AfterHours Tales: Naval Ravikant's Harsh Truths in the Markets - ep. 1

The Mindset and Psychology of Financial Success + Exclusive gift

In the quiet moments before markets open, every trader faces the same challenge—not just analyzing charts or scanning headlines, but managing the most powerful and unpredictable trading tool: the human mind.

As traders and investors, we navigate a constant stream of information. Charts flash across screens, news alerts ping our devices, and social media buzzes with market opinions. Yet amid this digital symphony, the greatest insights about successful trading might come from timeless wisdom rather than real-time data.

This article explores the fascinating intersection between ancient principles of mindfulness and the modern practice of trading. Drawing inspiration from Naval Ravikant's and Chris Williamson's thought-provoking discussions (found in this three-hour conversation on YouTube), I've identified patterns and principles that resonate deeply with the trader's journey.

Throughout these lines, Ravikant's most powerful quotes serve as our guideposts. Each quote opens a doorway to deeper understanding, which we'll explore through practical discussion and real-world trading scenarios. Rather than presenting abstract concepts, we've paired each principle with concrete examples from market situations you'll likely recognize—moments of fear during sharp drawdowns, impulses to chase momentum, or the struggle to maintain conviction during market volatility.

These practical illustrations are designed to help you absorb these ideas quickly and apply them immediately to your trading practice. By seeing wisdom principles in action through familiar trading scenarios, you'll find these concepts easier to implement when facing similar situations in your trading journey.

As we take this moment to reflect, we're also considering our journey and progress on Substack. To add more value for our subscribers, we've decided to publish a monthly Portfolio recap. This will offer a clear view of our work and management strategies. Additionally, we're exploring the idea of creating a second Portfolio featuring only the most promising companies we believe in—often smaller but with immense potential for future growth.

While this approach carries some risk, it promises an exciting opportunity to see how these selections perform over time. We'd love your feedback on this idea; please feel free to send us your thoughts!

We're also thrilled to offer a special opportunity for those who join our Community with an exclusive price available from today until April 20th. There are just 20 seats available, and it might be the last promotion we run until Christmas—if at all.

This offer applies to both Annual and Founder memberships. Here's what you can expect from us:

As a paid subscriber, you will have access to:

Subscriber-only posts and the full archive

Community membership and real-time chat

Daily or weekly commentary and real-time operations from our swing trading desk

As a Founding member, you will have access to:

Exclusive Email Support for all your questions about trading, investing, and everything you need.

Quarterly Portfolio Reviews

Expert Stock Analysis On-Demand

You will strongly support our development as a team

"If you want to be successful, you must be choosy about your desires."

Naval Ravikant cuts to the heart of why so many people fail to achieve financial success in this profound statement. The modern world bombards us with infinite possibilities and desires – new investment opportunities, business ideas, trading strategies, and financial products appear daily. The instinct is to chase them all, spreading our resources thin and jumping from one hot opportunity to the next.

What Naval illuminates is that success doesn't come from pursuing every financial desire, but from careful, intentional selection of which goals truly matter. This selectivity functions as a filtering mechanism, removing the noise that distracts most investors and entrepreneurs. The paradox of choice applies powerfully to wealth building – having too many options often leads to decision paralysis or scattered efforts that yield mediocre results.

In the financial world, this translates directly to portfolio construction and career decisions. The most successful investors aren't those who dabble in every asset class or follow every market trend. Rather, they're individuals who develop deep expertise in specific domains and maintain focus despite market noise. Warren Buffett exemplifies this principle perfectly with his famous "circle of competence" approach – he only invests in businesses he thoroughly understands, deliberately choosing to ignore thousands of opportunities outside his area of expertise.

Consider the real-world example of an individual investor who constantly switches between day trading, cryptocurrency speculation, real estate flipping, and value investing. Despite intelligence and effort, they never develop mastery in any area. Their returns suffer from transaction costs, tax inefficiencies, and a lack of specialized knowledge. In contrast, someone who chooses to focus exclusively on, for instance, dividend growth investing – meticulously studying companies with consistent dividend increases, understanding their business models deeply, and building a concentrated portfolio of these businesses – often achieves superior long-term results through the power of specialized knowledge and compound interest.

🌱 Support Our Work: Buy Us a Coffee or Shop Our Services! 🌱

Your small gesture fuels our big dreams. Click below to make a difference today.

[☕ Buy Us a Coffee]

[🛒 Visit Our Shop]

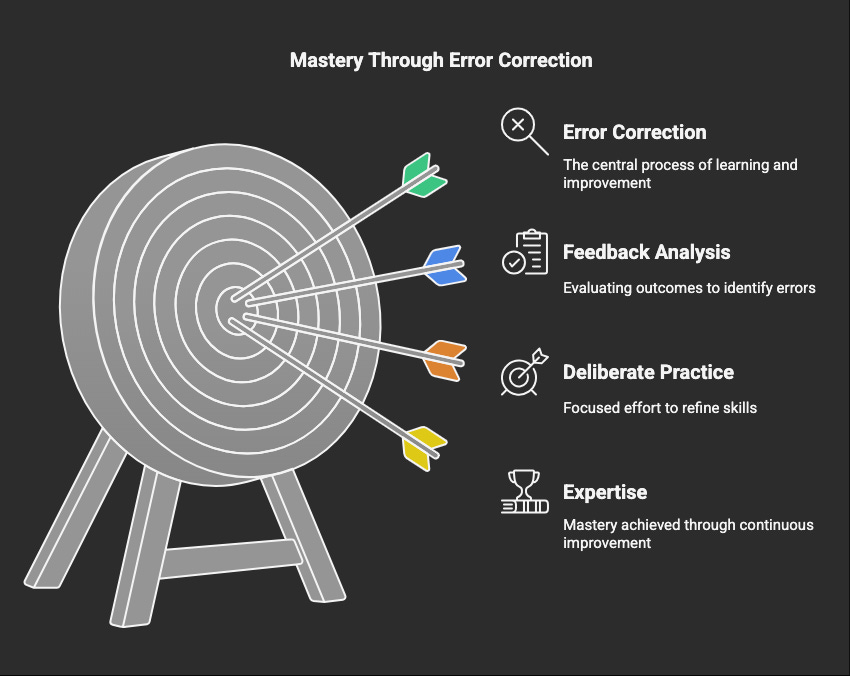

"If you get 10,000 error corrections at anything, you will be an expert at it."

Naval offers a powerful reframing of mastery here. Rather than the popular notion of "10,000 hours of practice," he emphasizes 10,000 error corrections – a crucial distinction that highlights the importance of deliberate, feedback-driven improvement. This perspective is revolutionary for financial skill development, where many practitioners engage in activities without proper feedback loops.

In trading and investing, the path to expertise isn't merely spending time in the market; it's systematically identifying mistakes, correcting them, and refining your approach. Each trade, investment decision, or financial move contains valuable information that, when properly analyzed, creates the foundation for expertise. The harsh truth embedded in this insight is that many market participants never improve because they fail to implement structured error correction – they make the same mistakes repeatedly without learning from them.

This principle applies across every financial discipline. Successful traders meticulously journal their trades and conduct post-mortems on both winners and losers. Value investors analyze their investment theses against actual outcomes to refine their analytical frameworks. Financial advisors solicit client feedback to improve their service models. In each case, the distinguishing factor between mediocrity and excellence isn't time spent, but errors identified and corrected.

A compelling real-world example comes from Ray Dalio, founder of Bridgewater Associates, the world's largest hedge fund. Dalio built his entire investment philosophy around error correction through "radical transparency" and "believability-weighted decision-making." Every investment decision at Bridgewater is scrutinized, challenged, and learned from, regardless of whose idea it was. This systematic approach to error identification and correction helped transform Bridgewater from a small operation in Dalio's apartment to a $150+ billion institutional powerhouse.

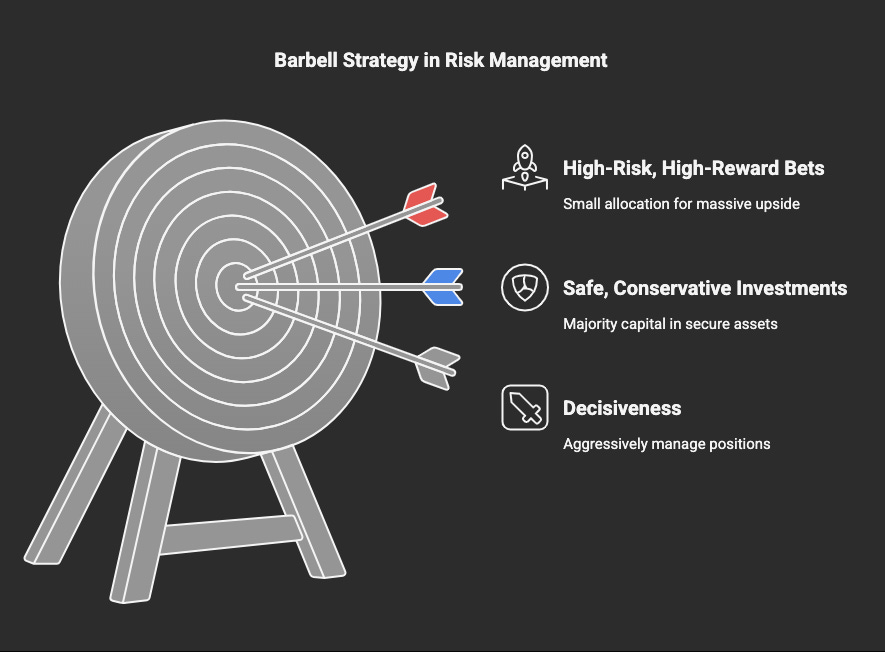

"The barbell strategy: go all-in when something works, but be willing to walk away quickly when it doesn't"

Naval here articulates a sophisticated approach to risk management that contradicts conventional wisdom about diversification and moderation. The barbell strategy suggests positioning yourself at two extremes – extreme safety on one end and calculated high-risk, high-reward bets on the other – while avoiding the mediocre middle.

In financial terms, this translates to keeping the majority of your capital in extremely safe, conservative investments while allocating a smaller portion to asymmetric opportunities with massive upside potential. The critical insight is the decisiveness required at both ends: aggressively scaling winning positions and ruthlessly cutting losers.

This approach directly challenges the institutional portfolio construction theory of evenly distributed risk across moderately correlated assets. Instead, it embraces the power law distribution often seen in venture capital, where a small number of investments generate the vast majority of returns. The harsh truth Naval conveys is that most "balanced" approaches to investing simply guarantee mediocre results.

The financial applications are numerous. In personal finance, it might mean keeping most savings in ultra-safe treasury bonds while allocating 10% to early-stage startups or cryptocurrency. In trading, it could manifest as using tight stop losses on speculative positions while letting winners run with trailing stops. For businesses, it suggests maintaining a healthy cash position while making concentrated bets on high-potential growth initiatives.

A fascinating real-world example comes from Nassim Taleb, who implemented this strategy as a trader. Taleb would allocate roughly 85-90% of his portfolio to extremely safe instruments like U.S. Treasury bills while using the remaining 10-15% for highly speculative options trades designed to profit from rare, extreme market moves. Most of his speculative bets expired worthless, but the occasional massive payoffs during market dislocations more than compensated for the small, regular losses. During the 1987 Black Monday crash, this strategy reportedly netted him tens of millions in a single day.

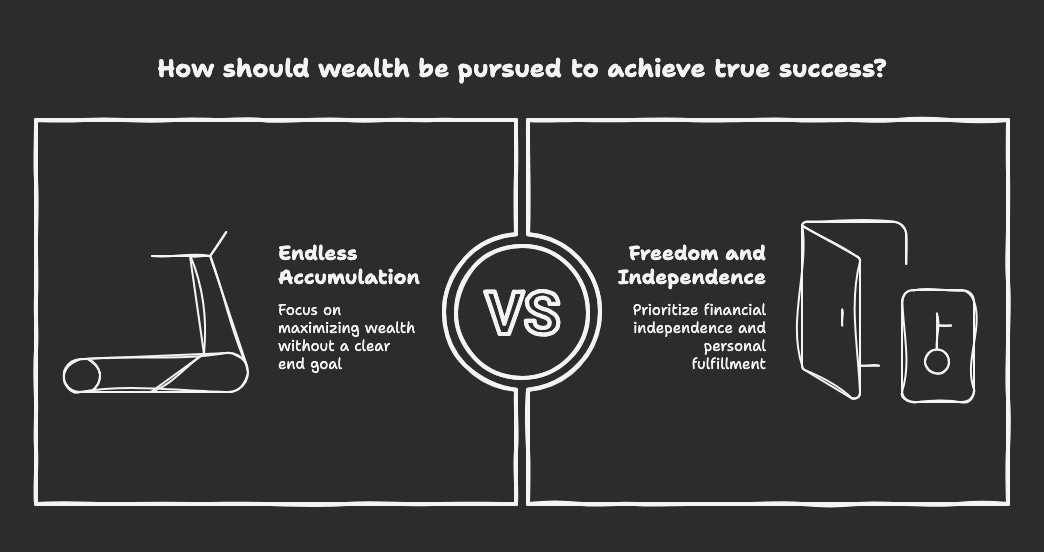

"The reason to win the game is to be free of it."

In this deceptively simple statement, Naval reveals a profound truth about the ultimate purpose of wealth accumulation that many successful people discover too late. The game of making money isn't meant to be played indefinitely – the victory condition isn't having the highest score (most money), but achieving liberation from financial concerns altogether.

This perspective fundamentally reframes the objective of financial pursuits. Rather than chasing wealth as an end in itself – an endless treadmill that never satisfies – Naval suggests wealth should serve as a means to freedom, optionality, and self-determination. This insight connects directly to the financial independence movement, where the goal isn't necessarily maximizing returns but reaching a specific threshold of passive income that covers your needs.

In the investment world, this shifts the focus from outperforming benchmarks or accumulating the largest possible portfolio to constructing assets that sustainably generate cash flow with minimal intervention. It suggests that at some point, capital preservation and reliable income become more important than growth and outperformance. For entrepreneurs, it means building businesses not to maximize valuation at all costs, but to create systems that eventually run independently of their time and effort.

The harsh truth embedded here is that many financially successful people remain trapped in the game long after they've "won," continuing to accumulate wealth they don't need while sacrificing time, health, relationships, and meaning – the very things wealth was supposed to enable.

Consider the real-world example of Jason Fried and David Heinemeier Hansson, founders of Basecamp (formerly 37signals). They deliberately chose to keep their company private and modest in size (around 50 employees) despite opportunities to raise venture capital and pursue hypergrowth. This decision has allowed them to maintain complete ownership, work reasonable hours, avoid the startup treadmill, and focus on creating products they believe in. They've effectively won the game and freed themselves from it, enabling a sustainable, balanced approach to business and life.

"Most of the gains in life come from suffering in the short term so you can get paid in the long term."

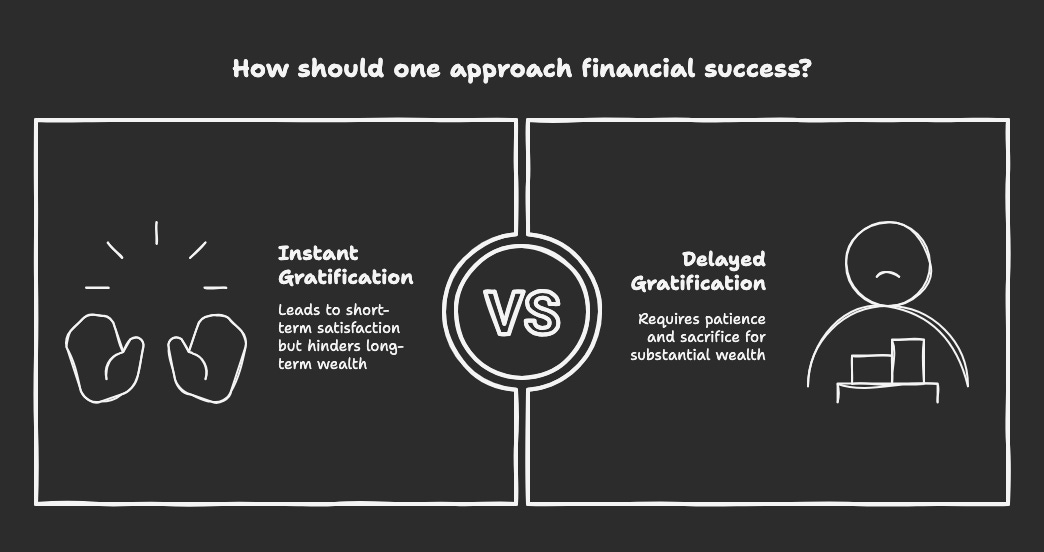

Naval here articulates the uncomfortable reality of delayed gratification that underlies virtually all meaningful financial accomplishment. The path to wealth inevitably involves sacrifice, difficulty, and often outright pain before the rewards materialize. This harsh truth directly contradicts the instant gratification culture that permeates modern society.

In the financial world, this principle manifests in countless ways. Saving for retirement means forgoing immediate consumption. Value investing requires the psychological fortitude to buy assets when others are fearful and prices are depressed. Building a business demands years of effort before substantial profits emerge. The stark reality Naval illuminates is that there are no shortcuts – the financial rewards worth having almost always require enduring difficulty first.

This insight helps explain why so few people achieve significant wealth despite widespread knowledge about the principles of investing and business. The emotional challenge of short-term suffering prevents most from staying the course long enough to reap the rewards. Most investors can't stomach the temporary losses required for long-term gains. Most entrepreneurs give up before their ventures gain traction. Most savers find reasons to raid their investments before compound interest works its magic.

A powerful real-world example is Amazon and its early investors. For years after its IPO, Amazon plowed all potential profits back into growth, reporting minimal earnings or outright losses. The stock experienced multiple 50%+ drawdowns, and shareholders endured years of criticism from analysts who questioned the business model. Those who held through this extended period of "suffering" have been rewarded with one of the greatest investment returns in modern history – $10,000 invested in Amazon's IPO would be worth over $12 million today. This extraordinary outcome required the fortitude to endure nearly a decade of uncertainty and paper losses before the long-term vision materialized.

This principle becomes especially relevant as markets face increasing uncertainty about a potential US recession in 2025. According to Polymarket's prediction markets, investors currently place the odds at roughly 50/50 for a US economic contraction next year—a coin flip that creates both anxiety and opportunity.

While many investors might panic-sell at the first signs of economic weakness, those with the psychological fortitude to maintain strategic positions during short-term suffering may find themselves uniquely positioned for outsized returns when markets eventually recover. As Naval might suggest, the ability to endure temporary market pain while others flee could be the defining characteristic separating successful investors from the crowd in the coming economic cycle.

"The more seriously you take yourself, the unhappier you're gonna be."

With this insight, Naval highlights the destructive role of ego in financial decision-making. Taking yourself too seriously creates rigid identity attachments to specific strategies, positions, or predictions – attachments that inevitably lead to cognitive biases and emotional suffering when markets move against you.

In the financial world, this manifests as confirmation bias, loss aversion, and the endowment effect – psychological tendencies that destroy returns by preventing rational adaptation to new information. Investors who strongly identify with particular market views often ignore contradictory evidence, doubling down on losing positions rather than accepting they were wrong. Traders who view their win rate as a reflection of their worth make progressively worse decisions as they try to protect their self-image rather than their capital.

The harsh truth is that markets don't care about your ego, identity, or self-image. They ruthlessly punish those who prioritize being right over making money. The most successful investors maintain what psychologists call a "growth mindset" – they see setbacks as learning opportunities rather than threats to their identity, enabling them to adapt quickly and make better decisions.

A striking real-world example is Bill Ackman's massive short position against Herbalife. After publicly declaring the company a pyramid scheme destined for collapse, Ackman maintained the position for years despite mounting losses, reportedly totaling over $1 billion. His public identity became so intertwined with this short thesis that admitting defeat became psychologically impossible. Meanwhile, investors who approached the situation with less ego attachment – including Carl Icahn – profited significantly by taking the opposite side of the trade. Ackman eventually closed the position at a substantial loss, a costly lesson in the dangers of taking yourself too seriously in markets.

Funny how everyone wants to master the markets, but nobody wants to master themselves. Naval's right: most people are self-medicating with volatility. Until you treat the market less like a casino and more like a mirror, you’ll keep mistaking noise for opportunity and pain for progress.

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e