36. Weekly Market Recap: Key Movements & Insights

Fed’s Rate Cut Hopes Dashed: Markets Brace for “Higher for Longer” 📉

Trade War Escalation and Fed Pessimism Keep Markets on Edge

This week, markets swung between gains and losses as investors digested a mix of corporate earnings, trade war developments, and Federal Reserve commentary. On Tuesday, Fed Chair Jerome Powell dampened hopes for imminent rate cuts, stating at an event on the Canadian economy that there has been a "lack of further progress so far this year on returning to our 2% inflation goal." His remarks dashed optimism that the Fed would ease its monetary policy anytime soon, leaving traders bracing for a prolonged "higher for longer" rate environment.

According to Polymarket, traders are now betting nearly 100% on the Fed holding rates steady at its May policy meeting, with no rate cuts expected until September. This shift in sentiment is a stark reversal from earlier in the year, when many anticipated multiple rate cuts. Bond markets reflected this uncertainty, with the benchmark 10-year Treasury yield falling to approximately 4.64% on Wednesday after rising in previous sessions.

Trade War Tensions Hit Critical Industries

Meanwhile, the escalating trade war between the U.S. and China has taken a new turn, with Beijing halting exports of rare earth minerals and magnets essential to the semiconductor and automotive industries. This move follows President Donald Trump’s imposition of steep tariffs on Chinese goods, prompting China to restrict the export of seven critical materials used in the automotive, defense, and energy sectors.

Exporters in China now face a lengthy licensing process through the Ministry of Commerce, which could take weeks or even months, according to sources cited by Reuters. The suspension of these exports has raised concerns about potential shortages for global companies reliant on these materials, further straining already fragile supply chains.

Nvidia Takes a Hit Amid U.S. Export Controls

Adding to the market's woes, Nvidia (NVDA) shares tumbled nearly 7% on Wednesday after the AI chipmaker revealed it would take a $5.5 billion hit due to new U.S. government restrictions on semiconductor exports to China. The U.S. government informed Nvidia that its H20 chips, designed specifically for the Chinese market, would now require a special license for export—a license that has never been granted for GPU shipments to China.

The move, which analysts described as a "surprise," comes despite earlier reports suggesting the Trump administration had softened its stance on Nvidia’s chips following a meeting with CEO Jensen Huang. Jefferies analyst Blayne Curtis noted that the new rule effectively acts as a ban, given the U.S. government’s concerns about the chips being used to build AI supercomputers in China.

Nvidia disclosed in a regulatory filing that the $5.5 billion charge would impact its first-quarter results, further weighing on the company’s stock and investor sentiment.

A Resilient Market Amid Uncertainty

Despite the turbulence, the markets showed signs of resilience. The short trading week ended nearly flat, with major indexes still struggling to find their footing. All the main indexes remain below their key moving averages, signaling caution for investors looking to enter new positions.

However, there are glimmers of hope. The market appears to be losing less ground when faced with negative headlines, suggesting a more resilient sentiment among investors. Additionally, trading volume this week was lower than in previous weeks, raising the possibility of a higher low forming soon.

Seize the Easter Opportunity before it's too late!

With only a handful of seats left from our original 20 for the annual plan, this is your chance to secure a spot, The price will not change F-O-R-E-V-E-R

Upcoming Key Events:

Monday, April 21:

Earnings:

Economic Data: None

Tuesday, April 22:

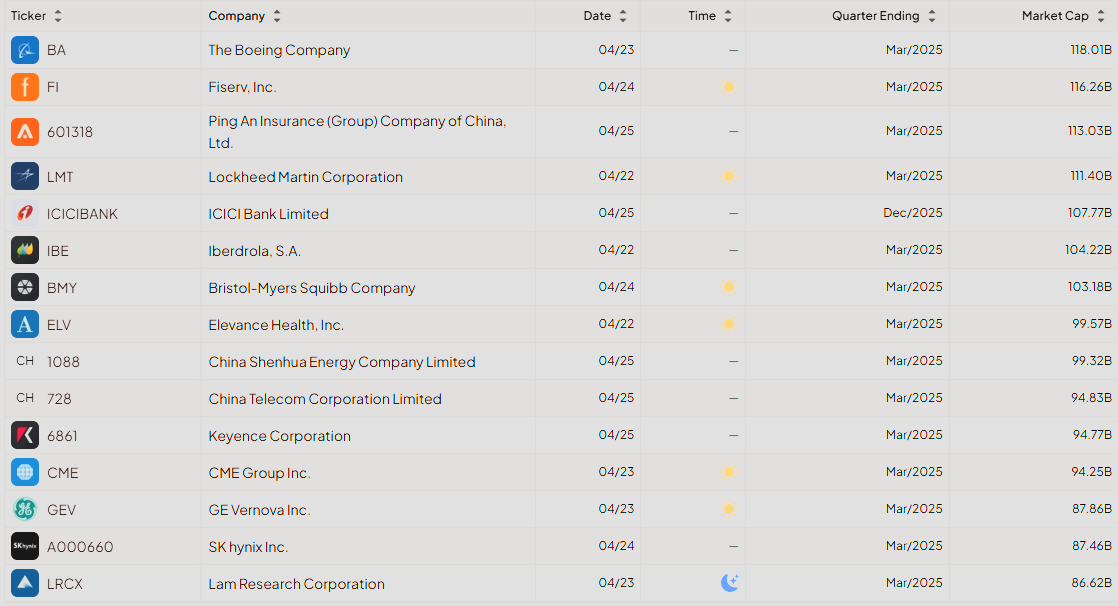

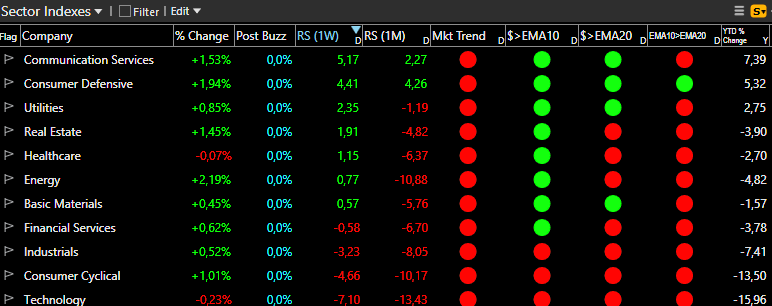

Earnings: Tesla, Inc. (TSLA), General Electric Company (GE), Intuitive Surgical, Inc. (ISRG), Lockheed Martin Corporation (LMT)

Economic Data: API Crude Oil Stock Change

Wednesday, April 23:

Earnings: Philip Morris International Inc. (PM), International Business Machines Corporation (IBM), Thermo Fisher Scientific Inc. (TMO), The Boeing Company (BA)

Economic Data: New Home Sales, EIA Crude Oil Stocks Change

Thursday, April 24:

Earnings: Alphabet Inc. (GOOGL), The Procter & Gamble Company (PG), PepsiCo, Inc. (PEP), Bristol-Myers Squibb Company (BMY)

Economic Data: Durable Goods Orders MoM, Initial Jobless Claims, Existing Home Sales

Friday, April 25:

Earnings: Kweichow Moutai Co., Ltd. (600519), BYD Company Limited (1211)

Economic Data: Michigan Consumer Sentiment Final

Here are the most pertinent earnings details.

Due to the volume of reports during the earnings season, it is not feasible to include every single one in our calendar.

⚡ AI-optimized, human-verified: Our expert team carefully selected Premium market intelligence from Finchat.io data. Explore now →

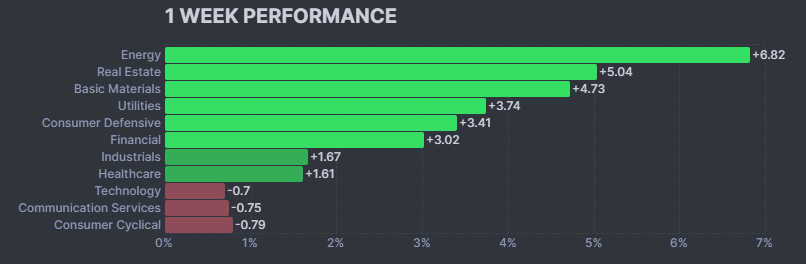

Index Insights: How Major Benchmarks Performed Last Week

Price>MA10: 🟢

Price>MA20: 🔴

MA10>MA20: 🔴

Market Trend*:🔴

Trend Signal: 🔴

*When Price and Moving Averages are all green, the Market Trend will also be green

Price>MA10: 🟢

Price>MA20: 🔴

MA10>MA20: 🔴

Market Trend: 🔴

Trend Signal: 🔴

Price>MA10: 🟢

Price>MA20: 🔴

MA10>MA20: 🔴

Market Trend: 🔴

Trend Signal: 🔴

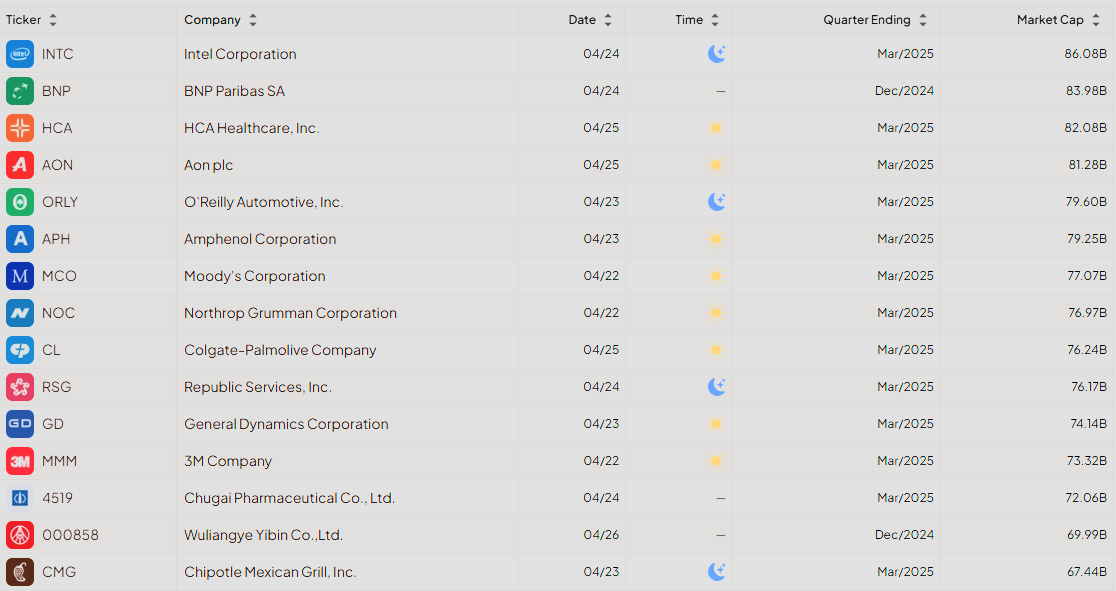

Sector Performance: Winners and Losers from Last Week

Put the market on autopilot, experience the Best Platform with TC2000

Explore now →

Winners

🛢️ Energy (+6.82%)

Leading all sectors with the strongest performance, Energy showcased significant strength and investor confidence, likely driven by rising commodity prices and renewed demand.

🏢 Real Estate (+5.04%)

Second-best performer, Real Estate benefited from improved market sentiment and optimism around property investments.

🛠️ Basic Materials (+4.73%)

Basic Materials saw robust gains, reflecting increased demand for commodities and positive market outlooks.

⚡ Utilities (+3.74%)

Utilities posted solid gains, supported by their defensive positioning and steady demand during uncertain times.

🛒 Consumer Defensive (+3.41%)

Consumer Defensive stocks performed well, benefiting from their resilience and stability in volatile markets.

💰 Financial (+3.02%)

Financials experienced notable gains, suggesting renewed confidence in banking and financial services.

🏭 Industrials (+1.67%)

Industrials showed moderate growth, indicating resilience amid improving global manufacturing sentiment.

🏥 Healthcare (+1.61%)

Healthcare posted modest gains, remaining a steady performer despite limited growth.

Losers

💻 Technology (-0.7%)

Technology was among the weakest sectors this week, experiencing a slight decline as investors rotated out of growth stocks.

📱 Communication Services (-0.75%)

Communication Services also saw a minor loss, reflecting cautious sentiment in advertising and media-related industries.

🛍️ Consumer Cyclical (-0.79%)

Consumer Cyclical stocks declined, indicating some investor caution around discretionary spending and retail sectors.

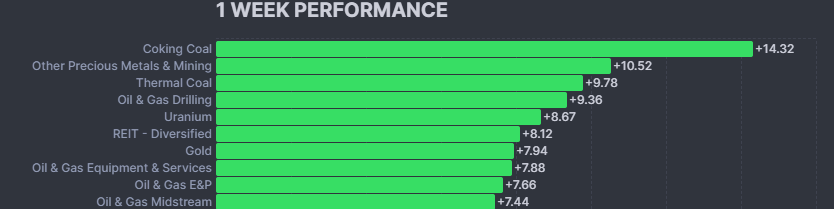

🌟 Weekly Industry Leaders: Precious Metals and Energy Shine

🔥 Coking Coal (+14.32%)

Leading all industries with exceptional gains, Coking Coal surged as demand for steel production remained strong.

⛏️ Other Precious Metals & Mining (+10.52%)

Second-best performer, this industry benefited from rising commodity prices and increased market optimism.

🌡️ Thermal Coal (+9.78%)

Thermal Coal posted significant gains, reflecting robust energy market conditions.

🛢️ Oil & Gas Drilling (+9.36%)

Oil & Gas Drilling saw impressive growth, driven by increased exploration and production activity.

☢️ Uranium (+8.67%)

Uranium advanced strongly, likely due to renewed interest in nuclear energy as a clean power source.

🏢 REIT - Diversified (+8.12%)

Diversified REITs performed well, indicating resilience in real estate investment trusts.

🏅 Gold (+7.94%)

Gold continued to attract investors as a safe-haven asset, posting solid weekly gains.

🔧 Oil & Gas Equipment & Services (+7.88%)

This industry benefited from increased oil and gas sector activity, supporting equipment and service providers.

🛢️ Oil & Gas E&P (+7.66%)

Exploration & Production companies posted strong results, reflecting higher energy prices and demand.

🔗 Oil & Gas Midstream (+7.44%)

Midstream companies also saw notable gains, supported by increased transportation and storage needs in the energy sector.

🚀 Top Market Gainers: Strategic Investments, Rare Earth Momentum, and Speculative Surges Fuel Explosive Growth

ELPW eLong Power Holding Limited (+281.37%)

📈Up on no news, this China-based ticker is likely experiencing artificial price inflation. Market watchers suspect someone is lifting the price before dumping shares onto retail traders—a pattern seen repeatedly in recent months.

MSGM Motorsport Games Inc (+228.5%)

🎮 Multimedia Update: Motorsport Games announced a $2.5 million strategic investment led by virtual reality company Pimax, sparking renewed interest in the company’s future within immersive gaming.

AREC American Resources Corporation (+172.35%)

🏗️Rare Earth Surge: American Resources unveiled a mobile modular rare earth leaching solution to extract value from coal and mine waste. The move, combined with a sector-wide rally in U.S. rare earth companies after China’s export ban, fueled the explosive growth.

SBEV Splash Beverage Group Inc (+164.34%

🍹No news, but heavy trader speculation after a recent reverse split sent shares soaring. The stock’s volatility highlights the speculative nature of post-split trading.

MURA Mural Oncology Limited (+159.22%)

🧬Strategic Shift: Following a review of phase 2 and phase 3 trial data, Mural will discontinue all clinical development of nemvaleukin. With $144.4 million in cash as of December 31, 2024, the company is exploring strategic alternatives and will reduce its workforce by approximately 90%.

🔻 Biggest Decliners: Manipulation Schemes and Fraudulent Activity Devastate Valuations

CLIK Click Holdings Ltd (-88.64%)

💸 Suspected Manipulation: Another pump and dump from China. Investors are warned to avoid newly listed companies in Hong Kong, Singapore, and China without a strong history or reputable founders. More often than not, these tickers will rug-pull unsuspecting traders.

LXEH Liziang Education Holding Ltd (-73.07%)

💸 Suspected Manipulation: Echoing CLIK, this is another example of a rapid pump and dump. The same warning applies: extreme caution is advised with these speculative Chinese listings.

IOTR iOThree Limited (-67.26%)

💸 Suspected Manipulation: The same story as CLIK and LXEH. The pattern of artificial gains followed by a swift collapse is all too familiar in this segment of the market.

MLGO MicroAlgo Inc (-51.19%)

💸 Suspected Manipulation: Probably one of the most rigged tickers out there, as many day traders can confirm. This week’s action highlights the ongoing battle between Chinese and U.S. interests on Wall Street, with Chinese “scam” stocks dominating the list of worst performers.

MULN Mullen Automotive Inc (-50.46%)

📉 Dilution Concerns: Even the U.S. market isn’t immune. Mullen Automotive, notorious for its relentless dilution, continues to lose value. Despite being American, MULN’s reputation now rivals the worst Chinese frauds, leaving investors questioning how such operations persist.

🌱 Support Our Work: Buy Us a Coffee or Shop Our Services! 🌱

Your small gesture fuels our big dreams. Click below to make a difference today.