37. Weekly Market Recap: Key Movements & Insights

Wall Street’s Wild Week: Tariffs, Tech Giants, and Consumer Jitters 🏦📰

Markets Rally as Tariff Uncertainty and Big Tech Earnings Take Center Stage

This past week, the stock market staged a dramatic comeback, with a robust rally erasing Monday’s steep losses from Tuesday onward. Investors navigated a landscape shaped by shifting tariff rhetoric, major earnings reports, and a sharp drop in consumer sentiment. As the new week approaches, all eyes are on further tariff developments, a packed earnings calendar featuring several Mag 7 giants, and a slew of key economic data releases.

Tariff Talk Fuels Market Swings

Tariff headlines once again dominated market sentiment. Monday saw stocks tumble as renewed trade tensions sent investors scrambling for safety. However, Tuesday's softer tone from the Trump administration sparked a bullish reversal that carried through the week. The S&P 500 surged more than 5%, buoyed not only by easing trade anxieties but also by a significant drop in oil prices—WTI crude fell to just over $63 per barrel, down sharply from early April highs.

President Trump’s recent comments suggest that tariff negotiations will remain a key market driver. In an exclusive Time Magazine interview, Trump claimed to have “failed over 200 trade agreements,” likening the U.S. to a “giant department store” in need of price adjustments. Despite the rhetoric, markets remain skeptical about the substance of these deals.

Meanwhile, Trump denied that bond market volatility influenced his decision to pause tariffs for 90 days, and he authorized deep-sea mining for nickel and rare earths to counter China’s supply chain dominance. Citadel CEO Ken Griffin, however, warned that the administration’s tariff strategy could damage U.S. Treasury credibility and the nation’s global reputation.

Consumer Sentiment Sinks to Multi-Year Lows

The University of Michigan’s April survey revealed that consumer sentiment plunged 8% from March, marking the steepest monthly drop since 1990 and the fourth-lowest reading since 1952. Concerns over trade policy and inflation weighed heavily on Americans’ outlook, with expectations deteriorating across income, age, and political lines.

Despite the gloomy mood, the market’s reaction was muted. The Dow slipped 0.5%, the S&P 500 dipped 0.15%, and the Nasdaq eked out a 0.1% gain as investors digested the data. The disconnect between sentiment and spending remains a puzzle for economists and policymakers, especially as the job market cools and pandemic-era savings dwindle.

China Softens, Apple Shifts, and Bitcoin Surges

In a sign of possible de-escalation, China rolled back some of its 125% retaliatory tariffs on U.S. semiconductors, according to CNN. Apple, meanwhile, announced plans to shift all U.S.-bound iPhone production to India by 2026, doubling its capacity in the region as trade tensions with China persist.

Bitcoin had a standout week, jumping nearly 12% and closing in on the $100,000 mark. Gold, on the other hand, slipped 2.1% but remains up nearly 25% year-to-date.

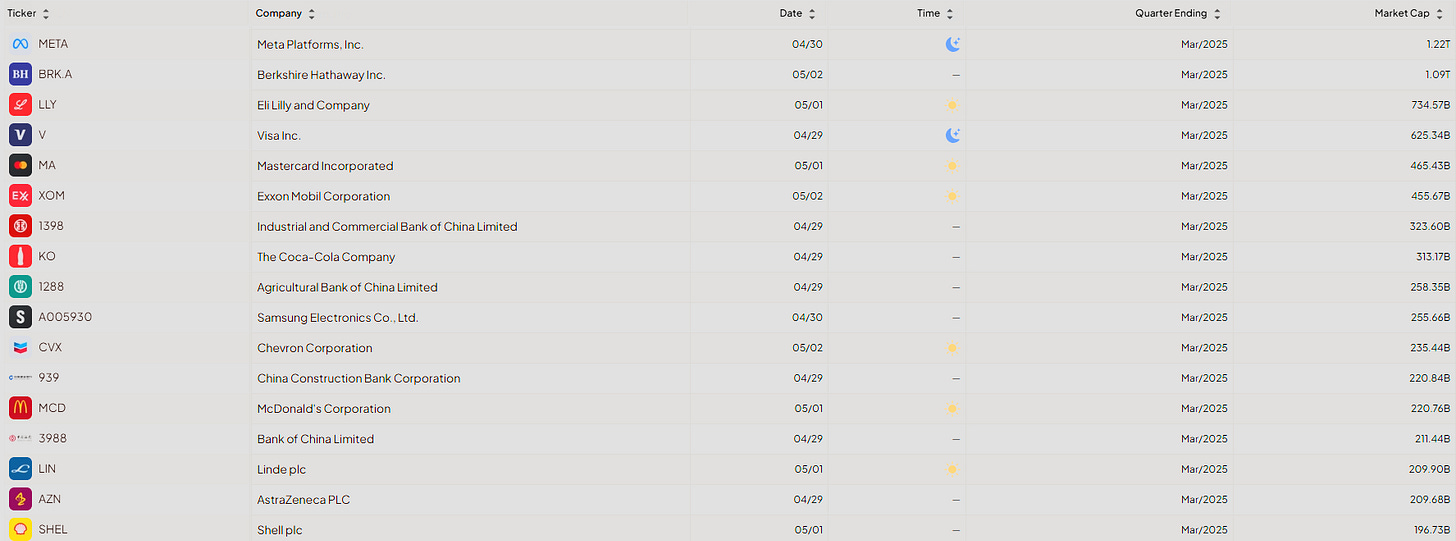

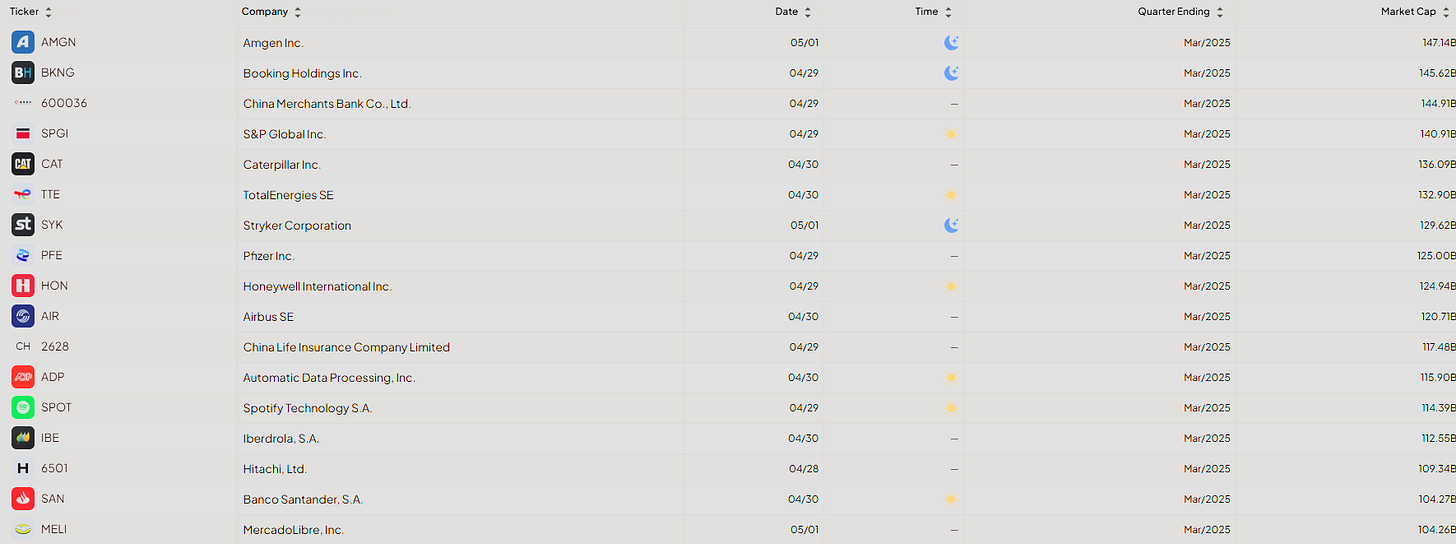

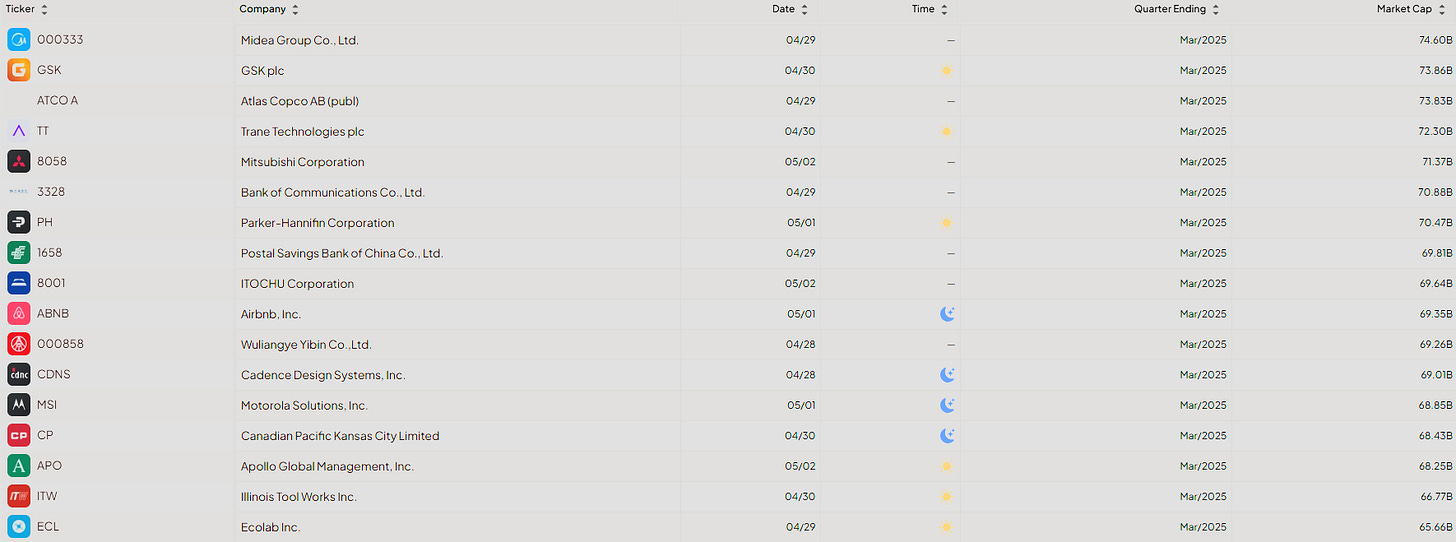

Upcoming Key Events:

Monday, April 28:

Earnings: Hitachi, Ltd. (6501), Waste Management, Inc. (WM)

Economic Data: Dallas Fed Manufacturing Index

Tuesday, April 29:

Earnings: Amazon (AMZN), Visa (V)

Economic Data: JOLTs Job Openings, CB Consumer Confidence APR, Personal Income MoM,

Wednesday, April 30:

Earnings: Microsoft (MSFT), Meta Platforms (META)

Economic Data: GDP Growth Rate QoQ Adv, Core PCE Price Index MoM, Personal Income MoM, Personal Spending MoM

Thursday, May 1:

Earnings: Apple (AAPL), Mastercard (MA), Eli Lilly and Company (LLY)

Economic Data: ISM Manufacturing PMI

Friday, May 2:

Earnings: Berkshire Hathaway Inc. (BRK.A), Chevron Corporation (CVX)

Economic Data: Non-Farm Payrolls, Unemployment Rate

Here are the most pertinent earnings details.

Due to the volume of reports during the earnings season, it is not feasible to include every single one in our calendar.

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Finchat.io data. Explore now →

Index Insights: How Major Benchmarks Performed Last Week

Price>MA10: 🟢

Price>MA20: 🟢

MA10>MA20: 🔴

Market Trend*:🔴

Trend Signal: 🟢

*When Price and Moving Averages are all green, the Market Trend will also be green

Price>MA10: 🟢

Price>MA20: 🟢

MA10>MA20: 🔴

Market Trend: 🔴

Trend Signal: 🟢

Price>MA10: 🟢

Price>MA20: 🔴

MA10>MA20: 🔴

Market Trend: 🔴

Trend Signal: 🟡

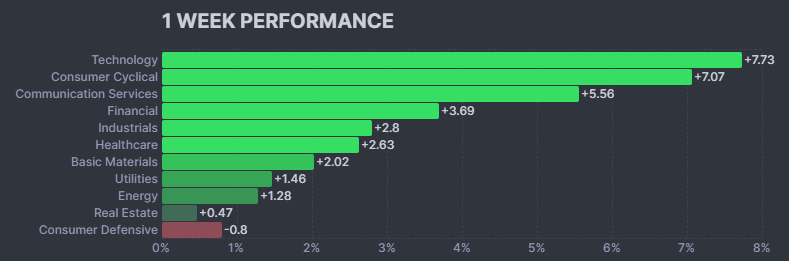

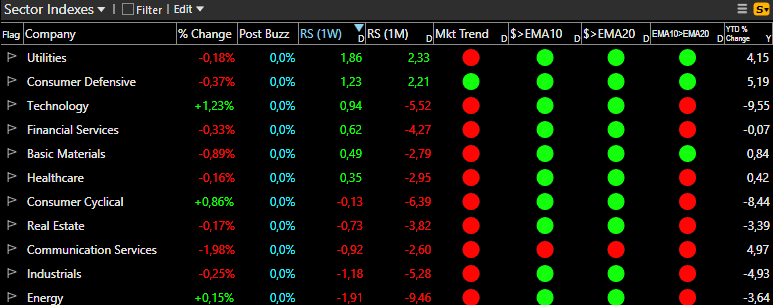

Sector Performance: Winners and Losers from Last Week

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

Winners

💻 Technology (+7.73%)

Leading all sectors this week, Technology surged ahead with the strongest performance. The sector’s impressive gains reflect robust investor confidence, likely fueled by innovation momentum and strong earnings reports.

🛍️ Consumer Cyclical (+7.07%)

Consumer Cyclical stocks followed closely, posting significant gains. This performance suggests renewed optimism in discretionary spending and retail, possibly driven by positive consumer sentiment and economic data.

📱 Communication Services (+5.56%)

Communication Services delivered solid returns, benefiting from increased demand for digital content and connectivity. The sector’s growth highlights its resilience and relevance in a tech-driven market.

💰 Financial (+3.69%)

Financials experienced healthy gains, indicating growing confidence in banking and financial services. Improved economic outlooks and stable interest rates may have contributed to the sector’s positive momentum.

🏭 Industrials (+2.8%)

Industrials posted steady growth, reflecting ongoing strength in manufacturing and infrastructure. The sector’s performance points to continued recovery and expansion in global industrial activity.

🏥 Healthcare (+2.63%)

Healthcare stocks advanced, maintaining their reputation as a stable and defensive sector. The gains suggest ongoing demand for healthcare services and products.

🧱 Basic Materials (+2.02%)

Basic Materials saw moderate gains, likely driven by steady demand for commodities and positive market sentiment around resource-based industries.

⚡ Utilities (+1.46%)

Utilities posted modest gains, supported by their defensive characteristics and consistent demand, especially during periods of market uncertainty.

🛢️ Energy (+1.28%)

Energy stocks edged higher, reflecting stable commodity prices and ongoing demand for energy resources.

🏢 Real Estate (+0.47%)

Real Estate experienced slight gains, indicating cautious optimism in property markets and investment activity.

Losers

🛒 Consumer Defensive (-0.8%)

Consumer Defensive was the only sector to post a loss this week. The slight decline suggests some rotation out of defensive names as investors favored higher-growth sectors, despite the sector’s traditional stability during volatility.

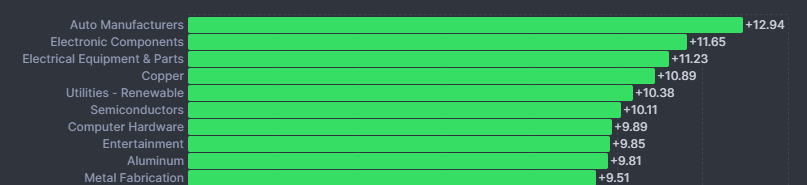

🌟 Weekly Industry Leaders: Precious Metals and Energy Shine

🚗 Auto Manufacturers (+12.94%)

Auto Manufacturers led all industries with outstanding gains this week. The sector’s surge reflects strong demand for vehicles, innovation in electric mobility, and positive earnings momentum.

🔌 Electronic Components (+11.65%)

Electronic Components posted impressive growth, benefiting from robust demand in consumer electronics, industrial automation, and ongoing supply chain improvements.

⚡ Electrical Equipment & Parts (+11.23%)

Electrical Equipment & Parts saw significant gains, driven by increased investment in infrastructure, electrification trends, and modernization projects across industries.

🥉 Copper (+10.89%)

Copper prices and related stocks climbed, supported by rising global demand for industrial metals and optimism around infrastructure spending and green energy initiatives.

🌱 Utilities – Renewable (+10.38%)

Renewable Utilities delivered a strong performance, reflecting growing investment in clean energy and supportive policy environments for sustainable power generation.

💻 Semiconductors (+10.11%)

Semiconductors continued their rally, fueled by persistent demand for chips in AI, automotive, and consumer electronics, as well as easing supply constraints.

🖥️ Computer Hardware (+9.89%)

Computer Hardware companies posted robust gains, likely driven by new product launches, enterprise upgrades, and increased technology spending.

🎬 Entertainment (+9.85%)

Entertainment stocks advanced, benefiting from strong content releases, streaming growth, and improving consumer engagement.

🪙 Aluminum (+9.81%)

Aluminum producers saw notable gains, supported by higher commodity prices and increased demand from construction and manufacturing sectors.

🔩 Metal Fabrication (+9.51%)

Metal Fabrication rounded out the top performers, reflecting strength in industrial production and infrastructure development.

🚀 Top Market Gainers: Strategic Placements, Bitcoin Ambitions, and Speculative Surges Drive Explosive Growth

UPXI Upexi Inc (+576.25%)

💰Upexi soared after announcing the closing of a $100 million private placement. The substantial capital injection has fueled speculation about the company’s next moves, with investors piling in on hopes of aggressive expansion or strategic acquisitions.

CEP Cantor Equity Partners Inc (+192.45%)

₿ Backed by Tether and SoftBank Group, Cantor Equity Partners is making headlines with the upcoming launch of “Twenty One,” a Bitcoin-focused entity expected to debut with over 42,000 Bitcoin. Co-founder Jack Mallers will lead as CEO, and the company aims to maximize Bitcoin Ownership Per Share. Twenty One is positioning itself as a one-stop vehicle for Bitcoin exposure, advocacy, and media, with plans to expand into Bitcoin-native financial products.

EPWK EPWK Holdings Ltd (+166.47%)

🚩Despite a lack of news, EPWK’s meteoric rise is raising eyebrows. Market watchers suspect this is yet another pump and dump, a pattern all too familiar in recent months. Caution is advised, as such manipulated stocks often crater just as quickly as they rise.

RLMD Relmada Therapeutics (+120.70%)

🧬Relmada Therapeutics gained after announcing a data presentation at the American Urological Association (AUA) highlighting a study in patients with high-grade non-muscle invasive bladder cancer (HG-NMIBC). The news has reignited interest in the company’s clinical pipeline.

OMEX Odyssey Marine Exploration Inc (+117.00%)

⚓Odyssey Marine Exploration surged after former President Donald Trump signed an executive order to boost the deep-sea mining industry. The move is seen as a push to secure U.S. access to critical minerals like nickel and copper, which are vital for the broader economy.

🔻 Biggest Decliners: Manipulation Schemes and Regulatory Setbacks Hammer Valuations

CGTL Creative Global Technology Holdings Limited (-72.42%)

💸Another week, another suspected scam from China. CGTL’s collapse follows the classic pump and dump playbook, with investors left holding the bag after a rapid price spike and dump.

INTS Intensity Therapeutics Inc (-68.86%)

💉 Intensity Therapeutics tumbled after announcing a $2.35 million public offering. The dilution spooked investors, sending shares sharply lower.

JZXN Jiuzi Holdings Inc (-64.98%)

🕳️Jiuzi Holdings is back in the spotlight for all the wrong reasons. The company appears to have repeated its 2024 scheme: artificially inflating the price before dumping shares onto retail investors. The pattern is becoming all too predictable.

LXEH Lixiang Education Holding Co Ltd (-64.91%)

📉 Echoing JZXN, Lixiang Education is another example of a rapid pump and dump. The company’s history of price manipulation continues to devastate retail traders.

CTHR Charles & Colvard Ltd (-46.17%)

🚪Charles & Colvard announced its delisting from Nasdaq, triggering a sharp selloff. The move underscores the risks facing small-cap stocks struggling to maintain compliance with major exchanges.

🌱 Support Our Work: Buy Us a Coffee or Shop Our Services! 🌱

Your small gesture fuels our big dreams. Click below to make a difference today.