40. Weekly Market Recap: Key Movements & Insights

S&P 500 Recovers! 🏆📈 Trade Optimism vs. Moody’s Credit Cut

Stocks Recover 2025 Losses as Trade Talks, Moody’s Downgrade, and Inflation Data Shape Market Sentiment

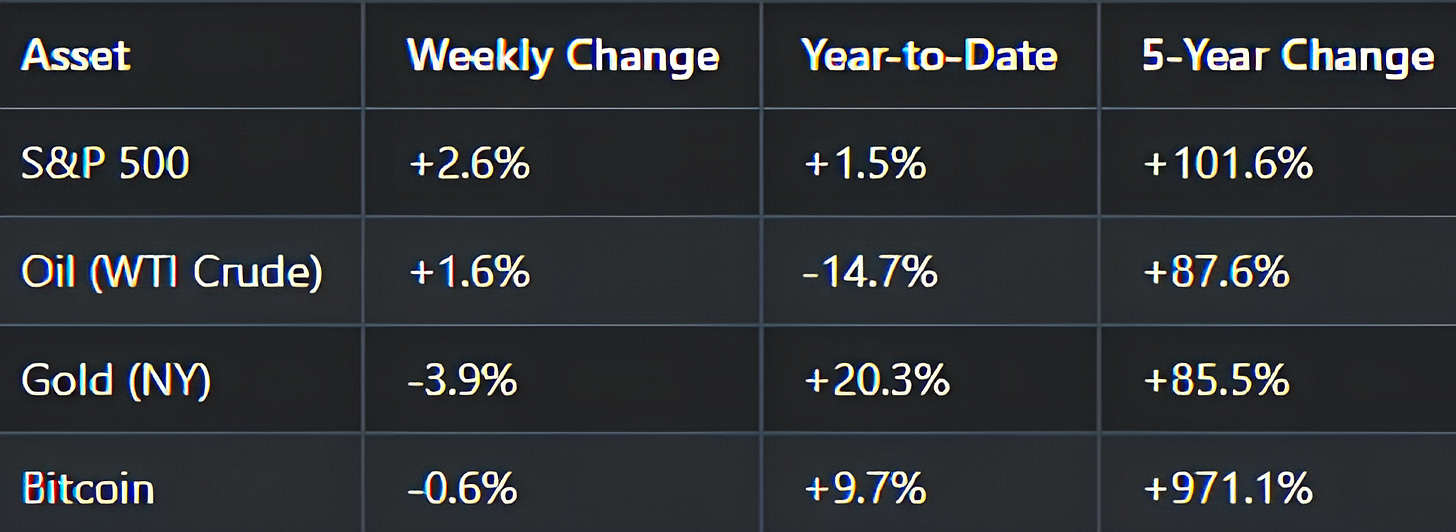

After a challenging start to the year, the S&P 500 has finally erased its 2025 losses, climbing 2.6% this week. Investors cheered a temporary U.S.-China tariff reduction, a softer-than-expected inflation report, and strong performance in key sectors, even as Moody’s downgraded U.S. debt and consumer sentiment hit near-record lows.

Trade Optimism Fuels Market Rally

The week began on a high note after the White House announced a temporary agreement with China to lower tariffs, a move widely seen as a step toward de-escalating trade tensions. Both countries agreed to reduce tariffs to 80% and 100%, respectively, from their previous highs of 145% and 125%. The news sparked optimism that the agreement could help stave off a recession, lifting equities across the board.

By Tuesday, the S&P 500 had fully retraced its 2025 losses, closing above the year’s opening level. Nvidia (NVDA) was a standout performer, surging over 16% on news of a major chip deal with the UAE. Meanwhile, a softer-than-expected Consumer Price Index (CPI) report signaled progress in the fight against inflation, further boosting investor confidence.

However, the rally faced headwinds on Friday as Moody’s downgraded the U.S. credit rating from AAA to Aa1, citing rising government debt and political instability. Despite the downgrade, markets held steady, with the S&P 500 ending the week up 2.6%.

Sector Winners and Losers

Sector performance reflected the week’s mixed signals. Consumer durables, electronic technology, and transportation led the way, while health services, non-energy minerals, and communications lagged.

Gold prices fell 3.9% as investors shifted focus to equities and other risk assets, while Bitcoin held steady after last week’s surge. Oil prices rose early in the week on cooling recession fears but pulled back later on news of a potential U.S.-Iran nuclear deal.

Key Market Metrics

Source: Yahoo Finance, as of May 16, 2025

Moody’s Downgrade Adds to Uncertainty

On Friday, Moody’s stripped the U.S. of its last perfect credit rating, downgrading it to Aa1. The agency cited ballooning deficits, rising interest payments, and political gridlock as key factors. This marks the third major downgrade of U.S. debt in recent history, following similar moves by Fitch in 2023 and S&P in 2011.

Moody’s noted that the downgrade reflects long-term fiscal challenges, including the growing debt burden and the unique U.S. debt ceiling mechanism. However, the agency maintained a “stable” outlook, citing the country’s strong institutional framework and effective monetary policy.

The downgrade could lead to higher Treasury yields, increasing borrowing costs for the government and consumers alike.

“This is a wake-up call for policymakers to address the structural issues in our fiscal policy,” said a Moody’s spokesperson.

Consumer Sentiment Hits Near-Record Low

Despite the market rally, consumer sentiment continued to deteriorate. The University of Michigan’s consumer sentiment index fell to 50.8 in May, its second-lowest reading on record. The index has dropped nearly 30% since January, reflecting widespread pessimism about the economy amid ongoing trade tensions and inflationary pressures.

"Americans are feeling the pinch of higher prices and uncertainty about the future," said several major economists. "The trade war and political instability are weighing heavily on consumer confidence."

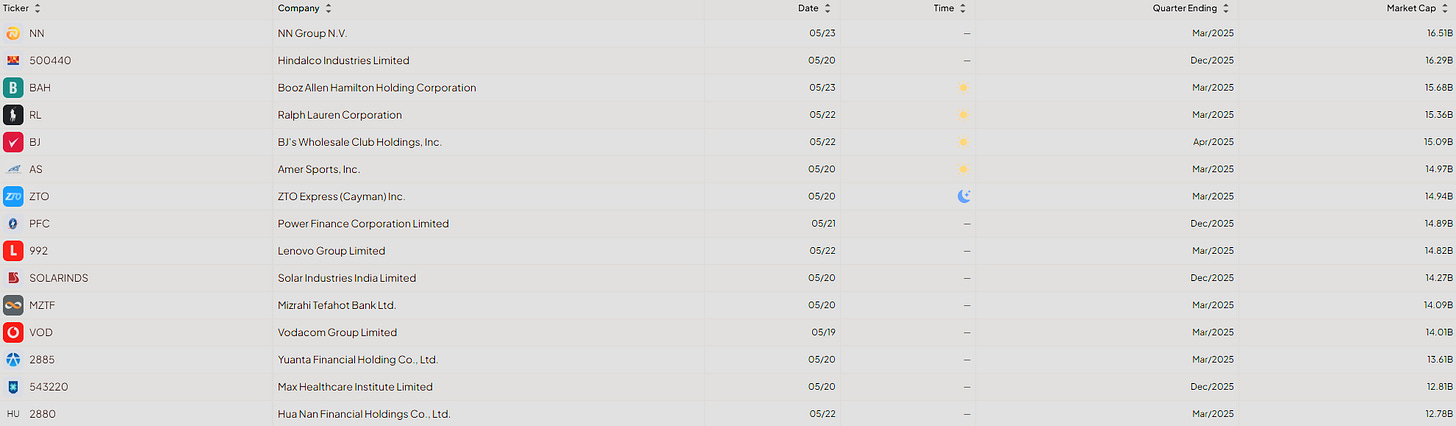

Upcoming Key Events:

Monday, May 19:

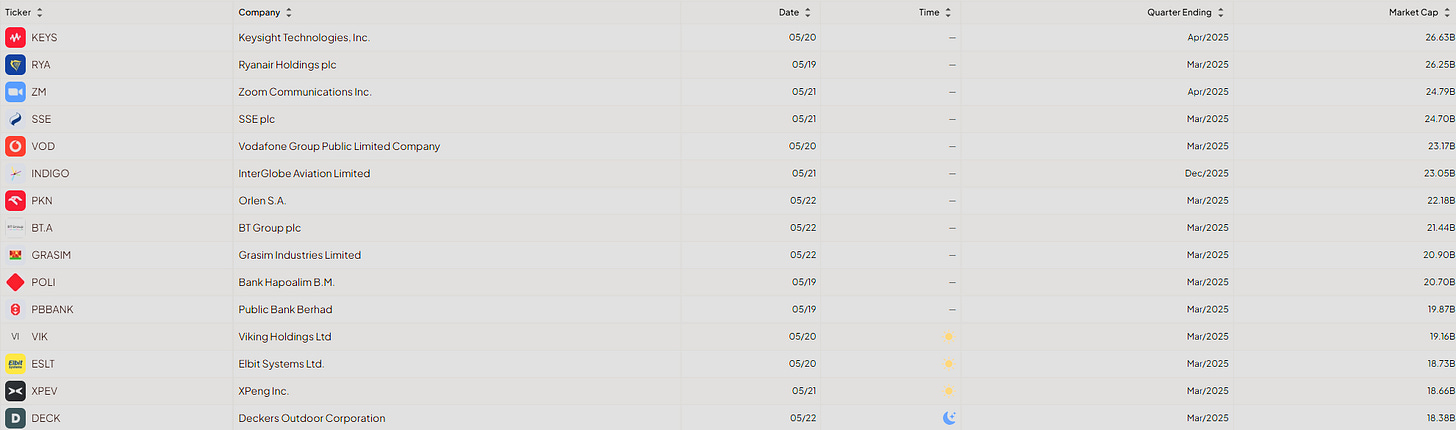

Earnings: Ryanair Holdings plc (RYA), Trip.com Group Limited (TCOM)

Economic Data: None

Tuesday, May 20:

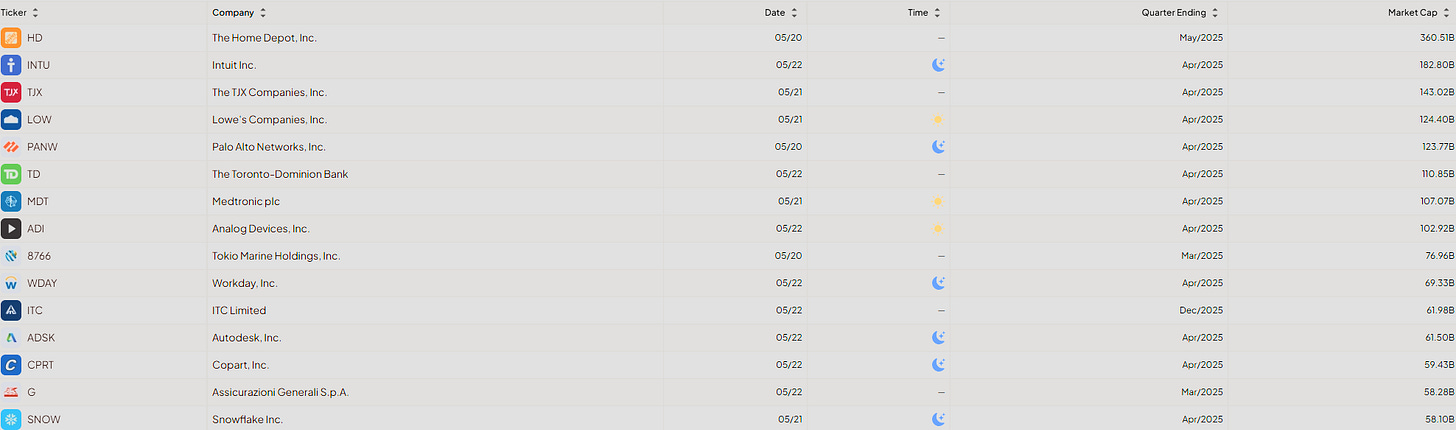

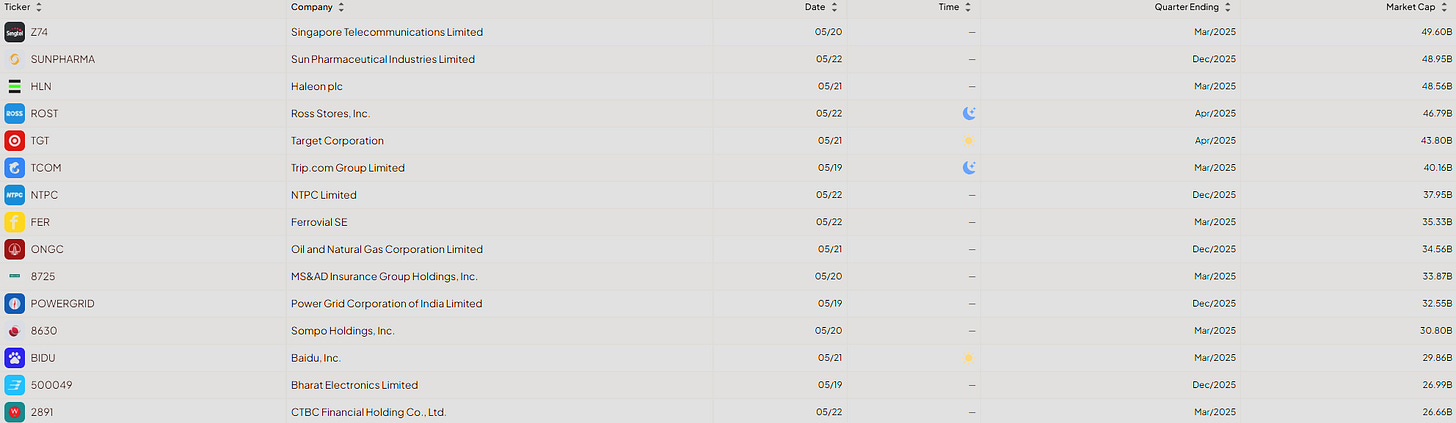

Earnings: The Home Depot, Inc. (HD), Palo Alto Networks, Inc. (PANW)

Economic Data: API Crude Oil Stock Change

Wednesday, May 21:

Earnings: Lowe's Companies, Inc. (LOW), Medtronic plc (MDT), Snowflake Inc. (SNOW), Target Corporation (TGT)

Economic Data: MBA 30-Year Mortgage Rate, EIA Crude Oil Stocks Change

Thursday, May 22:

Earnings: Intuit Inc. (INTU), Autodesk, Inc. (ADSK)

Economic Data: Existing Home Sales

Friday, May 23:

Earnings: Booz Allen Hamilton Holding Corporation (BAH)

Economic Data: None

Here are the most pertinent earnings details.

Due to the volume of reports during the earnings season, it is not feasible to include every single one in our calendar.

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Finchat.io data. Explore now →

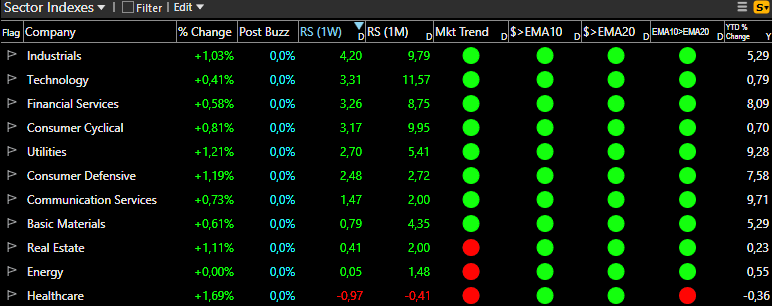

Index Insights: How Major Benchmarks Performed Last Week

Price>MA10: 🟢

Price>MA20: 🟢

MA10>MA20: 🟢

Market Trend*:🟢

Trend Signal: 🟢

*When Price and Moving Averages are all green, the Market Trend will also be green

Price>MA10: 🟢

Price>MA20: 🟢

MA10>MA20: 🟢

Market Trend: 🟢

Trend Signal: 🟢

Price>MA10: 🟢

Price>MA20: 🟢

MA10>MA20: 🟢

Market Trend: 🟢

Trend Signal: 🟢

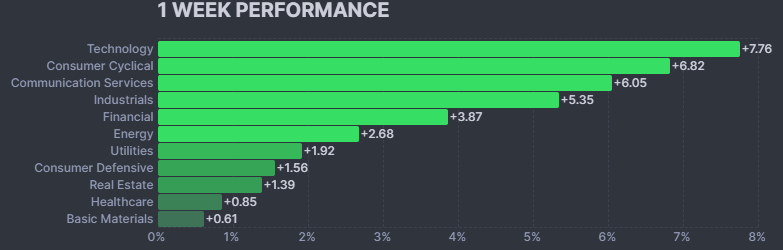

Sector Performance: Winners and Losers from Last Week

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

Winners

💻 Technology (+7.76%)

Technology led the week with a remarkable 7.76% gain, highlighting strong momentum in innovation and digital transformation. This sector’s robust performance underscores its leadership in driving market growth.

🛍️ Consumer Cyclical (+6.82%)

Consumer Cyclical stocks surged by 6.82%, reflecting renewed optimism in discretionary spending and retail. Positive consumer sentiment and economic data likely contributed to this impressive growth.

📱 Communication Services (+6.05%)

Communication Services climbed 6.05%, benefiting from increased demand for digital content and connectivity, as well as strong performance from leading industry players.

🏭 Industrials (+5.35%)

Industrials posted a solid 5.35% gain, reflecting steady growth in manufacturing and infrastructure. This performance highlights the sector’s resilience and its role in supporting global economic activity.

💰 Financial (+3.87%)

Financials advanced by 3.87%, indicating stability and renewed confidence in banking and financial services amid a favorable economic outlook.

🛢️ Energy (+2.68%)

Energy gained 2.68%, supported by stable commodity prices and consistent demand for energy resources.

⚡ Utilities (+1.92%)

Utilities rose by 1.92%, benefiting from their defensive characteristics and steady demand, particularly during uncertain market conditions.

🛡️ Consumer Defensive (+1.56%)

Consumer Defensive stocks increased by 1.56%, suggesting ongoing demand for essential goods and services.

🏢 Real Estate (+1.39%)

Real Estate saw a 1.39% gain, reflecting resilience in property markets and investment activity.

🏥 Healthcare (+0.85%)

Healthcare posted a modest 0.85% increase, indicating cautious optimism and ongoing developments within the sector.

🧱 Basic Materials (+0.61%)

Basic Materials rose by 0.61%, driven by steady demand for commodities and positive sentiment in resource-based industries.

Losers

All sectors posted gains this week. No sectors were in negative territory according to the latest data.

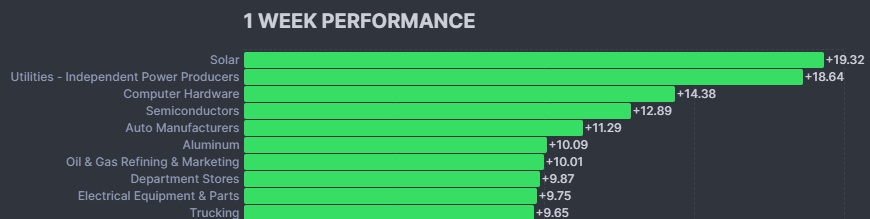

🌟 Weekly Industry Leaders 🌟

☀️ Solar (+19.32%)

Solar led all industries this week with an outstanding 19.32% gain. The sector’s surge reflects strong demand for renewable energy and significant advancements in solar technology.

⚡ Utilities – Independent Power Producers (+18.64%)

Independent Power Producers in the Utilities sector followed closely, posting an impressive 18.64% increase. This performance highlights the growing importance of alternative and independent energy sources.

💻 Computer Hardware (+14.38%)

Computer Hardware gained 14.38%, driven by robust demand for new technology and ongoing digital transformation across industries.

🔌 Semiconductors (+12.89%)

Semiconductors rose by 12.89%, benefiting from continued innovation and high demand for chips in various sectors, including automotive and consumer electronics.

🚗 Auto Manufacturers (+11.29%)

Auto Manufacturers posted an 11.29% gain, reflecting strong sales and renewed interest in electric and next-generation vehicles.

🥄 Aluminum (+10.09%)

Aluminum advanced by 10.09%, supported by increased industrial demand and favorable commodity prices.

🛢️ Oil & Gas Refining & Marketing (+10.01%)

Oil & Gas Refining & Marketing saw a 10.01% increase, driven by stable energy prices and consistent demand for refined products.

🏬 Department Stores (+9.87%)

Department Stores gained 9.87%, indicating strong consumer spending and positive retail trends.

🔧 Electrical Equipment & Parts (+9.75%)

Electrical Equipment & Parts rose by 9.75%, reflecting robust demand for industrial and infrastructure-related products.

🚚 Trucking (+9.65%)

Trucking rounded out the top performers with a 9.65% gain, highlighting the ongoing strength in logistics and transportation.

🚀 Top Market Gainers: Mergers, Bitcoin Treasuries, and Strategic Partnerships Drive Explosive Moves

INZY Inozyme Pharma Inc (+243.04%) 💊

BioMarin’s announcement of a $270 million acquisition of Inozyme Pharma sent INZY shares soaring by over 240%. The deal, which highlights the growing appetite for innovative biotech assets, ignited a buying frenzy as investors rushed to capture the premium.

KDLY Kindly MD Inc (+224.36%) 🪙

KindlyMD rocketed higher after David Bailey and Bitcoin-Native Holding Company Nakamoto revealed a landmark merger with KindlyMD to establish a Bitcoin treasury. The move taps into the surging trend of companies adding Bitcoin to their balance sheets, fueling investor excitement and a massive rally.

NWTN NWTN Inc (+222.80%) 🚗

NWTN Inc., a leader in sustainable energy and mobility, announced a strategic joint venture with W Motors Automotive Group Holding Limited. The partnership aims to expand their automotive business across diverse mobility projects, combining NWTN’s global network with W Motors’ design and technology expertise. The news sparked a sharp rally as investors bet on the future of sustainable vehicles in the Middle East and beyond.

GRYP Gryphon Digital Mining Inc (+144.17%) ⛏️

Gryphon Digital Mining surged after news broke that the Trump family’s crypto company, American Bitcoin, is going public via a merger with Gryphon. The deal positions Gryphon at the center of the crypto mining narrative, attracting speculative interest and driving shares sharply higher.

CTMX CytomX Therapeutics Inc (+122.92%) 🧬

CytomX Therapeutics jumped after reporting strong Q1 2025 results and providing a bullish business update. The company’s lead candidate, CX-2051, showed promising interim clinical results in advanced colorectal cancer, with plans to advance to Phase 2 trials in 2026. CEO Sean McCarthy highlighted the rapid progress and strategic focus, reassuring investors and fueling the rally.

🔻 Biggest Decliners: Scams, Earnings Misses, and Macro Headwinds Hammer Stocks

WYHG Wing Yip Food Holdings Group (-83.54%) 🏮

Wing Yip Food Holdings suffered a dramatic collapse, widely attributed to a classic pump-and-dump scheme. The stock’s rapid rise and fall mirror a familiar pattern among certain China-based equities, raising red flags for investors.

SUP Superior Industries International Inc (-81.88%) 🚙

Superior Industries plunged after a disastrous earnings call, where management dodged key questions about major clients. The lack of transparency spooked investors, who punished the stock for poor communication and uncertainty about future business.

LGPS LogProstyle Inc (-77.31%) 🏯

LogProstyle, another suspected pump-and-dump, crashed as investors fled. Despite using a Japanese trading vehicle, the underlying story is similar to WYHG, with market manipulation suspected as the primary driver of the extreme volatility.

REE REE Automotive Ltd (-71.89%) ⚡

REE Automotive tumbled after its earnings call revealed significant challenges from US tariffs and trade policies, leading to a temporary production pause. The company’s uncertain outlook and questions about its ability to continue as a going concern triggered a wave of selling.

NAOV NanoVibronix Inc (-68.45%) 💸

NanoVibronix shares were hammered following the closing of a $10 million public offering of preferred stock and warrants. The dilution and capital raise raised concerns about the company’s financial health, sending the stock sharply lower.

🌱 Support Our Work: Buy Us a Coffee or Shop Our Services! 🌱

Your small gesture fuels our big dreams. Click below to make a difference today.