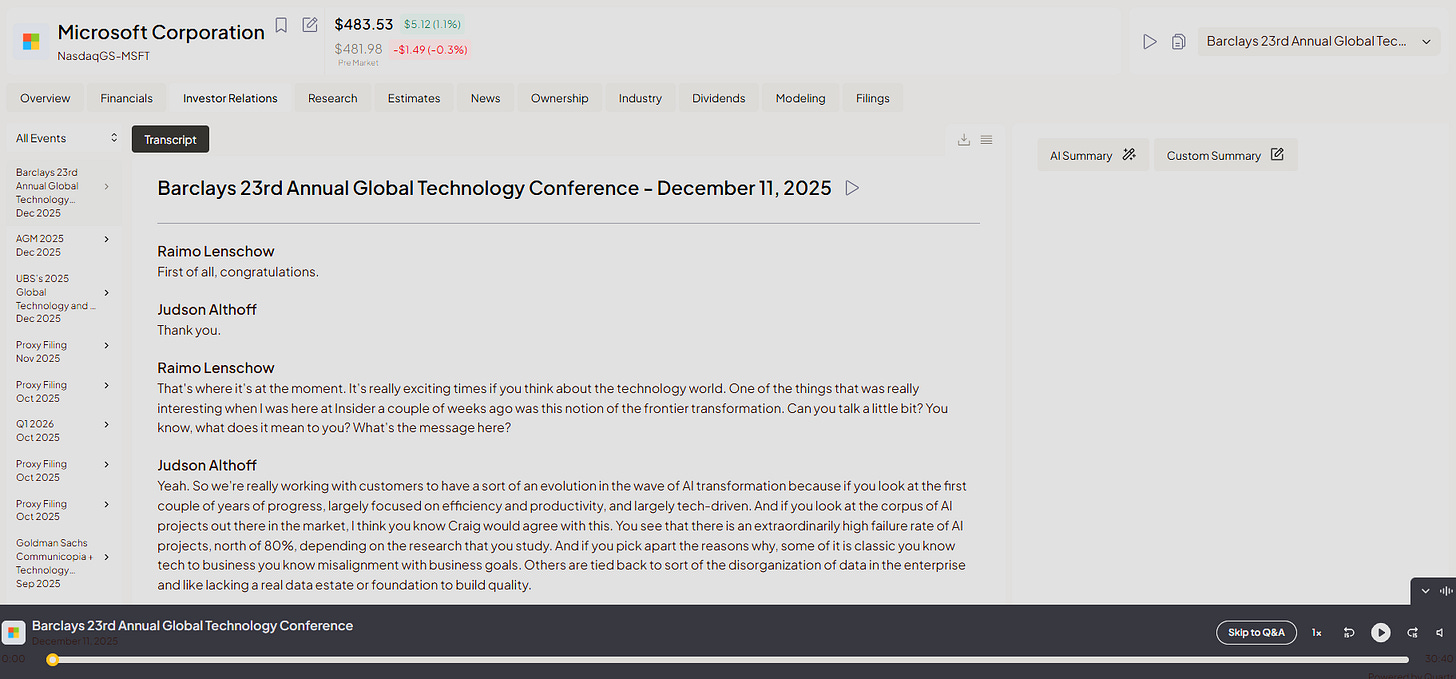

Fiscal.ai — Deep Fundamental Data

What it does: Comprehensive fundamental analysis, portfolio tracking, document analysis

When we use it: When researching new positions or reviewing existing holdings

Cost: Paid subscription

This is probably the best platform available for accessing deep fundamental data on companies. We’re proud to have collaborated with them since the early days because we genuinely believe they’ve filled a gap in the market.

Key Features We Use

Portfolio Management: We track all our positions here, with real-time updates on performance, allocation, and risk metrics.

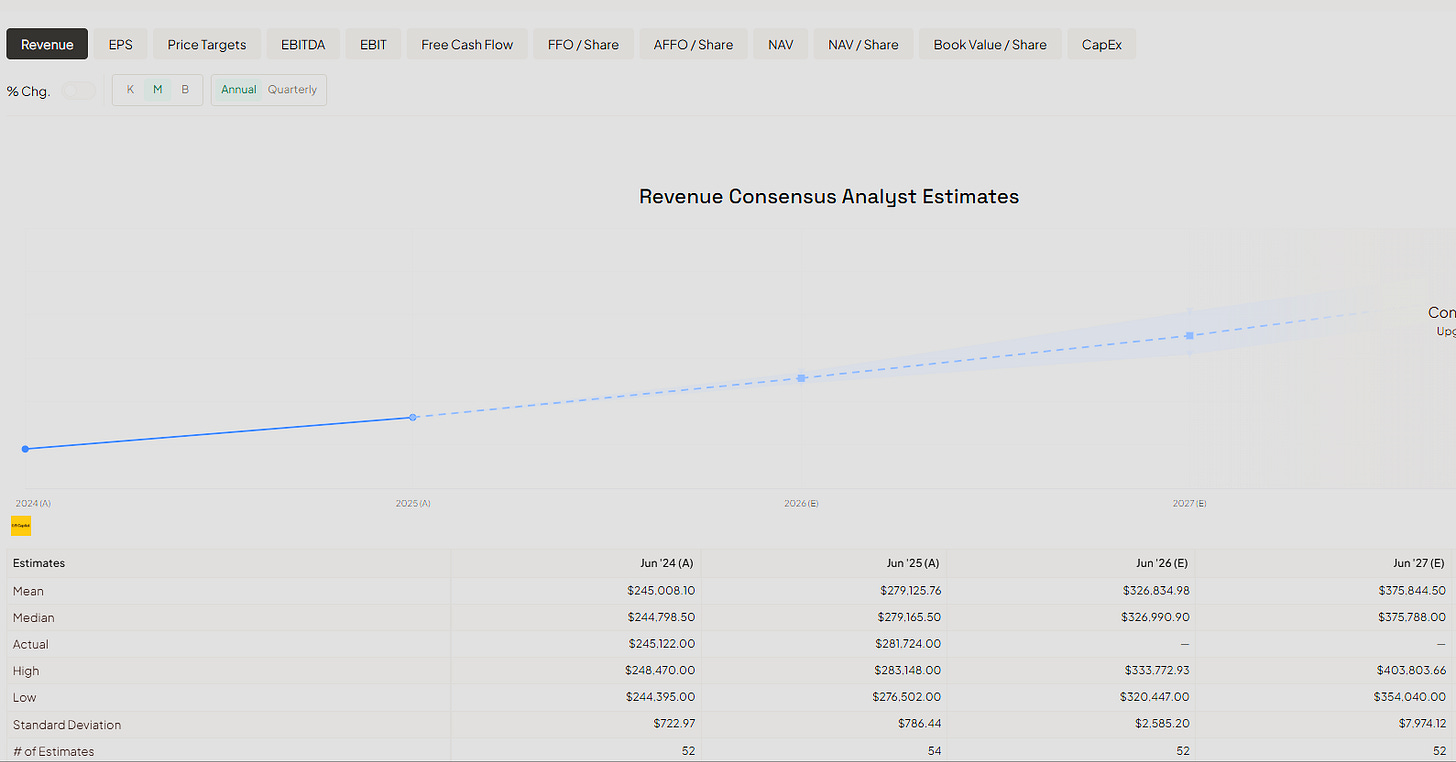

Financial Data: Everything you’d want to know about a company’s financials: EPS, revenue, margins, cash flow, debt levels, and forward estimates. The data is clean, well-organized, and easy to navigate.

Investor Relations Hub: This is where Fiscal.ai really shines. You get access to all earnings reports, earnings call transcripts, investor presentations, and conference appearances. Even better, you can use AI to generate concise summaries of these documents, condensing a 50-page earnings report or an hour-long call transcript into a one-page summary of key points.

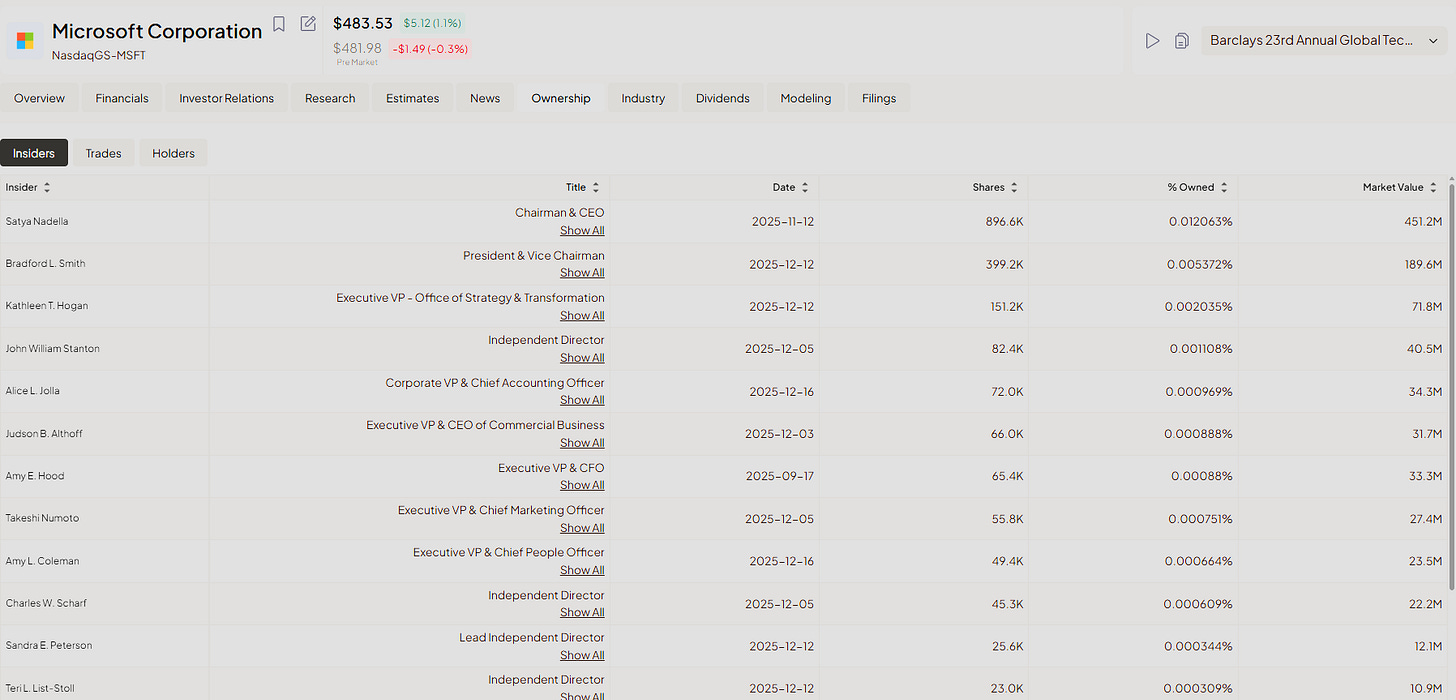

Ownership Analysis: See who owns the stock; insider holdings, institutional investors, and major funds. This can be revealing. Are insiders buying or selling? Are smart money funds accumulating or distributing? This context matters.

Valuation & Estimates: Forward-looking estimates and valuation metrics to understand where the company might be headed and how the market is pricing its future.

For our style of trading, this level of fundamental depth isn’t strictly necessary: we’re not value investors building DCF models. But we don’t like trading blind. We want to understand what we own, and Fiscal.ai gives us that understanding efficiently.

The service isn’t cheap, but it’s high quality. If you’re serious about incorporating fundamental awareness into your trading, it’s worth the investment.

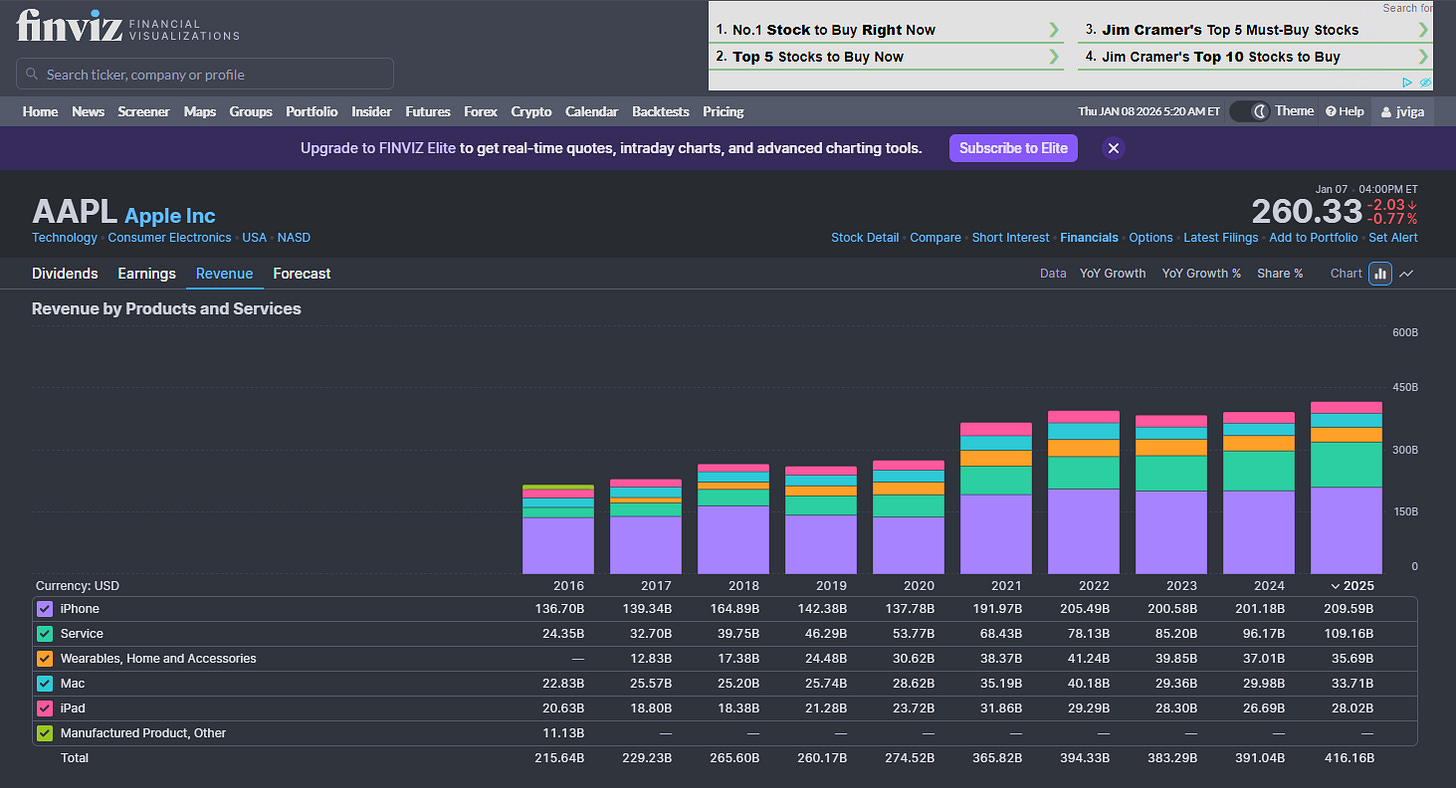

Budget Alternative: Yahoo Finance (free) provides basic fundamental data like financials, estimates, and key statistics. It’s not as comprehensive or well-organized as Fiscal.ai, but it covers the essentials. Finviz (free) also offers a solid fundamental snapshot. If you’re on a tight budget, a combination of these free tools can get you most of the fundamental information you need, though you’ll sacrifice the convenience and depth of a premium platform.

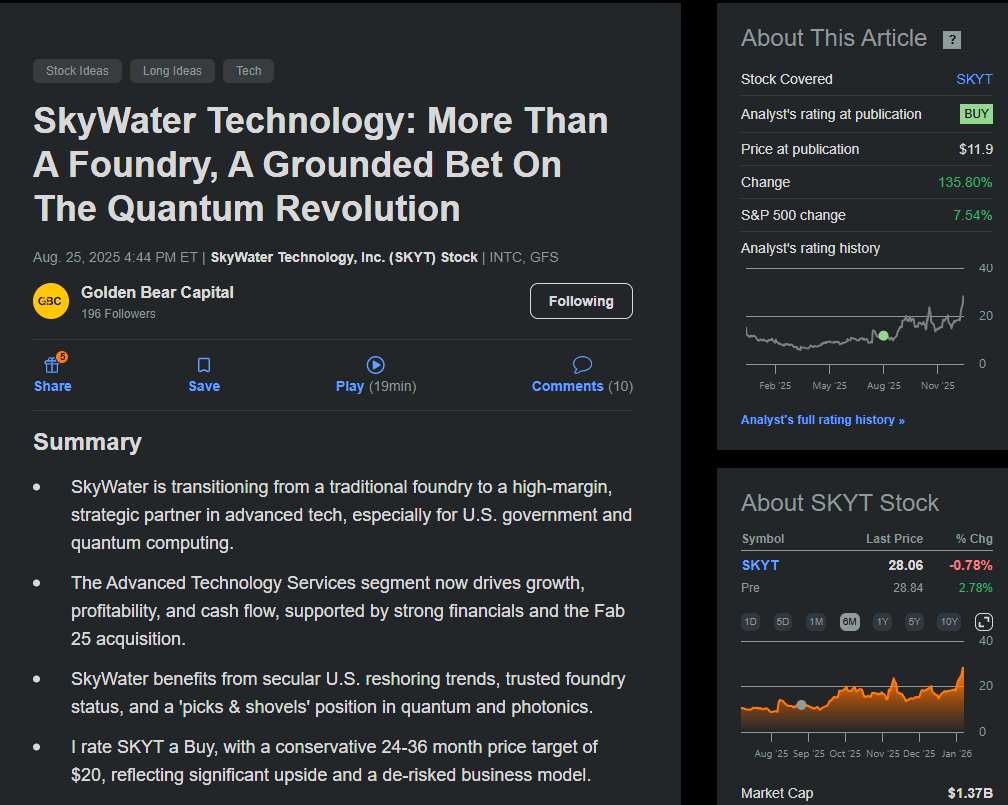

Seeking Alpha — Deep-Dive Analysis (Use With Caution)

What it does: Crowdsourced stock analysis and commentary

When we use it: Selectively, for learning about companies outside our expertise

Cost: Free tier available; paid subscription for full access

Seeking Alpha is controversial, and we understand why. It’s a platform where anyone can publish stock analysis, which means the quality varies wildly. On the same stock, you’ll find one analyst arguing it’s a screaming buy while another insists it’s heading to zero. Both will present compelling arguments. It’s confusing, contradictory, and can be genuinely misleading if you don’t know how to filter the noise.

Why We Still Use It:

Despite the chaos, Seeking Alpha has one massive advantage: coverage. If a stock has a market cap over $500 million, there’s probably at least one detailed analysis written about it. For many smaller or more obscure companies, Seeking Alpha might be the only place you’ll find in-depth commentary.

The Seeking Alpha editorial team does enforce quality standards: articles need to be well-researched, detailed, and substantive to get published. This means even if you disagree with the conclusion, you’ll usually find useful information in the analysis.

How to Use It Properly:

Ignore the buy/sell recommendations: Don’t go to Seeking Alpha to find out whether you should buy a stock. Go there to learn about the business.

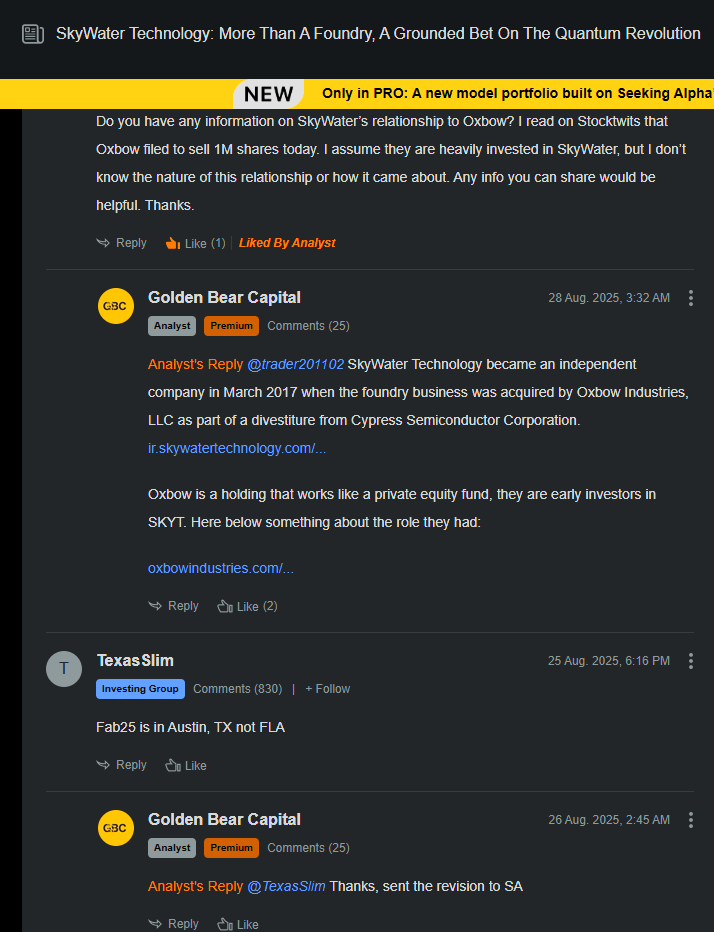

Focus on the facts, not the opinions: Extract information about the company’s operations, competitive position, industry dynamics, and business model. Ignore the valuation arguments and price targets, but always read the comments. That’s where additional value often emerges.

When a research piece is published, it’s rarely “fully correct.” Disagreements and opposing views usually follow, and that’s a good thing. Debate attracts more data, more perspectives, and more scrutiny, as everyone tries to prove their point.

If you can stay neutral, you can turn this collective friction into insight, using the shared information to refine and build your own core thesis.

Look for domain expertise: The real value is when you find an analyst who has deep expertise in a specific industry. Someone who worked in the mining industry for 30 years, writing about a gold company? That’s a valuable perspective. An analyst who exclusively covers restaurant stocks? They probably understand that sector better than you do. Take the insights, leave the predictions.

Use it to expand your circle of competence: When you’re looking at a company in an industry you don’t understand well, Seeking Alpha can provide the educational foundation you need to make an informed decision.

What to Avoid:

Analysts who are clearly talking their book (heavily long or short)

Overly promotional or sensationalist articles

Anyone promising guaranteed returns or “can’t miss” opportunities

Getting sucked into the comment sections, which are often toxic

Seeking Alpha is a tool, not an oracle. Used correctly (as a source of information and education rather than trading signals), it can be valuable. Used incorrectly, it’s just noise.

Budget Alternative: Seeking Alpha already has a free tier that provides access to many articles, though with limitations. For pure budget research, combining Yahoo Finance news, company investor relations pages (always free and often overlooked), and SEC filings (free via EDGAR) can give you much of the same information, though it requires more work. If you combine all of this with AI, you can use it as an assistant to help analyze the data and generate insights.

It takes more time, but it’s free: you’re investing your hours instead of your dollars.

Finviz — The Free Powerhouse

What it does: Market overview, stock screening, news aggregation, sector analysis

When we use it: Throughout the day; always have a tab open

Cost: Free (paid tier available for real-time data)

Finviz is a goldmine, and it’s free. Let that sink in. This is one of the best values in the entire trading ecosystem.

How We Use Finviz:

News Aggregation: Quick access to the latest news for any specific stock. Just search the ticker, and you’ll see recent headlines and articles.

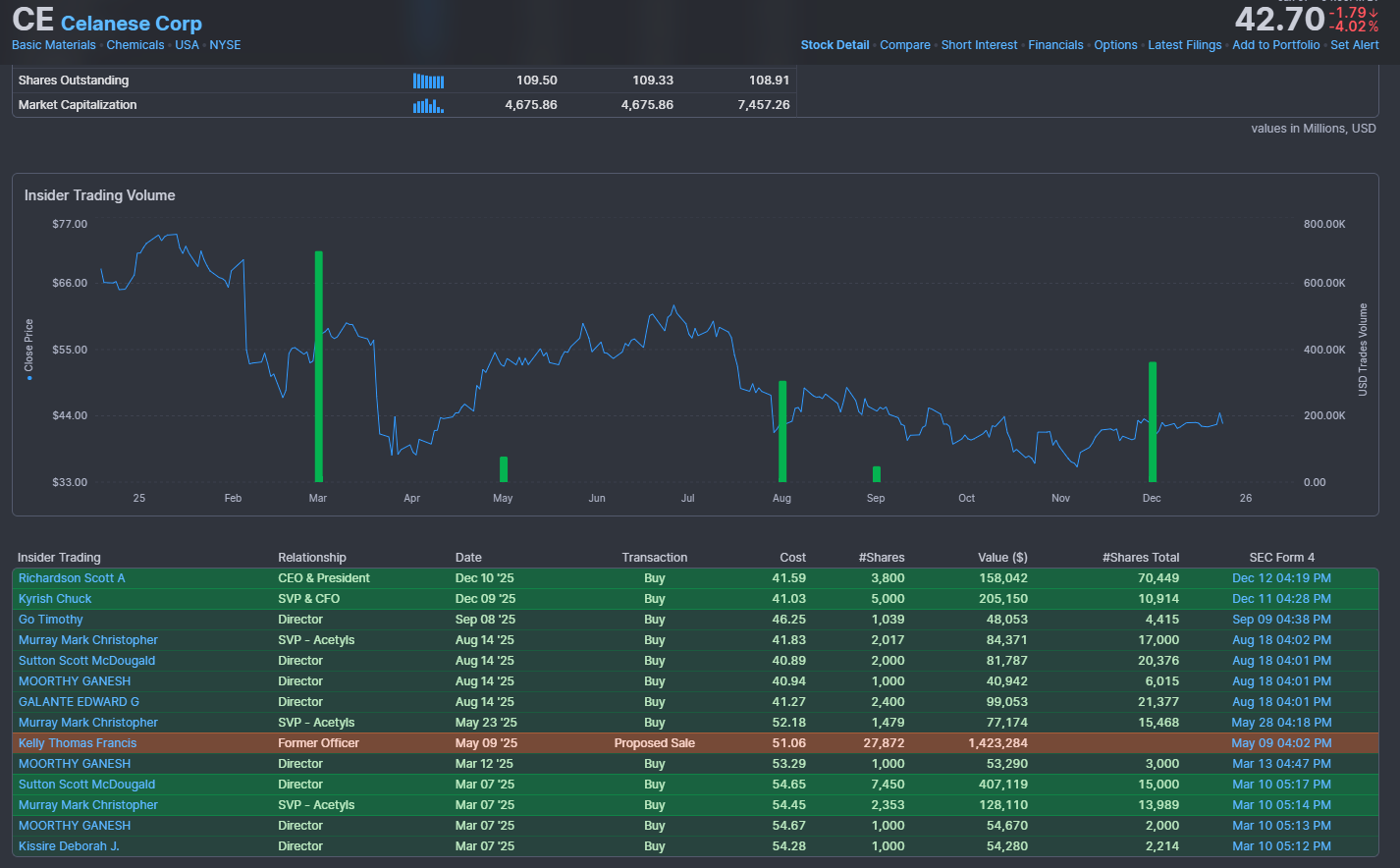

Insider Trading: Track insider buying and selling. When executives are putting their own money into their company’s stock, it’s worth noticing.

Quick Fundamental Snapshot: Need a fast overview of a company’s financials without opening a premium platform? Finviz provides key metrics, valuation ratios, and performance data in a clean, scannable format. It’s not as comprehensive as Fiscal.ai, but for a quick check, it’s perfect.

Groups & Sectors Analysis: This is where Finviz really shines. The “Groups” section shows you which sectors and industries are leading and lagging over various timeframes—daily, weekly, monthly, quarterly, and annually. This is essential for understanding where money is flowing in the market.

Why does this matter? Because sector and industry trends are powerful. If you’re looking for swing trades, you want to be fishing in the right pond. Buying a stock in a sector that’s been the worst performer for the past three months is fighting an uphill battle. The path of least resistance is to trade stocks in sectors showing strength and momentum.

Finviz makes this analysis effortless. A few clicks and you have a complete picture of sector rotation and relative strength.

Heat Maps: Visual representation of market performance, color-coded by sector and size. It’s an intuitive way to see what’s working and what’s not at a glance.

Stock Screener: The free screener is interesting. You can filter by dozens of fundamental and technical criteria to find stocks matching your specifications. It’s not as fast or customizable as TC2000, but for a free tool, it’s great.

Zacks — Earnings Calendar

What it does: Comprehensive earnings calendar and estimates

When we use it: Daily, to track upcoming and recent earnings reports

Cost: Free tier available

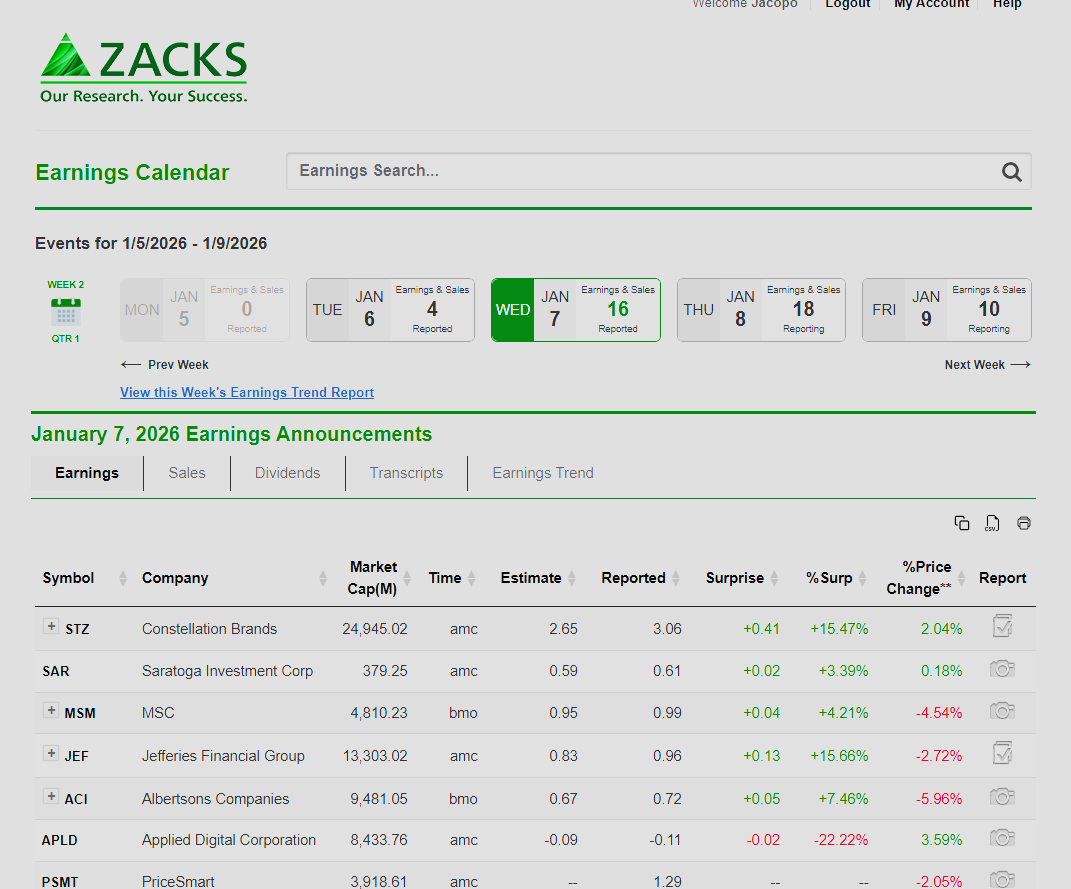

We use Zacks primarily for one thing: staying on top of earnings. The earnings calendar shows us which companies reported the previous day and which are reporting today, along with consensus estimates and actual results.

This is crucial for our process. We want to review earnings reports before the market opens, looking for companies that beat expectations, show strong guidance, or reveal something interesting in their commentary. Sometimes the best swing trade opportunities emerge on earnings day itself, when a strong report creates immediate momentum.

Zacks presents this information cleanly and reliably. That’s really all we need from it.

Tradervue — Your Trading Performance Lab

What it does: Trade journaling, performance analytics, pattern recognition

When we use it: Weekly and monthly performance reviews

Cost: Free tier available; paid subscription for advanced features

If you’re not journaling your trades, you’re flying blind. Tradervue transforms the tedious task of trade journaling into a powerful performance analysis system that reveals exactly what’s working, what’s not, and where you’re leaving money on the table.

How We Use Tradervue:

Trade Logging: Every trade we take gets logged in Tradervue: entry price, exit price, position size, the setup we were trading, our thesis, and how it played out. You can import trades directly from your broker or enter them manually. The platform automatically calculates your P&L, win rate, and key metrics.

Performance Analytics: This is where Tradervue earns its keep. The platform breaks down your performance across dozens of dimensions. Want to know if you’re more profitable trading long or short? Morning or afternoon? Large caps or small caps? Breakouts or pullbacks? Tradervue tells you.

Pattern Recognition: Over time, Tradervue helps you identify your behavioral patterns. Are you cutting winners too early? Letting losers run too long? Overtrading on certain days? Taking revenge trades after losses? These patterns are invisible in the moment but glaringly obvious when the data is aggregated and visualized.

Trade Reviews: The ability to attach charts, add detailed notes, and tag trades by setup type creates a searchable database of your trading history. When you want to review how you’ve historically traded a specific pattern or setup, everything is there. This is invaluable for continuous improvement.

Accountability: There’s something powerful about knowing every trade will be recorded and analyzed. It creates a psychological accountability that improves discipline. You’re less likely to take a marginal setup when you know you’ll have to justify it in your journal later.

Progress Tracking: Weekly and monthly reports show your trajectory over time. Are you improving? Stagnating? Regressing? The metrics tell the story. You can see your equity curve, track your consistency, and measure whether the changes you’re making to your process are actually improving results.

Why does this matter? Because most traders have no idea what their actual edge is. They remember their winners vividly and conveniently forget their losers. They think they’re profitable on a certain setup when the data shows they’re actually losing money on it. They believe they’re disciplined when their journal reveals they’re breaking their rules constantly.

Budget Alternative: A spreadsheet (Google Sheets or Excel) can serve as a basic trade journal if you’re disciplined about maintaining it. You’ll need to manually calculate metrics and create your own charts, but the core function (recording trades and tracking performance) is achievable for free. The downside is that it requires significantly more work and won’t provide the automated insights and pattern recognition that Tradervue delivers.

Interactive Brokers — Our Primary Broker

What it does: Full-service brokerage with global market access

When we use it: For all our swing trading positions

Cost: No account minimums; competitive per-share or tiered pricing

When it comes to brokers, we prioritize execution quality, reasonable commissions, and reliability over flashy features. Interactive Brokers checks all those boxes for our style of trading.

Why We Use Interactive Brokers:

Commission Structure: IB offers some of the most competitive commission rates in the industry. For the volume we trade, the per-share pricing (typically $0.005 per share with a $1 minimum) or tiered pricing structure keeps costs manageable. When you’re swing trading and holding positions for days or weeks, commissions aren’t as critical as they are for day traders, but they still matter. Every dollar saved on commissions is a dollar that stays in your account.

Options Trading: While we don’t trade options heavily, we do use them occasionally for defined-risk positions or to hedge existing holdings. IB’s options platform is robust, with competitive pricing and good execution. It’s there when we need it, which is exactly what we want.

Platform Reliability: IB’s Trader Workstation (TWS) is rock-solid. It’s not the prettiest interface (it’s functional rather than beautiful), but it’s stable, fast, and rarely has issues. When you’re managing real money, reliability trumps aesthetics every time.

Global Access: IB provides access to stocks, options, futures, and forex across multiple global markets. While we primarily trade U.S. equities, having the flexibility to access international markets if opportunities arise is valuable.

Account Management: Portfolio margin (for qualified accounts), detailed reporting, and comprehensive account management tools. Everything you need is there, even if it takes some time to learn where everything is.

The Limitation: Shorting:

Here’s where IB falls short for our needs: short-selling, particularly on small-cap or hard-to-borrow stocks. IB’s inventory of shares available to short is decent for large and mid-cap stocks, but when you want to short smaller, more volatile names (the kind that often present the best short opportunities), the shares often aren’t available, or the borrow costs are prohibitively expensive.

This isn’t a dealbreaker for us because we rarely short. Our strategy is primarily long-biased. When we do want short exposure, we have alternatives: buying put options or trading inverse ETFs. These aren’t perfect substitutes (options have time decay and inverse ETFs have tracking issues), but they’re workable solutions that let us express a bearish view without needing to borrow shares.

If short-selling was a core part of our strategy, we’d need a different solution. Which brings us to...

Cobra Trading & Centerpoint Securities — The Short-Selling Specialists

What they do: Brokers specializing in hard-to-borrow inventory and active trading

When you’d use them: If short-selling small caps is a significant part of your strategy

Cost: Higher commissions than IB; monthly platform fees; account minimums typically required

For traders who actively short small-cap stocks or need access to hard-to-borrow shares, these two brokers are the gold standard. We’ve used both, and they excel at what they do.

Cobra is probably one step ahead of Centerpoint, particularly in customer service. Their support team is exceptional: responsive, knowledgeable, and genuinely helpful. When you’re dealing with the complexities of short-selling and location fees, having a broker that actually answers the phone and solves problems quickly is invaluable.

Their inventory of hard-to-borrow shares is extensive. Stocks that are impossible to short at traditional brokers are often available at Cobra. Yes, you’ll pay borrowing fees, sometimes substantial ones, on the most in-demand shorts, but at least the shares are there.

The platform (typically DAS Trader Pro) is built for active traders. It’s fast, customizable, and designed for quick execution. The learning curve is steeper than IB’s TWS, but once you’re comfortable with it, it’s a powerful tool.

The tradeoff is cost. Commissions are higher than IB (though negotiable based on volume), there are monthly platform fees, and you’ll need to maintain a minimum account balance. This isn’t a broker for casual traders or small accounts. It’s for professionals who need specific capabilities and are willing to pay for them.

Centerpoint Securities (now ClearStreet)

CenterPoint is also excellent, with similar hard-to-borrow inventory and an active trader focus. The platform and execution quality are top-notch. The customer service is good: professional and competent.

The difference between Centerpoint and Cobra is subtle. Both will serve you well if short-selling is your game. Cobra edges ahead slightly in our experience, primarily due to the exceptional customer service. When you’re dealing with complex situations (rejected orders, locate issues, margin questions), having a support team that goes above and beyond makes a real difference.

Who Needs These Brokers:

If you’re a swing trader like us, primarily trading long positions with occasional shorts, you don’t need Cobra or Centerpoint. IB will serve you well, and you’ll save money on commissions and fees.

But if short-selling is a core component of your strategy and if you’re actively looking for overvalued small caps to short, then the investment in a specialized broker is worth it. The access to inventory and the execution quality will more than pay for the higher costs.

Budget Alternative:

For basic long-only trading, Webull and Robinhood offer commission-free trading with no account minimums. These are fine for beginners or small accounts. The execution quality isn’t as good as IB (you’re the product, not the customer; they’re selling your order flow), and the platforms are limited, but for learning and small-scale trading, they work.

For options trading on a budget, Tastytrade offers competitive options commissions and a platform designed specifically for options traders.

If you want to incorporate short-selling into your strategy but aren't ready for the account minimums and costs of Cobra or Centerpoint, TradeZero is worth considering. It's positioned as a middle ground between traditional retail brokers and the premium short-selling specialists.

Bottom Line on Brokers:

Your broker should match your strategy. We’re swing traders who occasionally use options and rarely short, so Interactive Brokers gives us everything we need at a reasonable cost. If your strategy is different—if you’re day trading, actively shorting, or trading complex options strategies—your broker choice should reflect that.

Don’t overpay for features you won’t use, but don’t cheap out on capabilities you actually need. Execution quality, reliability, and access to the instruments you trade are worth paying for.

Building Your Stack: Pro vs. Scrappy

Let’s bring this together with two complete setups—one for traders with budget flexibility, and one for those starting with limited capital.

The Pro Setup (What We Actually Use)

Briefing.com — Pre-market news and intelligence

TC2000 — Primary charting, scanning, and market breadth

Abacus AI — AI-powered research and analysis

X — Real-time market intelligence and idea generation (free)

Fiscal.ai — Deep fundamental data and document analysis

Seeking Alpha — Supplemental research on unfamiliar companies

Zacks — Earnings calendar

Finviz — Sector analysis and quick reference (free)

Total Monthly Cost: Approximately $200-300, depending on specific plan tiers

Who This Is For: Traders who are consistently profitable, managing significant capital, or treating trading as a serious business. The efficiency gains and information edge justify the cost.

The Scrappy Setup (Maximum Value, Minimum Cost)

Yahoo Finance — Pre-market news and basic fundamental data (free)

TradingView — Charting and basic scanning (free tier or $12.95/month for Pro)

ChatGPT or Claude — AI research assistant (free tier with limitations)

X — Real-time market intelligence and idea generation (free)

Finviz — Sector analysis, screening, news, insider trading (free)

Earnings Whispers — Earnings calendar (free)

Company IR Pages & SEC Filings — Direct access to earnings reports and filings (free)

Total Monthly Cost: $0-15, depending on whether you upgrade TradingView

Who This Is For: Beginning traders, those with limited capital, or anyone who wants to prove their strategy works before investing in premium tools.

Final Thoughts: Tools Don’t Make the Trader

Here’s the truth that’s easy to forget when you’re comparing platforms and subscription costs: tools don’t make you profitable.

Your process, discipline, and decision-making make you profitable. Tools just make the process more efficient.

We’ve seen traders with Bloomberg terminals and every premium service available lose money consistently. We’ve also seen traders with nothing but free tools and a solid strategy build substantial accounts.

Start with what you can afford. Focus on learning your craft—understanding price action, developing your edge, managing risk, controlling your psychology. As you grow and your trading generates income, you can gradually upgrade your toolkit.

The worst mistake is spending thousands on premium tools before you’ve proven you can trade profitably with basic ones. Master the fundamentals first. The fancy tools will still be there when you’re ready for them.

And remember: every tool we’ve mentioned is just an information source. The real work—the analysis, the decision-making, the risk management, the execution—that’s all on you. No platform can do that for you.

Build your stack thoughtfully, use each tool for its intended purpose, and always remember that the most important tool in your trading arsenal is the one between your ears.

This playbook is here to help. If you’re new or still finding your feet, we hope you got real, practical value from it. If you’re experienced, you’ll recognize a lot, but you may still catch a fresh angle, a small tweak, or a subtle shift that makes a difference.

The heart of it is simple: take what speaks to you and make it your own. Trading is personal. We all see the market differently. We move on different timeframes. We carry different risks, routines, strengths, and flaws.

There is no single right way. There is only your way.

Use it to sharpen your process, not to replace it.

Keep what resonates.

Let go of what doesn’t.

Build a style that fits who you are.

That is the most important thing.

Excellent list for all stripes of traders and investors. I liked that you included the ways in which you use each one of these tools.

Nice one, solid list